TIDMGLE

RNS Number : 2691F

MJ Gleeson PLC

07 July 2023

7 July 2023

MJ Gleeson plc (GLE.L)

("Gleeson" or "the Company")

Trading Update, Capital Markets Day and Notice of Results

-- Full year results ("FY2023") expected to be in-line with expectations

-- Shift in buyer demographics underpins encouraging prospects for FY2024

-- Capital Markets Day today sets out longer-term growth agenda

Trading Update

MJ Gleeson plc (GLE.L), the low-cost housebuilder and land

promoter, today provides an update for the year ended 30 June 2023

("FY2023").

Gleeson Homes

Gleeson Homes completed the sale of 1,723 homes during FY2023

(FY2022: 2,000 homes sold). During the second half of the year, 829

homes were sold (H2 FY2022: 1,068 homes sold), reflecting the

downturn in the wider economy and the immediate impact on buyer

confidence as a result of higher interest rates. The 1,723

completions included 115 homes sold out of 377 contracted

reservations under four multi-unit sale agreements.

Selling prices were resilient, underpinned by a shortage of

supply, and helped to offset material and labour cost increases

experienced across the sector in the period. The average selling

price of Gleeson homes sold during the year increased by 11.3% to

GBP186,200 (FY2023: GBP167,300).

There was a significant shift in buyer demographics in the

second half, with first-time buyers accounting for c. 50% of

open-market reservations (FY2022: 71%), whilst over 20% of sales

were to purchasers over 55 years old (FY2022: 10%).

We have successfully concluded the restructuring of Gleeson

Homes from nine regional management teams to six and moved to a

standardised operating structure. The process resulted in

annualised administrative overhead cost savings of GBP3.2m, at a

one-off cost of GBP1.0m. These savings will be realised from FY2024

onwards.

Purchasing a Gleeson home has become increasingly attractive to

customers who would have previously bought a more expensive home,

but who are attracted by Gleeson's affordable price points and

equally high quality. At the same time, a couple working full time

earning the National Living Wage can afford to buy a home on any

Gleeson site.

Reservation rates over the last 6 months improved to 0.64 net

reservations per site per week against 0.62 net reservations per

week over the comparable period last year. Excluding the four

multi-unit sale agreements, the reservation rate was 0.44 per site

per week net of 19% cancellations.

We enter the new financial year with a stronger forward order

book of 665 plots (31 December 2022: 319 plots, 30 June 2022: 618

plots).

Outlook

Gleeson Homes opened 3 new build sites during the year, starting

the new financial year with 82 sites (30 June 2022: 87 build sites)

of which 71 are actively selling (30 June 2022: 61 sales

sites).

Land continues to be available at sensible prices. The pipeline

of owned and conditionally purchased sites increased by 3.3% to

17,375 plots on 173 sites as at 30 June 2023, of which 9,701 plots

on 84 sites have been conditionally purchased subject to receiving

planning permission.

Looking ahead, whilst the Board believes that demand from

first-time buyers will continue at the levels seen through the last

few months, it anticipates that interest from other value-driven

buyers will increase as purchasers look to take advantage of

Gleeson's more affordable price points and high quality.

Gleeson Land

During the year, Gleeson Land appointed a new Managing Director,

Guy Gusterson.

The business sold 3 sites with the potential to deliver 413

plots for housing development.

The portfolio of sites at 30 June 2023 included six sites with

either planning permission or resolution to grant and which have

the potential to deliver 1,400 plots for housing development (30

June 2022: three sites, 1,206 plots). The portfolio also includes

18 sites awaiting a planning decision (30 June 2022: 16 sites) with

the potential to deliver 4,285 plots for housing development (30

June 2022: 3,559 plots).

The portfolio comprises 70 sites, with the potential to deliver

17,831 plots, and 25 acres of commercial land.

Outlook

Whilst planning delays and economic uncertainty are causing some

larger housebuilders to hesitate in completing land purchases,

mid-size and regional housebuilders remain active buyers of

high-quality consented land.

Group

The Group ended the year with cash balances of GBP5.2m and no

debt (30 June 2022: GBP33.8m cash and no debt). This was a pleasing

outcome given the significant investment during the period in

bringing forward a higher proportion of new homes starts.

The Board expects the results for FY2023 to be in line with

market expectations.

Capital Markets Day

The Company is today hosting a Capital Markets Day at its

Petersmiths Park development in Nottinghamshire which, when

completed, will comprise 305 homes.

Under the banner "Putting in place the foundations for future

growth" Graham Prothero (Chief Executive Officer) and Stefan

Allanson (Chief Financial Officer), along with Mark Knight (Chief

Executive, Gleeson Homes) and Guy Gusterson (Managing Director,

Gleeson Land), will set out a roadmap to significantly scale the

Company's operations over the long term. This will focus in

particular on broadening out Gleeson Homes' proven model, including

exploring opportunities in partnerships, and expanding Gleeson

Land's footprint.

No new material financial information will be disclosed and a

copy of the presentation materials that will be used through the

day will be available on the Company's website.

Graham Prothero, Chief Executive Officer, commented:

"We are pleased with the year's performance in a challenging

economic environment. We have taken advantage of the quieter market

to restructure Gleeson Homes, putting the business in great shape

to grow as the market recovers. I am hugely impressed with the

resilience of our team, who remained focused and committed through

that process to deliver these results. This gives me confidence in

achieving our potential. As we will describe later today at our

Capital Markets Day, the changes we are implementing in the

business for the new financial year will further improve our

competitiveness in the current market, and position us well for

gradual stabilisation in the economy.

"We are also very excited about the longer-term prospects for

the business and look forward to setting out later today why we

believe that Gleeson is well-placed to scale significantly over the

long-term, realising its true potential."

Notice of Results

The Company will report its audited full year results on

Thursday, 14 September 2023. A presentation for analysts will be

held at 09:30 that morning at the offices of Hudson Sandler, 25

Charterhouse Square, London, EC1M 6AE, and will also be

webcast.

ENDS

Enquiries:

MJ Gleeson plc Tel: +44 1142 612900

Graham Prothero, Chief Executive

Officer Stefan Allanson,

Chief Financial Officer

Hudson Sandler Tel: +44 (0) 20 7796 4133

Mark Garraway Tel: +44 (0) 7771 860 938

Harry Griffiths Tel: +44 (0) 7860 630 046

Singer Capital Markets Tel: +44 (0) 20 7496 3000

Shaun Dobson

Liberum Tel: +44 (0) 20 3100 2222

Richard Crawley

About MJ Gleeson:

MJ Gleeson plc is the leading low-cost, affordable housebuilder

listed on the London Stock Exchange. Gleeson Homes' customers are

typically young, first-time buyers, with a median income of

GBP28,000. Its two-bedroom homes start from around GBP116,000.

Gleeson's vision is "Building Homes. Changing Lives", prioritising

areas where people need affordable housing the most.

Buying a Gleeson home typically costs less than renting a

similar property. All Gleeson homes are traditional brick built

semi or detached homes which include a driveway and front and rear

gardens. Gleeson offers a wide mix of two, three and four bedroom

layouts.

Gleeson Land is the Group's land promotion division, which

identifies development opportunities and works with stakeholders to

promote land through the residential planning system.

As a high-quality, affordable housebuilder, Gleeson has strong

and inherent sustainability credentials. Its social purpose

underpins the Company's strategy, and Gleeson measures itself

closely against UN SDGs 5, 8, 11, 12, 13 and 15.

More details on the Company's sustainability approach can be

found at: mjgleesonplc.com/sustainability/

This announcement is released by MJ Gleeson plc and contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 (MAR), and is disclosed in

accordance with the Company's obligations under Article 17 of MAR.

Upon the publication of this announcement, this information is

considered to be in the public domain.

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Company by Stefan Allanson, Chief Financial

Officer.

LEI: 21380064K7N2W7FD6434

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKABDDBKBDOK

(END) Dow Jones Newswires

July 07, 2023 02:00 ET (06:00 GMT)

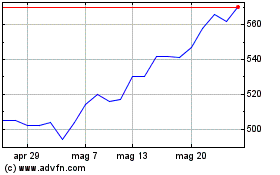

Grafico Azioni Mj Gleeson (LSE:GLE)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni Mj Gleeson (LSE:GLE)

Storico

Da Mar 2024 a Mar 2025