UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ |

Preliminary Information Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive Information Statement |

KAIVAL BRANDS INNOVATIONS GROUP, INC.

(Name

of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

INFORMATION STATEMENT OF

KAIVAL BRANDS INNOVATIONS GROUP, INC.

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND

NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO

YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

To: The Holders of Common Stock of Kaival Brands Innovations Group.:

Re: Action by Written Consent In Lieu of a Special Meeting of Stockholders

We are furnishing this notice and

the accompanying Information Statement to the stockholders of Kaival Brands Innovations Group., a Delaware corporation (the “Company”,

or the “Registrant”), for informational purposes only pursuant to Section 14(c) of the Exchange Act of 1934, as amended (the

“Exchange Act”), and the rules and regulations prescribed thereunder.

On February 21, 2025, the Board of Directors of the Company unanimously authorized and approved a reverse split of the issued and outstanding

shares of the Company’s common stock, par value $0.001 (the “Shares” or “Common Stock”), at a ratio of any

whole number within the range between one-for-two (1:2) and one-for-twenty (1:20), with such ratio to be determined in the discretion

of the Registrant’s Board of Directors and with such action to be effected at such time and date as determined by the Board of Directors

(the “Reverse Split”).

The Reverse Split was authorized

and approved by the Unanimous Written Consent of the Board of Directors dated February 21, 2025 and by the Action by Written Consent of

the Stockholders holding the majority of the voting power of the Company, dated February [ ], 2025.

In accordance with Rule 14c-2 of

the Exchange Act, corporate actions described above will be effective no earlier than twenty (20) days after this Information Statement

has been mailed to our stockholders, which we expect to be on or approximately [*], 2025.

This Information Statement has

been mailed to you for information purposes only on or about [*], 2025, and you are not required to take any action.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING

OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN.

| By Order of the Board of Directors: |

|

| |

|

| /s/ |

|

| |

|

| Mark Thoenes |

|

| Chief Executive Officer |

|

| [*], 2025 |

|

KAIVAL BRANDS INNOVATIONS GROUP, INC.

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

Information Statement Pursuant to Section 14C of

the Securities Exchange Act of 1934

This Information Statement is being filed by Kaival

Brands Innovations Group., (the “Company”, or “Registrant”) with the United States Securities and Exchange Commission

(the “SEC”) on [ ], 2025, based upon the Written Consent of the Board of Directors dated February 21, 2025 (the “Board

Consent”) and the consent of the holders of a majority of outstanding shares of voting capital stock of the Company (the “Majority

Consenting Stockholders”) dated February [ ], 2025 (the “Stockholder Consent” and, together with the Board Consent,

the “Written Consents”).

The purpose of this Information Statement is to provide disclosure to our stockholders

regarding the corporate action ratified and approved by our Board of Directors and the Majority Consenting Stockholders, to implement

a reverse split at a ratio of any whole number within the range between one-for-two (1:2) and one-for-twenty (1:20), with such ratio to

be determined in the discretion of the Registrant’s Board of Directors and with such action to be effected at such time and date

as determined by the Board of Directors (the “Reverse Split” or the “Corporate Action”).

The Written Consents approving the Corporate Action

were adopted pursuant to the provisions of Section 141(f) and Section 228 of Title 8 of the Delaware General Corporation Law (“DGCL”).

Under Section 228 of Title 8 of DGCL any action required

or permitted by the DGCL to be taken at an annual or special meeting of stockholders of a Delaware corporation may be taken without a

meeting, without prior notice and without a vote, if a consent in writing, setting forth the action so taken, is signed by the holders

of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting

at which all voting shares entitled to vote thereon were present and voted. Prompt notice of the approval of any action so taken must

be given to those stockholders who have not consented in writing to the action and who, if the action had been taken at a meeting, would

otherwise have been entitled to notice of the meeting.

Under the DGCL and the Company’s Certificate

of Incorporation, the affirmative vote of the holders of a majority of the Company’s outstanding voting capital stock is required

to approve the Reverse Split. On February 25, 2025, Majority Consenting Stockholders that, in the aggregate, are the record owners of

[ ] shares of our Common Stock representing, in the aggregate, [ ]% of our outstanding voting capital stock, executed and delivered to

the Company a written consent authorizing and approving the Reverse Split. The Majority Consenting Stockholders include several members

of our Board of Directors and other significant stockholders.

Accordingly, the Reverse Stock Split has been approved

by stockholders representing the requisite number of shares of our outstanding voting capital stock. As such, no vote or further action

of the stockholders of the Company is required to approve the Reverse Split.

In order to properly implement the Reverse Split,

after filing of the Definitive Information Statement on Schedule 14C with the SEC, the Company must submit a Company Event Notification

Form to The Nasdaq Stock Market LLC (“Nasdaq”) notifying Nasdaq of the Reverse Split and must comply with Nasdaq Rule 5250(e)(7).

Pursuant to Rule 14c-2(b) promulgated by the SEC under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the actions approved by the Written Consents cannot

become effective until twenty (20) days from the date of mailing of the Definitive Information Statement to our stockholders. This Information

Statement shall constitute notice to our stockholders of the above Corporate Action taken by the Corporation pursuant to the Written Consents.

New Common Stock certificates will not be issued on

or after the date that the Reverse Split is effected (the “Effective Date”) but may be issued subsequently with respect to

any certificates returned to the transfer agent upon a sale, exchange, or for any other purpose following the implementation of the Reverse

Split. No fractional shares will be issued in connection with the Reverse Split. Any fractional share will be rounded up to the next whole

number.

REVERSE SPLIT

Actions By Board of Directors and Majority Consenting

Stockholders

On February 20, 2025, the Company’s Board of Directors and Majority

Consenting Stockholders unanimously approved the Reverse Split of the issued and outstanding shares of Common Stock, including shares

of Common Stock reserved for issuance, at a ratio of any whole number within the range between one-for-two (1:2) and one-for-twenty (1:20),

with such ratio, time and date to be determined by the Company’s Board of Directors.

The Corporate Action, which provides for the implementing

of the Reverse Split, was based upon and approved by the Written Consents.

The Majority Consenting Stockholders are:

| Name of Consenting Stockholder | |

Number of Shares Owned | |

Percentage of Beneficial Ownership* |

| | |

| | | |

| | % |

| | |

| | | |

| | % |

| | |

| | | |

| | % |

| | |

| | | |

| | % |

| Total Voting Power: | | |

| | | |

| | % |

*Based on [ ] issued and outstanding shares of Common Stock as of February

25, 2025.

Material Terms of the Reverse Split

As of February 25, 2025 (the “Record Date”),

the Company has [ ] issued and outstanding shares of Common Stock, which does not include shares of Common Stock reserved for issuance

underlying certain derivative securities. The Majority Consenting Stockholders own, in the aggregate, approximately [ ]% of the total

voting power of all issued and outstanding voting shares of the Company.

In the event that the Board of Directors implements a reverse split at a ratio of any whole number within the range between one-for-two (1:2)

and one-for-twenty (1:20), the maximum authorized by the Written Consents, of which there can be no assurance, there will be approximately

[ ] shares of Common Stock issued and outstanding if the ratio of one-for-ten (1:10) (the “Estimated Split Ratio”), which

is the midpoint between the split ratio range of one-for-two (1:2) and one-for-twenty (1:20), is used. The Board of Directors believes

that the Reverse Split will affect all holders of shares of Common Stock and holders of derivative securities equally. The Company believes

that the Reverse Split will benefit all stockholders, as without the Reverse Split, the Company in all likelihood will have difficulties

maintaining compliance with the listing requirements of Nasdaq.

However, the reduction in the number of issued and

outstanding shares of Common Stock following implementation of the Reverse Split, if implemented, could adversely affect the trading market

for our Common Stock by reducing the relative level of liquidity of the shares of Common Stock. Further, there can be no assurance that

the Reverse Split will result in a proportionate increase or, for that matter, any increase, in the price of the shares of Common Stock

on Nasdaq.

Any new shares issued following the Effective Date

of the Reverse Split will be fully-paid and non-assessable shares. On the Effective Date of the Reverse Split, the number of stockholders

will remain unchanged because those stockholders who would otherwise only be entitled to receive a fractional share will receive a number

of shares rounded up to the next whole number.

The Reverse Split will not change the number of authorized

shares of Common Stock, which will continue to be 1,000,000,000 shares of Common Stock, or the par value of our Common Stock, which will

continue to be $0.001 per share. While the aggregate par value of our outstanding Common Stock will be reduced as a result of the Reverse

Split, our additional paid-in capital will be increased by a corresponding amount. Therefore, the Reverse Split will not affect our total

stockholders’ equity. All share and per share information will be retroactively adjusted to reflect the Reverse Split for all periods

presented in our future financial reports and regulatory filings.

On [ ], 2025, the trading date immediately preceding

the filing of the Definitive Information Statement on Schedule 14C, the closing price of our shares of Common Stock on Nasdaq was $[ ]

and the total market value was approximately $[ ] based on the [ ] shares of Common Stock issued and outstanding.

Rationale for the Reverse Split

The Board of Directors believes that a Reverse Split should, at least initially, and based upon reverse split of the issued and outstanding

shares of Common Stock at an assumed ratio of one-for-ten (1:10), which is the midpoint between the split ratio range of one-for-two (1:2)

and one-for-twenty (1:20), and $[ ] stock price as of [ ], 2025, increase the price of our shares of Common Stock to approximately $[

] per share. Our stockholders should understand that as of the date of the Definitive Information Statement, our Board of Directors has

not determined the exact ratio of the Reverse Split nor the date that the Reverse Split will be implemented.

The Company entered into a Merger

and Share Exchange Agreement on September 23, 2024, and as amended on February 21, 2025, with Delta Corp Holdings Limited, a company incorporated

in England and Wales (“Delta”), shareholders of Delta, including Delta Corp Cayman Limited, a company organized under

the laws of the Cayman Islands, which is owned entirely beneficially by Delta’s founder and chief executive officer, Mudit Paliwal

and his related persons (the “Sellers”), Delta Corp Holdings Limited, a Cayman Islands exempted company (“Pubco”),

KAVL Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Pubco (“Merger Sub”), and the other parties

thereto (as amended from time to time, collectively, the “Merger Agreement”). The Merger Agreement provides for the

combination of the Company and Delta as wholly owned subsidiaries of Pubco, a newly formed holding company, and pursuant to which (a) Pubco

will acquire all of the issued and outstanding capital shares of Delta from the Sellers in exchange for the issue by Pubco of ordinary

shares in the capital of Pubco, such that Delta will become a wholly owned subsidiary of Pubco and the Sellers become shareholders of

Pubco (the “Share Exchange”); and immediately thereafter (b) Merger Sub will merge with and into Kaival, with

Kaival continuing as the surviving entity and wholly owned subsidiary of Pubco (the “Merger”). We refer to the Share

Exchange, the Merger and the other transactions contemplated by the Merger Agreement as the “Business Combination.

The Board of Directors intends

to implement the Reverse Split with the primary intent of increasing the per share price of Common Stock for the following principal reasons:

| |

● |

to encourage increased investor interest in the Company’s Common Stock and promote greater liquidity for its stockholders through the Merger and resulting combined company’s listing on Nasdaq; |

| |

|

|

| |

● |

to help attract, retain, and motivate employees; and |

| |

|

|

| |

● |

to facilitate the closing of the Merger and Business Combination. |

Investor Interest and Liquidity

In addition, in approving the proposed

Reverse Split, the Board of Directors considered that the Reverse Split and the resulting increase in the per share price of Common Stock

could encourage increased investor interest in Common Stock, and the shares of Pubco (“Pubco Ordinary Shares”) exchanged

for Common Stock as a result of the Merger, and thereby promote greater liquidity for its stockholders.

In the event that the Merger was

consummated and Kaival’s Common Stock did not have a minimum price sufficient to list Pubco Ordinary Shares on Nasdaq, the combined

company’s ordinary shares would likely trade in the over-the-counter market. If Pubco Ordinary Shares were to trade on the over-the-counter

market, selling Pubco Ordinary Shares could be more difficult because smaller quantities of shares would likely be bought and sold, and

transactions could be delayed. In addition, many brokerage houses and institutional investors have internal policies and practices that

prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their

customers, further limiting the liquidity of Kaival Common Stock or Pubco Ordinary Shares. These factors could result in lower prices

and larger spreads in the bid and ask prices for such stock. Additionally, investors may be dissuaded from purchasing lower priced stocks

because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts

at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. A greater price per

share of Kaival Common Stock, and thereby Pubco Ordinary Shares resulting from the Merger, could allow a broader range of institutions

to invest in the combined company’s ordinary shares. For all of these reasons, Kaival believes the Reverse Split could potentially

increase marketability, trading volume, and liquidity of the combined company’s ordinary shares.

Employee Retention

The Kaival board of directors believe

that Kaival’s employees and directors who are compensated in the form of Kaival’s equity-based securities (or Pubco’s

ordinary shares as a result of the Merger) may be less incentivized and invested in the combined company’s ordinary shares if Pubco

is no longer listed on Nasdaq. Accordingly, the Kaival board of directors believes that obtaining Nasdaq listing qualifications for Pubco

Ordinary Shares, can help attract, retain, and motivate employees and members of the Pubco board of directors.

Merger Agreement Provisions

The Merger Agreement provides that

it is a mutual closing condition (in other words that the obligations of each of Kaival and Delta to consummate the Business Combination’s

Transactions shall be subject to the satisfaction or written waiver (where permissible) by Delta and Kaival of the condition) that the

Pubco Ordinary Shares to be issued in connection with those Transactions shall have been approved for listing on the Nasdaq, subject to

official notice of issuance. The Merger Agreement also requires each of Kaival and Delta to use specified efforts to consummate the Business

Combination.

By potentially increasing Kaival’s

stock price, the Reverse Split would reduce the risk that Kaival Common Stock would be below the threshold required pursuant to Nasdaq

Marketplace Rules, in order to list the Pubco Ordinary Shares for the combined company, which requirements may include a minimum price

of $4.00 per share (or $3.00 per share under specified circumstances).

The Kaival board of directors has

considered the potential harm to Kaival and its stockholders should Nasdaq fail to list the Pubco Ordinary Shares on The Nasdaq Capital

Market, including that the Merger was not consummated or that if consummated would trade on the over-the-counter market, or OTC Market.

Such results could adversely affect the liquidity of such stock, since alternatives, such as the OTC Market, are generally considered

to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to

buy Pubco Ordinary Shares on the OTC Market. Many investors likely would not buy or sell Pubco Ordinary Shares due to difficulty in accessing

the OTC Market, policies preventing them from trading in securities not listed on a national exchange or for other reasons.

The Kaival board of directors believes

that the proposed Reverse Split is a potentially effective means for Kaival to comply with the $4.00 minimum price requirement and to

avoid, or at least mitigate, the likely adverse consequences of Pubco Ordinary Shares not being listed on Nasdaq Capital Market by producing

the immediate effect of increasing the bid price of Kaival Common Stock to above the applicable threshold required by Nasdaq.

In light of the factors mentioned

above, the Kaival board of directors unanimously approved the proposed Reverse Split as Kaival’s best means of obtaining and maintaining

the price of the combined company’s (Pubco’s) ordinary shares to be above $4.00 per share in compliance with Nasdaq requirements.

Criteria to be Used for Determining Whether to

Implement Reverse Split

In determining whether to implement

the Reverse Split and which Reverse Split ratio to implement, Kaival’s board of directors may consider, among other things, various

factors, such as:

| |

● |

the historical trading

price and trading volume of Kaival Common Stock; |

| |

|

|

| |

● |

the then-prevailing trading

price and trading volume of Kaival Common Stock and the expected impact of the Reverse Split on the trading market for Kaival Common

Stock in the short- and long-term; |

| |

|

|

| |

● |

Pubco’s ability to

obtain or continue its listing on The Nasdaq Capital Market; |

| |

|

|

| |

● |

the conditions to closing

and covenants in the Merger Agreement; |

| |

|

|

| |

● |

which Reverse Split ratio

would result in the least administrative cost to Kaival; |

| |

|

|

| |

● |

prevailing general market

and economic conditions; and |

| |

|

|

| |

● |

if Kaival stockholders

approve the Reverse Split, the implementation of a Reverse Split may provide greater flexibility to use Kaival Common Stock for business

and/or financial purposes. |

Certain Risks and Potential Disadvantages Associated

with Reverse Split

Kaival cannot assure you that the

proposed Reverse Split will increase its stock price and have the desired effect of facilitating Pubco’s compliance with Nasdaq

Listing Rules. Kaival expects that the Reverse Split will increase the market price of Kaival Common Stock in connection with Nasdaq’s

minimum price requirement for listing of Pubco Ordinary Shares at or following the Merger. However, the effect of the Reverse Split upon

the market price of Kaival Common Stock cannot be predicted with any certainty, and the history of similar Reverse Splits for companies

in like circumstances is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the

per share price of Kaival Common Stock after the Reverse Split will not rise in proportion to the reduction in the number of shares of

Kaival Common Stock outstanding resulting from the Reverse Split, and the market price per post-Reverse Split share may not exceed or

remain in excess of the minimum price for the requisite listing criteria. Even if Kaival implements the Reverse Split, the market price

of Kaival Common Stock may decrease due to factors unrelated to the Reverse Split. In any case, the market price of Kaival Common Stock

may also be based on other factors which may be unrelated to the number of shares outstanding, including the combined company’s

future performance. If the Reverse Split is consummated and the trading price of the common stock declines, the percentage decline as

an absolute number and as a percentage of Kaival’s overall market capitalization may be greater than would occur in the absence

of the Reverse Split. Even if the market price per post-Reverse Split share of Kaival Common Stock remains in excess of the minimum price,

Pubco may not be listed on Nasdaq due to a failure to meet other listing requirements, including Nasdaq requirements related to the minimum

stockholders’ equity requirement, the minimum number of shares that must be in the public float, the minimum market value of the

public float and the minimum number of “round lot” holders.

The proposed Reverse Split may

decrease the liquidity of Kaival Common Stock and result in higher transaction costs. The liquidity of Kaival Common Stock may be negatively

impacted by a Reverse Split, given the reduced number of shares that would be outstanding after the Reverse Split, particularly if the

stock price does not increase as a result of the Reverse Split. In addition, if a Reverse Split is implemented, it will increase the number

of Kaival stockholders who own “odd lots” of fewer than 100 shares of Kaival Common Stock. Brokerage commission and other

costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly,

a Reverse Split may not achieve the desired results of increasing marketability and liquidity of Kaival Common Stock described above.

Effects of the Reverse Split

After the filing of the Definitive Information Statement on Schedule 14C and

the final determination by the Board of Directors of the ratio of the Reverse Split, which is expected to be any whole number in the range

of one-for-two (1:2) to one-for-twenty (1:20), the Company will file a Certificate of Amendment to our Certificate of Incorporation with

the State of Delaware in the form substantially similar to the form included as Exhibit A to this Information Statement and submit a Corporate

Event Notification Form to Nasdaq and take the appropriate actions in order to comply with Nasdaq Rule 5250(e)(7).

Except for the number of shares of Common Stock issued

and outstanding, the rights and preferences of shares of our Common Stock prior and subsequent to the Reverse Split would remain the same.

We do not anticipate that our financial condition, the percentage of our stock owned by management, the number of our stockholders, or

any aspect of our current business would materially change as a result of the Reverse Split.

Based upon the Reverse Stock Split ratio determined by the Board, proportionate adjustments are generally required to be made to the per

share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible

or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This would result

in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities

upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange or conversion,

immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares deliverable

upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares. The number

of shares reserved for issuance pursuant to these securities will be proportionately based upon the Reverse Stock Split ratio determined

by the Board, subject to our treatment of fractional shares.

For example, upon the effectiveness of the Reverse Stock Split at a ratio

of 1:20, a warrant holder that previously held a warrant to purchase 100,000 shares of common stock at an exercise price of $0.10 per

share, would hold a warrant to purchase 5,000 shares at an exercise price of $2.00 per share. Similarly, a holder of convertible preferred

stock that previously held a share of convertible preferred stock that is convertible into 100,000 shares of common stock at a conversion

price of $0.10 per share, would hold a note that is convertible into 5,000 shares at a conversion price of $2.00 per share.

Our Common Stock is currently registered under Section

12(b) of the Exchange Act and, as a result, we are subject to periodic reporting and other requirements. The proposed Reverse Split would

not affect the registration of our Common Stock under the Exchange Act.

After the Effective Date of the Reverse Split, each

stockholder would own a reduced number of shares of our Common Stock, based upon the ratio of the reverse, which will be subject to the

determination of our Board of Directors. However, a Reverse Split would affect all stockholders equally and will not affect any stockholder’s

percentage ownership of the Company, except for the immaterial result that the Reverse Split shall involve in the rounding up of any fractional

shares up to the next whole in such a manner that every stockholder shall own at least one (1) share subsequent to the Reverse Split,

as described herein. Proportionate voting rights and other rights and preferences of the holders of our Common Stock would not be affected

by the Reverse Split. There will be no payment of cash in lieu of any fractional shares. Furthermore, the number of stockholders of record

would not be affected by the Reverse Split.

Fairness of the Process

The Board of Directors did not obtain a report, opinion

or appraisal from an appraiser or financial advisor with respect to the Reverse Split and no representative or advisor was retained on

behalf of the unaffiliated stockholders to review or negotiate the transaction. The Board of Directors concluded that the additional expense

of these independent appraisal procedures was unreasonable in relation to the Company’s available cash resources and concluded that

the Board of Directors could adequately establish the fairness of the Reverse Split without the engagement of third parties.

Outstanding Shares

| Status |

|

Number of

Shares of

Common

Stock Authorized |

|

Number of

Shares of

Common

Stock Issued

and

Outstanding* |

|

Number of

Shares of

Common

Stock

Authorized

but

Unissued |

|

Hypothetical

Initial

Market

Value of

Shares of

Common

Stock

Authorized

but

Unissued** |

| Pre-Reverse Stock Split |

|

|

1,000,000,000 |

|

|

|

11,935,134 |

|

|

|

988,064,866 |

|

|

$ |

[] |

|

| Post-Reverse Stock Split (assuming a split ratio of 1:10) |

|

|

1,000,000,000 |

|

|

|

1,193,513 |

|

|

|

998,806,487 |

|

|

$ |

[] |

|

| Post-Reverse Stock Split (assuming a split ratio of 1:20) |

|

|

1,000,000,000 |

|

|

|

559,676 |

|

|

|

999,440,324 |

|

|

$ |

[] |

|

| * |

|

Includes 392,832 shares of Kaival Common Stock that will

be issued at or prior to the Closing of the Merger |

| ** |

|

Based on a hypothetical post-split stock price calculated by multiplying the closing stock price on [*], 2025 of $[*] by the assumed split ratio

of one-for-ten (1:10) and one-for-twenty (1:20). |

Vote Required

Pursuant to DGCL and the Company’s Certificate

of Incorporation, the approval of the Reverse Split required a majority of the Company’s outstanding voting capital stock. Pursuant

to the Company’s Certificate of Incorporation, each share of Common Stock is entitled to one vote on all matters submitted to the

Company’s stockholders for approval. As discussed above, stockholders owning greater than a majority of the outstanding shares of

Common Stock have consented to Reverse Split.

Material U.S. Federal Income Tax Consequences

The following is a summary

of material U.S. federal income tax consequences of a Reverse Split to stockholders. This summary is based on the provisions of the Internal

Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative rulings and judicial decisions, all

as in effect on the date of this filing, and all of which are subject to change or differing interpretations, possibly with retroactive

effect. Any such change or differing interpretation could affect the tax consequences described below.

We have not sought and will

not seek an opinion of counsel or ruling from the Internal Revenue Service (the “IRS”) with respect to the statements made

and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will agree with such statements

and conclusions.

This summary is limited to

stockholders that are U.S. holders, as defined below, and that hold our common stock as a capital asset (generally, property held for

investment).

This summary is for general

information only and does not address all U.S. federal income tax considerations that may be applicable to a holder’s particular

circumstances or to holders that may be subject to special tax rules, such as, for example, brokers and dealers in securities, currencies

or commodities, banks and financial institutions, regulated investment companies, real estate investment trusts, expatriates, tax-exempt

entities, governmental organizations, traders in securities that elect to use a mark-to-market method of accounting for their securities,

certain former citizens or long-term residents of the U.S., insurance companies, persons holding shares of our common stock as part of

a hedging, integrated or conversion transaction or a straddle or persons deemed to sell shares of our common stock under the constructive

sale provisions of the Code, persons that hold more than 5% of our common stock, persons that hold our common stock in an individual retirement

account, 401(k) plan or similar tax-favored account or partnerships or other pass-through entities for U.S. federal income tax purposes

and investors in such entities.

This summary does not address

any U.S. federal tax consequences other than U.S. federal income tax consequences (such as estate or gift tax consequences), the Medicare

tax on net investment income, the alternative minimum tax or any U.S. state, local or foreign tax consequences. This summary also does

not address any U.S. federal income tax considerations relating to any other transaction other than the Reverse Split.

For purposes of this summary,

a “U.S. holder” means a beneficial owner of our common stock that is, for U.S. federal income tax purposes:

| ● |

an individual who is a citizen or resident of the U.S.; |

| |

|

| ● |

a corporation created or organized in or under the laws of the U.S., any state thereof or the District of Columbia; |

| |

|

| ● |

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| |

|

| ● |

a trust if (1) it is subject to the primary supervision of a court within the U.S. and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. |

If an entity (or arrangement)

classified as a partnership for U.S. federal income tax purposes holds shares of our common stock, the tax treatment of a partner in the

partnership will generally depend upon the status of the partner and the activities of the partnership. If a holder of our common stock

is a partner of a partnership holding shares of our common stock, such holder should consult his or her own tax advisor.

This summary of certain

U.S. federal income tax consequences is for general information only and is not tax advice. Stockholders are urged to consult their own

tax advisor with respect to the application of U.S. federal income tax laws to their particular situation as well as any tax considerations

arising under other U.S. federal tax laws (such as the estate or gift tax laws) or under the laws of any state, local, foreign or other

taxing jurisdiction or under any applicable tax treaty.

The Reverse Split is intended

to be treated as a recapitalization for U.S. federal income tax purposes. Assuming the Reverse Split qualifies as a recapitalization,

except as described below with respect to cash received in lieu of a fractional share, a U.S. holder will not recognize any gain or loss

for U.S. federal income tax purposes upon the Reverse Split. In the aggregate, a U.S. holder’s tax basis in the common stock received

pursuant to the Reverse Split (excluding the portion of the tax basis that is allocable to any fractional share) will equal the U.S. holder’s

tax basis in its common stock surrendered in the Reverse Split in exchange therefor, and the holding period of the U.S. holder’s

common stock received pursuant to the Reverse Split will include the holding period of the common stock surrendered in the Reverse Split

in exchange therefor.

In general, a U.S. holder

who receives a cash payment in lieu of a fractional share will recognize capital gain or loss equal to the difference between the amount

of cash received in lieu of the fractional share and the portion of the U.S. holder’s tax basis of the common stock surrendered

in the Reverse Split that is allocable to the fractional share. Such gain or loss generally will be long-term capital gain or loss if

the U.S. holder’s holding period in its common stock surrendered in the Reverse Split is more than one year as of the date of the

Reverse Split. The deductibility of net capital losses by individuals and corporations is subject to limitations. Depending on a stockholder’s

individual facts and circumstances, it is possible that cash received in lieu of a fractional share could be treated as a distribution

under Section 301 of the Code, so stockholders should consult their own tax advisors as to that possibility and the resulting tax consequences

to them in that event.

U.S. holders that have acquired

different blocks of our common stock at different times or at different prices are urged to consult their own tax advisors regarding the

allocation of their aggregated adjusted basis among, and the holding period of, our common stock.

Information returns generally

will be required to be filed with the IRS with respect to the payment of cash in lieu of a fractional share made pursuant to the Reverse

Split unless such U.S. holder is an exempt recipient and timely and properly establishes with the applicable withholding agent the exemption.

In addition, payments of cash in lieu of a fractional share made pursuant to the Reverse Split may, under certain circumstances, be subject

to backup withholding, unless a U.S. holder timely provides to the applicable withholding agent proof of an applicable exemption or a

correct taxpayer identification number, and otherwise complies with the applicable requirements of the backup withholding rules. Any amounts

withheld under the backup withholding rules are not additional tax and may be refunded or credited against the U.S. holder’s U.S.

federal income tax liability, provided that the U.S. holder timely furnishes the required information to the IRS. U.S. holders should

consult their tax advisors regarding their qualification for an exemption from backup withholding and the procedures for obtaining such

an exemption.

Accounting Consequences

The par value per share of

our common stock will remain unchanged at $0.00001 per share following a Reverse Split. As a result, as of the Effective Date, the stated

capital on the Company’s balance sheets attributable to common stock will be reduced proportionally based on the Reverse Split ratio,

and the additional paid-in capital will be credited with the amount by which the capital is reduced. The net income or loss per share

of common stock will be increased as a result of the fewer shares of common stock outstanding. The Reverse Split will be reflected retroactively

in our consolidated financial statements.

We present earnings per share (“EPS”)

in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 128, “Earnings per Share,” and we

will comply with the requirements of SFAS No. 128 with respect to reverse stock splits. In pertinent part, SFAS No. 128 says as follows:

“If the number of common shares outstanding decreases as a result of a reverse stock split, the computations of basic and diluted

EPS shall be adjusted retroactively for all periods presented to reflect that change in capital structure. If changes in Common Stock

resulting from reverse stock splits occur after the close of the period but before issuance of the financial statements, the per-share

computations for those and any prior period financial statements presented shall be based on the new number of shares. If any per-share

computations reflect such changes in the number of shares, that fact shall be disclosed.”

Street Name Holders of Common Stock

The Company intends for the Reverse Split to treat

stockholders holding Common Stock in street name through a nominee (such as a bank or broker) in the same manner as stockholders whose

shares are registered in their names. Nominees will be instructed to affect the Reverse Split for their beneficial holders. However, nominees

may have different procedures. Accordingly, stockholders holding Common Stock in street name should contact their nominees.

Stock Certificates

Mandatory surrender of certificates is not required

by our stockholders. The Company’s transfer agent will adjust the record books of the company to reflect the Reverse Split as of

the Effective Date of the Reverse Split. New certificates will not be mailed to stockholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information,

as of the Record Date, that are beneficially owned by (i) each person or entity known to our Company to be the beneficial owner of more

than 5% of the outstanding Common Stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group.

Information relating to beneficial ownership of Common Stock by our principal stockholders is based upon information furnished by each

person using “beneficial ownership” concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial

owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security,

or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial

owner of any security of which that person has a right to acquire beneficial ownership within sixty (60) days. Under the rules of the

SEC, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial

owner of securities as to which he/she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting

and investment power. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power

with respect to the shares. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the

table have sole voting and investment power with respect to all shares of our Common Stock held by them.

| Name and Address of Beneficial Owner(1) |

|

Title |

|

Beneficially

owned |

|

|

Percent of

Class(2) |

|

| Officers and Directors |

|

|

|

|

|

|

|

|

|

|

| Mark Thoenes(3) |

|

Chief Executive Officer and Director |

|

|

|

|

|

|

|

|

| Eric Morris(4) |

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

| David Worner(5) |

|

Director |

|

|

|

|

|

|

|

|

| Ashesh Modi(6) |

|

Director |

|

|

|

|

|

|

|

|

| Ketankumar Patel(7) |

|

Director |

|

|

|

|

|

|

|

|

| Officers and Directors as a Group (total of 5 persons) |

|

|

|

|

|

|

|

|

|

% |

| |

|

|

|

|

|

|

|

|

|

|

| 5%+ Stockholders |

|

|

|

|

|

|

|

|

|

|

| Kaival Holdings, LLC(8)(9) |

|

|

|

|

|

|

|

|

|

|

| Bidi Vapor LLC(10) |

|

|

|

|

|

|

|

|

|

|

| *Less than 1% |

| (1) The address for each person listed above is 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949, unless otherwise indicated. |

|

(2) Applicable percentage of ownership is based on

11,542,302 shares of common stock outstanding as of February 25, 2025.

Beneficial ownership is determined in accordance with

the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock that are currently

exercisable within 60 days of February 25, 2025, are deemed to be beneficially owned by the person holding such securities for the purpose

of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage

ownership of any person. |

| (3)Mark Thoenes serves as a member of our board. Includes approximately 14,524 shares of our common stock issuable upon the exercise of vested options. |

| (4) Eric Morris serves as our Interim Chief Financial Officer. Includes approximately 2,381 shares of our common stock issuable upon the exercise of vested options. |

| (5) David Worner serves as a member of our board. Includes approximately 10,952 shares of our common stock issuable upon the exercise of vested options. |

| (6) Includes 3,000 shares underlying vested options. |

| (7) Includes 3,000 shares underlying vested options. |

| (8) KDMM Trust I is the sole voting member of Kaival Holdings, LLC and Ankitaben Patel, as trustee of KDMM Trust I, has voting control over the Kaival shares owned by Kaival Holdings LLC |

| (9) Address is 401 N. Wickham Road, Suite 130 Melbourne, FL 32935 |

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO

MATTERS TO BE ACTED UPON

No person who has been our officer or director, or

to our knowledge, any of their associates, has any substantial interest, direct or indirect, by security holdings or otherwise in any

matter to be acted upon. None of our directors opposed the actions to be taken by the Company.

DISSENTERS’ RIGHTS

There are no rights of appraisal or similar rights

of dissenters with respect to any matter described in this Information Statement.

EXPENSE OF INFORMATION STATEMENT

The expenses of mailing this Information Statement

will be borne by the Company, including expenses in connection with the preparation and mailing of this Information Statement and all

documents that now accompany or may hereafter supplement it. It is contemplated that brokerage houses, custodians, nominees and fiduciaries

will be requested to forward the Information Statement to the beneficial owners of common stock held of record by such persons and that

the Company will reimburse them for their reasonable expenses incurred in connection therewith.

STOCKHOLDERS’ RIGHTS

The elimination of the need for a special meeting

of the stockholders to approve the actions described in this Information Statement is authorized by the DGCL which provides that any action

required or permitted to be taken at a meeting of stockholders of a corporation may be taken without a meeting, before or after the action,

if a written consent thereto is signed by the stockholders holding at least a majority of the voting power. In order to eliminate the

costs and management time involved in holding a special meeting and in order to effect the action disclosed herein as quickly as possible

in order to accomplish the purposes of our Company, we chose to obtain the written consent of a majority of our voting power to approve

the action described in this Information Statement.

STOCKHOLDERS SHARING THE SAME LAST NAME AND ADDRESS

The SEC has adopted rules that permit companies and

intermediaries such as brokers to satisfy delivery requirements for proxy and information statements with respect to two or more stockholders

sharing the same address by delivering a single proxy or information statement addressed to those stockholders. This process, which is

commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies.

We and some brokers household proxy materials, delivering a single proxy or information statement to multiple stockholders sharing an

address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker

or us that they are or we will be householding materials to your address, householding will continue until you are notified otherwise

or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate

proxy or information statement, or if you currently receive multiple proxy or information statements and would prefer to participate in

householding, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. You can notify

us by sending a written request to KAIVAL BRANDS INNOVATIONS GROUP, INC. 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949.

ADDITIONAL INFORMATION

The Company is subject to the filing requirements

of the Exchange Act, and in accordance therewith files reports, proxy/information statements and other information including annual and

quarterly reports on Form 10-K and 10-Q (the “Exchange Act Filings”) with the SEC. Reports and other information filed by

the Company can be inspected and copied at the public reference facilities maintained at the SEC at 100 F Street, NE Washington, D.C,

20549. Copies of such material can be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street, NE Washington,

D.C 20549, at prescribed rates. The SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information

statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis

and Retrieval System.

WHERE YOU CAN FIND MORE INFORMATION

This Information Statement refers to certain documents

that are not presented herein or delivered herewith. Such documents are available to any person, including any beneficial owner of our

shares, to whom this Information Statement is delivered upon oral or written request, without charge. Requests for such documents should

be directed to KAIVAL BRANDS INNOVATIONS GROUP, INC. 4460 Old Dixie Highway, Grant-Valkaria, Florida 32949.

We file annual and quarterly reports and other information

with the SEC. Certain of our SEC filings are available over the Internet at the SEC’s website at http://www.sec.gov.

| By Order of the Board of Directors: |

|

| |

|

| |

/s/ |

|

| Name: |

Mark Thoenes |

|

| Title: |

Chief Executive Officer and Director |

|

| [*], 2025 |

|

Exhibit

A

FORM OF CERTIFICATE OF AMENDMENT

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION

OF

KAIVAL BRANDS INNOVATIONS GROUP, INC.

Kaival Brands Innovations

Group, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation

Law of the State of Delaware (the “DGCL”), does hereby certify:

1. Pursuant

to Section 242 of the DGCL, this Certificate of Amendment (this “Certificate of Amendment”) amends the provisions of

the Amended and Restated Certificate of Incorporation of the Corporation (the “Charter”).

2. This

Certificate of Amendment has been approved and duly adopted by the Corporation’s Board of Directors and stockholders in accordance

with the provisions of Section 242 of the DGCL.

3. Upon

this Certificate of Amendment becoming effective, the Charter is hereby amended as follows:

Paragraph

6 of the Charter is hereby amended by adding the following new paragraph at the end of such article:

“Effective at 4:05

p.m., Eastern Time, on [ ] (the “2025 Split Effective Time”), every [ ] shares of common stock issued and outstanding

or held by the Corporation as treasury shares as of the 2025 Split Effective Time shall automatically, and without action on the part

of the stockholders, be combined, reclassified and changed into one (1) validly issued, fully paid and non-assessable share

of common stock, without effecting a change to the par value per share of common stock, subject to the treatment of fractional interests

as described below (the “2025 Reverse Split”). Notwithstanding the immediately preceding sentence, no fractional shares

will be issued in connection with the combination effected by the preceding sentence. Stockholders of record who otherwise would be entitled

to receive fractional shares in connection with such combination will instead be entitled to receive, in lieu of such fractional shares,

shall receive a full share of Common Stock upon the surrender of such stockholders’ old stock certificate. No stockholders will

receive cash in lieu of fractional shares.. As of the 2025 Split Effective Time and thereafter, a certificate(s) representing shares of

common stock prior to the 2025 Reverse Split is deemed to represent the number of post-2025 Reverse Split shares into which the pre-2025

Reverse Split shares were reclassified and combined. The 2025 Reverse Split shall also apply to any outstanding securities or rights convertible

into, or exchangeable or exercisable for, common stock of the Corporation and all references to such common stock in agreements, arrangements,

documents and plans relating thereto or any option or right to purchase or acquire shares of common stock shall be deemed to be references

to the common stock or options or rights to purchase or acquire shares of common stock, as the case may be, after giving effect to the

2025 Reverse Split.”

3. This

Certificate of Amendment shall become effective at 4:05 p.m., Eastern Time, on [ ].

* _ * _ * _ *

IN WITNESS WHEREOF,

the undersigned authorized officer of the Corporation has executed this Certificate of Amendment to the Amended Certificate of Incorporation

as of [ ].

| KAIVAL BRANDS INNOVATIONS GROUP, INC. |

| By: |

|

|

| Name: |

Mark Thoenes |

|

| Title: |

Chief Executive Officer |

|

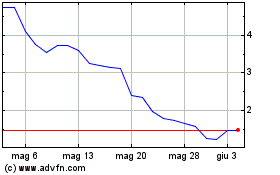

Grafico Azioni Kaival Brands Innovations (NASDAQ:KAVL)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Kaival Brands Innovations (NASDAQ:KAVL)

Storico

Da Apr 2024 a Apr 2025