Ethereum L2 development is ‘double-edged sword’ for ETH value

16 Aprile 2025 - 4:00PM

Cointelegraph

Ethereum’s push toward layer-2 (L2) blockchain scalability may

be a double-edged sword for Ether, potentially weakening the value

accrual of the world’s second-largest cryptocurrency, according to

a new report from Binance Research.

The report suggests that Ethereum’s L2 blockchain networks —

built to improve mainnet scalability and lower transaction costs —

may be cannibalistic of the Ethereum base layer, negatively

impacting the price of Ether (ETH).

Ethereum’s dominance in terms of decentralized exchange (DEX)

volume and fees generated is “under threat” by Solana and BNB Smart

Chain, Binance Research wrote.

Ethereum, Solana, BNB, DEX volume. Source: Binance

Research

The main factors include slow and expensive transactions,

fragmented “developer mindshare and liquidity, and reduced value

accrual to the L1 due to the rise of L2s,” the report said.

Ethereum’s roadmap already includes future upgrades aimed at

creating cheaper transactions, additional security, and more

future-proof incentives for the mainnet.

Still, Ether’s value accrual may continue to suffer in the near

term since the next two major upgrades don’t immediately address

these issues, but are aimed at creating more scalability around

data availability and incorporating more L2 networks.

Related: Google to enforce MiCA rules for crypto ads in

Europe starting April 23

Concerns have been reignited around the Ethereum mainnet’s

economic incentives since Ether’s price

fell to $1,410 on April 7, marking its lowest level since March

2023.

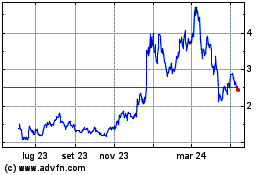

ETH/USD, 1-year chart. Source: Cointelegraph

Ether’s price fell over 61% during a four-month downtrend, which

started on Dec. 16, 2024, when ETH briefly peaked above $4,100,

Cointelegraph Markets Pro data shows.

Ethereum’s Pectra, Fusaka upgrade won’t address Ether’s value

accrual

After initial delays, Ethereum’s highly

anticipated

Pectra upgrade is set to go live on the mainnet on May 7.

The Pectra upgrade aims to improve Ether staking and L2 network

scalability, increase blob capacity to enable more data handling on

the mainnet and improve overall network capacity.

The Fusaka upgrade, expected in late 2025, will focus on scaling

the Ethereum mainnet as a data availability layer by introducing

EIP-7594. Fusaka may also bring an update to the Ethereum Virtual

Machine (EVM), resulting in a “more structured approach” to

smart-contract creation, reducing runtime overhead and improving

developer experience.

Ethereum data capacity upgrades. Source: Binance

Research

Ethereum’s commitment to L2 scaling may be a “double-edged

sword” due to concerns around the mainnet’s “competitiveness as a

data availability layer” and “the sustainability of value accrual

to Ethereum the asset,” the report said.

Related: Ethereum shorter gains $1.1M on 50X leverage in

2 days

“One promising path for stronger ETH value accrual is the

development of based rollups,” which “contribute significantly more

in fees” to Ethereum compared with L2s like Base, Arbitrum and

Optimism, according to a Binance Research spokesperson.

L2s, rollups by costs paid to Ethereum mainnet. Source:

Binance Research

“Another avenue is Ethereum’s evolving role as a data

availability layer,” the spokesperson told Cointelegraph,

adding:

“Value accrual through this model depends on external

factors: L2s must continue to choose Ethereum for data

availability, and blockspace demand must grow in a competitive

landscape where alternatives like Solana and BNB Smart Chain are

gaining traction.”

“Aligning incentive structures between Ethereum and L2s, whether

through fee sharing, MEV capture, or protocol-level integrations,

will be essential to ensure sustainable value flow back to ETH as

an asset should Ethereum continue to commit to scaling with L2s,”

he added.

Magazine: 3

reasons Ethereum could turn a corner: Kain Warwick, X Hall of

Flame

...

Continue reading Ethereum L2 development is

‘double-edged sword’ for ETH value

The post

Ethereum L2 development is ‘double-edged sword’ for

ETH value appeared first on

CoinTelegraph.

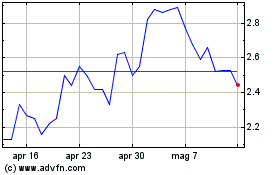

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Apr 2024 a Apr 2025