Form 8-K - Current report

23 Dicembre 2024 - 11:00PM

Edgar (US Regulatory)

FALSE000178976900017897692024-12-202024-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2024

Instil Bio, Inc.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 001-40215 | 83-2072195 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| | |

3963 Maple Avenue, Suite 350 Dallas, Texas | | 75219 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(972) 499-3350

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.000001 par value | | TIL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 20, 2024 (the “Closing Date”), Complex Therapeutics LLC (“Borrower”), a wholly-owned subsidiary of Instil Bio, Inc. (the “Company”), entered into a Term Loan Agreement (the “2024 Loan Agreement”) and related loan documents with Midland National Life Insurance Company (“Lender”), pursuant to which Lender loaned Borrower a term loan in the principal amount of $85.6 million (the “Loan”) to refinance loans secured by the facility in Tarzana, California owned by Borrower (the “Property”). Substantially all of the Loan proceeds were used to repay in full the loans related to the construction and development of the Property made pursuant to the Loan Agreement between Borrower and OP USA Debt Holdings II Limited Partnership (as successor-by-assignment to OPG Hermes Investments (DE) LLC) (“Construction Lender”) dated as of June 10, 2022, as amended, and the Mezzanine Loan Agreement between the Company’s wholly-owned subsidiary, Complex Therapeutics Mezzanine LLC, and Construction Lender dated as of June 10, 2022, as amended (together, the “Construction Loan Agreements”).

The Loan has a term of two years with a one-year extension option. The extension option is subject to certain conditions being met, including: (a) no potential default or event of default, (b) payment of a 0.35% extension fee and the costs and expenses of Lender incurred in connection with the extension, (c) replenishing of all reserve funds as reasonably determined by Lender, and (d) compliance with minimum debt yield and debt service coverage ratio requirements. The Loan bears interest at a fixed rate of 6.35% per annum, with interest-only payments during the term of the Loan and the principal balance due in full at maturity.

The Loan may be prepaid in whole but not in part. If the Loan is prepaid on or prior to the 12-month anniversary of the Closing Date, a prepayment fee is required (other than in connection with a casualty or condemnation event) to make Lender whole for the interest it would have otherwise earned on the Loan during the first 12 months. There is no prepayment fee due if the Loan is prepaid after the 12-month anniversary of the Closing Date.

The Loan is secured by a first mortgage lien on the Property, as assignment of all leases and rents of the Property, and a first priority security interest in all other assets of Borrower. The Loan is generally non-recourse; however, the Company has entered into a Recourse Indemnity Agreement with Lender, which provides that in certain circumstances the Loan will be recourse to the Company to the extent of losses incurred by Lender as a result of the breach of certain customary non-recourse carveouts, and will be full recourse to the Company in the event of (a) a voluntary or collusive bankruptcy or other insolvency proceeding against Borrower or the Company, (b) the substantive consolidation of Borrower, (c) Borrower’s incurring of any debt in violation of the Loan Agreement, or (d) a transfer of the Property in violation of the Loan Agreement. The 2024 Loan Agreement and the Recourse Indemnity Agreement include customary representations, covenants, cash sweep provisions and events of default for a financing transaction of this nature, including financial covenants that require the Company to maintain a consolidated net worth of not less than $50 million (exclusive of any interest in the Property) and minimum liquidity of $17.1 million.

The foregoing description of the 2024 Loan Agreement and the Recourse Indemnity Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the 2024 Loan Agreement and the Recourse Indemnity Agreement, copies of which will be filed as exhibits to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Item 1.02 Termination of a Material Definitive Agreement

Effective as of the Closing Date, the Construction Loan Agreements and all related loan documents have been terminated, including the obligations under the Construction Loan Agreements that were guaranteed by the Company.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under and Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth above in Item 1.01 is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | Instil Bio, Inc. |

| | | | |

| Dated: | December 23, 2024 | | | | By: | | /s/ Sandeep Laumas, M.D. |

| | | | | | | Sandeep Laumas, M.D. |

| | | | | | | Chief Financial Officer and Chief Business Officer

(Principal Financial Officer and Principal Accounting Officer) |

Cover

|

Dec. 20, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

Instil Bio, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40215

|

| Entity Tax Identification Number |

83-2072195

|

| Entity Address, Address Line One |

3963 Maple Avenue, Suite 350

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75219

|

| City Area Code |

972

|

| Local Phone Number |

499-3350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.000001 par value

|

| Trading Symbol |

TIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001789769

|

| Document Period End Date |

Dec. 20, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

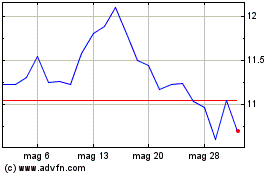

Grafico Azioni Instill Bio (NASDAQ:TIL)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Instill Bio (NASDAQ:TIL)

Storico

Da Apr 2024 a Apr 2025