As

filed with the Securities and Exchange Commission on March 19, 2025

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

SINTX

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

84-1375299 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1885

West 2100 South

Salt

Lake City, UT 84119

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Eric

Olson

President

and Chief Executive Officer

SINTX

Technologies, Inc.

1885

West 2100 South

Salt

Lake City, UT, 84119

(801)

839-3500

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

David

F. Marx

Daniel

P. Lyman

Dorsey

& Whitney LLP

111

South Main Street, Suite 2100

Salt

Lake City, Utah 84111

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement as

determined by the selling stockholders.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION

PRELIMINARY PROSPECTUS | DATED

MARCH 19, 2025 |

SINTX

Technologies, Inc.

3,007,271

Shares of Common Stock Offered by the Selling Stockholders

This

prospectus relates to the offer and resale by the selling stockholders identified in this prospectus or their donees, pledgees, assignees,

transferees, distributees or other successors-in-interest (the “selling stockholders”) of up to an aggregate of 3,007,271

shares (the “Shares”) of our common stock, par value $0.01 per share (the “common stock”), issued by us in connection

with a private placement on February 20, 2025 consisting of (i) 1,171,189 shares of our common stock (the “PIPE Shares”),

(ii) 278,098 shares of our common stock (the “Pre-Funded Warrant Shares”) issuable upon the exercise of pre-funded warrants

to purchase shares of our common stock held by certain selling stockholders (the “Pre-Funded Warrants”), (iii) 1,449,287

shares of our common stock (the “Common Warrant Shares”) issuable upon the exercise of common warrants to purchase shares

of our common stock held by selling stockholders (the “Common Warrants”), and (iv) placement agent warrants (the “Placement

Agent Warrants” and together with the Common Warrants and Pre-Funded Warrants, the “Warrants”) to purchase an aggregate

of up to 108,697 shares of common stock (the “Placement Agent Warrant Shares” and together with the Common Warrant Shares

and Pre-Funded Warrant Shares, the “Warrant Shares”). The Shares and Warrants were issued to the selling stockholders in

a private placement (the “Private Placement”) pursuant to a securities purchase agreement dated February 20, 2025.

We

are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale by the selling stockholders

of the Shares. We would, however, receive proceeds of up to approximately $5.28 million upon the exercise for cash of the Warrants held

by the selling stockholders. Proceeds, if any, received from the exercise of such Warrants will be used for general corporate purposes

and working capital. No assurances can be given that any Warrants will be exercised or that we will receive any cash proceeds upon such

exercise if cashless exercise is available.

Sales

of the Shares by the selling stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related

to prevailing market prices or at negotiated prices. The selling stockholders may sell Shares from time to time to or through underwriters,

broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders,

the purchasers of the Shares, or both.

We

are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling

stockholders are responsible for all broker or similar commissions related to the offer and sale of their Shares. See the section titled

“Plan of Distribution” on page 23 for more information about how the selling stockholders may sell or dispose of their Shares.

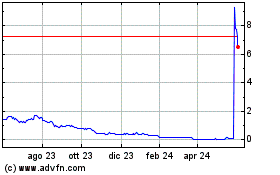

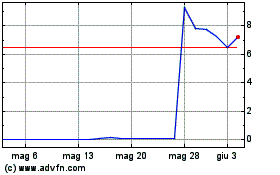

Our

common stock is listed on the Nasdaq Capital Market under the trading symbol “SINT.” On March 18, 2025, the last reported

sale price of our common stock was $2.88 per share.

On

May 28, 2024, we effected a 1-for-200 reverse stock split (the “Reverse Stock Split”) of our issued and outstanding shares

of common stock, and the Company’s shares of common stock began trading on a split-adjusted basis on the Nasdaq Capital Market

on May 28, 2024 under the same symbol “SINT.” Unless otherwise indicated, all other share and per share prices in this prospectus

have been adjusted to reflect the Reverse Stock Split.

We

are a “smaller reporting company” as defined under the federal securities laws and, as such, have elected to comply with

certain reduced public company reporting requirements for this prospectus and the documents incorporated by reference herein and may

elect to comply with reduced public company reporting requirements in future filings.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the section

titled “Risk Factors” on page 6 of this prospectus and any similar section contained in any amendment or supplement to

this prospectus or in any filing with the Securities and Exchange Commission that is incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (“SEC”).

Under this registration statement, the selling stockholders may sell from time to time in one or more offerings the common stock described

in this prospectus. We will not receive any proceeds from the sale of common stock by the selling stockholders pursuant to this prospectus,

except for cash received upon any exercise of the Warrants, if any.

This

prospectus may be supplemented from time to time by one or more prospectus supplements. Such prospectus supplement may also add, update

or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the

applicable prospectus supplement, you must rely on the information in the prospectus supplement. You should carefully read both this

prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You

Can Find Additional Information” and “Incorporation of Certain Information by Reference.” before deciding to invest

in the Shares being offered.

We

and the selling stockholders have not authorized anyone to provide you with information other than the information that we have provided

or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is at your own risk.

This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. Persons outside the United

States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering

of our securities and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not

be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any

person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

You

should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of

delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed

since those dates.

Unless

otherwise mentioned or unless the context indicates otherwise, all references in this prospectus to the “Company,” “we,”

“us” and “our” refer to the business of Sintx Technologies, Inc., a Delaware corporation, and its consolidated

subsidiaries.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain

all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus,

the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities discussed

under the sections titled “Risk Factors” contained in this prospectus, the applicable prospectus supplement, if any, and

any related free writing prospectus, and under similar sections in the other documents that are incorporated by reference into this prospectus.

You should also carefully read the other information incorporated by reference into this prospectus, including our financial statements,

and the exhibits to the registration statement of which this prospectus is a part.

Overview

SINTX

Technologies is an advanced ceramics company formed in December 1996, focused on providing biomedical solutions for medical devices.

We have grown from focusing primarily on the research, development and commercialization of medical devices manufactured with silicon

nitride to becoming an advanced ceramics company engaged in diverse fields, including biomedical and antipathogenic applications. This

diversification enables us to focus on our core competencies which are the manufacturing, research, and development of products comprised

from advanced ceramic materials. We seek to connect with new customers, partners and manufacturers to help them realize the goal of leveraging

our expertise in advanced ceramics to create new, innovative products across these sectors.

SINTX

Core Business

Biomedical

Applications: Since its inception, SINTX has been focused on medical grade silicon nitride. SINTX biomedical products have been shown

to be biocompatible, bioactive, antipathogenic, and to have superb bone affinity. Spinal implants made from SINTX silicon nitride have

been successfully implanted in humans since 2008 in the U.S., Europe, South America and Asia. This established use, along with its inherent

resistance to bacterial adhesion and bone affinity suggests that it may also be suitable in other fusion device applications such as

arthroplasty implants, foot wedges, and dental implants. Bacterial infection of any biomaterial implants is always a concern. SINTX silicon

nitride has been shown to be resistant to bacterial colonization and biofilm formation, making it antibacterial. SINTX silicon nitride

products can be polished to a smooth and wear-resistant surface for articulating applications, such as bearings for hip and knee replacements.

We

believe that silicon nitride has a superb combination of properties that make it suited for long-term human implantation. Other biomaterials

are based on bone grafts, metal alloys, and polymers- all of which have well-known practical limitations and disadvantages. In contrast,

silicon nitride has a legacy of success in the most demanding and extreme industrial environments. As a human implant material, silicon

nitride offers bone ingrowth, resistance to bacterial and viral infection, ease of diagnostic imaging, resistance to corrosion, and superior

strength and fracture resistance, all of which claims are validated in our large and growing inventory of peer-reviewed, published literature

reports. We believe that our versatile silicon nitride manufacturing expertise positions us favorably to introduce new and innovative

devices in the medical and non-medical fields.

Antipathogenic

Applications: Today, there is a global need to improve protection against pathogens in everyday life. SINTX believes that by incorporating

its unique composition of silicon nitride antipathogenic powder into products such as face masks, filters, and wound care devices, it

is possible to manufacture surfaces that inactivate pathogens, thereby limiting the spread of infection and disease. The discovery in

2020 that SINTX silicon nitride inactivates SARS-CoV-2, the virus which causes the disease COVID-19, has opened new markets and applications

for our material.

We

presently manufacture advanced ceramic powders and components in our manufacturing facilities based in Salt Lake City, Utah.

Corporate

Information

Our

headquarters is located at 1885 West 2100 South, Salt Lake City, Utah 84119, and our telephone number is (801) 839-3500. We maintain

a website at https://www.sintx.com. Information on the website is not incorporated by reference and is not a part of this prospectus.

This

prospectus may include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade

names included herein are the property of their respective owners.

Smaller

Reporting Company Status

We

are a smaller reporting company as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may

take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these

scaled disclosures for so long as (i) our voting and non-voting common stock held by nonaffiliates is less than $250.0 million measured

on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100.0 million during the most recently

completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700.0 million measured on the last

business day of our second fiscal quarter.

The

Offering

| Shares

of common stock offered by the selling stockholders |

|

We

are registering the resale by the selling stockholders of an aggregate of 3,007,271 Shares, consisting of (i)1,171,189 PIPE Shares,

(ii) 278,098 Pre-Funded Warrant Shares, (iii) 1,449,287 Common Warrant Shares, and (iv) 108,697 Placement Agent Warrant

Shares. |

| |

|

|

| Common

stock outstanding |

|

2,515,179

shares

|

| |

|

|

Common

stock outstanding assuming exercise of all Warrants |

|

4,351,261

shares

|

| |

|

|

| Terms

of the offering |

|

Each

selling stockholder will determine when and how it will sell the common stock offered in

this prospectus, as described in the “Plan of Distribution” on page 23.

|

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of the Shares. In the event the selling stockholders

exercise all of the Warrants for cash, we will, receive an aggregate of approximately $5.28

million of gross proceeds, assuming all of the Warrants, including the Placement Agent Warrants.

Any proceeds that we receive from the exercise of such Warrants will be used for working

capital and general corporate purposes.

|

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” on page 6 for a discussion of factors you should carefully consider

before deciding to invest in our common stock.

|

| |

|

|

| Nasdaq

Capital Market symbol |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “SINT.”

|

The

number of shares of common stock to be outstanding after this offering is based on 2,515,179 shares of common stock outstanding as of

March 18, 2025 and excludes, in each case as of March 18, 2025:

| |

● |

100,572

shares of common stock issuable upon the exercise of outstanding options and restricted stock units granted under our equity incentive

plans at a weighted average exercise price of $17.17 per share; |

| |

● |

169,308

shares of common stock issuable upon the exercise

of outstanding warrants, excluding the Warrants; |

| |

● |

7,385

shares of our common stock issuable upon the conversion of 19 shares of series B convertible preferred stock outstanding; |

| |

● |

2

shares of our common stock issuable upon the conversion of 50 shares of series C convertible preferred stock outstanding; and |

| |

● |

60

shares of common stock reserved for issuance upon conversion of 180 shares of the Series D Preferred Stock outstanding. |

Unless

otherwise indicated, the information in this prospectus, including the number of shares outstanding after this offering, does not reflect

(i) any issuance, exercise, vesting, expiration, or forfeiture of any additional equity awards under our incentive plans that occurred

after December 31, 2024 or (ii) the effect of the “full-ratchet” anti-dilution adjustment of the conversion price of our

outstanding Series B Convertible Preferred Stock and the exercise price of our outstanding October 2022 warrants by this offering.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Exchange Act, which involve risks and uncertainties. These statements relate to future events or to our future operating or financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that

does not directly relate to any historical or current fact. Forward-looking statements are based on our management’s current beliefs,

expectations and assumptions about future events, conditions and results and on information currently available to us. Discussions containing

these forward-looking statements may be found, among other places, in the Sections of this prospectus entitled “Prospectus Summary”

and “Risk Factors.”

In

some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “may,” “plans,” “potential” “predicts,”

“projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking

statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to

risks and uncertainties. Given these assumptions, risks and uncertainties, you should not place undue reliance on these forward-looking

statements. We discuss in greater detail many of these risks under the heading “Risk Factors” contained in the this prospectus,

in any applicable prospectus supplement, in any free writing prospectuses we may authorize for use in connection with a specific offering,

and in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto

reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these

forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

In addition, past financial and/or operating performance is not necessarily a reliable indicator of future performance and you should

not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated

by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial

condition. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information

or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as

expressed or implied in such forward-looking statements.

You

should read this prospectus, any applicable prospectus supplement, together with the documents we have filed with the SEC that are incorporated

by reference and any free writing prospectuses that we may authorize for use in connection with a specific offering completely and with

the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking

statements in the foregoing documents by these cautionary statements.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks and uncertainties discussed in this section and under the sections titled Risk Factors contained in our most recent Annual

Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of

such Annual Report on Form 10-K, as well as any amendments or updates to our risk factors reflected in subsequent filings with the SEC,

which are incorporated by reference into this prospectus, together with other information in this prospectus, the documents incorporated

by reference, any prospectus supplement and any free writing prospectus that we may authorize. These risks and uncertainties are not

the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as

immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and

uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely

affected. In that case, the trading price of our common stock could decline and you might lose all or part of your investment. Please

also read carefully the section titled “Special Note Regarding Forward-Looking Statements.”

Risks

Related to Our Business

You

should read and consider risk factors specific to our business before making an investment decision. Those risks are described in the

sections entitled “Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024, and in other

documents incorporated by reference into this prospectus. Please be aware that additional risks and uncertainties not currently known

to us or that we currently deem to be immaterial could also materially and adversely affect our business, results of operations, financial

condition, cash flows or prospects.

Risks

Related to this Offering

The

sale or availability for sale of shares issuable upon exercise of the Warrants may depress the price of our common stock and encourage

short sales by third parties, which could further depress the price of our common stock.

To

the extent that the selling stockholders sell shares of our common stock issued upon exercise of the Warrants, the market price of such

shares may decrease due to the additional selling pressure in the market. In addition, the dilution from issuances of such shares may

cause stockholders to sell their shares of our common stock, which could further contribute to any decline in the price of our common

stock. Any downward pressure on the price of our common stock caused by the sale or potential sale of such shares could encourage short

sales by third parties. Such sales could place downward pressure on the price of our common stock by increasing the number of shares

of our common stock being sold, which could further contribute to any decline in the market price of our common stock.

Future

sales and issuances of our common stock or other securities might result in significant dilution and could cause the price of our common

stock to decline.

To

raise capital, we may sell common stock, convertible securities or other equity securities in one or more transactions, at prices and

in a manner we determine from time to time. We may sell shares or other securities in any other offering at a price per share that is

less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could

have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities

convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors

in this offering.

We

cannot predict what effect, if any, sales of shares of our common stock in the public market or the availability of shares for sale will

have on the market price of our common stock. However, future sales of substantial amounts of our common stock in the public market,

or the perception that such sales may occur, could adversely affect the market price of our common stock.

Management

will have broad discretion as to the use of the proceeds from the offering and uses may not improve our financial condition or market

value.

We

will not receive any proceeds from the sale of the Shares by the selling stockholders. In the event the selling stockholders exercise

all of the Warrants in cash, we may receive an aggregate of approximately $5.28 million of gross proceeds. Any proceeds that we receive

from the exercise of such Warrants will be used for working capital and general corporate purposes.

Because

we have not designated the amount of proceeds from the offering to be used for any particular purpose, our management will have broad

discretion as to the application of such proceeds and could use them for purposes other than those contemplated hereby. Our management

may use the proceeds for corporate purposes that may not improve our financial condition or market value.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale or other disposition of the Shares offered pursuant to this prospectus. Upon any exercise

of the Warrants for cash, the applicable selling stockholder would pay us the exercise price set forth in the applicable Warrants, totaling

approximately $5.28 million.

Each

Pre-Funded Warrant has an exercise price equal to $0.0001 per share, and if all 278,098 Pre-Funded Warrants registered hereunder are

exercised on a cash basis, we will receive proceeds of approximately $27.81. Each Common Warrant has an exercise price equal to $3.32

per share, and if all 1,449,287 Common Warrants registered hereunder are exercised on a cash basis, we will receive proceeds of approximately

$4,811,633. Each Placement Agent Warrant has an exercise price equal to $4.3125 per share, and if all 108,697 Placement Agent Warrants

registered hereunder are exercised on a cash basis, we will receive proceeds of approximately $468,756.

We

intend to use any proceeds from the exercise of any Warrants for working capital and general corporate purposes. The Warrants are exercisable

on a cashless basis. If any of the Warrants are exercised on a cashless basis, we would not receive any cash payment from the applicable

selling stockholder upon any such exercise.

We

will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be

sold by the selling stockholders pursuant to this prospectus. Other than registration expenses, the selling stockholders will bear their

own broker or similar commissions payable with respect to sales of the Shares.

DESCRIPTION

OF THE SECURITIES

The

selling stockholders are offering up to an aggregate of 3,007,271 Shares of our common stock, issued by us in connection with the Private

Placement consisting of (i) 1,171,189 PIPE Shares, (ii) 278,098 Pre-Funded Warrant Shares, (iii) 1,449,287 Common Warrant Shares, and

(iv) 108,697 Placement Agent Warrant Shares. The following description summarizes the material terms and provisions of our capital stock,

including the common stock the selling stockholders may offer under this prospectus. The following description of our capital stock does

not purport to be complete and is subject to, and qualified in its entirety by, our amended restated certificate of incorporation (the

“Amended and Restated Certificate of Incorporation”) and amended and restated bylaws (the “Amended and Restated Bylaws”),

which are exhibits to the registration statement of which this prospectus forms a part, and by applicable law. The terms of our capital

stock may also be affected by Delaware law.

General

Our

authorized capital stock consists of two hundred and fifty million (250,000,000) shares of common stock, $0.01 par value per share, and

one hundred thirty million (130,000,000) shares of preferred stock, $0.01 par value per share.

Common

Stock

As

of March 18, 2025, there were 2,515,179 shares of common stock outstanding. Each outstanding share of common stock entitles the holder

thereof to one vote per share on all matters. Our Amended and Restated Bylaws provide that any vacancy occurring in the Board of Directors

may be filled by the affirmative vote of a majority of the remaining directors. Stockholders do not have preemptive rights to purchase

shares in any future issuance of our common stock. In the event of our liquidation, dissolution or winding up, holders of our common

stock are entitled to receive, ratably, the net assets available to stockholders after payment of all creditors.

Holders

of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, and

do not have cumulative voting rights. Accordingly, the holders of a majority of the shares of our common stock entitled to vote can elect

all directors standing for election. Subject to preferences that may be applicable to any outstanding shares of preferred stock, holders

of our common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by our Board of Directors

out of funds legally available for dividend payments. All outstanding shares of our common stock are fully paid and nonassessable, and

any shares of our common stock to be sold pursuant to this prospectus will be fully paid and nonassessable. The holders of common stock

have no preferences or rights of conversion, exchange, pre-emption, or other subscription rights. There are no redemption or sinking

fund provisions applicable to our common stock. In the event of any liquidation, dissolution or winding-up of our affairs, holders of

our common stock will be entitled to share ratably in our assets that are remaining after payment or provision for payment of all of

our debts and obligations and after liquidation payments to holders of outstanding shares of preferred stock, if any.

The

transfer agent and registrar for our common stock is Equinity Trust Company, LLC. The transfer agent and the registrar’s address

is 48 Wall St., Floor 23, New York, NY 10005. Our common stock is listed on The Nasdaq Capital Market under the symbol “SINT.”

Preferred

Stock

Our

Board of Directors has the authority under our Amended and Restated Certificate of Incorporation, without further action by our stockholders,

to issue up to 130,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be

included in each such series, to fix the rights, preferences, privileges and restrictions of the shares of each wholly unissued series,

including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preference and sinking fund terms, and

to increase or decrease the number of shares of any such series (but not below the number of shares of such series then outstanding).

Our

Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could have the effect of restricting

dividends on our common stock, diluting the voting power of our common stock, impairing the liquidation rights of our common stock or

otherwise adversely affecting the rights of holders of our common stock. The issuance of preferred stock, while providing flexibility

in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring

or preventing a change of control and may adversely affect the market price of our common stock.

Series

B Preferred Stock.

Our

Board of Directors designated 15,000 shares of our preferred stock as Series B Preferred Stock. There are currently 19 shares of Series

B Preferred stock outstanding which are convertible into 7,385 shares of our common stock.

Conversion

Each

share of Series B Preferred Stock is convertible into shares of our common stock at any time at the holder’s option at the Conversion

Price described below. We may not effect any conversion of Series B Preferred Stock, with certain exceptions, to the extent that, after

giving effect to an attempted conversion, the holder of Series B Preferred Stock (together with such holder’s affiliates, and any

persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares

of common stock in excess of 4.99% (or, at the election of the holder, 9.99%) of the shares of our common stock then outstanding after

giving effect to such conversion, referred to as the Preferred Stock Beneficial Ownership Limitation; provided, however, that upon notice

to the Company, the holder may increase or decrease the Preferred Stock Beneficial Ownership Limitation, provided that in no event may

the Preferred Stock Beneficial Ownership Limitation exceed 9.99% and any increase in the Preferred Stock Beneficial Ownership Limitation

will not be effective until 61 days following notice of such increase from the holder to us.

Subject

to certain ownership limitations as described below and certain equity conditions being met, if during any 30 consecutive trading days,

the volume weighted average price of our common stock exceeds $13,060.80 and the daily dollar trading volume during such period exceeds

$500,000 per trading day, we have the right to force the conversion of the Series B Preferred Stock into common stock.

Conversion

Price.

The

Series B Preferred Stock is convertible into shares of common stock by dividing the stated value of the Series B Preferred Stock ($1,100)

by $2.83 (the “Conversion Price”). The Conversion Price is subject to adjustment for stock splits, stock dividends,

and distributions of common stock or securities convertible, exercisable or exchangeable for common stock, subdivisions, combinations

and reclassifications.

Subject

to certain exclusions contained in the certificate of designation, if the Company in any manner grants or sells any rights, warrants

or options and the lowest price per share for which one share of common stock is at any time issuable upon the exercise of any such option

or upon conversion, exercise or exchange of any common stock Equivalents (as defined in the certificate of designation) issuable upon

exercise of any such option, exercise or exchange of any common stock Equivalent issuable upon the exercise of such option or otherwise

pursuant to the terms thereof is less than the Conversion Price, then such share of common stock will be deemed to be outstanding and

to have been issued and sold by the Company at the time of the granting or sale of such option for such price per share. For purposes

of this paragraph only, the “lowest price per share for which one share of common stock is issuable upon the exercise of any such

options or upon conversion, exercise or exchange of any common stock Equivalent issuable upon exercise of any such option or otherwise

pursuant to the terms thereof” will be equal to (1) the lower of (x) the sum of the lowest amounts of consideration (if

any) received or receivable by the Company with respect to any one share of common stock upon the granting or sale of such option, upon

exercise of such option and upon conversion, exercise or exchange of any common stock Equivalents issuable upon exercise of such option

or otherwise pursuant to the terms thereof and (y) the lowest exercise price set forth in such option for which one share of common stock

is issuable upon the exercise of any such options or upon conversion, exercise or exchange of any common stock Equivalents issuable upon

exercise of any such option or otherwise pursuant to the terms thereof. Except as contemplated by the terms of the certificate of designation,

no further adjustment of the Conversion Price will be made upon the actual issuance of such shares of common stock or of such convertible

securities upon the exercise of such options or otherwise pursuant to the terms of or upon the actual issuance of such common stock Equivalents.

Subject

to certain exclusions contained in the certificate of designation, if the Company in any manner issues or sells any common stock Equivalents

and the lowest price per share for which one share of common stock is at any time issuable upon the conversion, exercise or exchange

thereof or otherwise pursuant to the terms thereof is less than the Conversion Price, then such share of common stock will be deemed

to be outstanding and to have been issued and sold by the Company at the time of the issuance or sale of such convertible securities

for such price per share. For purposes of this paragraph only, the “lowest price per share for which one share of common stock

is issuable upon the conversion, exercise or exchange thereof or otherwise pursuant to the terms thereof” will be equal to (1)

the lower of (x) the sum of the lowest amounts of consideration (if any) received or receivable by the Company with respect to

one share of common stock upon the issuance or sale of the common stock Equivalent and upon conversion, exercise or exchange of such

convertible security or otherwise pursuant to the terms thereof and (y) the lowest conversion price set forth in such convertible security

for which one share of common stock is issuable upon conversion, exercise or exchange thereof or otherwise pursuant to the terms thereof

minus (2) the sum of all amounts paid or payable to the holder of such common stock Equivalent (or any other person) upon the issuance

or sale of such common stock Equivalent plus the value of any other consideration received or receivable by, or benefit conferred on,

the holder of such common stock Equivalent (or any other person). Except as contemplated by the terms of the certificate of designation,

no further adjustment of the Conversion Price will be made upon the actual issuance of such shares of common stock upon conversion, exercise

or exchange of such common stock Equivalents or otherwise pursuant to the terms thereof, and if any such issuance or sale of such common

stock Equivalents is made upon exercise of any options for which adjustment of the Conversion Price has been or is to be made, except

as contemplated by the terms of the certificate of designation, no further adjustment of the Conversion Price will be made by reason

of such issuance or sale.

If

the purchase or exercise price provided for in any options, the additional consideration, if any, payable upon the issue, conversion,

exercise or exchange of any convertible securities, or the rate at which any convertible securities are convertible into or exercisable

or exchangeable for shares of common stock increases or decreases at any time (other than proportional changes in conversion or exercise

prices, as applicable, in connection with stock dividends, splits or combination of outstanding common stock) the Conversion Price in

effect at the time of such increase or decrease will be adjusted to the Conversion Price which would have been in effect at such time

had such options or convertible securities provided for such increased or decreased purchase price, additional consideration or increased

or decreased conversion rate, as the case may be, at the time initially granted, issued or sold. If the terms of any option or convertible

security that was outstanding as of the date of issuance of the Preferred Stock and related Warrants are increased or decreased in the

manner described in the immediately preceding sentence, then such option or convertible security and the shares of common stock deemed

issuable upon exercise, conversion or exchange thereof will be deemed to have been issued as of the date of such increase or decrease.

No adjustment will be made if such adjustment would result in an increase of the Conversion Price then in effect.

If

any option and/or convertible security and/or Adjustment Right is issued in connection with the issuance or sale or deemed issuance or

sale of any other securities of the Company (as determined by the holder of Preferred Stock, the “Primary Security”, and

such option and/or convertible security and/or Adjustment Right (as defined below), the “Secondary Securities” and together

with the Primary Security, each a “unit”), together comprising one integrated transaction, the aggregate consideration per

share of common stock with respect to such Primary Security will be deemed to be the lower of (x) the purchase price of such

unit, (y) if such Primary Security is an option and/or convertible security, the lowest price per share for which one share of common

stock is at any time issuable upon the exercise or conversion of the Primary Security in accordance with the paragraphs above and (z)

the lowest volume-weighted average price of the common stock on any trading day during the four trading day period immediately following

the public announcement of such dilutive issuance. If any shares of common stock, options or convertible securities are issued or sold

or deemed to have been issued or sold for cash, the consideration received therefor will be deemed to be the net amount of consideration

received by the Company therefor. If any shares of common stock, options or convertible securities are issued or sold for a consideration

other than cash, the amount of such consideration received by the Company will be the fair value of such consideration, except where

such consideration consists of publicly traded securities, in which case the amount of consideration received by the Company for such

securities will be the arithmetic average of the volume-weighted average prices of such security for each of the five (5) trading days

immediately preceding the date of receipt. If any shares of common stock, options or convertible securities are issued to the owners

of the non-surviving entity in connection with any merger in which the Company is the surviving entity, the amount of consideration therefor

will be deemed to be the fair value of such portion of the net assets and business of the non-surviving entity as is attributable to

such shares of common stock, options or convertible securities (as the case may be). The fair value of any consideration other than cash

or publicly traded securities will be determined jointly by the Company and the holder. If such parties are unable to reach agreement

within ten (10) days after the occurrence of an event requiring valuation (the “Valuation Event”), the fair value of such

consideration will be determined within five trading days after the tenth day following such Valuation Event by an independent, reputable

appraiser jointly selected by the Company and the holder.

“Adjustment

Right” means any right granted with respect to any securities issued in connection with, or with respect to, any issuance or sale

(or deemed issuance or sale in accordance with the paragraph above) of shares of common stock that could result in a decrease in the

net consideration received by the Company in connection with, or with respect to, such securities (including, without limitation, any

cash settlement rights, cash adjustment or other similar rights).

In

addition, holders of Preferred Stock may be eligible to elect an alternative price in the event we issue certain variable price securities.

Liquidation;

Dividends; Repurchases.

In

the event of a liquidation, the holders of Series B Preferred Stock are entitled to participate on an as-converted-to-common stock basis

with holders of the common stock in any distribution of assets of the Company to the holders of the common stock. Additionally, we will

not pay any dividends on shares of common stock (other than dividends in the form of common stock) unless and until such time as we pay

dividends on each Series B Preferred Share on an as-converted basis. Other than as set forth in the previous sentence, no other dividends

will be paid on Series B Preferred Stock and we will pay no dividends (other than dividends in the form of common stock) on shares of

common stock unless we simultaneously comply with the previous sentence.

Redemption

Right.

The

Company holds an option to redeem some or all of the Series B Preferred Stock at any time after the six-month anniversary of its issuance

date at a 25% premium to the stated value of the Series B Preferred Stock subject to redemption, upon 30 days prior written notice to

the holder of the Series B Preferred Stock. The Series B Preferred Stock would be redeemed by the Company for cash.

Fundamental

Transactions.

In

the event of any fundamental transaction, generally including any merger with or into another entity, sale of all or substantially all

of our assets, tender offer or exchange offer, or reclassification of our common stock, then upon any subsequent conversion of the Series

B Preferred Stock, the holder will have the right to receive as alternative consideration, for each share of our common stock that would

have been issuable upon such conversion immediately prior to the occurrence of such fundamental transaction, the number of shares of

common stock of the successor or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration

receivable upon or as a result of such transaction by a holder of the number of shares of our common stock for which the Series B Preferred

Stock is convertible immediately prior to such event.

Voting

Rights.

With

certain exceptions, the holders of shares of Series B Preferred Stock have no voting rights. However, as long as any shares of Series

B Preferred Stock remain outstanding, we may not, without the affirmative vote of holders of a majority of the then-outstanding Series

B Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Series B Preferred Stock or alter or

amend the certificate of designation, (b) increase the number of authorized shares of Series B Preferred Stock, (c) amend our Amended

and Restated Certificate of Incorporation or other charter documents in any manner that adversely affects any rights of holders of Series

B Preferred Stock disproportionately to the rights of holders of our other capital stock, or (d) enter into any agreement with respect

to any of the foregoing.

Jurisdiction

and Waiver of Trial by Jury

Other

than with respect to suits, actions or proceedings arising under the federal securities laws, the certificate of designation provides

for investors to consent to exclusive jurisdiction to courts located in New York, New York and provides for a waiver of the right to

a trial by jury. It also provides that disputes are governed by Delaware law.

Series

C Preferred Stock.

Our

Board of Directors designated 9,440 shares of our preferred stock as Series C Preferred Stock. As of March 18, 2025, there were 50 shares

of Series C Preferred stock outstanding which are convertible into 2 shares of our common stock.

Conversion. Each

share of Series C Preferred Stock will be convertible at our option at any time on or after the first anniversary of the expiration of

the Rights Offering or at the option of the holder at any time, into the number of shares of our common stock determined by dividing

the $1,000 stated value per share of the Series C Preferred Stock by a conversion price of $ 29,628.00 per share. In addition, the conversion

price per share is subject to adjustment for stock dividends, distributions, subdivisions, combinations or reclassifications. Subject

to limited exceptions, a holder of the Series C Preferred Stock will not have the right to convert any portion of the Series C Preferred

Stock to the extent that, after giving effect to the conversion, the holder, together with its affiliates, would beneficially own in

excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect to its conversion. A holder of

the Series C Preferred Stock, upon notice to the Company, may increase or decrease the beneficial ownership limitation provisions of

such holder’s Series C Preferred Stock, provided that in no event shall the limitation exceed 9.99% of the number of shares of

our common stock outstanding immediately after giving effect to its conversion. In the event that a conversion is effected at our option,

we will exercise such option to convert shares of Series C Preferred Stock on a pro rata basis among all of the holders based on such

holders’ shares of Series C Preferred Stock.

Fundamental

Transactions. In the event we effect certain mergers, consolidations, sales of substantially all of our assets, tender or exchange

offers, reclassifications or share exchanges in which our common stock is effectively converted into or exchanged for other securities,

cash or property, we consummate a business combination in which another person acquires 50% of the outstanding shares of our common stock,

or any person or group becomes the beneficial owner of 50% of the aggregate ordinary voting power represented by our issued and outstanding

common stock, then, upon any subsequent conversion of the Series C Preferred Stock, the holders of the Series C Preferred Stock will

have the right to receive any shares of the acquiring corporation or other consideration it would have been entitled to receive if it

had been a holder of the number of shares of common stock then issuable upon conversion in full of the Series C Preferred Stock.

Dividends. Holders

of Series C Preferred Stock shall be entitled to receive dividends (on an as-if-converted-to-common-stock basis) in the same form as

dividends actually paid on shares of the common stock when, as and if such dividends are paid on shares of common stock.

Voting

Rights. Except as otherwise provided in the certificate of designation or as otherwise required by law, the Series C Preferred

Stock has no voting rights.

Liquidation

Preference. Upon our liquidation, dissolution or winding-up, whether voluntary or involuntary, holders of Series C Preferred

Stock will be entitled to receive out of our assets, whether capital or surplus, the same amount that a holder of common stock would

receive if the Series C Preferred Stock were fully converted (disregarding for such purpose any conversion limitations under the certificate

of designation) to common stock, which amounts shall be paid pari passu with all holders of common stock.

Redemption

Rights. We are not obligated to redeem or repurchase any shares of Series C Preferred Stock. Shares of Series C Preferred Stock

are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous provisions.

Series

D Preferred Stock

Our

Board of Directors designated 4,656 shares of our preferred stock as Series D Preferred Stock. As of March 18, 2025, there were 180 shares

of Series D Preferred stock outstanding which are convertible into 60 shares of our common stock.

Conversion. Each

share of Series D Preferred Stock is convertible at the option of the holder at any time, into the number of shares of our common stock

determined by dividing the $1,000 stated value per share of the Series D Preferred Stock by a conversion price of $ 3,020.40 per share.

In addition, the conversion price per share is subject to adjustment for stock dividends, distributions, subdivisions, combinations or

reclassifications. Subject to limited exceptions, a holder of the Series D Preferred Stock will not have the right to convert any portion

of the Series D Preferred Stock to the extent that, after giving effect to the conversion, the holder, together with its affiliates,

would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect to

its conversion. A holder of the Series D Preferred Stock, upon notice to us, may increase or decrease the beneficial ownership limitation

provisions of such holder’s Series D Preferred Stock, provided that in no event shall the limitation exceed 9.99% of the number

of shares of our common stock outstanding immediately after giving effect to its conversion.

Fundamental

Transactions. In the event we effect certain mergers, consolidations, sales of substantially all of our assets, tender or exchange

offers, reclassifications or share exchanges in which our common stock is effectively converted into or exchanged for other securities,

cash or property, we consummate a business combination in which another person acquires 50% of the outstanding shares of our common stock,

or any person or group becomes the beneficial owner of 50% of the aggregate ordinary voting power represented by our issued and outstanding

common stock, then, upon any subsequent conversion of the Series D Preferred Stock, the holders of the Series D Preferred Stock will

have the right to receive any shares of the acquiring corporation or other consideration it would have been entitled to receive if it

had been a holder of the number of shares of common stock then issuable upon conversion in full of the Series D Preferred Stock.

Dividends. Holders

of Series D Preferred Stock shall be entitled to receive dividends (on an as-if-converted-to-common-stock basis) in the same form as

dividends actually paid on shares of the common stock when, as and if such dividends are paid on shares of common stock.

Voting

Rights. Except as otherwise provided in the certificate of designation or as otherwise required by law, the Series D Preferred

Stock has no voting rights.

Liquidation

Preference. Upon our liquidation, dissolution or winding-up, whether voluntary or involuntary, holders of Series D Preferred

Stock will be entitled to receive out of our assets, whether capital or surplus, the same amount that a holder of common stock would

receive if the Series D Preferred Stock were fully converted (disregarding for such purpose any conversion limitations under the certificate

of designation) to common stock, which amounts shall be paid pari passu with all holders of common stock.

Redemption

Rights. We are not obligated to redeem or repurchase any shares of Series D Preferred Stock. Shares of Series D Preferred Stock

are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous provisions.

Future

Preferred Stock.

Our

Board of Directors will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series

that we may sell. The General Corporation Law of the State of Delaware, the state of our incorporation, provides that the holders of

preferred stock will have the right to vote separately as a class on any proposal involving fundamental changes in the rights of holders

of that preferred stock. This right is in addition to any voting rights that may be provided for in the applicable certificate of designation.

Description

of Other Outstanding Securities of the Company

Warrants

As

of March 18, 2025, there were 2,005,390 common stock purchase warrants outstanding, which expire between October 2025 and August

2030. Each of these warrants entitles the holder to purchase one share of common stock at prices ranging between $2.83 and $3,322.40

per share. Certain of these warrants has a net exercise provision under which its holder may, in lieu of payment of the exercise

price in cash, surrender the warrant and receive a net amount of shares based on the fair market value of our common stock at the time

of exercise of the warrant after deduction of the aggregate exercise price. Additionally, certain of these warrants entitle a holder

to also effect an “alternative cashless exercise” wherein the holder may surrender a certain number of warrants in return

for a lesser number of shares of our common stock on a cashless basis. Each of these warrants also contains provisions for the adjustment

of the exercise price and the aggregate number of shares issuable upon the exercise of the warrant in the event of dividends, share splits,

reorganizations and reclassifications and consolidations. Certain of these warrants contain a provision requiring a reduction to the

exercise price in the event we issue common stock, or securities convertible into or exercisable for common stock, at a price per share

lower than the warrant exercise price.

The

holders of certain of these warrants have registration rights, as described in greater detail below.

The

Pre-Funded Warrants, Common Warrants, and Placement Agent Warrants

The

Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in

full. The Pre-Funded Warrants may be exercised on a cashless basis at any time, in which case the holder would receive upon such

exercise the net number of shares of common stock determined according to the formula set forth in the Pre-Funded Warrants. No fractional

shares of common stock will be issued in connection with the exercise of a Pre-Funded Warrant. In lieu of fractional shares, we will

pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

The

Common Warrants are exercisable immediately upon issuance and have a term of exercise equal to five and one-half years from the

date of issuance. If a registration statement registering the resale of the shares of common stock underlying

the Common Warrants under the Securities Act, is not effective or available, the holder may, in its sole

discretion, elect to exercise the Common Warrants through a cashless exercise, in which case the holder would receive upon

such exercise the net number of shares of common stock determined according to the formula set forth in

the Common Warrants. No fractional shares of common stock will be issued upon the exercise of any Common Warrant. In lieu

of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or

round up to the next whole share.

The

Placement Agent Warrants will be exercisable immediately upon issuance and have a term of exercise equal to five and one-half years from

the date of issuance. If a registration statement registering the resale of the shares of common stock underlying the Placement Agent

Warrants under the Securities Act, is not effective or available, the holder may, in its sole discretion, elect to exercise the Placement

Agent Warrants through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common

stock determined according to the formula set forth in the Placement Agent Warrants. No fractional shares of common stock will be issued

upon the exercise of any Placement Agent Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the

fractional amount multiplied by the exercise price or round up to the next whole share.

Fundamental

Transaction. If a Fundamental Transaction (as defined in the respective Warrants) occurs, then the successor entity will succeed

to, and be substituted for the Company, and may exercise every right and power that the Company may exercise and will assume all of the

Company’s obligations under the Warrants with the same effect as if such successor entity had been named in the Warrants itself.

If holders of shares of common stock are given a choice as to the securities, cash or property to be received in such a Fundamental Transaction,

then the holder shall be given the same choice as to the consideration it would receive upon any exercise of the Warrants following such

a Fundamental Transaction. Additionally, as more fully described in the Common Warrants and Placement Agent Warrants, in the event of

certain Fundamental Transactions, the holders of the Common Warrants and Placement Agent Warrants will be entitled to receive consideration

in an amount equal to the Black Scholes Value (as defined in the respective Warrants), on the date of consummation of such Fundamental

Transaction.

Stock

Dividends and Splits. If at any time on or after the date of issuance there occurs any share split, share dividend, share combination

recapitalization or other similar transaction involving our common stock then in each case the exercise price shall be multiplied by

a fraction of which the numerator shall be the number of shares of common stock (excluding treasury shares, if any) outstanding immediately

before such event and of which the denominator shall be the number of shares of common stock outstanding immediately after such event,

and the number of shares issuable upon exercise of the Warrant shall be proportionately adjusted such that the aggregate exercise price

of the Warrant shall remain unchanged.

Beneficial

Ownership Limitations. A holder will not have the right to exercise any portion of the Warrants if the holder (together with

its affiliates) would beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any warrants, 9.99%)

of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is

determined in accordance with the terms of the Warrants and Pre-Funded Warrants. However, any holder may increase or decrease such percentage

to any other percentage not in excess of 9.99%, upon at least 61 days’ prior notice from the holder to us with respect to any increase

in such percentage.

The

foregoing description of the Pre-Funded Warrants, Common Warrants, and Placement Agent Warrants is not complete. For the complete terms

of the Pre-Funded Warrants, Common Warrants, and Placement Agent Warrants, please refer to the forms of the Pre-Funded Warrants, Common

Warrants, and Placement Agent Warrants filed as exhibits to the registration statement of which this prospectus forms a part.

We

do not intend to list the Pre-Funded Warrants, the Common Warrants, or the Placement Agent Warrants on any securities exchange or other

trading market. Without an active trading market, the liquidity of these securities will be limited.

February

2023 Offering Warrants

On

February 7, 2023, we issued a Class C common stock purchase warrant to purchase up to 10,750 shares of common stock (the “Class

C Warrants”) and a Class D common stock purchase warrant to purchase up to 5,375 shares of common stock (the “Class D Warrants”). The

Class C and Class D Warrants are exercisable at a price of $1,120 per share. The Class C Warrants will expire five years from the date

of issuance and the Class D Warrants will expire three years from the date of issuance. In addition, a holder may also effect an “alternative

cashless exercise” wherein the aggregate number of shares of common stock issuable in such alternative cashless exercise shall

equal the product of (x) the aggregate number of shares of common stock that would be issuable upon exercise of the Class C Warrant or

Class D Warrant in accordance with the terms of such warrant if such exercise were by means of a cash exercise rather than a cashless

exercise and (y) 0.40 with respect to the Class C Warrant or 0.80 with respect to the Class D Warrant.

The

following summary of certain terms and provisions of the Class C Warrants, and Class D Warrants is not complete and is subject to, and

qualified in its entirety by the provisions of the form of Class C Warrant, and the form of Class D Warrant, which are filed as exhibits

to this registration statement.

Exercisability.

The Class C Warrants are exercisable at any time after their original issuance and at any time up to the date that is five years after

their original issuance. The Class D Warrants are exercisable at any time after their original issuance and at any time up to the date

that is three years after their original issuance. Each of the Class C Warrants, Class D Warrants, are exercisable, at the option of

each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering

the issuance of the shares of common stock underlying the Class C Warrants or Class D Warrants, under the Securities Act is effective

and available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock

purchased upon such exercise. If a registration statement registering the issuance of the shares of common stock underlying the Class

C Warrants, Class D Warrants, under the Securities Act is not effective or available, the holder may, in its sole discretion, elect to

exercise the Class C Warrant or Class D Warrant, through a cashless exercise, in which case the holder would receive upon such exercise

the net number of shares of common stock determined according to the formula set forth in the warrant. We may be required to pay certain

amounts as liquidated damages as specified in the warrants in the event we do not deliver shares of common stock upon exercise of the

warrants within the time periods specified in the warrants. In addition, a holder may also effect an “alternative cashless exercise.”

In such event, the aggregate number of shares of common stock issuable in such alternative cashless exercise shall equal the product

of (x) the aggregate number of shares of common stock that would be issuable upon exercise of the Class C Warrant or Class D Warrant

in accordance with the terms of such warrant if such exercise were by means of a cash exercise rather than a cashless exercise and (y)

0.40 with respect to the Class C Warrant or 0.80 with respect to the Class D Warrant. No fractional shares of common stock will be issued

in connection with the exercise of a Class C Warrant or Class D Warrant. With respect to any alternative cashless exercise, fractional

shares will be rounded down to the nearest whole share.

Fractional

Shares. No fractional shares of common stock will be issued in connection with the exercise of a warrant. Other than as described

above with respect to alternative cashless exercises, in lieu of fractional shares, we will, at our election, either pay the holder an

amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Exercise

Limitation. A holder will not have the right to exercise any portion of the Class C Warrants, or Class D Warrants if the holder (together

with its affiliates) would beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any warrants,

9.99%) of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership

is determined in accordance with the terms of the warrants. However, any holder may increase or decrease such percentage to any other

percentage not in excess of 9.99%, upon at least 61 days’ prior notice from the holder to us with respect to any increase in such

percentage.

Exercise

Price. The exercise price per whole share of common stock purchasable upon exercise of the Class C Warrants and the Class D Warrants

is $1,120 per share. The exercise price and number of shares of common stock issuable on exercise are subject to appropriate adjustments

in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting

our common stock.

Transferability.

Subject to applicable laws, the Class C Warrants and Class D Warrants may be offered for sale, sold, transferred or assigned without

our consent.

Exchange

Listing. We do not intend to list the Class C Warrants or the Class D Warrants on any securities exchange or other trading market.

Without an active trading market, the liquidity of these securities will be limited.

Warrant

Agent. The Class C Warrants and Class D Warrants are issued in registered form under a warrant agreement between American Stock Transfer

& Trust Company, LLC, as warrant agent, and us. The Class C Warrants and Class D Warrants shall initially be represented only by

one or more global warrants deposited with the warrant agent, as custodian on behalf of The Depository Trust Company (“DTC”)

and registered in the name of Cede & Co., a nominee of DTC, or as otherwise directed by DTC.

Fundamental

Transactions. In the event of a fundamental transaction, and generally including, with certain exceptions, any reorganization, recapitalization

or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets,

our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding shares of common stock,

or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding shares of common stock,

the holders of the Class C Warrants and Class D Warrants will be entitled to receive upon exercise of the warrants the kind and amount

of securities, cash or other property that the holders would have received had they exercised the warrants immediately prior to such

fundamental transaction. In addition, in the event of a fundamental transaction, we or the successor entity, at the request of a holder

of Class C Warrants or Class D Warrants, will be obligated to purchase any unexercised portion of such Class C Warrants or Class D Warrants

in accordance with the terms of the warrants. Additionally, as more fully described in the warrants, in the event of certain fundamental

transactions, the holders of the warrants will be entitled to receive consideration in an amount equal to the Black Scholes value of

the warrants on the date of consummation of such transaction.

Rights

as a Shareholder. Except as otherwise provided in the Class C Warrants and Class D Warrants or by virtue of such holder’s ownership

of our shares of common stock, the holder of a Class C Warrant or Class D Warrant does not have the rights or privileges of a holder

of our common stock, including any voting rights, until the holder exercises the warrant.

Governing

Law. The Class C Warrants, Class D Warrants, and warrant agreement are governed by New York law.

Maxim

and Ascendiant February 2023 Warrants

In