Ty Pennington from Extreme Makeover: Home Edition Sees the Potential Here

16 Giugno 2014 - 1:30PM

InvestorsHub NewsWire

Companies in the

public domain such as Home Depot (HD), Lowe's (LOW) and Mohawk

(MHK) currently are on the rise and moving quickly but there is a

new company looking to raise the bar...

An Immediate Bounce Alert is Being Issued on…

Lapolla Industries, Inc.

(LPAD)

www.Lapolla.com

Lapolla Industries (LPAD) has a lot going on as

you will soon find. The company is a global supplier, and

manufacturer of spray polyurethane foam insulation, reflective roof

coatings, and equipment, designed to reduce energy consumption in

the residential, industrial and commercial markets, for both new

construction and retrofit applications. Over the past 6

months, LPAD has been growing by leaps and bounds with many of its

more recent developments sparking positive investor sentiment in

the market. LPAD could be in for a breakout year so we strongly

recommend beginning your research now.

We’ve been having a lot of success

with bounce plays and undervalued companies this year and right now

LPAD has piqued my full interest. It was only 3 months ago

when this stock was trading $0.72 and with a current PPS around

$0.44, a move back to those March highs would be a solid 64%

gain. The most recent activity in the market has shown

that LPAD may be forming a new bottom support level in the low to

mid $0.40’s, which could position this for a rebound.

Mind-blowing

Financials

With LPAD, the main goal is

efficiency and effectiveness when it comes to energy savings and

the recent addition of two experienced industry leaders bodes well

for a growth driven company. In fact, LPAD is coming off of a

banner year and as noted in its April release, the company has not

only increased its EBITDA 349% to $2.1 million,

but the company also realized a 15.8% increase in Gross profit from

a combination of both its business segments: foams and

coatings…we’re not talking small numbers either; LPAD’s

gross profit was $15million!

Ground-breaking

News

And if that’s not enough, Lapolla has

gone one step further in naming a new spokesperson who has quickly

become a household name in industry. Ty Pennington is the

host of Extreme Makeover: Home Edition and is now the main

spokesman for Lapolla’s leading spray foam insulation brand!

Mr. Pennington is best known for hosting and leading the design

team on “Extreme Makeover: Home Edition.” Prior to that role, he

was the lead carpenter on TLC’s “Trading Spaces.” He is also the

author of two books on home improvement. Ty Pennington, will

act as the Company’s official spokesperson. Ty will promote

Lapolla’s products in upcoming national and local campaigns, as

well as make appearances at international trade shows and

participate in consumer events, media relations and social media

activities.

“For years, I’ve been bringing

attention to the importance of purposeful and creative home

renovation. By teaming up with Lapolla, we have an opportunity to

build awareness about the importance of proper insulation to create

significant energy savings to the entire residential market. The

best home construction in the world needs the best, most efficient

insulation to be truly effective for home

owners.”

- Ty

Pennington-

But it doesn’t stop there…LPAD

also recently announced that its AirTight® Division is

implementing a Multi-Family Energy Savings Program agreement with

the multi-bil dollar REIT, Home Properties, Inc. (NYSE:HME), to

implement its proprietary energy savings program at the Jacob Ford

Village Apartments located in Morristown, New Jersey. The company’s

four-component program is a turn-key service that provides energy

assessments and analysis with the assistance of independent

consultants, project design, and regulatory due diligence to secure

rebates from state and utility authorities.

Home Properties is a multi-bil dollar

Real Estate Investment Trust based in Rochester, New York that owns

and manages more than 41,000 residential apartment

units, primarily in the Mid-Atlantic and North

Eastern United States! The potential for LPAD to quickly

capitalize on the agreement could be monumental and may be the

first of many. AirTight also has a rebate/incentive plan in

place to enhance an already solid return on investment for capital

improvement in both the commercial and residential

markets.

As far as the industry potential

goes, LPAD may quickly become a leader in an industry positioned

for strong growth. ReportLinker states that the growing

demand from the construction industry coupled with supporting

government regulations is expected to drive the global market for

spray polyurethane foam from 2013 to 2019. Moreover,

ResearchandMarkets reports that Lapolla, among others, is a quickly

dominating company within the space and stands tall against the

likes of BASF Chemical Company, Bayer Material Science, and even

Dow Chemical.

If there was one company to look at

right now, LPAD is it. Not only does the chart show signs for

a bounce but Lapolla has absolutely begun to take a major foothold

within the industry, gaining notoriety from analysts already

comparing it to much larger companies. On top of that, LPAD has

aligned itself with a market giant through the agreement with Home

Properties and kicked its marketing into high gear after bringing

on Celebrity Spokesman, Ty Pennington. I think this has all

the makings for a great growth story and now I feel is a time to

take an even closer look at this small cap company.

Begin researching LPAD today

because with such exciting news and mind-blowing financial growth

figures, this company could take off in no time and experience a

true breakout year.

DISCLAIMER:

Pursuant to an agreement between us and Lapolla Industries, we were

hired for a 1 month period beginning on 6/15/14 and ending on

7/15/14 to publicly disseminate information about Lapolla

Industries, including on the Website and other media including

Facebook and Twitter. We are being paid $12,000 (CASH) for or were

paid "ZERO" shares of unrestricted or restricted common shares. We

own zero shares of Lapolla Industries, which we purchased in the

open market. We plan to sell the "ZERO" shares of Lapolla

Industries that we hold during the time the Website and/or Facebook

and Twitter Information recommends that investors or visitors to

the website purchase without further notice to you. We may buy or

sell additional shares of Lapolla Industries, in the open market at

any time, including before, during or after the Website and

Information, provide public dissemination of favorable Information

about Lapolla Industries Please Read Our Full Disclaimer Here:

http://searchingwallstreet.com/disclaimer/

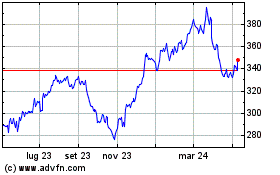

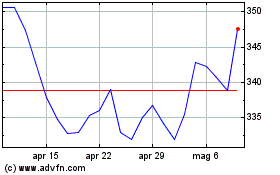

Grafico Azioni Home Depot (NYSE:HD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Home Depot (NYSE:HD)

Storico

Da Mar 2024 a Mar 2025