Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 Marzo 2025 - 12:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 000-51469

BAIDU, INC.

Baidu Campus

No. 10 Shangdi 10th Street

Haidian District, Beijing 100085

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release—Baidu Announces Proposed Offering of Exchangeable Bonds |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| BAIDU, INC. |

|

|

| By: |

|

/s/ Junjie He |

| Name: |

|

Junjie He |

| Title: |

|

Interim Chief Financial Officer |

Date: March 7, 2025

Exhibit 99.1

Baidu Announces Proposed Offering of Exchangeable Bonds

BEIJING, March 7, 2025 /PRNewswire/ — Baidu, Inc. (NASDAQ: BIDU and HKEX: 9888 (HKD Counter) and 89888 (RMB Counter)), (“Baidu” or the

“Company”), a leading AI company with strong Internet foundation, today announced that it proposes to offer up to US$2 billion in aggregate principal amount of exchangeable bonds due 2032 (the “Bonds”) in offshore

transactions outside the United States to non-U.S. persons in reliance on Regulation S under the Securities Act of 1933, as amended (the “Securities Act”), subject to market conditions and other

factors (the “Bonds Offering”).

The Bonds will reference ordinary shares of Trip.com Group Limited that are listed on The Stock Exchange of

Hong Kong Limited (the “Hong Kong Stock Exchange”) (HKEX: 9961) (“Trip.com Shares”). Holders of the Bonds may not exchange their Bonds prior to the first anniversary of the issue date of the Bonds, except upon an event of

default. Between the first anniversary of the issue date and the date falling 6 months prior to the maturity date of the Bonds, holders of the Bonds may exchange the Bonds into cash only upon the satisfaction of certain contingencies. Thereafter and

until the second scheduled trading day preceding the maturity date, holders may exchange the Bonds into cash at any time. Subject to certain conditions, the Company may elect to deliver Trip.com Shares held by the Company in lieu of cash or a

combination of cash and Trip.com Shares. The Bonds are not exchangeable for American depositary shares of Trip.com Group Limited (Nasdaq: TCOM) (“Trip.com ADSs”). The exchange ratio and other terms of the Bonds have not been finalized and

will be determined at the time of pricing of the Bonds Offering.

The Company intends to use the net proceeds from the Bonds Offering for repayment of

certain existing indebtedness, payment of interest and general corporate purposes. The Bonds have not been and will not be registered under the Securities Act or any state securities laws. They may not be offered or sold in the United

States or to U.S. persons (as defined in Regulation S under the Securities Act) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The Trip.com Shares

currently held by the Company are “restricted securities” (within the meaning of Rule 144 under the Securities Act). Any Trip.com Shares that the Company may elect to deliver upon exchange of the Bonds shall be freely transferable for the

purposes of the Securities Act.

Investor Hedging Transactions

The Company expects that certain purchasers of the Bonds will employ a convertible arbitrage strategy through a short position in respect of Trip.com Shares

and/or Trip.com ADSs to hedge their exposure to the Bonds, Trip.com Shares and/or Trip.com ADSs. Concurrently with the pricing of the Bonds, the bookrunners of the Bonds Offering expect to facilitate a sale of Trip.com Shares (for the avoidance of

doubt, not Trip.com ADSs), representing the initial delta of such hedging investors, in off-market privately negotiated transactions (such sale, a “delta placement”).

Other Matters

This announcement shall not constitute an offer to sell or a solicitation of an offer to purchase any securities, in the United States or elsewhere, and shall

not constitute an offer, solicitation or sale of the securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

This announcement contains information about the pending Bonds Offering, and there can be no assurance that the Bonds Offering will be completed.

About Baidu

Founded in 2000, Baidu’s mission is to

make the complicated world simpler through technology. Baidu is a leading AI company with strong Internet foundation, trading on Nasdaq under “BIDU” and HKEX under “9888”. One Baidu ADS represents eight Class A ordinary

shares.

Safe Harbor Statement

This announcement

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Baidu may also make written or

oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in announcements made on the website of the Hong Kong Stock Exchange, in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about Baidu’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following:

Baidu’s growth strategies; its future business development, including development of new products and services; its ability to attract and retain users and customers; competition in the Chinese Internet search and newsfeed market; competition

for online marketing customers; changes in the Company’s revenues and certain cost or expense items as a percentage of its revenues; the outcome of ongoing, or any future, litigation or arbitration, including those relating to intellectual

property rights; the expected growth of the Chinese-language Internet search and newsfeed market and the number of Internet and broadband users in China; Chinese governmental policies relating to the Internet and Internet search providers, and

general economic conditions in China and elsewhere. Further information regarding these and other risks is included in the Company’s annual report on Form 20-F and other documents filed with the

Securities and Exchange Commission, and announcements on the website of the Hong Kong Stock Exchange. Baidu does not undertake any obligation to update any forward-looking statement, except as required under applicable law. All information provided

in this announcement is as of the date of the announcement, and Baidu undertakes no duty to update such information, except as required under applicable law.

SOURCE Baidu, Inc.

Investors Relations, Baidu, Inc.

Tel: +86-10-5992-8888

Email: ir@baidu.com

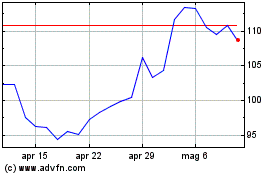

Grafico Azioni Baidu (NASDAQ:BIDU)

Storico

Da Mar 2025 a Apr 2025

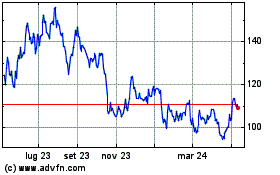

Grafico Azioni Baidu (NASDAQ:BIDU)

Storico

Da Apr 2024 a Apr 2025