- Simplified Access Made Possible by GeoWealth and iCapital’s

Technology

- Models provide customizable access to private markets alongside

public markets in a single account

BlackRock (NYSE: BLK) today has gone live with a

first-of-its-kind customizable public-private model portfolio

within a Unified Managed Account (UMA). The models are powered by

GeoWealth’s UMA technology and supported by iCapital’s underlying

technology capabilities.

The launch marks the first time a customizable model portfolio

that includes access to both private and public market assets is

available through a UMA, featuring streamlined administration and

custodial integration.

Advisors are increasingly turning to models-based solutions to

meet demands for more tailored products and access to diversified

exposures. This collaboration is designed to simplify and enhance

advisors’ ability to allocate across public and private

markets.

“This launch represents a significant step forward, helping

advisors allocate across both public and private markets all in one

unified, professionally managed portfolio,” said Jaime Magyera,

Co-Head of BlackRock’s U.S. Wealth Advisory Business. “BlackRock’s

mission is to make investing easier and help more people access the

full power of capital markets. Through our partnership with

GeoWealth and iCapital, we are doing just that, helping advisors

deliver differentiated service and outcomes for their clients

across their whole portfolio.”

BlackRock is a leading provider of models, with approximately

$300 billion in assets in such models, globally. As more RIAs adopt

model portfolios into their practices, managed models present a

significant growth opportunity, driven by the customization,

efficiency and scalability of these solutions. BlackRock expects

managed model portfolios to roughly double in assets over the next

four years, growing from $5 trillion today into a $10 trillion

business. BlackRock’s custom models business is its fastest growing

models segment, accounting for $50 billion in new assets over the

past 5 years.

"We are proud to support the launch of the first customizable

public-private model portfolio within a Unified Managed Account

(UMA). This innovative solution enables advisors to easily

incorporate alternative investments into their investment

strategies for their clients in a simplified way, within a single

account," said Lawrence Calcano, Chairman and CEO of iCapital. "We

believe models will be an important way for advisors to allocate to

private markets, and iCapital’s underlying technology allows our

clients to customize what they want to buy or deliver into the

market.”

Tech enhancements to better enable portfolio management and data

analytics are also driving the growing adoption of model portfolios

among RIAs. This growing theme underscores the broader benefits of

the collaboration with iCapital, a global fintech platform helping

drive the world’s alternative investment marketplace, and

GeoWealth, a proprietary technology and turnkey asset management

platform (TAMP) serving RIAs.

“Advisors and asset managers have long understood the role of

private markets investments, the challenge has been the inability

to systematically integrate and implement at scale in a wealth

management practice,” said Colin Falls, CEO of GeoWealth.

“GeoWealth’s UMA technology and workflow solutions, in partnership

with BlackRock and iCapital, creates an entirely new paradigm for

advisors considering a public-private portfolio.”

These models will provide advisors with intuitive workflows,

efficient reporting tools, and comprehensive investment management

capabilities throughout the investment’s lifecycle. iCapital’s

Multi-Investment Workflow Tool streamlines the entire alternative

assets investing experience.

BlackRock sees significant growth opportunity in the U.S. wealth

market and is actively positioning the firm to become an integral,

whole portfolio partner to advisors in an increasingly complex

environment. Overall, BlackRock’s U.S. Wealth Advisory business is

a key growth-driver for the firm, generating a quarter of

BlackRock’s revenues in 2024.

BlackRock, GeoWealth and iCapital are separate and

non-affiliated companies. GeoWealth provides rebalancing

capabilities for portfolios containing private market vehicles.

iCapital offers streamlined subscription document processing to

invest in the private market vehicles. BlackRock is a strategic

investor in GeoWealth and iCapital.

Incorporating products providing private market exposure into a

portfolio presents the opportunity for significant losses,

including in some cases losses which exceed the principal amount

invested. Funds that seek to provide exposure to private assets

(“private investment funds”) may have experienced periods of high

volatility and in general, are not suitable for all investors.

Asset allocation and diversification strategies do not ensure

profit or protect against loss in declining markets. An investment

in shares of the private investment funds should be considered

illiquid. In addition, the securities in which the private

investment funds invest may be valued at prices that the funds are

unable to obtain upon sale due to factors such as incomplete data

or market instability. Such private investment funds may not be

able to realize the investment at the latest fair value price. End

client account performance may differ due to the illiquidity of the

private investment funds.

Forward-Looking Statements This press release, and other

statements that BlackRock may make, may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act, with respect to BlackRock’s future financial or

business performance, strategies or expectations. Forward-looking

statements are typically identified by words or phrases such as

“trend,” “potential,” “opportunity,” “pipeline,” “believe,”

“comfortable,” “expect,” “anticipate,” “current,” “intention,”

“estimate,” “position,” “assume,” “outlook,” “continue,” “remain,”

“maintain,” “sustain,” “seek,” “achieve,” and similar expressions,

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “may” and similar expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

About BlackRock BlackRock’s purpose is to help more and

more people experience financial well-being. As a fiduciary to

investors and a leading provider of financial technology, we help

millions of people build savings that serve them throughout their

lives by making investing easier and more affordable. For

additional information on BlackRock, please visit

www.blackrock.com/corporate | Twitter: @blackrock | LinkedIn:

www.linkedin.com/company/blackrock

About GeoWealth GeoWealth is a turnkey asset management

platform (TAMP) and financial technology solution built

specifically for the needs of modern RIAs. GeoWealth’s

user-friendly, cost-efficient, integrated technology enables

advisors to access a diversified lineup of model portfolios and

fully offload mid-and back-office responsibilities, including

performance reporting, billing, portfolio accounting and more. Via

its customizable open-architecture platform, GeoWealth enables

advisors and firms to grow faster and serve clients more

efficiently. Founded in 2010, GeoWealth is headquartered in

Chicago, IL. Visit us at geowealth.com and follow us on

LinkedIn.

About iCapital iCapital powers the world’s alternative

investment marketplace, offering a complete suite of tools,

end-to-end enterprise solutions, data management and distribution

capabilities, and an innovative operating system. iCapital is the

trusted technology partner to financial advisors, wealth managers,

asset managers, as well as other participants in this ecosystem,

and offers unrivaled access, technology, and education to

incorporate alternative assets, structured investments (SI), and

annuities into the core portfolio strategies for their clients.

At the forefront of the digital transformation in alternative

investing, iCapital’s secure platform delivers a complete portfolio

of management capabilities for education, transactions, data flows,

analytics, and client support throughout the investment lifecycle.

With $880 billion of global volume activity on platform, inclusive

of $220 billion in global alternative assets, the iCapital

operating system automates and streamlines the complex process of

private market investing and seamlessly integrates with clients’

existing infrastructure platform and tools.

iCapital employs more than 1,750 people globally and has 16

offices worldwide, including New York, Greenwich, Zurich, Lisbon,

London, Hong Kong, Singapore, Tokyo, and Toronto. iCapital has

consistently been recognized for its outstanding innovation,

fintech industry leadership, and performance, including CNBC World

Top Fintech Companies for 2024, and Forbes Fintech 50 for seven

consecutive years since 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250326374537/en/

For media inquiries, please contact: BlackRock: Reem

Jazar, 646-357-6135, reem.jazar@blackrock.com iCapital:

919-602-2806, icapital@neibartgroup.com GeoWealth: Will Ruben, 847

208 8289, william@streetcredpr.com

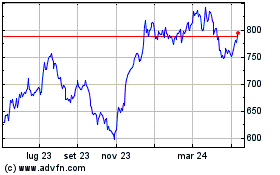

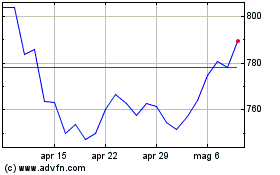

Grafico Azioni BlackRock (NYSE:BLK)

Storico

Da Mar 2025 a Mar 2025

Grafico Azioni BlackRock (NYSE:BLK)

Storico

Da Mar 2024 a Mar 2025