Unlocking the potential of dormant Bitcoin in DeFi

21 Aprile 2025 - 5:00PM

Cointelegraph

Opinion by: Amitej Gajjala, co-founder and CEO of

KernelDAO

Bitcoin is the principal asset of the cryptocurrency world and

even one of the world’s top 10 most valuable assets, recognized for

its role as a store of value. Yet a huge percentage of the Bitcoin

(BTC) supply remains dormant

for years, meaning the crypto market only works with a fraction

of the circulating supply each year.

This idle Bitcoin has an enormous amount of untapped financial

potential.

Bitcoin’s principal narratives are “store of value” and “never

sell.” Today’s decentralized finance (DeFi) tools, however, enable

yield gain by holding Bitcoin and taking advantage of dormant

Bitcoin, which just sits in investors’ wallets and does

nothing.

Existing dormant Bitcoin is not being fully utilized

Dormant Bitcoin has not been used for long periods, usually one

or more years. According to Glassnode, as

of early 2025, the active supply that has not moved in more than

one year is approximately 62%.

This Bitcoin is held in wallets that show no activity on the

blockchain and remain inactive for various reasons. These could be

intentional long-term holding strategies or even permanent loss as

a result of negligence or the death of their users.

Let’s put aside the rest of the reasons and focus on long-term

Bitcoin holding strategies. The existence of this group implies

that they could enter the market at any time, producing significant

volatility in the price of Bitcoin. Why aren’t we using that

Bitcoin in DeFi right now?

Activating dormant Bitcoin will make waves in the market

If large quantities of dormant Bitcoin were to reactivate

immediately, it could significantly affect the cryptocurrency

market, creating a noticeable

event. These movements could dramatically affect Bitcoin's

price in a negative way due to potential

selling pressure and influence the market with a significant

increase in active circulating supply.

Recent:

Stablecoin presence key to blockchain legitimacy, says

ZachXBT

If the reactivated Bitcoin is, however, reintegrated into

productive DeFi ecosystems rather than sold en masse, it could

provide liquidity without destabilizing the market. With that

amount of active liquidity, Bitcoin would not only be a “store of

value” but also a productive asset with utility and

application.

Let’s look at the announcement of the creation of a

Bitcoin strategic reserve in the United States. One of the key

points of this reserve is that it will follow budget-neutral

strategies without selling the estimated 198,000 BTC held by the

government. Those conditions are perfect for putting this Bitcoin

into restaking and using it in DeFi to obtain rewards. Just picture

all the gains the US could make by using most of its Bitcoin

reserves in that way, without selling.

We need to explore Bitcoin’s potential in DeFi

Integrating dormant Bitcoin into DeFi platforms offers

interesting Bitcoin and decentralized finance opportunities.

Bitcoin would encourage transactions and fees on the network to

support miners. The total value locked (TVL) in DeFi will be

tremendous compared to all the liquidity Bitcoin will add to the

DeFi market.

Advances like wrapped tokens and crosschain bridges have enabled

Bitcoin holders to engage in flash loans, lending, staking,

restaking and yield farming on DeFi platforms. The current levels

are, however, insufficient and will not be the only way to take

advantage of this enormous liquidity injection.

As of March 10, Bitcoin’s TVL in DeFi stood at over $5 billion,

according to DefiLlama data. This represents only

6% of the TVL of all the current blockchains on the market, with

Ethereum the king at 52.56% with $48 billion. If Bitcoin became the

new king of TVL in DeFi, it would only need to use some of the

dormant Bitcoin mentioned above.

In this scenario, Bitcoin will provide more stability to DeFi,

as its holders, including institutional and long-term investors,

are not prone to selling during market downturns. In addition,

activating even a small fraction of currently idle Bitcoin could

unlock billions of dollars of liquidity for decentralized finance

applications.

The best way to use BTC in DeFi is restaking

Today, restaking is emerging as an innovative, engaging way to

integrate Bitcoin into DeFi while maintaining its appeal as a

conservative, secure investment vehicle. Restaking enables holders

to stake their assets in decentralized protocols and earn passive

income while contributing to the economic security of the

network.

This mechanism offers several benefits, including passive income

with minimal risk and economic security, by supporting the

development of new products. It parallels traditional finance by

offering predictable returns while preserving capital, which

appeals more to conventional investors.

Restaking aligns with the conservative mindset typical among

many Bitcoin holders, allowing them to participate in innovations

within the DeFi space. Restaking is desirable for every Bitcoiner

to obtain yield with their reserves.

Dormant Bitcoin is a massive opportunity for DeFi

Dormant Bitcoin is a vast, untapped reservoir within the Web3

ecosystem. By integrating Bitcoin into DeFi platforms today,

individual investors and the broader ecosystem will significantly

benefit from the increased stability, liquidity and growth

opportunities.

Opinion by: Amitej Gajjala, co-founder and CEO of

KernelDAO.

...

Continue reading Unlocking the potential of dormant

Bitcoin in DeFi

The post

Unlocking the potential of dormant Bitcoin in

DeFi appeared first on

CoinTelegraph.

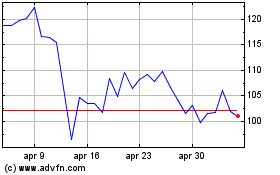

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

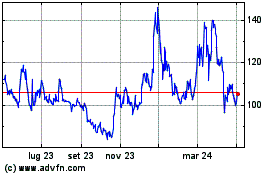

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025