Bitcoin Holds Above $85K—But These 4 Metrics May Decide What Happens Next

26 Marzo 2025 - 7:00AM

NEWSBTC

Bitcoin has started the week maintaining relative stability, with

its price currently hovering around $87,000 despite a minor 0.4%

dip over the past 24 hours. The crypto asset showed upward momentum

earlier in the week, briefly rallying beyond $88,000. Although the

rally has slowed, the broader market remains focused on whether

Bitcoin’s recent performance signals a temporary correction or a

more substantial shift in trend. Market analysts have turned to

on-chain metrics for additional clarity. One such analyst, Burak

Kesmeci, a contributor to CryptoQuant’s QuickTake platform,

recently examined four key cyclical indicators to assess whether

Bitcoin’s bullish phase is losing steam. Related Reading: Bitcoin’s

Realized Cap and UTXO Data Signal a Major Shift—Here’s What to

Watch Key Indicators Reflect Mixed Sentiment According to Kesmeci,

while some metrics suggest weakness, they do not yet indicate a

market top. Kesmeci’s first point highlights the Internal Funding

Pressure (IFP) metric, which currently stands at 696K—below its

90-day simple moving average (SMA90) of 794K. Historically, a cross

above the SMA90 tends to signal renewed bullish momentum, but for

now, the metric suggests a lack of reversal strength. The second

metric analyzed is the Bull & Bear Market Cycle Indicator.

Kesmeci notes the current setup mirrors earlier soft bearish

signals observed during this cycle. The 30-day moving average

(DMA30) sits at -0.16, while the longer-term 365-day moving average

(DMA365) is at 0.18. Until the shorter-term average crosses above

the longer-term trend, the indicator remains tilted toward bearish

sentiment. Do 4 Different Cyclical On-Chain Metrics Signal the End

of Bitcoin’s Bull Market? “All of these metrics suggest that

Bitcoin is experiencing significant turbulence in the short to

mid-term. However, none of them indicate that Bitcoin has reached

an overheated or cycle-top… pic.twitter.com/tPw74wqERy —

CryptoQuant.com (@cryptoquant_com) March 25, 2025 Bitcoin MVRV and

NUPL Provide Additional Clues Kesmeci also assessed the Market

Value to Realized Value (MVRV) score, which remains below its

365-day SMA. Historically, this positioning tends to precede

increased selling pressure, although a rebound is possible once the

score crosses back above its moving average. The last such event

occurred during the August 2024 carry trade crisis, which was

resolved with a recovery after macroeconomic pressures eased.

Similarly, the Net Unrealized Profit/Loss (NUPL) metric sits below

its SMA365. Currently, NUPL stands at 0.49, compared to a moving

average of 0.53. While not a definitive end to the bullish trend,

the metric’s position implies that further strength is needed for

Bitcoin to regain bullish footing. Related Reading: Bitcoin Bottom

In Sight As Trump Expected To Soften Stance On Reciprocal Tariffs:

Report Kesmeci concludes that these on-chain indicators

collectively point to short- and mid-term uncertainty but fall

short of confirming a market top. Drawing comparisons to last

year’s macro-driven selloff, he suggests that external factors—such

as recent economic uncertainty and tariff-related tensions—may be

temporarily suppressing BTC’s performance. If macroeconomic

conditions stabilize, BTC could resume its upward trajectory,

mirroring the recovery seen in 2024. Featured image created with

DALL-E, Chart from TradingView

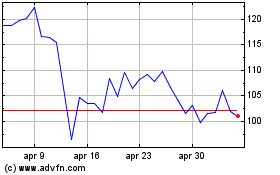

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

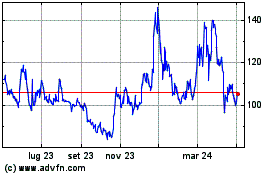

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025