Sodexo First half Fiscal 2025 estimates and full year guidance update

20 Marzo 2025 - 7:00AM

Issy-les-Moulineaux, March 20, 2025 (7am)Sodexo

(Euronext Paris FR 0000121220-OTC: SDXAY)

Sodexo First half Fiscal 2025

estimates and full year guidance

update

- First half

Organic revenue growth of +3.5%

- First half

Underlying operating profit up +6.4% at constant

currencies, margin up +10bps

- Update to

full year guidance mainly triggered by slower than expected organic

growth in North America :

- Organic

revenue growth between +3% and +4% (from between +5.5% and

+6.5%)

- Underlying

operating profit margin improvement between +10 to + 20 bps, at

constant currencies (from +30 to +40 bps)

First half Fiscal 2025 key figures -

unaudited1

|

(in million euros) |

H1 FISCAL 2025 |

H1 FISCAL 2024 |

DIFFERENCE |

DIFFERENCE CONSTANT RATES |

|

Revenues |

12,475 |

12,101 |

+3.1% |

+3.2% |

|

Organic revenue growth |

+3.5% |

+8.5% |

|

|

|

UNDERLYING OPERATING PROFIT |

651 |

612 |

+6.4% |

+6.4% |

|

UNDERLYING OPERATING PROFIT MARGIN |

5.2% |

5.1% |

+10bps |

+10bps |

|

Other operating income & expenses |

(71) |

30 |

|

|

|

OPERATING PROFIT |

580 |

642 |

(9.7%) |

(10.0%) |

|

Net financial expense |

(40) |

(46) |

|

|

|

Tax charge |

(105) |

(99) |

|

|

|

Effective tax rate |

19.5% |

16.6% |

|

|

|

NET PROFIT FROM CONTINUING OPERATIONS |

434 |

496 |

(12.5%) |

(12.7%) |

|

UNDERLYING NET PROFIT FROM CONTINUING

OPERATIONS |

450 |

427 |

+5.4% |

+5.2% |

|

Basic underlying EPS from continuing operations (in euros) |

3.08 |

2.91 |

|

|

Sodexo Chairwoman and CEO, Sophie Bellon,

said:

“While our industry fundamentals remain strong, in

North America the continued soft trend in volumes in Education and

slower than expected net new ramp-up in Healthcare have impacted

our ability to meet initial expectations. We are determined to

strengthen execution on identified areas where improvement is

required. We continue to see significant opportunities in a highly

attractive market, and we are investing in the future to grow

faster. We are confident in our ability to create sustainable value

for our stakeholders.”

H1 Fiscal 2025 highlights

- First half Fiscal

2025 consolidated revenues reached 12.5 billion

euros, up +3.1% year-on year including a negative currency impact

of -0.1% and a net contribution from acquisitions and disposals of

-0.3%. Organic revenue growth was +3.5%.

- In North America,

Organic growth was +3.5%, lower than expected, with Education

affected by the continuation of soft volumes, and Healthcare by

delays in the opening of new contracts, meanwhile Business &

Administrations and Sodexo Live! demonstrated good organic

growth.

- Europe was up +2.1%

organically, with good performance in Healthcare & Seniors but

continued soft growth in Facilities Management.

- In Rest of the

World, Organic growth was +6.6%, fueled by strong performance in

Australia, India and Brazil.

|

REVENUES(in million euros) |

H1 FY 2025 |

H1 FY 2024 |

|

ORGANIC GROWTH |

EXTERNAL GROWTH |

CURRENCY EFFECT |

TOTAL GROWTH |

|

North America |

5,977 |

5,756 |

|

+3.5% |

-0.6% |

+1.0% |

+3.8% |

|

Europe |

4,336 |

4,254 |

|

+2.1% |

-0.8% |

+0.7% |

+1.9% |

|

Rest of the World |

2,162 |

2,091 |

|

+6.6% |

+1.5% |

-4.7% |

+3.4% |

|

SODEXO |

12,475 |

12,101 |

|

+3.5% |

-0.3% |

-0.1% |

+3.1% |

- During First half

Fiscal 2025, last-12-months (LTM) client retention stood at 93.9%

with a development of 7.3%.

- Underlying

operating profit in the First half was 651 million euros,

up +6.4%. The Underlying operating margin improved

+10 basis points at 5.2%, with good improvement in North America

despite the revenue shortfall, and softer improvement in Europe,

specifically in Corporate services, and in Rest of the World due to

some operational challenges in a couple of contracts in Latin

America.

|

(in million euros) |

UNDERLYING OPERATING PROFIT

H1 FISCAL 2025 |

DIFFERENCE |

DIFFERENCE (EXCLUDING CURRENCY EFFECT) |

UNDERLYING OPERATING PROFIT MARGIN H1 FISCAL

2025 |

DIFFERENCE IN MARGIN |

DIFFERENCE IN MARGIN (EXCLUDING CURRENCY MIX

EFFECT) |

|

North America |

422 |

+6.8% |

+5.6% |

7.1% |

+20 bps |

+10 bps |

|

Europe |

186 |

+3.3% |

+3.3% |

4.3% |

+10 bps |

+10 bps |

|

Rest of the World |

85 |

+6.3% |

+12.7% |

3.9% |

+10 bps |

+20 bps |

|

Corporate expenses |

(42) |

-2.3% |

-2.3% |

|

|

|

|

UNDERLYING OPERATING PROFIT (continuing

activities) |

651 |

+6.4% |

+6.4% |

5.2% |

+10 bps |

+10 bps |

FY25 Guidance

- Organic

revenue growth guidance revised to between +3% and +4%

(from +5.5% to +6.5% in the initial guidance)

- Underlying

operating margin YoY improvement guidance revised to +10 to +20

bps (from +30 to +40 bps in the initial

guidance)

Our adjustment to the full-year organic revenue

growth guidance is primarily driven by weaker-than-expected volume

trends in Education in the First half, which are expected to

persist. Additionally, in North America, delays in certain

contracts start dates in Healthcare, and softer commercial

performance in the First half have impacted expectations for net

new contributions in the second half.Similarly, the revision of the

Underlying operating margin guidance mainly reflects the full-year

impact of the revenue shortfall.

Sodexo is strengthening execution on identified

areas where improvement is required, with a particular focus on

North America towards commercial discipline and operational

execution, as well as global organizational efficiency and strict

overhead cost control.

Further details will be provided in the upcoming H1

results announcement, scheduled for April 4th, 2025.

Conference call

Sodexo will hold a conference call (in

English) today at 8:30 a.m. (Paris time), 7:30 a.m. (London time)

to comment on this release.

Those who wish to connect:

- From the UK: +44

121 281 8004, or

- From France: +33 1

70 91 87 04, or

- From the US: +1 718

705 8796,

Followed by the access code 07 26

13.

The live audio webcast will be available on

www.sodexo.com

The press release, presentation and webcast will be

available on the Group website www.sodexo.com in both the

“Newsroom” section and the “Investors – Financial Results”

section.

Financial calendar

|

Fiscal 2025 First half Results |

April 4, 2025 |

|

Fiscal 2025 Third quarter Revenues |

July 1, 2025 |

|

Fiscal 2025 Annual Results |

October 24, 2025 |

These dates are indicative and may be subject to

change without notice.Regular updates are available in the calendar

on our website www.sodexo.com

About Sodexo

Founded in Marseille in 1966 by Pierre Bellon,

Sodexo is the global leader in sustainable food and valued

experiences at every moment in life: learn, work, heal and play.

The Group stands out for its independence, its founding family

shareholding and its responsible business model. Thanks to its two

activities of Food and Facilities Management Services, Sodexo meets

all the challenges of everyday life with a dual goal: to improve

the quality of life of our employees and those we serve, and

contribute to the economic, social and environmental progress in

the communities where we operate. For Sodexo, growth and social

commitment go hand in hand. Our purpose is to create a better

everyday for everyone to build a better life for all.

Sodexo is included in the CAC Next 20, Bloomberg

France 40, CAC 40 ESG, CAC SBT 1.5, FTSE 4 Good and DJSI

indices.

Key figures

- 23.8 billion euros

Fiscal 2024 consolidated revenues

- 423,000 employees

as at August 31, 2024

- #1 France-based

private employer worldwide

- 45 countries (as of

August 31, 2024)

- 80 million

consumers served daily

- 10.7 billion euros

in market capitalization (as at March 19, 2024)

|

|

|

|

|

|

|

|

Contacts |

|

|

|

| |

Analysts and Investors |

|

Media |

|

| |

Juliette Klein+33 1 57 75 80 27 juliette.klein@sodexo.com |

|

Mathieu Scaravetti +33 6 28 62 21 91

mathieu.scaravetti@sodexo.com |

|

| |

|

|

|

|

1 Sodexo's Board of Directors met on March 19,

2025, reviewed the financial data for the first half of Fiscal 2025

and reviewed this press release. These financial data are

preliminary, the financial results for the first half of Fiscal

2025 will be approved by the Board of Directors on April 3, 2025.

The limited review procedures by the Statutory Auditors are

ongoing.

- PR Sodexo - H1 Fiscal 2025 estimates and FY guidance

update

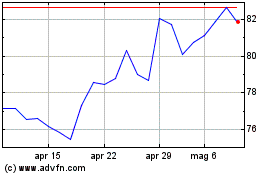

Grafico Azioni Sodexo (EU:SW)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Sodexo (EU:SW)

Storico

Da Mar 2024 a Mar 2025