Bitcoin ‘Probably’ Hit Its Bottom At $77,000, Arthur Hayes Says

21 Marzo 2025 - 1:00AM

NEWSBTC

According to a recent X post by crypto entrepreneur Arthur Hayes,

Bitcoin (BTC) probably hit its bottom during the plunge to $77,000

on March 10. However, Hayes cautioned that while BTC may have

bottomed, stock markets could face more pain ahead. BTC Bottomed At

$77,000? Hayes Thinks So Former BitMEX CEO Arthur Hayes recently

took to X to declare that BTC may have likely bottomed at $77,000.

The acclaimed crypto market commentator referred to the US Federal

Reserve’s (Fed) latest remarks signaling the end of quantitative

tightening (QT). Hayes remarked: JAYPOW delivered, QT basically

over Apr 1. The next thing we need to get bulled up for realz is

either SLR exemption and or a restart of QE. Was BTC $77K the

bottom, prob. But stonks prob have more pain left to fully convert

Jay to team Trump so stay nimble and cashed up. Related Reading:

Bitcoin Needs Weekly Close Above This Level To Confirm Market

Bottom, Analyst Says For the uninitiated, QT is one of the Fed’s

monetary policies aimed at reducing the money supply by selling off

assets like government bonds or letting them mature without

reinvesting. While this helps control inflation, it can also lead

to higher interest rates and slower economic growth. The Fed began

its most recent QT cycle nearly three years ago in June 2022 to

combat high inflation resulting from COVID-era economic stimulus.

Now that inflation appears to be easing, the Fed has little reason

to continue QT. Yesterday, the Fed announced that from April 1

onwards, it will slow the pace of its balance sheet drawdown. Such

a shift in monetary policy is likely to benefit risk-on assets like

BTC and stocks. As stated in his X post, Hayes emphasized that the

next potential bullish catalysts could be either a Supplementary

Leverage Ratio (SLR) exemption or the start of quantitative easing

(QE). To explain, the SLR exemption temporarily allowed banks to

exclude certain assets, like US Treasuries and central bank

reserves, from their leverage calculations to encourage lending and

support financial markets during crises. Similarly, QE is a

monetary policy through which the Fed increases the money supply in

the economy, potentially benefiting high-risk assets like BTC. Axie

Infinity co-founder Jeff Jirlin echoed Hayes’ sentiments, stating

that an end to QT from April onwards would be “great for both

crypto and equity markets.” Jirlin added that the current monetary

policy is the tightest he has observed since 2010. Bitcoin Not Out

Of The Woods Yet While market optimism has increased following the

Fed’s recent comments, the premier cryptocurrency is not fully out

of the woods yet. For instance, BTC recently broke down through a

12-year trend line against gold, raising fears of heightened

economic uncertainty in the near term. Related Reading: As Bitcoin

Sell Pressure Fades, Could A Local Bottom Be Forming? Analyst

Explains Further, CryptoQuant CEO Ki Young Ju recently spooked the

market by declaring that the Bitcoin bull run is likely over. At

press time, BTC trades at $85,203, up 2% in the past 24 hours.

Featured image from Unsplash, Chart from TradingView.com

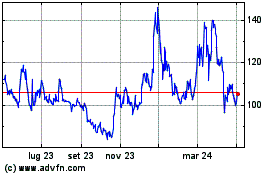

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

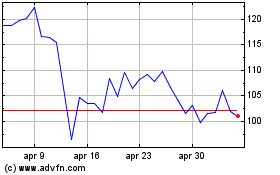

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025