Bitcoin Hits $90K Milestone—Is A Path to $100K On The Horizon? Analyst Weighs In

15 Novembre 2024 - 7:30AM

NEWSBTC

Bitcoin has reached a major milestone by surpassing the $90,000

price mark, marking a significant moment in its ongoing bullish

rally. The price surge has drawn the attention of existing

investors and attracted a new wave of market participants. This

influx is evidenced by the increase in UTXO (Unspent Transaction

Output) Age Bands. This metric tracks the distribution of Bitcoin

holdings by age, according to an analysis shared by CryptoQuant

analyst Shiven Moodley. This development reflects heightened

interest and engagement in the Bitcoin market. Moodley’s analysis

revealed that a high percentage of market participants are

currently profitable, as indicated by the UTXO profit percentage

metric. However, despite this strong market performance, long-term

holders appear to maintain their positions even as the derivatives

market becomes increasingly leveraged. Related Reading: Short-Term

Bitcoin Holders Move Millions To Binance—Is A Market Correction

Imminent? Samuel Edyme Profitability Metrics Signal Market Momentum

One of the key insights highlighted by Moodley is the positive

Spent Output Profit Ratio (SOPR). This indicator suggests that many

Bitcoin transactions are occurring at a profit, reflecting an

optimistic market sentiment and providing a foundation for

potential further price increases. However, Moodley pointed to a

developing “mania phase” in the market, evidenced by the growing

number of options market call contracts set to expire over the next

two months. This surge in call contracts indicates that many

traders are betting on continued upward momentum, potentially

driving further speculative activity. The CryptoQuant analyst also

discussed the implications of probability models that track

Bitcoin’s price movements over time. According to these models,

with a lag of 500 days, Bitcoin has breached two standard

deviations at the $90,000 level. The next significant price marker,

represented by the third standard deviation, according to Moodley

is currently projected to be around $101,000. This suggests that,

while Bitcoin’s current upward trajectory is notable, the potential

for further price gains remains. Bitcoin Market Performance Bitcoin

appears to be now seeing a cool off in its recent bullish momentum.

Particularly, following a consistent week of new highs reaching a

peak of $93,477 yesterday, BTC has since faced a major pullback in

price, bringing its price to trade as low as below $89,000, as of

today. At the time of writing, the asset currently trades for

$88,878, down by 2.9% in the past day. Regardless, BTC seems to

still be in an uptrend with a past week performance of nearly 20%.

Notably, while the market environment still reflects strong bullish

sentiment, there are risks to be aware of. As highlighted by

Moodley, the increased leverage in the derivatives market, combined

with rising call options activity, could lead to heightened

volatility in the BTC market. Related Reading: Bitcoin Crosses

$93,000 – Is There More Room for Gains or Are We Nearing a Peak?

Overleveraged markets are historically prone to corrections,

especially when market sentiment shifts rapidly. Therefore, while

many market participants may currently be in profit, maintaining

caution is worth considering. Featured image created with DALL-E,

Chart from TradingView

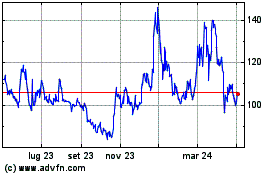

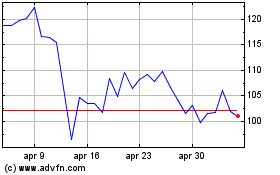

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025