0001823406FY00018234062024-01-012024-12-3100018234062024-06-3000018234062025-03-19xbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39914

Affinity Bancshares, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

Maryland |

|

82-1147778 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

|

|

3175 Highway 278, Covington, Georgia |

|

30014 |

(Address of principal executive offices) |

|

(Zip code) |

(770) 786-7088

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class Trading Symbols |

Name of exchange on which registered |

Common Stock, par value $0.01 per share AFBI |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate value of the voting and non-voting common stock held by non-affiliates of the registrant, computed by reference to the closing price of the common stock of $21.20 as of June 30, 2024, was $114.1 million.

As of March 19, 2025 there were 6,387,329 shares outstanding of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

EXPLANATORY NOTE

Affinity Bancshares, Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (“Amendment”) to amend its Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”), which was originally filed with the Securities and Exchange Commission on March 21, 2025. The purpose of this Amendment is to file Exhibits 19 and 97, which were inadvertently not included as linked to the references included in the exhibit index from the originally filed Form 10-K.

This Amendment speaks as of the original filing date and does not reflect events occurring after the filing of the Form 10-K or modify or update disclosures that may be affected by subsequent events. No revisions are being made to the Company’s financial statements or any other disclosure contained in the Form 10-K. Our independent registered public accounting firm is Wipfli LLP, Atlanta, GA, Auditor Firm ID: 344.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications by the Company’s principal executive officer and principal financial officer are filed herewith as exhibits to this Amendment pursuant to Rule 13a-14(a) and 15d-14(a) of the Exchange Act. The Company is not including certifications pursuant to Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) as no financial statements are being filed with this Amendment.

PART IV

ITEM 15. Exhibits and Financial Statement Schedules

(a) Financial Statements and Schedules:

The following documents are filed as part of this report:

1. Financial Statements: The consolidated financial statements of the Company were previously submitted with the original filing of this Form 10-K.

2. Financial Statement Schedules: All schedules are omitted because they are not applicable or the required information is shown in the financial statements or notes thereto.

3. Exhibits: The documents listed in the Exhibit Index are incorporated by reference or are filed with this report, in each case as indicated therein (numbered in accordance with Item 601 of Regulation S-K).

(b) Exhibits. The following is a list of Exhibits to this annual report.

|

|

|

|

101 |

The following materials from the Company’s Annual Report on Form 10-K, formatted in inline XBRL: (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Income, (iii) Consolidated Statements of Comprehensive Income, (iv) Consolidated Statements of Changes in Stockholders’ Equity, (v) Consolidated Statements of Cash Flows and (vi) Notes to the Consolidated Financial Statements |

† Management contract or compensation plan or arrangement.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

AFFINITY BANCSHARES, INC. |

|

|

|

|

Date: March 27, 2025 |

|

By: |

/s/ Brandi Pajot |

|

|

|

Brandi Pajot |

|

|

|

Senior Vice President and Chief Financial Officer |

|

|

|

|

AFFINITY BANCSHARES, INC.

POLICY REGARDING INSIDER TRADING

Affinity Bancshares, Inc. (the “Company”) is a public company, the common stock of which is quoted on the Nasdaq Capital Market and registered under the Securities Exchange Act of 1934, as amended. As a public company, the Company files periodic reports and proxy statements with the Securities and Exchange Commission (the “SEC”). Investment by directors, officers and employees in the Company stock is generally desirable and encouraged. However, such investments should be made with caution and with recognition of the legal prohibitions against the use of confidential information by “insiders” for their own profit.

As a director, officer or employee of a public company, you have the responsibility not to participate in the market for the Company stock while in possession of material inside information about the Company. There are harsh civil and criminal penalties if you wrongly obtain or use such material, inside information when you are deciding whether to buy or sell securities, or if you give that information to another person who uses it in buying or selling securities. If you buy or sell securities while in possession of material, inside information, you will not only have to pay back any profit you made, but you could be found guilty of criminal charges, and face substantial fines or even prison. Additionally, the Company could be held liable for your violations of insider trading laws.

To avoid these harsh consequences, the Company has developed the following guidelines to briefly explain the insider trading laws and set forth procedures and limitations on trading by directors, officers and employees. However, these guidelines do not address all possible situations that you may face. In addition, you need to review and understand the Company’s Policy on Fair Disclosure to Investors that describes your obligations regarding the selective disclosure of confidential information to ensure compliance with SEC Regulation FD, which requires “fair disclosure” of material, non-public information.

Insider Trading Concepts

What is “Inside” Information?

Inside information includes any non-public information of which you become aware because of your “special relationship” with the Company as a director, officer or employee and which has not been disclosed to the public (i.e., is non-public). The information may be about the Company, Affinity Bank (the “Bank”) or other subsidiaries or affiliates. It may also include information you learn about another company (for example, companies that are current or prospective customers or suppliers to the Company or those with which the Company may be in negotiations regarding a potential transaction).

What is Material Information?

Information is material if an investor would think that it is important in deciding whether to buy, sell or hold stock, or if it could affect the market price of the stock. Either good or bad information may be material. If you are unsure whether the information is material, assume it is material.

Examples of material information typically include, but are not limited to:

• Financial or accounting problems;

• Estimates of future earnings or losses;

• Significant non-recurring gains or losses;

• Events that could result in restating financial information;

• A proposed acquisition, sale or merger;

• Changes in key management personnel;

• Beginning or settling a major lawsuit;

• Changes in dividend policies;

• Declaring a stock split;

• A stock repurchase program; or

• A stock or bond offering.

What is Non-Public Information?

Non-public information is information that has not yet been made public by the Company. Information only becomes public when the Company makes an official announcement (in a publicly accessible conference call, a press release or in SEC filings, for example) and people have had an opportunity to see or hear it.

Trading Guidelines

A. Rules Applicable to All Directors, Officers and Employees.

No director, officer or employee may trade any security, whether issued by the Company or by any other company, while in possession of “material inside information” about the issuer. Further, no director, officer or employee may disclose “material inside information” to any other person (including immediate family members, friends or stockbrokers) so that such other person may trade in the stock. It is usually safe to buy or sell stock after the information is officially announced, as long as you do not know of other material information that has not yet been announced. Even after the information is announced, you should generally wait one full trading day before buying or selling securities to allow the market to absorb the information.

This means the following with respect to certain Bank or Company employee benefit plans:

•401(k) Plan. An officer or employee having material inside information regarding the Company may not (i) initiate a transfer of funds into or out of the Community First Bancshares, Inc. stock fund of the 401(k) plan, or (ii) increase an existing election to invest funds in the Community First Bancshares, Inc. stock fund. However, ongoing purchases of the Company’s stock through the plan pursuant to a prior election are not prohibited.

•Other Company Stock Purchase Plans. A director, officer or employee having material inside information regarding the Company may not sign up for, or increase participation in, any employee stock purchase plan or dividend reinvestment plan. However, ongoing purchases through those plans pursuant to a prior election are not prohibited.

•Stock Options. A director, officer or employee may exercise a stock option at any time, but any stock acquired upon such exercise may not be sold (whether by means of a cashless exercise or otherwise) if the employee has material inside information regarding the Company. At any time, however, an employee may deliver Company stock already owned to pay the option exercise price and taxes.

B. Additional Rules Applicable to All Officers with the Title of Senior Vice President or Higher, All Directors, and All Persons in the Accounting Department (the “Restricted Group”).

1. Blackout Periods

Quarterly Blackout Periods. No person in the Restricted Group may trade in Company securities during a blackout period that begins on the 15th day of the last month of each calendar quarter (i.e., on March 15, June 15, September 15 and December 15) and ends at the end of the first full trading day after the public release of the Company’s earnings for such quarter. The blackout period applies to (i) open market purchases or sales, (ii) a sale of securities following exercise of a stock option (including a sale by way of a cashless exercise), (iii) signing up for, or increasing participation in, any employee stock purchase plan or dividend reinvestment plan, and (iv) initiating a transfer of funds into or out of any Company stock fund of a 401(k) plan or increasing an existing election to invest funds in any Company stock fund. However, ongoing purchases through the 401(k) plan or other Company-sponsored plan pursuant to a prior election are permitted at any time (i.e., they are not subject to the blackout period).

Temporary Blackout Periods. The Company may also institute temporary blackout periods in the event of a material corporate development. Notice of temporary blackout periods will be distributed by means of a written or electronic communication specifying the duration of the blackout period and the persons subject to it.

Written Plan Exception. The limitations of the blackout periods shall not apply to trading in Company securities pursuant to a “written plan for trading securities” provided that such plan was entered into prior to the commencement of the applicable blackout period, meets the requirements of SEC Rule 10b5-1 (including satisfaction of a cooling-off period and inclusion in the plan of certain certifications) and is approved in advance by the Company’s Board of Directors. See also Section C.4 below.

2. Selling Short. No person in the Restricted Group may at any time sell short Company stock or otherwise sell any equity securities of the Company that they do not own. Generally, a short sale means any transaction whereby one may benefit from a decline in the Company’s stock price.

3. Options. No person in the Restricted Group may at any time buy or sell options on Company securities (so called “puts” and “calls”) except in accordance with a program approved by the Company’s Board of Directors or a trade cleared by the President and Chief Executive Officer. This restriction does not apply to the exercise of employee or director stock options, which is treated under Section A above.

4. Margin Accounts and Pledges. Securities held in a margin account may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Similarly, securities held in an account which may be borrowed against or are otherwise pledged (or hypothecated) as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. A margin sale or foreclosure sale may occur at a time when the pledgor is aware of material non- public information or otherwise is not permitted to trade in Company securities and, as a result, the pledgor may be subject to liability under insider trading laws.

Therefore, you may not purchase Company securities on margin, or borrow against any account in which Company securities are held, or pledge Company securities as collateral for a loan.

An exception to this prohibition may be granted where a person wishes to pledge Company securities as collateral for a loan from a third party (not including margin debt) and clearly demonstrates the financial capacity to repay the loan without resort to the pledged securities. Any person who wishes to pledge Company securities as collateral for a loan from a third party must submit

a request for approval to the Company’s Board of Directors at least two weeks prior to the execution of the documents evidencing the proposed pledge.

C. Additional Rules.

1. Pre-Clearance and Reporting: Directors and executive officers, and any family member sharing the same household or a corporation or trust they control, must have transactions in the Company’s securities pre-cleared by the Filing Coordinator prior to effecting such transactions. If, upon requesting clearance, you are advised that Company stock may not be traded, you may not engage in any trade of any type under any circumstances, nor may you inform anyone of the restriction. You may re-apply for pre-clearance at a later date when trading restrictions may no longer be applicable. It is critical that you obtain pre-clearance of any trading to assist you in avoiding short-swing or insider trading violations and to avoid even the appearance of an improper transaction (which could result, for example, when an officer engages in a trade while unaware of a pending major development).

2. Options and Other Stock Plans. The exercise of stock options and/or sale of stock acquired upon an exercise of stock options and the transfer of funds into and out of the Company’s stock plans are subject to special rules. The Filing Coordinator should be contacted before any such transaction is conducted.

3. Pension Fund Blackouts. The Sarbanes-Oxley Act of 2002 also requires the Company to prohibit all purchases, sales or transfers of the Company’s securities by directors and executive officers during a pension fund blackout

period. A pension fund blackout period exists whenever 50% or more of the plan participants are unable to conduct transactions in their accounts for more than three consecutive days. These blackout periods typically occur when there is a change in the retirement plan’s trustee, record keeper or investment manager. Directors and executive officers will be contacted when these or other restricted trading periods are instituted.

4. Rule 10b5-1 Plans. Directors and executive officers may only enter into a trading plan when they are not in possession of material inside information. In addition, directors and executive officers may not enter into a trading plan during a quarterly blackout period or during a pension blackout period. The Filing Coordinator should be contacted prior to implementation of a trading plan under SEC Rule 10b5-1. Once a trading plan is pre-cleared, trades made pursuant to the plan will not require additional pre-clearance, but only if the plan specifies the dates, prices and amounts of the contemplated trades or establishes a formula for determining dates, prices and amounts. The actual establishment of a trading plan must be reported to the Chief Financial Officer and the Corporate Secretary so that the required public disclosure (including a description of the material terms of such trading plan) can be made in the Company’s SEC filings. Transactions made under a trading plan then need to be promptly reported to the Filing Coordinator who will prepare the necessary Form 4.

D. Additional Rules Applicable to Proposed Mergers/Acquisitions.

Whenever the Company is actively considering a particular company for merger, acquisition or for another significant business relationship (such as a joint venture) or whenever the Company is engaged in active discussion regarding the sale of control of the Company, all of the Company’s personnel involved in, or aware of, due diligence or other planning for or attention to the acquisition or business relationship are prohibited from trading in any of the Company’s securities and any securities of the other company.

Note: This policy applies to personal securities transactions by the directors, officers and employees identified above and also applies to:

(a) Transactions for accounts in which the director, officer or employee has an interest or an ability to influence transactions; and

(b) Transactions by the director’s, officer’s or employee’s spouse or any other member of their household unless (i) the household member’s investment decisions are made independently of the director, officer or employee and (ii) the household member has not received inside information about the issuer of the security. It must be understood, however, that the director, officer and employee and/or the household member will bear the burden of demonstrating that the household member has not received inside information. Furthermore, directors and executive officers are subject to special rules in this regard and any proposed transaction in Company securities by a corporation or trust they control or by a family member sharing the same household must be discussed in advance with the Chief Executive Officer or Company counsel.

5.Stock Repurchase by the Company.

Although this policy does not restrict the Company’s purchase of its common stock, the Board of Directors has delegated to the Chief Executive Officer or his designee(s) the authority and discretion to authorize the Company to purchase Company common stock pursuant to a Board-approved and currently effective stock repurchase program, including during a restricted trading period under this policy, provided that the Chief Executive Officer determines that the Company is not in possession of non-public material information that prohibits such purchases.

Confidentiality

Serious problems could develop for the Company by unauthorized disclosure of inside information about the Company, whether or not for the purpose of facilitating improper trading of the Company’s stock.

1.Confidentiality of Non-Public Information.

Directors, officers and employees should not discuss internal matters or developments with anyone outside of the Company (including family members, securities analysts, individual investors, members of the investment community and news media), except as required in the performance of regular corporate duties. In addition, directors, officers and employees of the Company with knowledge of material, non-public information should only disclose such information to other Company personnel on a “need-to-know” basis so that the group of individuals with knowledge of material, non-public information is kept as small as possible.

All inquiries about the Company made by the financial press, investment analysts or others in the financial community, or by shareholders must be handled in accordance with the Company’s Policy on Fair Disclosure to Investors. If you have any doubt as to your responsibilities under this policy, you should seek clarification from the Disclosure Policy Compliance Officer before acting.

2.Prohibition Against Internet Disclosure

It is inappropriate for any unauthorized person to disclose Company information or to discuss the Company on the Internet, including in any forum or chat room where companies and their prospects are discussed. The posts in these forums are, in some cases, made by investors who are poorly informed, who have malicious intent or who intend to benefit their own stock positions. To avoid the disclosure of material, inside information, no director, officer or employee may discuss the Company or Company-related information in an Internet forum or chat room, regardless of the situation.

***

If you have any questions regarding this policy, please contact Edward Cooney or Brandi Pajot.

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Edward J. Cooney, certify that:

|

|

|

|

|

|

|

1. |

I have reviewed this annual report on Form 10-K/A of Affinity Bancshares, Inc.; |

|

|

|

|

|

|

|

2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

|

|

|

|

|

|

|

3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

|

|

|

|

|

|

|

4. |

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

|

|

|

|

|

|

|

a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

|

b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

|

|

|

|

|

|

|

c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

|

|

|

|

|

|

|

d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

|

|

|

|

|

|

|

5. |

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors: |

|

|

|

|

|

|

|

a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

|

|

|

|

|

|

|

b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

|

|

|

|

|

|

|

|

Date: |

March 27, 2025 |

/s/ Edward J. Cooney |

|

|

|

Edward J. Cooney |

|

|

|

Chief Executive Officer |

|

Exhibit 31.2

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Brandi Pajot, certify that:

|

|

|

|

1. |

I have reviewed this annual report on Form 10-K/A of Affinity Bancshares, Inc.; |

|

|

|

|

|

|

|

2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

|

|

|

|

3. |

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

|

|

|

|

4. |

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

|

|

|

|

a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

|

b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

|

|

|

|

c) |

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

|

|

|

|

d) |

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

|

|

|

|

5. |

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors: |

|

|

|

|

a) |

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

|

|

|

|

b) |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

|

|

|

Date: |

March 27, 2025 |

/s/ Brandi Pajot |

|

|

Brandi Pajot |

|

|

Chief Financial Officer |

AFFINITY BANCSHARES, INC.

CLAWBACK POLICY

The Board of Directors (the “Board”) of Affinity Bancshares, Inc. (the “Company”) believes that it is in the best interests of the Company and its shareholders to adopt this Clawback Policy (this “Policy”), which provides for the recovery of Erroneously Awarded Compensation in the event the Company is required to prepare an Accounting Restatement.

The Company has adopted this Policy as a supplement to any other clawback policies or provisions in effect now or in the future at the Company. To the extent this Policy applies to compensation payable to a person covered by this Policy, it shall supersede any other conflicting provision or policy maintained by the Company and shall be the only clawback policy applicable to such compensation and no other clawback policy shall apply; provided that, if such other policy or provision provides that a greater amount of such compensation shall be subject to clawback, such other policy or provision shall apply to the amount in excess of the amount subject to clawback under this Policy.

This Policy shall be interpreted to comply with the clawback rules found in 17 C.F.R. §240.10D-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the related listing rules of the national securities exchange or national securities association (the “Exchange”) on which the Company has listed securities, and, to the extent this Policy is in any manner deemed inconsistent with such rules, this Policy shall be treated as retroactively amended to be compliant with such rules.

(a)“Accounting Restatement” means an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period.

(b)“Accounting Restatement Date” means the earlier to occur of: (i) the date the Board, a committee of the Board, or the officer or officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement or (ii) the date a court, regulatory agency, or other legally authorized body directs the Company to prepare an Accounting Restatement.

(c)“Erroneously Awarded Compensation” means, in the event of an Accounting Restatement, the amount of Incentive-Based Compensation previously received that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts in such Accounting Restatement. The amount of Erroneously Awarded Compensation shall be determined on a gross basis without regard to any taxes paid by the relevant Executive Officer; provided, however, that for Incentive-Based Compensation based on the Company’s stock price or total shareholder return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement: (i) the amount of Erroneously Awarded Compensation shall be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total shareholder return upon which the Incentive-Based Compensation was received and (ii) the Company must maintain documentation of the determination of such reasonable estimate and provide such documentation to the Stock Exchange.

(d)“Executive Officer” means the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions

for the Company. An executive officer of the Company’s parent or subsidiary is deemed an “Executive Officer” if the executive officer performs policy making functions for the Company.

(e)“Financial Reporting Measure” means any measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measure that is derived wholly or in part from such measure; provided, however, that a Financial Reporting Measure is not required to be presented within the Company’s financial statements or included in a filing with the Securities and Exchange Commission to qualify as a “Financial Reporting Measure.” For purposes of this Policy, “Financial Reporting Measure” includes, but is not limited to, stock price and total shareholder return.

(f)“Incentive-Based Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure.

(g)“Received” means incentive-based compensation received in the Company’s fiscal period during which the financial reporting measure specified in the incentive-based compensation award is attained, even if the payment or grant of the incentive-based compensation occurs after the end of that period.

2. Application of the Policy. This Policy shall only apply in the event that the Company is required to prepare an Accounting Restatement and it shall apply to all Incentive-Based Compensation Received by a person: (a) after beginning service as an Executive Officer; (b) who served as an Executive Officer at any time during the performance period for such Incentive-Based Compensation; (c) while the Company had a class of securities listed on a national securities exchange or a national securities association; and (d) during the three completed fiscal years immediately preceding the Accounting Restatement Date. In addition to such last three completed fiscal years, the immediately preceding clause (d) includes any transition period that results from a change in the Company’s fiscal year within or immediately following such three completed fiscal years; provided, however, that a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to twelve months shall be deemed a completed fiscal year.

3. Recovery Period. The Incentive-Based Compensation subject to clawback is the Incentive-Based Compensation Received during the three completed fiscal years immediately preceding an Accounting Restatement Date; provided that the individual served as an Executive Officer at any time during the performance period applicable to the Incentive-Based Compensation in question. Notwithstanding the foregoing, the Policy shall only apply if the Incentive-Based Compensation is Received (1) while the Company has a class of securities listed on an Exchange, and (2) on or after October 2, 2023.

4. Erroneously Awarded Compensation. The amount of Incentive-Based Compensation subject to the Policy (“Erroneously Awarded Compensation”) is the amount of Incentive-Based Compensation Received that exceeds the amount of Incentive Based-Compensation that otherwise would have been Received had it been determined based on the restated amounts in the Company’s financial statements and shall be computed without regard to any taxes paid. For Incentive-Based Compensation based on stock price or total shareholder return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement: (1) the amount shall be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total shareholder return upon which the Incentive-Based Compensation was received; and (2) the Company must maintain documentation of the determination of that reasonable estimate and provide such documentation to the Exchange. The Board shall determine, in its sole discretion, the timing and method for promptly recouping Erroneously Awarded Compensation hereunder, which may include without limitation (a) seeking reimbursement of all or part of any cash or equity-based award, (b) cancelling prior cash or equity-based awards, whether vested or unvested or paid or unpaid, (c) cancelling or offsetting against any planned future cash or equity-based awards, (d) forfeiture of deferred compensation, subject to compliance with Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations promulgated thereunder and (e) any other method authorized by applicable law or contract. Subject to compliance with any applicable law, the Board may affect recovery under this Policy from any amount otherwise payable to the Executive Officer, including amounts payable to such individual under any otherwise applicable Company plan or program, including base salary, bonuses or commissions and compensation previously deferred by the Executive Officer.

5. Recovery Exceptions. The Company shall recover reasonably promptly any Erroneously Awarded Compensation except to the extent that the conditions of paragraphs (a), (b) or (c) below apply. The Compensation Committee of the Board of Directors (the “Committee”) shall determine the repayment schedule for each amount of Erroneously Awarded Compensation in a manner that complies with this “reasonably promptly” requirement. Such determination shall be consistent with any applicable legal guidance by the Securities and Exchange Commission, judicial opinion, or otherwise. The determination of “reasonably promptly” may vary from case to case and the Committee is authorized to adopt additional rules to further describe what repayment schedules satisfy this requirement.

(a) Erroneously Awarded Compensation need not be recovered if the direct expense paid to a third party to assist in enforcing the Policy would exceed the amount to be recovered and the Committee has made a determination that recovery would be impracticable. Before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on expense of enforcement, the Company shall make a reasonable attempt to recover such Erroneously Awarded Compensation, document such reasonable attempt(s) to recover, and provide that documentation to the Exchange, as required.

(b) If applicable, Erroneously Awarded Compensation need not be recovered if recovery would violate home country law where that law was adopted prior to November 28, 2022. Before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on violation of home country law, the Company shall obtain an opinion of home country counsel, acceptable to the Exchange, that recovery would result in such a violation and shall provide such opinion to the Exchange.

(c) Erroneously Awarded Compensation need not be recovered if recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of Section 401(a)(13) or Section 411(a) of the Code and regulations thereunder.

6. Committee Decisions. Decisions of the Committee with respect to this Policy shall be final, conclusive and binding on all Executive Officers subject to this Policy, unless determined by a court of competent jurisdiction to be an abuse of discretion. Any members of the Committee, and any other members of the Board who assist in the administration of this Policy, shall not be personally liable for any action, determination or interpretation made with respect to this Policy and shall be fully indemnified by the Company to the fullest extent under applicable law and Company policy with respect to any such action, determination or interpretation. The foregoing sentence shall not limit any other rights to indemnification of the members of the Board under applicable law or Company policy.

7. No Indemnification. Notwithstanding anything to the contrary in any other policy of the Company, the governing documents of the Company or any agreement between the Company and an Executive Officer, no Executive Officer shall be indemnified by the Company against the loss of any Erroneously Awarded Compensation. Further, the Company is prohibited from paying or reimbursing an Executive Officer for purchasing insurance to cover any such loss.

8. Agreement to Policy by Executive Officers. The Committee shall take reasonable steps to inform Executive Officers of this Policy and the Executive Officers shall acknowledge receipt and adherence to this Policy in writing.

9. Exhibit Filing Requirement. A copy of this Policy and any amendments thereto shall be filed as an exhibit to the Company’s Annual Report on Form 10-K.

10. Amendment. The Board may amend, modify or supplement all or any portion of this Policy at any time and from time to time in its discretion.

[TO BE SIGNED BY EACH OF THE COMPANY’S EXECUTIVE OFFICERS]

Clawback Policy Acknowledgment

I, the undersigned, agree and acknowledge that I am fully bound by, and subject to, all of the terms and conditions of the Affinity Bancshares, Inc. Clawback Policy (as may be amended, restated, supplemented or otherwise modified from time to time, the “Policy”) and that I have been provided a copy of the Policy. In the event of any inconsistency between the Policy and the terms of any employment or similar agreement to which I am a party, or the terms of any compensation plan, program or agreement under which any compensation has been granted, awarded, earned or paid, the terms of the Policy shall govern. If the Committee determines that any amounts granted, awarded, earned or paid to me must be forfeited or reimbursed to the Company, I will promptly take any action necessary to effectuate such forfeiture and/or reimbursement.

v3.25.1

Document And Entity Information - USD ($)

$ in Millions |

12 Months Ended |

|

|

Dec. 31, 2024 |

Mar. 19, 2025 |

Jun. 30, 2024 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

Affinity Bancshares, Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (“Amendment”) to amend its Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”), which was originally filed with the Securities and Exchange Commission on March 21, 2025. The purpose of this Amendment is to file Exhibits 19 and 97, which were inadvertently not included as linked to the references included in the exhibit index from the originally filed Form 10-K.This Amendment speaks as of the original filing date and does not reflect events occurring after the filing of the Form 10-K or modify or update disclosures that may be affected by subsequent events. No revisions are being made to the Company’s financial statements or any other disclosure contained in the Form 10-K. Our independent registered public accounting firm is Wipfli LLP, Atlanta, GA, Auditor Firm ID: 344.In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications by the Company’s principal executive officer and principal financial officer are filed herewith as exhibits to this Amendment pursuant to Rule 13a-14(a) and 15d-14(a) of the Exchange Act. The Company is not including certifications pursuant to Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) as no financial statements are being filed with this Amendment.

|

|

|

| Document Period End Date |

Dec. 31, 2024

|

|

|

| Document Fiscal Year Focus |

2024

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Trading Symbol |

AFBI

|

|

|

| Entity Registrant Name |

Affinity Bancshares, Inc.

|

|

|

| Entity Central Index Key |

0001823406

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Common Stock, Shares Outstanding |

|

6,387,329

|

|

| Entity Public Float |

|

|

$ 114.1

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Document Financial Statement Error Correction |

false

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity File Number |

001-39914

|

|

|

| Entity Tax Identification Number |

82-1147778

|

|

|

| Entity Address, Address Line One |

3175 Highway 278

|

|

|

| Entity Address, City or Town |

Covington

|

|

|

| Entity Address, State or Province |

GA

|

|

|

| Entity Address, Postal Zip Code |

30014

|

|

|

| City Area Code |

770

|

|

|

| Local Phone Number |

786-7088

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

|

|

| Entity Incorporation, State or Country Code |

MD

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Documents Incorporated by Reference |

None.

|

|

|

| Auditor Name |

Wipfli LLP

|

|

|

| Auditor Location |

Atlanta, GA

|

|

|

| Auditor Firm ID |

344

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionDocuments incorporated by reference. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-23

| Name: |

dei_DocumentsIncorporatedByReferenceTextBlock |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

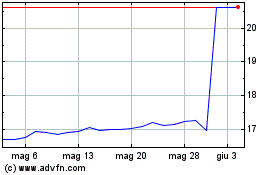

Grafico Azioni Affinity Bancshares (NASDAQ:AFBI)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Affinity Bancshares (NASDAQ:AFBI)

Storico

Da Apr 2024 a Apr 2025