OHA is Administrative Agent and Sole Lender for Emergent BioSolutions Debt Refinancing

04 Settembre 2024 - 11:51PM

Oak Hill Advisors (“OHA”) served as Administrative Agent and sole

lender of a $250 million term loan facility supporting Emergent

BioSolutions Inc. (“Emergent”) (NYSE: EBS), a global company

providing life-saving and life-extending products that address

public health threats. The new debt financing will refinance

Emergent’s existing credit facility, reaching a significant step in

its multi-year plan to stabilize its financial profile.

In connection with the execution of the term

loan, Emergent issued OHA 2.5 million warrants in addition to

common stock with an aggregate value of $10 million. Both the

number of shares and the warrant strike prices will be calculated

based on the volume weighted average price per share for the 30

trading days ending on, but excluding, the 10th business day

following the closing date.

This bespoke term loan structure exemplifies

OHA’s strategic approach to partnering with companies to address

complex and unique financial situations.

“For the past 18 months, Emergent has executed

on a series of actions to strengthen the balance sheet and

streamline operations,” said Joe Papa, president and CEO of

Emergent. “These steps, which include finalizing several asset/site

divestitures, resolving legacy issues, and now, securing this

significant debt refinancing, are critical to stabilizing our

financial profile.”

Papa continued, “We are thrilled to secure this

new credit facility with Oak Hill Advisors as we are on track to

reduce net debt by more than $200 million this year, positioning

Emergent to enter its next phase of our turnaround, enabling future

growth and additional investment opportunities with much greater

freedom and flexibility to operate through favorable terms.”

Joseph Goldschmid, Managing Director at Oak Hill

Advisors, added, “We are delighted to be a capital partner to

Emergent. This financing provides the company with additional

liquidity and flexibility to deliver on its business plan and

continue to provide critical, life-saving products. We are excited

to support and partner with the management team and company in this

next chapter of growth.”

To access more information related to the new

credit facility agreement, visit Emergent’s recently filed Form 8-K

and press release here.

###

About OHA: Oak Hill Advisors (OHA) is a

leading global credit-focused alternative asset manager with over

30 years of investment experience. OHA works with institutions and

individuals and seeks to deliver a consistent track record of

attractive risk-adjusted returns. The firm manages approximately

$65 billion of capital across credit strategies, including private

credit, high yield bonds, leveraged loans, stressed and distressed

debt and collateralized loan obligations as of June 30, 2024. OHA’s

emphasis on long-term partnerships with companies, sponsors and

other partners provides access to a proprietary opportunity set,

allowing for customized credit solutions across market cycles.

With over 400 experienced professionals across

six global offices, OHA brings a collaborative approach to offering

investors a single platform to meet their diverse credit needs. OHA

is the private markets platform of T. Rowe Price Group, Inc.

(NASDAQ – GS: TROW). For more information, please visit

oakhilladvisors.com.

Natalie Harvard, Head of Investor Relations & Partner

Oak Hill Advisors, L.P.

212-326-1505

nharvard@oakhilladvisors.com

Kristin Celestino, Public Relations

Oak Hill Advisors, L.P.

817-215-2934

kcelestino@oakhilladvisors.com

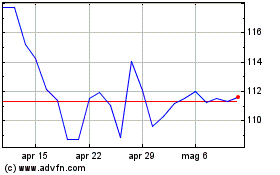

Grafico Azioni T Rowe Price (NASDAQ:TROW)

Storico

Da Mar 2025 a Mar 2025

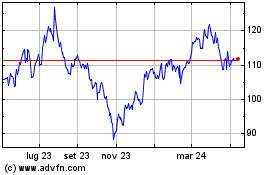

Grafico Azioni T Rowe Price (NASDAQ:TROW)

Storico

Da Mar 2024 a Mar 2025