UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-40858

XORTX Therapeutics Inc.

3710 – 33rd Street NW, Calgary, Alberta, T2L 2M1

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ⊠ Form 40-F □

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

XORTX THERAPEUTICS INC. |

|

| |

|

(Registrant) |

|

| |

|

|

|

|

| Date: |

March 25, 2025 |

By: |

/s/ Allen Davidoff |

|

| |

|

Name: |

Allen Davidoff |

|

| |

|

Title: |

Chief Executive Officer

|

|

EXHIBIT INDEX

Exhibit 99.1

CONSOLIDATED FINANCIAL STATEMENTS

As at and for the years ended

December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Directors of

XORTX Therapeutics Inc.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statement of

financial position of XORTX Therapeutics Inc. (the “Company”) as of December 31, 2024, and the related consolidated statements

of loss and comprehensive loss, changes in shareholders’ equity, and cash flows for the year ended December 31, 2024, and the related

notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in

all material respects, the financial position of the Company as of December 31, 2024, and the results of its operations and its cash flows

for the year ended December 31, 2024, in conformity with IFRS Accounting Standards as issued by the International Accounting Standards

Board (“IFRS”).

The financial statements of the Company for the years ended

December 31, 2023 and 2022, were audited by other auditors, whose report dated April 1, 2024, expressed an unqualified opinion on those

statements. We have also audited the adjustments to retrospectively apply the change in accounting policy described in Notes 3 and 12

to the financial statements. In our opinion, the retrospective adjustments are appropriate and have been properly applied. Additionally,

as discussed in Note 12(h), the December 31, 2022 statement of cash flows has been revised to correct certain immaterial misstatements.

We have audited the revision described in Note 12(h) to the statement of cash flows. In our opinion, such revisions are appropriate and

have been properly applied. We were not engaged to audit, review, or apply any procedures to the December 31, 2023 and 2022 financial

statements other than with respect to the adjustments and revision above and, accordingly, we do not express an opinion on any other form

of assurance on the December 31, 2023 and 2022 financial statements as a whole.

Going Concern

The accompanying financial statements have been prepared assuming that the entity will continue

as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations that

raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described

in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public

accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to

be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations

of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of

the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform,

an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal

control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal

control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the

risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those

risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Company’s auditor since 2025.

/s/ DAVIDSON & COMPANY LLP

| Vancouver, Canada | |

Chartered Professional Accountants |

March 21, 2025

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

TO THE SHAREHOLDERS AND DIRECTORS OF XORTX THERAPEUTICS INC.

Opinion on the Consolidated Financial Statements

We have audited, before the effects of the adjustments for

the change in accounting policy and the revision of previously issued financial statements as described in Note 12, the accompanying consolidated

statement of financial position of Xortx Therapeutics Inc. (the “Company”) and its subsidiaries as of December 31, 2023, and

the related consolidated statements of comprehensive loss, changes in shareholders’ equity and cash flows for the years ended December

31, 2023 and 2022, and the related notes (collectively referred to as the "consolidated financial statements"). In our opinion,

the consolidated financial statements, before the effects of the adjustments for the change in accounting policy and the revision of previously

issued financial statements as described in Note 12, present fairly, in all material respects, the financial position of the Company as

of December 31, 2023, and the results of its operations and its cash flows for the years ended December 31, 2023 and 2022, in conformity

with IFRS Accounting Standards as issued by the International Accounting Standards Board.

We were not engaged to audit, review, or apply any procedures

to the adjustments for the change in accounting policy and the revision of previously issued financial statements as described in Note

12 and accordingly, we do not express an opinion or make any other form of assurance about whether the adjustments are appropriate and

have been properly applied. Those adjustments were audited by the successor auditor.

Basis for Opinion

These consolidated financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on the Company's consolidated financial statements based on our

audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of

the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial

statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged

to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding

of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks

of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated

financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management,

as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable

basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period

audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that

(1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially

challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

We have served as the Company's auditor since 2018.

Chartered Professional Accountants

Vancouver, Canada

April 1, 2024

XORTX THERAPEUTICS INC.

Consolidated Statements of Financial Position

(Expressed in U.S. Dollars)

| | |

Note | |

|

December 31,

2024 |

| |

|

December 31,

2023 |

|

| | |

| |

| $ | | |

| $ | |

| Assets | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Current | |

| |

| | | |

| | |

| Cash | |

5 | |

| 2,473,649 | | |

| 3,447,665 | |

| Accounts receivable | |

| |

| 17,637 | | |

| 60,711 | |

| Prepaid expenses | |

6 | |

| 185,412 | | |

| 236,966 | |

| Deferred share issuance costs | |

12 | |

| - | | |

| 323,441 | |

| | |

| |

| | | |

| | |

| Total Current Assets | |

| |

| 2,676,698 | | |

| 4,068,783 | |

| Non-current | |

| |

| | | |

| | |

| Contract payments | |

7 | |

| 1,200,000 | | |

| 1,200,000 | |

| Intangible assets | |

8 | |

| 183,108 | | |

| 175,254 | |

| Property and equipment | |

9 | |

| 34,721 | | |

| 23,927 | |

| | |

| |

| | | |

| | |

| Total Assets | |

| |

| 4,094,527 | | |

| 5,467,964 | |

| | |

| |

| | | |

| | |

| Liabilities | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Current | |

| |

| | | |

| | |

| Accounts payable and accrued liabilities | |

10,13 | |

| 147,205 | | |

| 283,428 | |

| Derivative warrant liability | |

12(h) | |

| 572,000 | | |

| 531,000 | |

| Lease obligation | |

11 | |

| 38,785 | | |

| 11,510 | |

| | |

| |

| | | |

| | |

| Total Liabilities | |

| |

| 757,990 | | |

| 825,938 | |

| | |

| |

| | | |

| | |

| Shareholders’ Equity | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Share capital | |

12 | |

| 18,493,571 | | |

| 17,056,535 | |

| Reserves | |

12 | |

| 6,039,078 | | |

| 5,468,257 | |

| Obligation to issue shares | |

8(c) | |

| 24,746 | | |

| 24,746 | |

| Accumulated other comprehensive loss | |

| |

| (52,605 | ) | |

| (52,605 | ) |

| Accumulated deficit | |

| |

| (21,168,253 | ) | |

| (17,854,907 | ) |

| | |

| |

| | | |

| | |

| Total Shareholders’ Equity | |

| |

| 3,336,537 | | |

| 4,642,026 | |

| | |

| |

| | | |

| | |

| Total Liabilities and Shareholders’ Equity | |

| |

| 4,094,527 | | |

| 5,467,964 | |

Nature of operations and going concern (Note 1)

Commitments (Note 17)

Subsequent events (Note 19)

| /s/ “Allen Davidoff” |

|

/s/ “Paul Van Damme” |

| Director |

|

Director |

The accompanying notes are an integral part of these consolidated financial statements.

XORTX THERAPEUTICS INC.

Consolidated Statements of Loss and Comprehensive Loss

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| | |

Note | |

|

2024 |

| |

|

2023 |

| |

|

2022 |

|

| | |

| |

| $ | | |

| $ | | |

| $ | |

| Expenses | |

| |

| | | |

| | | |

| | |

| | |

| |

| | | |

| | | |

| | |

| Research and development | |

13 | |

| 183,830 | | |

| 2,418,715 | | |

| 6,761,818 | |

| Consulting, wages and benefits | |

13 | |

| 1,055,247 | | |

| 1,037,558 | | |

| 885,460 | |

| Directors’ fees | |

13 | |

| 168,143 | | |

| 179,406 | | |

| 122,572 | |

| Investor relations | |

| |

| 1,360,170 | | |

| 919,490 | | |

| 928,424 | |

| Professional fees | |

13 | |

| 616,859 | | |

| 514,263 | | |

| 454,071 | |

| General and administrative | |

| |

| 320,949 | | |

| 375,505 | | |

| 448,824 | |

| Public company costs | |

| |

| 141,404 | | |

| 170,184 | | |

| 120,813 | |

| Travel | |

| |

| 31,916 | | |

| 170,187 | | |

| 22,538 | |

| Amortization of property and equipment | |

9 | |

| 86,204 | | |

| 73,062 | | |

| 41,069 | |

| Amortization of intangible assets | |

8 | |

| 31,070 | | |

| 66,632 | | |

| 17,077 | |

| Share-based payments | |

12(g),13 | |

| 122,527 | | |

| 120,984 | | |

| 487,940 | |

| | |

| |

| | | |

| | | |

| | |

| Loss before other items | |

| |

| (4,118,319 | ) | |

| (6,045,986 | ) | |

| (10,290,606 | ) |

| | |

| |

| | | |

| | | |

| | |

| Fair value adjustment on derivative warrant liability | |

12(h) | |

| 1,035,105 | | |

| 3,641,403 | | |

| 3,396,137 | |

| Foreign exchange loss | |

| |

| (73,009 | ) | |

| (7,025 | ) | |

| (1,546 | ) |

| Interest income | |

| |

| 121,908 | | |

| 253,543 | | |

| 103,589 | |

| Transaction costs on derivative warrant liability | |

12(b) | |

| (279,031 | ) | |

| - | | |

| (926,456 | ) |

| | |

| |

| | | |

| | | |

| | |

| Net loss for the year | |

| |

| (3,313,346 | ) | |

| (2,158,065 | ) | |

| (7,718,882 | ) |

| | |

| |

| | | |

| | | |

| | |

| Other comprehensive loss: | |

| |

| | | |

| | | |

| | |

| Items that may be subsequently reclassified to profit or loss: | |

| |

| | | |

| | | |

| | |

| Currency translation differences | |

| |

| - | | |

| - | | |

| (128,145 | ) |

| | |

| |

| | | |

| | | |

| | |

| Total loss and comprehensive loss for the year | |

| |

| (3,313,346 | ) | |

| (2,158,065 | ) | |

| (7,847,027 | ) |

| | |

| |

| | | |

| | | |

| | |

| Basic and diluted loss per common share | |

| |

| (1.15 | ) | |

| (1.09 | ) | |

| (5.22 | ) |

| | |

| |

| | | |

| | | |

| | |

Weighted average number of common shares outstanding -

Basic and diluted | |

| |

| 2,878,514 | | |

| 1,981,734 | | |

| 1,479,914 | |

The accompanying notes are an integral

part of these consolidated financial statements.

XORTX THERAPEUTICS INC.

Consolidated Statements of Changes in Shareholders’ Equity

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| | |

Number of common shares | |

Share

capital | |

Reserves | |

Obligation to issue shares | |

Accumulated Deficit | |

Accumulated other comprehensive loss | |

Total |

| | |

| | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | | |

| $ | |

| Balance, December 31, 2021 | |

| 1,443,293 | | |

| 16,088,677 | | |

| 4,991,594 | | |

| 24,746 | | |

| (7,977,960 | ) | |

| 75,540 | | |

| 13,202,597 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued pursuant to public offering | |

| 155,555 | | |

| 359,868 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 359,868 | |

| Pre-funded warrants issued | |

| - | | |

| - | | |

| 925,015 | | |

| - | | |

| - | | |

| | | |

| 925,015 | |

| Share issuance costs | |

| - | | |

| (88,959 | ) | |

| (42,687 | ) | |

| - | | |

| - | | |

| - | | |

| (131,646 | ) |

| Pre-funded warrants exercised | |

| 71,223 | | |

| 164,768 | | |

| (164,704 | ) | |

| - | | |

| - | | |

| - | | |

| 64 | |

| Share-based payments | |

| - | | |

| - | | |

| 487,940 | | |

| - | | |

| - | | |

| - | | |

| 487,940 | |

| Comprehensive loss for the year | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,718,882 | ) | |

| (128,145 | ) | |

| (7,847,027 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 1,670,071 | | |

| 16,524,354 | | |

| 6,197,158 | | |

| 24,746 | | |

| (15,696,842 | ) | |

| (52,605 | ) | |

| 6,996,811 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reclassification of derivative warrant liability | |

| - | | |

| - | | |

| (318,000 | ) | |

| - | | |

| - | | |

| - | | |

| (318,000 | ) |

| Pre-funded warrants exercised | |

| 328,777 | | |

| 532,181 | | |

| (531,885 | ) | |

| - | | |

| - | | |

| - | | |

| 296 | |

| Share-based payments | |

| - | | |

| - | | |

| 120,984 | | |

| - | | |

| - | | |

| - | | |

| 120,984 | |

| Comprehensive loss for the year | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,158,065 | ) | |

| - | | |

| (2,158,065 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 1,998,848 | | |

| 17,056,535 | | |

| 5,468,257 | | |

| 24,746 | | |

| (17,854,907 | ) | |

| (52,605 | ) | |

| 4,642,026 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued pursuant to private placement | |

| 1,219,717 | | |

| 1,387,549 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,387,549 | |

| Pre-funded warrants issued | |

| - | | |

| - | | |

| 907,994 | | |

| - | | |

| - | | |

| - | | |

| 907,994 | |

| Reclassification of derivative warrant liability | |

| - | | |

| - | | |

| 123,651 | | |

| - | | |

| - | | |

| - | | |

| 123,651 | |

| Share issuance costs | |

| - | | |

| (331,541 | ) | |

| (224,140 | ) | |

| - | | |

| - | | |

| - | | |

| (555,681 | ) |

| Pre-funded warrants exercised | |

| 257,810 | | |

| 359,214 | | |

| (359,211 | ) | |

| - | | |

| - | | |

| - | | |

| 3 | |

| Warrants exercised | |

| 5,000 | | |

| 21,814 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 21,814 | |

| Share-based payments | |

| - | | |

| - | | |

| 122,527 | | |

| - | | |

| - | | |

| - | | |

| 122,527 | |

| Comprehensive loss for the year | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,313,346 | ) | |

| - | | |

| (3,313,346 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2024 | |

| 3,481,375 | | |

| 18,493,571 | | |

| 6,039,078 | | |

| 24,746 | | |

| (21,168,253 | ) | |

| (52,605 | ) | |

| 3,336,537 | |

The accompanying notes are an integral

part of these consolidated financial statements.

XORTX THERAPEUTICS INC.

Consolidated Statements of Cash Flows

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| | |

|

2024 |

| |

|

2023 |

| |

|

2022

Revised1 |

|

| | |

| $ | | |

| $ | | |

| $ | |

| Cash provided by (used in): | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Operating activities | |

| | | |

| | | |

| | |

| Net loss for the year | |

| (3,313,346 | ) | |

| (2,158,065 | ) | |

| (7,718,882 | ) |

| | |

| | | |

| | | |

| | |

| Items not affecting cash: | |

| | | |

| | | |

| | |

| Amortization | |

| 117,274 | | |

| 139,694 | | |

| 58,146 | |

| Fair value adjustment on derivative warrant liability | |

| (1,035,105 | ) | |

| (3,641,403 | ) | |

| (3,396,137 | ) |

| Fair value of finders’ warrants allocated to derivative liability | |

| - | | |

| - | | |

| 138,005 | |

| Share-based payments | |

| 122,527 | | |

| 120,984 | | |

| 487,940 | |

| Transaction costs on derivative warrant liability | |

| 279,031 | | |

| - | | |

| 797,598 | |

| Unrealized foreign exchange (gain) loss | |

| 34,178 | | |

| (13,634 | ) | |

| (6,391 | ) |

| Changes in non-cash operating assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| 43,074 | | |

| 21,041 | | |

| (41,098 | ) |

| Prepaid expenses | |

| 208,166 | | |

| 142,654 | | |

| 622,595 | |

| Accounts payable and accrued liabilities | |

| (134,447 | ) | |

| (1,194,436 | ) | |

| 892,265 | |

| | |

| (3,678,648 | ) | |

| (6,583,165 | ) | |

| (8,165,959 | ) |

| | |

| | | |

| | | |

| | |

| Investing activities | |

| | | |

| | | |

| | |

| Acquisition of intangible assets | |

| (38,924 | ) | |

| (42,052 | ) | |

| (26,005 | ) |

| Acquisition of equipment | |

| - | | |

| (4,311 | ) | |

| (19,696 | ) |

| | |

| (38,924 | ) | |

| (46,363 | ) | |

| (45,701 | ) |

| | |

| | | |

| | | |

| | |

| Financing activities | |

| | | |

| | | |

| | |

| Pre-funded warrants and warrants exercised | |

| 16,573 | | |

| 296 | | |

| 64 | |

| Payment of lease obligation | |

| (69,723 | ) | |

| (66,089 | ) | |

| (20,410 | ) |

| Cash share issuance costs | |

| (667,883 | ) | |

| (295,251 | ) | |

| (1,067,153 | ) |

| Proceeds from issuance of equity instruments | |

| 3,500,542 | | |

| - | | |

| 4,999,640 | |

| | |

| 2,779,509 | | |

| (361,044 | ) | |

| 3,912,141 | |

| | |

| | | |

| | | |

| | |

| Effect of foreign exchange (gain) loss on cash | |

| (35,953 | ) | |

| 4,041 | | |

| (136,146 | ) |

| | |

| | | |

| | | |

| | |

| Decrease in cash | |

| (974,016 | ) | |

| (6,986,531 | ) | |

| (4,435,665 | ) |

| | |

| | | |

| | | |

| | |

| Cash, beginning of year | |

| 3,447,665 | | |

| 10,434,196 | | |

| 14,869,861 | |

| | |

| | | |

| | | |

| | |

| Cash, end of year | |

| 2,473,649 | | |

| 3,447,665 | | |

| 10,434,196 | |

| | |

| | | |

| | | |

| | |

| Supplemental Cash Flow and Non-Cash Investing and Financing Activities Disclosure | |

| | | |

| | | |

| | |

| Fair value of agent’s warrants | |

| - | | |

| - | | |

| 185,738 | |

| Derivative warrant liability reclassified to share capital on exercise of warrants | |

| 5,244 | | |

| - | | |

| - | |

| Recognition of right-of-use asset | |

| 96,998 | | |

| - | | |

| 114,588 | |

| Deferred financing costs reclassified to share capital and transaction costs on derivative warrant liability | |

| 166,344 | | |

| - | | |

| - | |

1 The Company revised certain transaction

costs on derivative warrant liability from financing activities to operating activities (Note 12(h)).

The accompanying notes are an integral

part of these consolidated financial statements.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 1. | Nature of operations and going concern |

XORTX Therapeutics Inc. (the “Company” or “XORTX”)

was incorporated under the laws of Alberta, Canada on August 24, 2012.

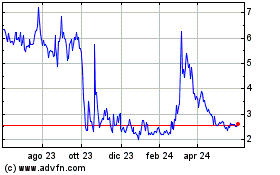

XORTX is a public company listed on the TSX Venture Exchange (the “TSXV”)

and on the Nasdaq Stock Market (“Nasdaq”) under the symbol “XRTX”. The Company’s operations and mailing

address is 3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1 and its registered address is located at 550 Burrard

Street, Suite 2900, Vancouver, British Columbia, V6C 0A3.

XORTX is a late-stage clinical pharmaceutical company focused on developing

innovative therapies to treat gout and progressive kidney disease modulated by aberrant purine and uric acid metabolism in orphan disease

indications such as allopurinol intolerant gout and autosomal dominant polycystic kidney disease, as well as more prevalent type 2 diabetic

nephropathy, and fatty liver disease. The Company’s current focus is on developing products to slow and/or reverse the progression

of these diseases.

The Company is subject to a number of risks associated with the successful

development of new products and their marketing and the conduct of its clinical studies and their results. The Company will have to finance

its research and development activities and its clinical studies. To achieve the objectives in its business plan, the Company plans to

raise the necessary capital and to generate revenues. Although there is no certainty, management is of the opinion that additional funding

for future projects and operations can be raised as needed. The products developed by the Company will require approval from the U.S.

Food and Drug Administration and equivalent organizations in other countries before their sale can be authorized. If the Company is unsuccessful

in obtaining adequate financing in the future, research activities will be postponed until market conditions improve. These circumstances

and conditions indicate the existence of a material uncertainty that casts significant doubt about the Company’s ability to continue

as a going concern.

Statement of Compliance

These consolidated financial statements

have been prepared in accordance with IFRS Accounting Standards (“IFRS”) as issued by the International Accounting Standards

Board (“IASB”).

Basis of Measurement and Presentation

These consolidated financial statements

have been prepared using the historical cost convention except for financial instruments which have been measured at fair value. These

consolidated financial statements were prepared on an accrual basis except for cash flow information.

These consolidated financial statements

incorporate the financial statements of the Company and its 100% owned subsidiary. The accounts of the Company’s subsidiary are

prepared for the same reporting period as the parent company, using consistent accounting policies. Inter-company transactions, balances

and unrealized gains or losses on transactions are eliminated. The Company’s subsidiary is the following:

| Name |

Place of Incorporation |

Ownership |

| XORTX Pharma Corp. |

Canada |

100% |

These consolidated financial statements

were approved for issue by the Board of Directors on March 21, 2025.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies |

These consolidated financial statements have been prepared using the following

accounting policies:

Financial Instruments

The Company classifies its financial instruments in the following categories:

at fair value through profit or loss (“FVTPL”), at fair value through other comprehensive income (loss) (“FVTOCI”)

or at amortized cost. The Company determines the classification of financial assets at initial recognition. The classification of debt

instruments is driven by the Company’s business model for managing the financial assets and their contractual cash flow characteristics.

Equity instruments that are held for trading are classified as FVTPL. For other

equity instruments, on the day of acquisition the Company can make an irrevocable election (on an instrument-by-instrument basis) to designate

them as at FVTOCI. Financial liabilities are measured at amortized cost, unless they are required to be measured at FVTPL (such as instruments

held for trading or derivatives) or if the Company has opted to measure them at FVTPL.

The following are the Company’s financial instruments as at December 31, 2024 and 2023:

| |

Classification |

| |

|

| Cash |

Amortized cost |

| Accounts payable and accrued liabilities |

Amortized cost |

| Derivative warrant liability |

FVTPL |

| Lease obligations |

Amortized cost |

| |

|

Financial assets at FVTOCI

Elected investments in equity instruments at FVTOCI are initially

recognized at fair value plus transaction costs. Subsequently they are measured at fair value, with gains and losses recognized in other

comprehensive income (loss).

Financial assets and liabilities at amortized cost

Financial assets and liabilities at amortized cost are initially

recognized at fair value plus or minus transaction costs, respectively, and subsequently carried at amortized cost using the effective

interest rate, less any impairment.

Financial assets and liabilities at FVTPL

Financial assets and liabilities carried at FVTPL are initially

recorded at fair value and transaction costs are expensed in the consolidated statements of comprehensive loss. Realized and unrealized

gains and losses arising from changes in the fair value of the financial assets and liabilities held at FVTPL are included in the consolidated

statements of comprehensive loss in the period in which they arise. Where management has opted to recognize a financial liability at FVTPL,

any changes associated with the Company’s own credit risk will be recognized in other comprehensive loss.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies (continued) |

Financial Instruments (continued)

Impairment of financial assets at amortized cost

The Company recognizes a loss allowance for expected credit losses

on financial assets that are measured at amortized cost.

At each reporting date, the Company measures the loss allowance

for the financial asset at an amount equal to the lifetime expected credit losses if the credit risk on the financial asset has increased

significantly since initial recognition. If at the reporting date, the financial asset has not increased significantly since initial recognition,

the Company measures the loss allowance for the financial asset at an amount equal to the twelve month expected credit losses. The Company

shall recognize in the consolidated statements of comprehensive loss, as an impairment gain or loss, the amount of expected credit losses

(or reversal) that is required to adjust the loss allowance at the reporting date to the amount that is required to be recognized.

Financial assets

The Company derecognizes financial assets only when the contractual

rights to cash flows from the financial assets expire, or when it transfers the financial assets and substantially all of the associated

risks and rewards of ownership to another entity. Gains and losses on derecognition are generally recognized in profit or loss. However,

gains and losses on derecognition of financial assets classified as FVTOCI remain within accumulated other comprehensive income (loss).

Financial liabilities

The Company derecognizes financial liabilities only when its obligations

under the financial liabilities are discharged, cancelled or expired. Generally, the difference between the carrying amount of the financial

liability derecognized and the consideration paid and payable, including any non-cash assets, is recognized in the consolidated statements

of comprehensive loss.

Cash

Cash include cash on hand, held at banks, or held with investment brokers as

well as short-term investments with an original maturity of 90 days or less, which are readily convertible into known amounts of cash.

Equipment

Equipment is recorded at cost less accumulated amortization and accumulated

impairment losses. The cost of an item of equipment includes expenditures that are directly attributable to the acquisition thereof. Amortization

is calculated on bases and rates designed to amortize the cost of the assets over their estimated useful lives. Amortization is recorded

using the straight-line method with an expectation of the following useful life estimates:

| Computer equipment | 3 years |

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies (continued) |

Leases

At inception of a contract, the Company assesses whether a contract is, or

contains, a lease determining whether the contract conveys the right to control the use of an identified asset for a period of time in

exchange for consideration. To assess whether a contract conveys the right to control the use of an identified asset, we assess whether:

| · | the contract involves the use of an identified asset; |

| · | the Company has the right to obtain substantially all of the economic benefits from use of the identified

asset throughout the period of use; and |

| · | the Company has the right to direct the use of the identified asset. |

The right-of-use asset and corresponding lease obligation is recognized at

the lease commencement date. The right-of-use asset is initially measured at cost, which comprises the initial amount of the lease obligation

adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs

to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives

received. The right-of-use asset is subsequently depreciated using the straight-line method from the commencement date to the end of the

lease term or its useful life, whichever is shorter. The lease term includes periods covered by an option to extend if the Company is

reasonably certain to exercise that option. In addition, the right-of-use asset is reduced by impairment losses and adjusted for certain

remeasurements of the lease obligation, if any.

The lease obligation is initially measured at the present value of the lease

payments that are not paid at the commencement date. The lease payments are discounted using the implicit interest rate in the lease.

If the rate cannot be readily determined, the Company’s incremental rate of borrowing is used. The lease obligation is subsequently

measured at amortized cost using the effective interest method. The lease obligation is remeasured when there is a change in future lease

payments arising from a change in an index or rate, if there is a change in our estimate of the amount expected to be payable under a

residual value guarantee, if we change our assessment of whether we will exercise a purchase, extension or termination option, or if the

underlying lease contract is amended.

The Company has elected not to separate fixed non-lease components from lease

components and instead account for each lease component and associated fixed non-lease components as a single lease component.

The Company has elected not to recognize right-of-use assets and lease obligations

for short-term leases that have a lease term of 12 months or less and for leases of low value assets. The lease payments associated with

those leases are recognized as an expense on a straight-line basis over the lease term.

Research and development costs

Research costs including clinical trial costs are expensed as incurred, net

of recoveries until a drug product receives regulatory approval. Development costs that meet specific criteria related to technical, market

and financial feasibility will be capitalized. To date, all research and development costs have been expensed.

Intangible assets

Intangible assets are measured at cost less accumulated amortization and accumulated

impairment losses. Costs incurred for patents, patents pending and licenses are capitalized and amortized from the date of capitalization

on a straight-line basis over the shorter of their respective remaining estimated lives or 20 years.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies (continued) |

Government assistance

Amounts received or receivable resulting from government assistance programs,

including grants and investment tax credits for research and development, are recognized where there is reasonable assurance that the

amount of government assistance will be received and all attached conditions will be complied with. Investment tax credits and grants

relating to qualifying scientific research and experimental development expenditures that are recoverable are recognized as a reduction

of expenses.

Impairment of long-lived assets

Intangible assets and equipment are tested for impairment when events or changes

in circumstances indicate that the carrying amount may not be recoverable. For the purpose of measuring recoverable amounts, assets are

grouped at the lowest levels for which there are separately identifiable cash flows (cash-generating units or CGUs). The recoverable amount

is the higher of an asset’s fair value less costs to sell, and its value in use (being the present value of the expected future

cash flows of the relevant asset or CGU). An impairment loss is recognized for the amount by which the asset’s carrying amount exceeds

its recoverable amount. The Company evaluates impairment losses for potential reversals when events or circumstances warrant such consideration.

Derivative warrant liabilities

Derivative warrant liabilities issued in relation to equity offerings that

fail to meet the definition of equity are classified as derivative liabilities and measured at fair value with changes in fair value recognized

in profit or loss at each period end. In instances where units consisting of a common share and a warrant classified as a derivative liability

are issued, the Company recognizes the unit as a compound financial instrument. In accordance with IAS 32 Financial Instruments: Presentation,

when a compound instrument has been determined to contain a financial liability and an equity component, the fair value of the instrument

is bifurcated by first determining the fair value of the liability, and then allocating any residual value to the equity instrument.

The derivative warrants will ultimately be converted into the Company’s

equity (common shares) when the warrants are exercised or will be extinguished on the expiry of the outstanding warrants and will not

result in the inflow of any cash to the Company. Immediately prior to exercise, the warrants are remeasured at their intrinsic value (the

intrinsic value being the share price at the date the warrant is exercised less the exercise price of the warrant), and this value is

transferred to Share Capital on exercise. Any remaining fair value is recorded through profit or loss as part of the change in estimated

fair value of the derivative warrant liabilities.

The Company uses the Black-Scholes option pricing model to estimate fair value

at each period end date. The key assumptions used in the model are described in Note 12(h).

Share-based payments

The Company has a stock option plan that is described in Note 12 and grants

share options to acquire common shares of the Company to directors, officers, employees and consultants. Share-based payments to employees

are measured at the fair value of the instruments granted. Share-based payments to non-employees are measured at the fair value of the

goods or services received or the fair value of the equity instruments issued as calculated using the Black-Scholes option pricing model

if the fair value of the goods or services cannot be reliably measured. The offset to the recorded expense is to reserves.

Consideration received on the exercise of stock options is recorded as share

capital and the recorded amount in reserves is transferred to share capital.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies (continued) |

Share capital

Common shares are classified as equity.

Costs directly identifiable with share capital financing are charged against share capital. Share issuance costs incurred in advance of

share subscriptions are recorded as deferred assets. Share issuance costs related to uncompleted share subscriptions are charged to operations

in the period they are incurred.

The Company’s common shares, pre-funded warrants, warrants (other than

derivative warrants) and options are classified as equity instruments. Incremental costs directly related to the issue of new shares or

options are shown in equity as a deduction from the proceeds. For equity offerings of units consisting of a common share and warrant,

when both instruments are classified as equity, the Company allocates proceeds first to common shares based on the estimated fair value

of the common shares at the time the units are issued, with any excess value allocated to warrants.

From time to time in connection with private placements and other equity offerings,

the Company issues compensatory warrants (“Finders’ Warrants”) or warrant units (“Finders’ Warrant Units”)

to agents as commission for services. Awards of Finders’ Warrants and Finders’ Warrant Units are accounted for in accordance

with the fair value method of accounting and result in share issuance costs and a credit to reserves when Finders’ Warrants and

Finders’ Warrant Units are issued. The fair value of Finders’ Warrants is measured using the Black-Scholes option pricing

model and the fair value of the Finders’ Warrant Units is measured using the Geske compound option pricing model that requires the

use of certain assumptions regarding the risk-free market interest rate, expected volatility in the price of the underlying stock, and

expected life of the instruments.

Earnings (loss) per common share

Basic earnings (loss) per common share is computed by dividing the net income

(loss) available to common shareholders by the weighted average number of common shares outstanding during the period and the diluted

loss per share assumes that the outstanding vested stock options and share purchase warrants had been exercised at the beginning of the

year. Diluted earnings per share reflect the potential dilution that could share in the earnings of an entity. In the periods where a

net loss is incurred, potentially dilutive common shares (outstanding vested stock options and share purchase warrants) are excluded from

the loss per share calculation as the effect would be anti-dilutive and basic and diluted loss per common share are the same. In a profit

year, the weighted average number of common shares outstanding used for the calculation of diluted earnings per share assumes that the

proceeds to be received on the exercise of dilutive stock options and warrants are used to repurchase the common shares at the average

price per period.

Foreign currency translation

The presentation and functional currency of the Company and its subsidiary

is the U.S. dollar. Foreign currency transactions are translated into U.S. dollars using the exchange rates prevailing at the dates of

the transactions. Monetary assets and liabilities denominated in foreign currencies are translated at the rate of exchange in effect as

of the financial position date. Gains and losses are recognized in profit or loss on a current basis.

Income taxes

The Company uses the asset and liability method of accounting for income taxes.

Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between

the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities

are measured using substantively enacted tax rates expected to apply to taxable income in the years in which those temporary differences

are expected to be recovered or settled.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 3. | Material Accounting policies (continued) |

Deferred income tax assets also result from unused loss carry forwards, resource

related pools and other deductions. A deferred tax asset is recognized for unused tax losses, tax credits and deductible temporary differences

to the extent that it is probable that future taxable profits will be available against which they can be utilized. Deferred tax assets

are reviewed at each reporting date and are reduced to the extent that it is no longer probable that the related tax benefit will be realized.

New and recent accounting pronouncements

In October 2022, IASB issued amendments to IAS 1, Presentation of Financial

Statements. The amendments aim to clarify the criteria for classifying liabilities with covenants as current or non-current. Liabilities

are required to be classified as non-current if an entity has a substantive right to defer settlement for at least 12 months at the end

of the reporting period. The amendments were adopted by the Company as of January 1, 2024. These amendments to standards resulted in the

reclassification of the derivative warrant liability from non-current to current liability as described in Note 12(h).

In April 2024, IASB issued IFRS 18, Presentation and Disclosure in Financial

Statements to replace IAS 1, Presentation of Financial Statements. The aim of IFRS 18 is to set out requirements for presentation and

disclosure of financial statements to ensure the entity provides relevant and accurate information about its assets, liabilities, equity,

income and expenses. IFRS 18 is effective for the Company as of January 1, 2027. The Company is assessing the impact of this standard

on the consolidated financial statements.

| 4. | Critical accounting judgments and estimates |

The preparation of consolidated financial statements requires management to

make judgments and estimates that affect the amounts reported in the consolidated financial statements and notes. By their nature, these

judgments and estimates are subject to change and the effect on the consolidated financial statements of changes in such judgments and

estimates in future periods could be material. These judgments and estimates are based on historical experience, current and future economic

conditions, and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Actual

results could differ from these judgments and estimates.

Revisions to accounting estimates are recognized in the period in which the

estimate is revised and may affect both the period of revision and future periods. Information about critical accounting judgments in

applying accounting policies that have the most significant risk of causing material adjustment to the carrying amounts of assets and

liabilities recognized in the consolidated financial statements within the next financial year are discussed below:

Share-based payment transactions and warrant liabilities

The Company measures the cost of equity-settled transactions with employees

by reference to the fair value of the equity instruments at the date at which they are granted. Warrant liabilities are accounted for

as derivative liabilities as the proceeds from exercise are either not fixed, denominated in a currency other than the functional currency,

or can be settled on a net basis, and therefore do not meet the fixed for fixed criteria. Estimating fair value for share-based transactions

requires determining the most appropriate valuation model, which is dependent on the terms and conditions of the instrument. This estimate

also requires determining the most appropriate inputs to the valuation model including the expected life of the share option or warrant,

volatility and dividend yield and making assumptions about them.

Classification of contract payments

In concluding that contract payments are a non-current asset, management considered

when future regulatory and clinical trial programs are anticipated to be completed. Management assessed that the future regulatory and

clinical trial programs would not be completed within 12 months from period end and therefore classified contract payments as a non-current

asset.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 4. | Critical accounting judgments and estimates (continued) |

Impairment of intangible assets

Patents (obtained and pending) and licenses are reviewed for impairment at

each financial reporting date. If, in the judgment of management, future economic benefits will not flow to the Company, then the Company

will assess the recoverable value of the asset. If the carrying value is greater than the recoverable value, the asset will be impaired

to the recoverable value.

Determination of functional currency

In concluding that the U.S. dollar is the functional currency of the Company

and its subsidiary, management considered the currency that mainly influences the cost of providing goods and services in the primary

economic environment in which each entity operates and the currency in which funds from financing are generated, or if there has been

a change in events or conditions that determined the primary economic environment.

Treatment of research and development costs

Costs to develop products are capitalized to the extent that the criteria for

recognition as intangible assets in IAS 38 Intangible Assets are met. Those criteria require that the product is technically and economically

feasible, the Company has the intention and ability to use the asset, and how the asset will generate future benefits. Management assessed

the capitalization of development costs based on the attributes of the development project, perceived user needs, industry trends and

expected future economic conditions. Management considers these factors in aggregate and applies significant judgment to determine whether

the product is feasible. The Company has not capitalized any development costs as at December 31, 2024.

Leases

Value of right-of-use assets and lease obligations require judgement in determining

lease terms such as extension options, determining whether a lease contract contains an identified asset to which the Company has the

right to use substantially all of the economic benefits from the use of that asset and the incremental borrowing rate applied. The Company

estimates the incremental borrowing rate based on the lease term, collateral assumptions and the economic environment in which the lease

is denominated. Renewal options are only included if management is reasonably certain that the option will be renewed.

Classification of pre-funded warrants

Management applied judgment when determining the appropriate classification

of pre-funded warrants included in unit offerings. Management considered the characteristics of derivative instruments and concluded that

the pre-funded warrants should be classified as an equity instrument.

Current and deferred taxes

The measurement of income taxes payable and deferred income tax assets and

liabilities requires management to make judgments in the interpretation and application of the relevant tax laws. Such differences may

result in eventual tax payments differing from amounts accrued. Reported amounts for deferred tax assets and liabilities are based on

management’s expectation for the timing and amounts of future taxable income or loss, as well as future taxation rates. Changes

to these underlying estimates may result in changes to the carrying value, if any, of deferred income tax assets and liabilities.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

The Company’s cash consists of cash held and interest-bearing deposits

with the Company’s bank and brokerage accounts. The current annual interest rate earned on these deposits is 3.62% (2023 –

5.15%).

| | |

|

December 31,

2024 |

| |

|

December 31,

2023 |

|

| | |

| $ | | |

| $ | |

| | |

| | | |

| | |

| Cash | |

| 53,686 | | |

| 94,999 | |

| Interest-bearing deposits | |

| 2,419,963 | | |

| 3,352,666 | |

| | |

| 2,473,649 | | |

| 3,447,665 | |

The Company’s prepaid expenses relate to the following:

| | |

|

December 31,

2024 |

| |

|

December 31,

2023 |

|

| | |

| $ | | |

| $ | |

| | |

| | | |

| | |

| Research and development | |

| 1,167 | | |

| - | |

| Insurance | |

| 158,007 | | |

| 204,302 | |

| Investor relations conferences and services | |

| 19,490 | | |

| 25,309 | |

| Administrative services and other | |

| 6,748 | | |

| 7,355 | |

| | |

| 185,412 | | |

| 236,966 | |

During the year ended December 31, 2020, the Company entered into an agreement

with Prevail InfoWorks Inc. As part of the agreement, the Company paid $1,200,000 through the issuance of units in the private placement

that closed February 28, 2020, to be applied to future regulatory and clinical trial programs. The 108,590 units issued were measured

by reference to their fair value on the issuance date, which is equal to CAD $14.76 per unit.

| Cost | |

|

Total |

|

| | |

|

$ |

|

| Balance, December 31, 2022 | |

| 294,751 | |

| Additions | |

| 42,052 | |

| Balance, December 31, 2023 | |

| 336,803 | |

| Additions | |

| 38,924 | |

| Balance, December 31, 2024 | |

| 375,727 | |

| Accumulated amortization | |

|

Total |

|

| | |

| $ | |

| Balance, December 31, 2022 | |

| 94,917 | |

| Amortization | |

| 66,632 | |

| Balance, December 31, 2023 | |

| 161,549 | |

| Amortization | |

| 31,070 | |

| Balance, December 31, 2024 | |

| 192,619 | |

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 8. | Intangible assets (continued) |

| Carrying values | |

|

Total |

|

| | |

| $ | |

| At December 31, 2023 | |

| 175,254 | |

| At December 31, 2024 | |

| 183,108 | |

The Company has licensed intellectual property from various third parties.

The intangible assets relate solely to licensed intellectual property and there are no other classes of intangible assets. The intangible

assets are as described below:

| a) | The Company has licensed from a third party (the “Licensor”), under a patent rights purchase

agreement dated July 9, 2013 and amended April 15, 2014, certain patents relating to allopurinol for the treatment of hypertension. The

Company paid a total of $40,000 to the Licensor per the terms of the agreement. |

The Company will also pay the Licensor royalties on the cumulative

net revenues from the sale or sublicense of the product covered under the patent license until the later of (i) the expiration of the

last patent right covering the product; and (ii) the expiration of ten years from the date of the first commercial sales of a product.

As of December 31, 2024, no royalties have been accrued or paid.

| b) | In December 2012, the Company entered into an agreement to license certain intellectual property relating

to the use of all uric acid lowering agents to improve the treatment of metabolic syndrome. Under this patent rights purchase agreement,

between the Company and Dr. Richard Johnson and Dr. Takahiko Nakagawa (the “Vendors”), the Company will pay the Vendors a

royalty based on the cumulative net revenues from the sale or sublicense of the product covered under the licensed intellectual property

until the later of (i) the expiration of the last patent right covering the product; and (ii) the expiration of 10 years from the date

of the first commercial sales of a product. As of December 31, 2024, no royalties have been accrued or paid. |

| c) | Pursuant to a license agreement dated October 9, 2012 as amended on June 23, 2014, between the Company

and the University of Florida Research Foundation, Inc. (“UFRF”), the Company acquired the exclusive license to a patent that

claims the use of any uric acid lowering agent to treat insulin resistance. The Company has paid or is obligated to pay UFRF the following: |

| i) | An annual license fee of $1,000; |

| ii) | Reimburse UFRF for United States and/or foreign costs associated with the maintenance of the licensed

patents; |

| iii) | The issuance to UFRF of 180,397 shares of common stock of the Company. 160,783 have been issued to UFRF

as at December 31, 2024 and December 31, 2023. The remaining shares to be issued are included in obligation to issue shares ($24,746); |

| iv) | Milestone payments of $500,000 upon receipt of FDA approval to market licensed product in the United States

of America and $100,000 upon receipt of regulatory approval to market each licensed product in each of other agreed-upon jurisdictions; |

| v) | Royalty payments of up to 1.5% of net sales of products covered by the license until the later of (i)

the expiration of any patent claims; or (ii) 10 years from the date of the first commercial sale of any covered product in each country.

Following commencement of commercial sales, the Company will be subject to certain annual minimum royalty payments that will increase

annually to a maximum of $100,000 per year. As at December 31, 2024, no royalties have been accrued or paid; and |

| vi) | UFRF is entitled to receive a royalty of 5% of amounts received from any sub-licensee that are not based

directly on product sales, excluding payments received for research and development or purchases of the Company’s securities at

not less than fair market value. As at December 31, 2024, no royalties have been accrued or paid. |

UFRF may terminate the agreement if the Company fails to meet the above-specified

milestones.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| Cost | |

|

Right-of-use

asset |

| |

|

Equipment |

| |

|

Total |

|

| | |

| $ | | |

| $ | | |

| $ | |

| Balance, December 31, 2022 | |

| 114,588 | | |

| 19,033 | | |

| 133,621 | |

| Additions | |

| - | | |

| 4,311 | | |

| 4,311 | |

| Balance, December 31, 2023 | |

| 114,588 | | |

| 23,344 | | |

| 137,932 | |

| Additions | |

| 96,998 | | |

| - | | |

| 96,998 | |

| Balance, December 31, 2024 | |

| 211,586 | | |

| 23,344 | | |

| 234,930 | |

| Accumulated amortization | |

|

Right-of-use

asset |

| |

|

Equipment |

| |

|

Total |

|

| | |

| $ | | |

| $ | | |

| $ | |

| Balance, December 31, 2022 | |

| 38,195 | | |

| 2,748 | | |

| 40,943 | |

| Amortization | |

| 65,480 | | |

| 7,582 | | |

| 73,062 | |

| Balance, December 31, 2023 | |

| 103,675 | | |

| 10,330 | | |

| 114,005 | |

| Amortization | |

| 78,525 | | |

| 7,679 | | |

| 86,204 | |

| Balance, December 31, 2024 | |

| 182,200 | | |

| 18,009 | | |

| 200,209 | |

| Carrying values | |

|

Right-of-use

asset |

| |

|

Equipment |

| |

|

Total |

|

| | |

| $ | | |

| $ | | |

| $ | |

| At December 31, 2023 | |

| 10,913 | | |

| 13,014 | | |

| 23,927 | |

| At December 31, 2024 | |

| 29,386 | | |

| 5,335 | | |

| 34,721 | |

The Company entered into an office lease during the year ended December 31,

2022 for which a right-of-use asset was recognized (Note 11). During the year ended December 31, 2024, the Company extended its office

lease. A $96,998 right-of-use asset addition was recognized with a corresponding $96,998 increase to the lease liability.

| 10. | Accounts payable and accrued liabilities |

| | |

|

December

31,

2024 |

| |

|

December 31,

2023 |

|

| | |

| $ | | |

| $ | |

| Trade payables | |

| 84,020 | | |

| 195,814 | |

| Accrued liabilities | |

| 63,185 | | |

| 87,614 | |

| Total | |

| 147,205 | | |

| 283,428 | |

| | |

| | | |

| | |

The Company has entered into an office lease expiring in 2025, with an imputed

interest rate of 8% per annum. A reconciliation of the outstanding lease obligation as at December 31, 2024 is as follows:

| | |

|

$ |

|

| Balance, December 31, 2022 | |

| 77,599 | |

| Lease payments | |

| (66,089 | ) |

| Balance, December 31, 2023 | |

| 11,510 | |

| Additions | |

| 96,998 | |

| Lease payments | |

| (69,723 | ) |

| Balance, December 31, 2024 | |

| 38,785 | |

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 11. | Lease obligation (continued) |

The $96,998 lease obligation addition recognized in the year ended December

31, 2024 relates to an extension of the office lease to May 31, 2025.

The following is a schedule of the Company’s future minimum lease payments

related to the office lease obligation:

| | |

|

December 31, 2024 |

| |

|

December 31, 2023 |

|

| | |

|

$ |

| |

|

$ |

|

| 2024 | |

| - | | |

| 11,628 | |

| 2025 | |

| 39,535 | | |

| - | |

| Total minimum lease payments | |

| 39,535 | | |

| 11,628 | |

| Less: imputed interest | |

| (750 | ) | |

| (118 | ) |

| Total present value of minimum lease payments | |

| 38,785 | | |

| 11,510 | |

| Less: current portion | |

| (38,785 | ) | |

| (11,510 | ) |

| Non-current portion | |

| - | | |

| - | |

| 12. | Share capital and reserves |

Unlimited common shares –

3,481,375 issued at December 31, 2024 (2023 – 1,998,848, 2022 – 1,670,071).

On November 10, 2023, the shares

of the Company were consolidated on a 9:1 basis. Common shares, options, warrants and per share amounts have been adjusted for the 9:1

share consolidation unless otherwise noted.

Year ended December

31, 2024:

On February 15 and March 4, 2024, the Company closed two tranches

of a non-brokered offering of 899,717 common share units at a price of CAD $3.00 per common

share unit for aggregate gross proceeds of $2,000,549 (CAD $2,699,151). Each common share unit consists of one common share and one warrant

to purchase one common share at CAD $4.50 per common share for a period of two years, provided,

however that, if, the common shares on the TSXV trade at greater than CAD $6.00 for 10 or

more consecutive trading days, the warrants will be accelerated and the warrants will expire on the 30th business day following the

date of notice.

The proceeds were allocated $1,205,000

to the derivative warrant liability (Note 12(h)) and the residual $795,549 was allocated to common shares.

In connection with the offering, the Company

paid finder’s fees of $97,241, representing a 5% finder’s fee on certain subscriptions to qualified finders. The Company incurred

additional cash share issuance costs of $367,195 including $166,344 deferred at December 31, 2023. The costs were allocated between common

shares and derivative warrant liability in proportion to their initial carrying amounts with $185,405 recorded as a reduction of equity

and $279,031 recorded as transaction costs on derivative warrant liability.

On March 25, 2024, the Company issued 5,000

common shares for the exercise of warrants at CAD $4.50 per share in the amount of $16,570 (CAD $22,500). An amount of $5,244 was transferred

from derivative warrant liability to share capital as a result.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 12. | Share capital and reserves (continued) |

On October 18, 2024, the Company closed

its registered direct offering and concurrent private placement for the purchase and sale of: (i) 320,000 common share units at a price

of $1.85 per unit, with each unit consisting of one common share and one warrant to purchase one common share; and (ii) 490,810 pre-funded

warrant units at a price of $1.84999 per pre-funded unit, with each pre-funded unit consisting of one pre-funded warrant to purchase one

common share and one warrant to purchase one common share. Aggregate gross proceeds amounted to $1,499,993. The pre-funded warrants have

an exercise price of $0.00001 per share and will terminate once exercised in full. The unit warrants are exercisable at an exercise price

of $2.18 are immediately exercisable and expire five years from issuance.

In connection with the private placement,

the Company incurred issuance costs of $370,276. The costs were recorded as a reduction of equity.

On November 21, 2024, the Company issued

257,810 common shares for the exercise of pre-funded warrants at US$0.00001 per share in the amount of $3. An amount of $359,211 was transferred

from reserves to share capital as a result.

Year ended December 31,

2023:

On January 19, 2023, the Company issued

328,777 common shares for the exercise of pre-funded warrants at $0.0009 per share in the amount of $296. An amount of $531,885 was transferred

from reserves to share capital as a result.

Year ended December 31,

2022:

On October 7, 2022, the Company

closed a public offering of: (i) 155,555 common share units ("Common Share Units") at a price of $9.00 per Common Share Unit,

with each Common Share Unit consisting of one common share and one warrant ("Warrant") to purchase one common share; and (ii)

400,000 pre-funded warrant units (“Pre-Funded Units”) at a price of $8.9991 per Pre-Funded Unit, with each Pre-Funded Unit

consisting of one pre-funded warrant (“Pre-Funded Warrant”) to purchase one common share and one Warrant to purchase one common

share. Aggregate gross proceeds amounted to $4,999,640. The Pre-Funded Warrants have an exercise price of $0.0009 per share, and will

terminate once exercised in full. The Warrants are exercisable at an exercise price of $10.98 per share expiring five years from the date

of issuance.

The proceeds were allocated $3,714,757

to the derivative warrant liability (Note 12(h)) and the residual amounts of $359,868 and $925,015 were allocated to common shares and

pre-funded warrants respectively.

In connection with the public offering,

the Company incurred issuance costs of $1,067,153 and issued 27,777 underwriters warrants with a fair value of $185,738. The costs were

allocated between common shares and derivative warrant liability in proportion to their initial carrying amounts with $317,301 recorded

as a reduction of equity and $926,456 recorded as transaction costs on derivative warrant liability and pre-funded warrants.

On December 29, 2022, the Company issued

71,223 common shares for the exercise of Pre-Funded Warrants at $0.0009 per share in the amount of $64. An amount of $164,704 was transferred

from reserves to share capital as a result.

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 12. | Share capital and reserves (continued) |

| c) | Diluted Weighted Average Number of Shares

Outstanding |

| | |

Year ended |

| | |

December 31,

2024 | |

December 31,

2023 | |

December 31,

2022 |

| Basic weighted average shares outstanding | |

| 2,878,514 | | |

| 1,981,734 | | |

| 1,479,914 | |

| Effect of outstanding securities | |

| - | | |

| - | | |

| - | |

| Diluted weighted average shares outstanding | |

| 2,878,514 | | |

| 1,981,734 | | |

| 1,479,914 | |

During the years ended December 31, 2024, 2023 and 2022, the Company

had a net loss, as such, the diluted loss per share calculation excludes any potential conversion of options and warrants that would decrease

loss per share.

| d) | Common Share Purchase Warrants |

A summary of the changes in warrants for the years ended December

31, 2024, 2023 and 2022 is presented below:

| | |

Number of

Warrants | |

Weighted

Average

Exercise price |

| | |

| |

|

| Balance, December 31, 2021 | |

| 569,655 | | |

$ | 33.10 | |

| Granted – October 7,2022 | |

| 555,555 | | |

| 10.98 | |

| Balance, December 31, 2023 and 2022 | |

| 1,125,210 | | |

$ | 22.31 | |

| Granted – February 9, 2024 | |

| 824,767 | | |

| 3.13 | (1) |

| Granted – February 23, 2024 | |

| 74,950 | | |

| 3.13 | (1) |

| Granted – October 18, 2024 | |

| 810,810 | | |

| 2.18 | |

| Exercised | |

| (5,000 | ) | |

| 3.13 | (1) |

| Balance, December 31, 2024 | |

| 2,830,737 | | |

$ | 3.60 | |

(1) Exercise price of CAD $4.50.

During the year ended December 31, 2024, the Company amended the

exercise price of 1,125,210 common share purchase warrants that were issued pursuant to private placements that closed in February 2021,

October 2021 and October 2022. Pursuant to the polices of the TSXV the terms of the warrants, as amended, will be subject to an acceleration

expiry provision such that if for any 10 consecutive trading dates during the unexpired term of the warrants, the closing price of the

Company's shares on the exchange exceeds $6.50, the exercise period of the warrants will be reduced to 30 days, starting seven days after

the last premium trading day. All other terms of the warrants remain unchanged.

At December 31, 2024, the weighted average contractual remaining

life of the unexercised warrants was 2.58 years (2023 – 3.15 years).

XORTX THERAPEUTICS INC.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2024, 2023 and 2022

(Expressed in U.S. Dollars)

| 12. | Share capital and reserves (continued) |

| d) | Common Share Purchase Warrants (continued) |

The following table summarizes information on warrants

outstanding at December 31, 2024:

| |

Exercise Price | |

Number

Outstanding | |

Expiry date | |

Remaining

Contractual Life |

| $ | 5.00 | | |

| 198,333 | | |

February 9, 2026 | |

1.11 years |

| $ | 5.00 | | |

| 270,211 | | |

October 15, 2026 | |

1.79 years |

| $ | 5.00 | | |

| 101,111 | | |

October 15, 2026 | |

1.79 years |

| $ | 5.00 | | |

| 555,555 | | |

October 7, 2027 | |

2.77 years |

| CAD $ | 4.50 | | |

| 819,767 | | |

February 9, 2026 | |

1.11 years |

| CAD $ | 4.50 | | |

| 74,950 | | |

February 23, 2026 | |

1.15 years |

| $ | 2.18 | | |

| 810,810 | | |

October 18, 2029 | |

4.80 years |

| | Total | | |

| 2,830,737 | | |

| |

2.58 years |

A summary of the changes in pre-funded warrants for the years ended

December 31, 2024, 2023 and 2022 is presented below:

| | |

Number of

Warrants | |

Weighted

Average

Exercise price |

| | |

| |

|