Solana Turns Bullish On 8H Chart – Break Above $147 Could Confirm New Trend

18 Aprile 2025 - 12:00AM

NEWSBTC

Solana is now at a critical juncture as it trades around a pivotal

price level that could determine its short-term direction. After

weeks of selling pressure and underwhelming price action, bulls are

attempting to regain control—but success hinges on reclaiming

higher resistance zones. Without a decisive move upward, Solana’s

price action may continue to follow the broader downtrend that has

defined the last few months. Related Reading: Over 1.9M Ethereum

Positioned Between $1,457 And $1,598 – Can Bulls Hold Support?

Meanwhile, macroeconomic tensions continue to escalate. Trade

conflicts between the United States and China are intensifying,

with both nations imposing aggressive tariffs. This has created a

high-risk environment across global financial markets, and altcoins

like Solana are particularly vulnerable. With uncertainty rising

and investor sentiment turning cautious, digital assets are under

growing pressure. However, there is a glimmer of technical

optimism. Top crypto analyst Crypto Seth shared an analysis

suggesting that Solana has flipped bullish on the 8-hour chart.

According to his view, if SOL can break above key resistance, it

could confirm a trend shift and trigger a potential recovery rally.

Until then, traders are watching closely as Solana navigates a

critical support-resistance battleground amid a volatile macro

backdrop. Bulls Must Hold the Line as Market Faces Trade War

Pressure Solana is currently trading in a make-or-break zone,

having lost 55% of its value since reaching its all-time high in

January. This decline mirrors a broader crypto and equities market

correction that began when macroeconomic tensions escalated—most

notably due to rising inflation, global instability, and

intensifying trade war rhetoric between the United States and

China. Bulls now face a critical moment. Solana must hold current

levels and reclaim key resistance zones to spark a recovery rally.

Failing to do so could open the door to a sharp meltdown in price,

particularly if macro conditions continue to deteriorate. US

President Donald Trump’s unpredictable policy decisions, especially

surrounding tariff impositions, have created a hostile environment

for risk assets like Solana. Ongoing tariff escalations with China

are only adding to market uncertainty, further weighing on investor

sentiment. However, there is a glimmer of hope from the technical

side. Seth shared insights suggesting that Solana has flipped

bullish on the 8-hour chart. According to his analysis, a break

above the $147 level would confirm a trend shift and potentially

pave the way for a sustained recovery. For now, all eyes remain on

whether SOL can clear this level or face renewed pressure in a

volatile global climate. Related Reading: Dogecoin Whales Buy 800

Million DOGE in 48 Hours – Smart Money Or Bull Trap? Solana Faces

Pivotal Resistance: Can Bulls Break Through? Solana (SOL) is

currently trading at $132 after several days of struggling to

reclaim this key resistance zone. Price action remains uncertain,

and bulls must now show strength to avoid a deeper correction.

Reclaiming the $132–$135 range is crucial, as it could confirm

short-term momentum and signal the start of a recovery rally. To

establish a higher high and shift the current downtrend structure,

SOL must push decisively above the $150 level. This area has served

as a strong rejection point in previous attempts and stands as the

next major test for bullish continuation. A clean breakout above

this level could open the path toward higher targets and renewed

investor confidence. However, if bulls fail to defend the $125

support level, Solana may risk a drop back to lower demand zones

around $100—or potentially even lower, depending on broader market

conditions. Macroeconomic uncertainty, continued trade tensions

between the U.S. and China, and overall weakness in altcoins are

all contributing factors weighing heavily on SOL’s price. Related

Reading: Solana Retests Bearish Breakout Zone – $65 Target Still In

Play? For now, traders are watching the $135 level closely. A

breakout above this key threshold could shift the tide in Solana’s

favor. Until then, caution remains warranted. Featured image from

Dall-E, chart from TradingView

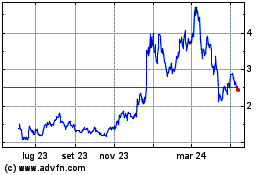

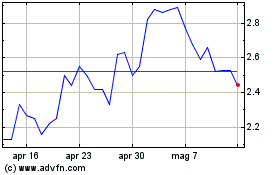

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Apr 2024 a Apr 2025