Analyst Compares Current Bitcoin Pullback to 2024 Market—Here’s What They Found

22 Marzo 2025 - 9:30AM

NEWSBTC

Bitcoin continues to experience short-term volatility, struggling

to maintain momentum above key resistance levels. After recently

attempting to break back above the psychological $90,000 level, the

asset has pulled back again. As of the time of writing, Bitcoin is

trading at approximately $83,239, down 2.2% over the past 24 hours

and nearly 23% below its all-time high above $109,000 reached in

January. Despite this, some analysts suggest underlying indicators

may point toward a potential market rebound if specific conditions

align. Related Reading: Bitcoin Whales Are Back—Could This Be the

Catalyst for the Next Rally? Stablecoin Trends Offer Insight into

Bitcoin Market Liquidity Crypto Dan, a contributor to the

CryptoQuant QuickTake platform shared an analysis titled

“Comparison of the March 2024 Correction and the Current Market,”

focusing on the relationship between stablecoin supply and

Bitcoin’s price behavior. According to Dan, the flow of stablecoins

into the market can serve as a proxy for measuring potential buying

power, with higher stablecoin reserves typically associated with

increased purchasing capacity among market participants. Dan noted

that during the March–October 2024 correction phase, the supply of

stablecoins remained relatively low or declined, contributing to a

more prolonged bearish trend. In contrast, the current correction

has been accompanied by a gradual increase in stablecoin supply,

which may indicate that market participants are preparing to

re-enter positions as they await favorable conditions. Dan wrote:

The current market is in a state where it is ready to rise quickly

whenever strong catalysts emerge. Patience remains essential in the

investment market. While it is premature to declare the end of the

bullish cycle, the market continues to present conditions worth

monitoring closely. Notably, this upward trend in stablecoin

reserves suggests that investors are not fully exiting the market

but are instead adopting a wait-and-see approach, holding liquidity

in stablecoins while watching for confirmation of a trend reversal.

This behavior often precedes renewed buying activity when

confidence begins to return. Sentiment Signals Shift on Binance as

Ratio Turns Positive Another CryptoQuant analyst, Burak Kesmeci,

analyzed the Taker Buy Sell Ratio on Binance—an exchange widely

viewed as a leading barometer of retail and institutional sentiment

due to its high trading volume. The Taker Buy Sell Ratio measures

the aggressiveness of buyers versus sellers, with values above 1.00

indicating that buyers are initiating more trades than sellers.

Kesmeci observed that this ratio has been steadily forming higher

lows over the past ten days and recently transitioned from the

negative to the positive zone. Related Reading: This Bear Market

Indicator Says Bitcoin Price Is Headed For Crash To $40,000, Here’s

When This shift could suggest that sentiment among active traders

is improving, potentially setting the stage for upward price

movement if this trend continues. Kesmeci explained: If the Taker

Buy Sell Ratio remains above 1.00, especially considering Binance’s

market influence, Bitcoin’s uptrend from the $76,600 region could

see continuation. Featured image from DALL-E, Chart from

TradingView

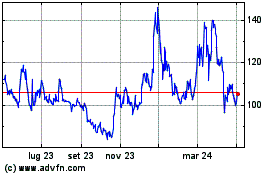

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

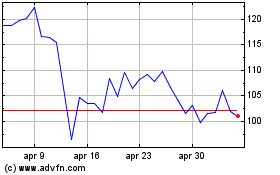

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025