0000078003DEF 14AFALSEiso4217:USD00000780032024-01-012024-12-3100000780032023-01-012023-12-3100000780032022-01-012022-12-3100000780032021-01-012021-12-3100000780032020-01-012020-12-31000007800312024-01-012024-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000078003ecd:PeoMember2024-01-012024-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000078003ecd:PeoMember2023-01-012023-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000078003ecd:PeoMember2022-01-012022-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000078003ecd:PeoMember2021-01-012021-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000078003ecd:PeoMember2020-01-012020-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000078003ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000078003ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000078003ecd:NonPeoNeoMember2020-01-012020-12-310000078003ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000078003ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000078003ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000007800322024-01-012024-12-31000007800332024-01-012024-12-31000007800342024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party Other Than the Registrant ¨

Check the Appropriate Box:

| | | | | | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

|

| Pfizer Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of filing fee (Check all boxes that apply): |

| |

| x | No fee required |

| |

| ¨ | Fee paid previously with preliminary materials |

| |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | | | | | | | |

| | |

| | |

A Letter from Pfizer’s Chairman & Chief Executive Officer | |

| | |

| | |

| | | | | | | | |

| | |

| Dear Shareholders, 2024 was a strong year of performance and positive impact for Pfizer. Our more than 80,000 global colleagues showed tremendous dedication as they worked to improve lives around the world, advance new breakthroughs and move our company forward. Through our disciplined execution, we achieved or exceeded our goals for each of our five strategic priorities for 2024: |

|

|

•Achieve world-class Oncology leadership

•Deliver the next wave of pipeline innovation

•Maximize performance of our new products

•Expand margins by realigning our cost base

•Allocate capital to enhance shareholder value.

Delivering for patients and executing on our priorities is how we continue to earn and maintain trust as we advance our purpose. This included expanding global access to medicines and vaccines with our robust and diverse commercial portfolio. We also achieved a series of notable regulatory approvals and pipeline advancements.

PATIENT IMPACT

In 2024, our medicines and vaccines reached more than 414 million patients around the world(¹).

We will continue working to discover, develop and bring forward innovative medicines and vaccines to help address some of the most significant global health challenges.

PERFORMANCE

For full-year 2024, we reported total revenues of $63.6 billion, reflecting 7% year-over-year operational growth. Our operational revenue growth when excluding contributions from our COVID-19 products was 12%(²). With strong contributions across our product portfolio, our performance reinforced the effectiveness of our commercial approach that we refined at the start of 2024 to focus on key products and geographies with optimized resources.

Additionally, cost reduction programs helped us advance work to expand our operating margin and improve operational efficiency. Our cost realignment program is expected to deliver total net cost savings of approximately $4.5 billion by the end of 2025, most of which was achieved by year-end 2024. Our capital allocation strategy is designed to enhance long-term shareholder value with priorities that include: maintaining and growing our dividend over time, reinvesting in our business at an appropriate level of financial return and making share repurchases after de-levering our balance sheet. In 2024, we returned $9.5 billion to shareholders via our quarterly dividend, invested $10.8 billion in internal R&D and paid down approximately $7.8 billion in debt.

HELPING PATIENTS

With 14 approvals received in 2024 from the U.S. Food and Drug Administration or the European Medicines Agency, we advanced new treatment and vaccine options addressing significant areas of patient need.

Highlights included medicines offering renewed hope for patients with metastatic colorectal cancer, advanced urothelial cancer, cervical cancer and several types of prostate cancer, as well as vaccines protecting against respiratory syncytial virus (RSV) and pneumococcal disease.

| | | | | | | | |

2025 Proxy Statement Pfizer | | i |

| | |

| A Letter from Pfizer’s Chairman & Chief Executive Officer |

EXPANDING ACCESS

We’re proud of our strong and innovative partnerships with governments, non-profit organizations and the private sector to help expand access to medicines and vaccines for people in the United States and around the world who face challenges in obtaining treatments they need.

Last year we achieved the milestone delivery of the one billionth dose of our pneumococcal conjugate vaccine for children in lower-income countries through Gavi, the Vaccine Alliance. This was the result of 15 years of partnership contributing to protecting millions of children. We also continue to make meaningful progress with Accord for a Healthier World, our first-of-its-kind initiative working to enable access to our full portfolio of patented and off-patent medicines and vaccines for which Pfizer holds global rights on a not-for-profit basis to 1.2 billion people living in 45 lower-income countries.

FUTURE BREAKTHROUGHS

We had a strong year of R&D pipeline performance in 2024. In addition to more than a dozen major market approvals, we had 7 pivotal study starts and 8 key Phase 3 readouts.

In 2024, we made significant strides toward realizing our vision for accelerating breakthroughs that help people with cancer live better and longer lives. We drove a very successful integration with Seagen, a transformational deal and our largest acquisition in many years. Pfizer is the third largest biopharmaceutical company in oncology in the U.S. by revenue as of December 31, 2024, and we believe we now have one of the most experienced and capable oncology teams in the industry.

Looking forward, we intend to continue advancing our oncology strategy aiming to deliver best-in-class or first-in-class small molecules, antibody drug conjugates (ADCs), and non-ADC biologics, including bispecific and other next-generation antibodies. We are prioritizing the cancer types where we have specific capabilities and deep expertise across research and development, medical and commercial, including breast cancer, genitourinary cancer, hematology and thoracic cancer.

Our R&D teams are also pursuing breakthroughs in other important areas, such as advancing our leadership in protecting against pneumococcal disease and developing a potential therapy for patients with cancer cachexia who lack treatment options for this life-threatening wasting condition.

We are working to further increase the value of our pipeline. Chris Boshoff, MD, Ph.D., has been appointed as our new Chief Scientific Officer. While serving as our Chief Oncology Officer, Dr. Boshoff guided our team in delivering a series of important new therapies. With his leadership, along with the addition last year of Andrew Baum, MA, BM ChB, as our new Chief Strategy and Innovation Officer, we are bringing a sharpened focus to directing our R&D investments toward the most impactful opportunities.

HARNESSING THE POWER OF AI

Artificial Intelligence (AI) and emerging technologies are revolutionizing the discovery, development and delivery of impactful new medicines and vaccines, and we believe Pfizer is well positioned as a leader within the biopharma industry. We continue to advance our strategic roadmap for incorporating AI across every aspect of our business, helping us move with greater speed, effectiveness and precision.

CREATING LONG-TERM VALUE

We reinforced our commitment to strong governance in 2024 by refreshing our Board of Directors with the addition of Mortimer (Tim) J. Buckley and Cyrus Taraporevala, two new members who bring extensive expertise in financial markets and shareholder value creation. After many years of dedicated service, Dr. Helen Hobbs will retire from the Board and will not stand for re-election in 2025. We extend our gratitude to Dr. Hobbs for her service, scientific expertise, valuable industry insights and unwavering commitment to Pfizer and our shareholders.

We believe we have a clear strategy, scientific leadership and strong capabilities that position us to create sustained, long-term value for shareholders and positive impact for the patients and others we’re privileged to serve.

| | | | | | | | |

ii | | Pfizer 2025 Proxy Statement |

| | |

A Letter from Pfizer’s Chairman & Chief Executive Officer |

WELL POSITIONED FOR THE YEARS TO COME

Since 1849, when Charles Pfizer and Charles Erhart founded Pfizer in Brooklyn, New York, we’ve demonstrated a relentless commitment to innovation, taking on some of the world’s greatest health challenges and improving hundreds of millions of lives. It’s this proud history of caring that drives our colleagues to continue innovating for our future.

We’re proud to be recognized for our progress, including being listed for three consecutive years among the top 10 companies on Fortune World’s Most Admired Companies All-Stars. We ranked No. 4 in the 2024 Access to Medicine Index for our efforts to expand access to our products in low- and middle-income countries.

I want to thank my colleagues for their commitment and hard work throughout 2024. With their focus and execution, we delivered on our financial commitments, strengthened our company and, most importantly, made a difference for those who depend on our medicines and vaccines.

As we continue to focus on patients and advancing our purpose with integrity, I’m confident that we’re well positioned for 2025 — and in the years to come — to develop and deliver the breakthroughs of tomorrow that will build on what we’ve done today.

Thank you for your continued engagement and support of Pfizer and the important work we do every day.

| | | | | |

| Dr. Albert Bourla Chairman & Chief Executive Officer |

We encourage you to read our 2024 Annual Report on Form 10-K, which includes our audited consolidated financial statements as of and for the year ended December 31, 2024, and the sections captioned “Risk Factors” and “Forward-Looking Information and Factors that May Affect Future Results,” for a description of the substantial risks and uncertainties related to the forward-looking statements included herein.

(1) The Patients Reached metric is calculated from Pfizer and third-party datasets. Figures may be limited given the coverage provided by external sources (e.g., calendar duration, geographic and product coverage) and are subject to change. Numbers are estimates and, in some cases, use global volume, daily dosage and number of treatment days to facilitate calculations. Methodologies to calculate estimates may vary by product type given the nature of the product and available data. Patients taking multiple Pfizer products may be counted as multiple patients towards total. Numbers include estimated patient counts from our Accord for a Healthier World program. Numbers do not include comprehensive estimated patient counts from Ex-U.S. Patient Support Programs. Historical estimates may periodically be subject to revision due to restatements in the underlying data source.

(2) Operational revenue growth excludes the impact of foreign exchange. For additional information on the company’s operational revenue performance, see the “Our 2024 Performance – Total Revenues” and the “Analysis of the Consolidated Statements of Operations” sections in Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2024 Annual Report on Form 10-K.

| | | | | | | | |

2025 Proxy Statement Pfizer | | iii |

| | | | | | | | |

| | |

| | |

A Message from Pfizer’s Lead Independent Director | |

| | |

| | |

| | | | | |

| |

Dear Shareholders, On behalf of the Board of Directors, I extend my gratitude to our shareholders for their investment and confidence in Pfizer during this transformative and exciting period. Serving as Lead Independent Director involves both privilege and responsibility and I am proud to serve on Pfizer’s Board of Directors. The full Board and I are dedicated to fulfilling our oversight duties on behalf of our shareholders. |

|

|

OVERSIGHT OF PERFORMANCE

2024 was a year of significant achievements for Pfizer. The Board’s continued robust oversight contributed to this performance and the company’s work to strengthen its position for the future. The Board focuses on ensuring that management delivers on its responsibility to drive long-term shareholder value creation. In doing so the Board engaged regularly with management over the course of the year to review the company’s corporate strategy and objectives, risk factors and competitive landscape. Key milestones in 2024 that demonstrate Pfizer’s progress, commitment to enhancing shareholder value and strong governance include:

•Successful integration of Seagen to create a leading oncology platform

•Robust cost realignment program expected to deliver approximately $4.5 billion in net cost savings by the end of 2025, most of which was achieved by year-end 2024

•Return of $9.5 billion in capital to shareholders through dividends

•Addition of two new Board members

•Appointments of a new Chief Scientific Officer and President, Research & Development, and a new Chief Strategy and Innovation Officer.

BOARD REFRESHMENT

Pfizer has a world-class, highly engaged Board with Directors providing the relevant expertise, skills and experiences essential to overseeing the company’s business needs and overall strategy. In support of Pfizer’s science-led transformation, our Board includes members with deep knowledge in science and medicine, as well as those with significant experience in business leadership, finance, financial markets, public policy and technology.

We welcomed two distinguished leaders to our Board in 2024 following a thoughtful evaluation process to identify candidates who would complement the Board’s collective skills and bring a fresh business lens to discussions. Cyrus Taraporevala, former President and CEO of State Street Global Advisors, joined the Board in July, and Mortimer (Tim) Buckley, former Chairman and CEO of The Vanguard Group, Inc., joined the Board in October. Cyrus contributes to the Board’s extensive knowledge of global strategy, executive leadership in active and index investment management, and experience in driving organic and inorganic growth. At Vanguard, Tim led a global and growing organization, overseeing multiple business segments. He also previously served as both Chief Technology Officer and Chief Investment Officer at Vanguard.

On a related note, Helen Hobbs has decided to retire from the Board, effective in April 2025, and will not stand for re-election. We sincerely thank Helen for her contributions to the Board, and especially for her leadership as Chair of the Science and Technology Committee.

| | | | | | | | |

iv | | Pfizer 2025 Proxy Statement |

| | |

A Message from Pfizer’s Lead Independent Director |

SHAREHOLDER ENGAGEMENT

In closing, I would like to thank our shareholders for their ongoing support and the valuable feedback they provide throughout the year. I had the opportunity to meet directly with several investors over the last year, and hearing their perspectives and insights is helpful in informing our strategy, governance and oversight practices.

We value the partnership and engagement of our shareholders and encourage you to participate in the Annual Meeting by exercising your right to vote.

| | | | | |

| Mr. Shantanu Narayen Lead Independent Director |

| | | | | | | | |

2025 Proxy Statement Pfizer | | v |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | |

Notice of 2025 Annual Meeting and Proxy Statement | |

| | | | | | | |

| | | | | | | | |

| Voting Your Shares. For information regarding how to vote your shares by telephone, by internet, by mail or at the virtual Annual Meeting, see “Annual Meeting Information – Voting” later in this Proxy Statement. | |

| |

| |

|

Items of Business1.To elect 13 members of the Board of Directors, each until our next Annual Meeting and until his or her successor has been duly elected and qualified.

2.To ratify the selection of KPMG LLP as our independent registered public accounting firm for 2025.

3.To conduct an advisory vote to approve our executive compensation.

4.To consider two shareholder proposals, if properly presented at the Annual Meeting.

5.To transact any other business that properly comes before the Annual Meeting or any adjournment or postponement of the Meeting.

Materials To Review

This booklet contains our Notice of 2025 Annual Meeting and Proxy Statement. Our 2024 Annual Report on Form 10-K is included as Appendix A and is followed by certain Corporate and Shareholder Information. None of Appendix A or the Corporate and Shareholder Information on the back inside cover are a part of our proxy solicitation materials.

This Notice of 2025 Annual Meeting and Proxy Statement and a proxy card or voting instruction form are being mailed or made available to shareholders starting on or about March 13, 2025.

Margaret M. Madden

Senior Vice President and Corporate Secretary, Chief Governance Counsel

March 13, 2025

| | | | | |

| MEETING TIME AND DATE |

|

9:00 a.m., Eastern Daylight Time (EDT), on Thursday, April 24, 2025 |

|

| VIRTUAL MEETING ONLY |

| |

The 2025 Annual Meeting will be held in a virtual meeting format only. To access the virtual Annual Meeting, please visit https://meetnow.global/PFE2025. We designed the format of the virtual Annual Meeting to ensure that our shareholders who attend the virtual Annual Meeting will be afforded comparable rights and opportunities to participate as they would at an in-person meeting. |

|

| RECORD DATE |

|

| February 26, 2025 |

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on April 24, 2025. This Notice of 2025 Annual Meeting and Proxy Statement and the 2024 Annual Report on Form 10-K are available on our website at https://investors.pfizer.com/Investors/Financials/Annual-Reports/default.aspx. Except as stated otherwise, information on our website is not considered part of this Proxy Statement. |

| | | | | | | | |

vi | | Pfizer 2025 Proxy Statement |

| | | | | | | | |

| | |

| | |

Our Business and Strategy | |

| | |

| | |

Pfizer Inc. is a research-based, global biopharmaceutical company. We apply science and our global resources to bring therapies to people that extend and significantly improve their lives through the discovery, development, manufacture, marketing, sale and distribution of biopharmaceutical products worldwide. We work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. We collaborate with healthcare providers, governments and local communities to support and expand access to reliable, affordable healthcare around the world.

2024 Year in Review

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Regulatory Approvals(1) | | | Regulatory Submissions | | | Pivotal Study Starts | | | Patients Reached |

14 | | | 6 | | | 7 | | | >414M |

| | | | | | | | | patients reached globally with our medicines and vaccines in 2024(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Research & Development | | | Commercial Execution | | | Global Reach | | | Employees Globally |

115 | | | 3rd | | | ~200 | | | ~81,000 |

projects in our product pipeline as of February 4, 2025 | | | largest U.S. biopharmaceutical company in Oncology by revenue | | | countries and territories where we supply our products | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Revenues | | | Shareholder Returns | | | Net Cost Savings |

~$63.6B | | | $9.5B | | | $4.0B |

in 2024 | | | to shareholders through cash dividends in 2024 | | | delivered on our $4.0 billion net cost savings target from ongoing cost realignment program |

Unless indicated otherwise, the information contained in this summary is as of December 31, 2024.

(1)U.S. Food and Drug Administration/European Medicines Agency

(2)The Patients Reached metric is calculated from Pfizer and third-party datasets. Figures may be limited given the coverage provided by external sources (e.g., calendar duration, geographic and product coverage) and are subject to change. Numbers are estimates and in some cases use global volume, daily dosage and number of treatment days to facilitate calculations. Methodologies to calculate estimates may vary by product type given the nature of the product and available data. Patients taking multiple Pfizer products may be counted as multiple patients towards total. Numbers include estimated patient counts from our Accord for a Healthier World program. Numbers do not include comprehensive estimated patient counts from Ex-U.S. Patient Support Programs. Historical estimates may periodically be subject to revision due to restatements in the underlying data source.

| | | | | | | | |

2025 Proxy Statement Pfizer | | 1 |

| | |

| Our Business and Strategy |

Strategy and Performance Overview

In 2024, we detailed five strategic priorities to guide us during our year of execution. Below are highlights of certain of our achievements in 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | | | 2 | | | | 3 | | | | 4 | | | | 5 | |

| Achieving world-class Oncology leadership | | | | Delivering the next wave of pipeline innovation | | | | Maximizing performance of our new products | | | | Expanding margins by realigning our cost base | | | | Allocating capital to enhance shareholder value | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| •Expanded leadership in Oncology through successful integration of Seagen •Third largest biopharmaceutical company in Oncology in the U.S. by revenue as of December 31, 2024 | | | | •Strong year of pipeline performance with 14 regulatory approvals; 6 regulatory submissions; and 7 pivotal study starts | | | | •Optimized commercial leadership delivering strong performance across key products including the Vyndaqel family, Eliquis, Xtandi, and Nurtec ODT/Vydura | | | | •Delivered on our $4.0 billion net cost savings target from ongoing cost realignment program and increased overall savings target to ~$4.5 billion by end of 2025 •In the second quarter of 2024, launched multi-year, multi-phased program to reduce our costs of goods sold | | | | •Paid down ~$7.8 billion of debt •Invested $10.8 billion in internal Research & Development (R&D) •Returned capital directly to shareholders through $9.5 billion of cash dividends | |

| | | | | | | | | | | | | | | | | | |

2024 was a year of execution for Pfizer — one that we believe puts us in a strong position for the future. In pursuit of our purpose, we created innovative ways to reach millions of patients around the world, met or exceeded our strategic and financial commitments, executed against our five 2024 strategic priorities with focus and discipline, successfully completed the Seagen integration, and shared potentially encouraging scientific results.

We delivered strong financial performance in 2024, resulting from our focus on opportunities to make an impact for patients and position the company for long-term success. We built on our solid commercial position in important therapeutic areas, received a number of new product approvals, and demonstrated scientific leadership in advancing our pipeline to help address areas of unmet patient need, all while being disciplined in strengthening our financial foundation.

We acted on our bold vision of combining Seagen’s transformative antibody-drug conjugate (ADC) medicines with Pfizer’s expertise, innovation and scale, with the goal of helping people with cancer live better and longer lives — and capturing a differentiated opportunity designed to drive long-term sustainable growth for Pfizer. The integration of Seagen has been successful, creating one of the most experienced and capable oncology teams in the industry. Our focus on execution and the acceleration of several next generation potential breakthrough treatments in development strengthened Pfizer’s position as a leader in delivering transformative cancer medicines.

In addition, our commitment to being a force for good in the world continues, as we delivered the one billionth dose of pneumococcal conjugate vaccine through our partnership with Gavi, the Vaccine Alliance. Further, our Accord for a Healthier World program shows how we are expanding access to medicines and vaccines to help close the health equity gap for the most vulnerable.

Looking ahead, we believe Pfizer is in a strong position for 2025 and beyond. We are working to enhance shareholder value with our 2025 strategic priorities:

•Improve R&D productivity with sharpened focus

•Expand margins and maximize operational efficiency

•Achieve commercial excellence in our key categories

•Optimize capital allocation.

| | | | | | | | |

2 | | Pfizer 2025 Proxy Statement |

| | |

| Our Business and Strategy |

ADVANCING OUR R&D PIPELINE

As of February 4, 2025, we had the following number of projects in various stages of R&D:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Phase 1 | à | | | | Phase 2 | à | | | | Phase 3 | à | | | | Registration | à | | | | Total | | |

| 51 Experimental products tested for first time in human clinical trials | | | | 27 Trials focused on product’s effectiveness, ideal dosage and delivery method | | | | 32 Randomized trials to test results of earlier trials on larger populations to analyze risks and benefits | | | | 5 Applications filed with appropriate regulatory authorities when trial results warrant | | | | 115 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

By the end of 2024, Pfizer achieved an end-to-end success rate of 21 percent — from first in human (FIH) to approval at a new molecular entity (NME) level. We are sustaining higher success rates through focused efforts in therapeutic areas where we believe we are equipped to make the biggest impact on patients’ lives.

| | | | | | | | | | | | | | |

Clinical Trial Success Rates*

(NMEs only) | Phase 1

(3-year avg.) | Phase 2

(5-year avg.) | Phase 3/Registration

(5-year avg.) | End-to-End

Success Rate |

Pfizer(1) (through 2024) | 37 | % | 68 | % | 84 | % | 21 | % |

Industry(2) (through 2023) | 35 | % | 32 | % | 72 | % | 8 | % |

* The analysis includes only studies involving NMEs.

(1)Success rates for Phase 1 are based on a 3-year rolling average (2022-2024); rates for Phase 2 and Phase 3/Registration represent a 5-year rolling average (2020-2024).

(2)Success rates are based on a 5-year rolling average for Phase 2 and Phase 3 studies, and a 3-year rolling average for Phase 1 studies, with the cut-off for the analysis ending on fiscal year-end 2023, which is the most recent information available. The “industry” in this analysis was based on the Pharmaceutical Benchmarking Forum’s participant companies: AbbVie Inc.; Astellas Pharma, Inc; Bayer AG; Bristol-Myers Squibb Company; Eli Lilly and Company; Gilead Sciences, Inc.; Johnson & Johnson; Merck & Co., Inc.; Novartis AG; Pfizer; Roche Holding AG and Sanofi.

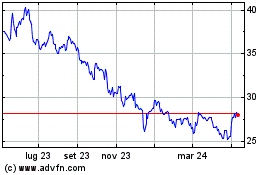

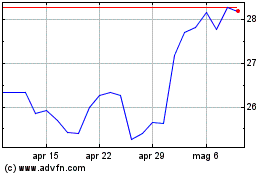

OUR DIVIDENDS AND TOTAL SHAREHOLDER RETURN (TSR)

Below is a summary of Pfizer’s dividends and TSR through 2024.

Additionally, in December 2024, the Board approved an increase in the quarterly cash dividend on the company’s common stock to $0.43 per share for the first-quarter 2025 dividend, marking the 345th consecutive dividend payment paid by Pfizer. This decision underscores the company’s continued commitment to returning capital to our shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Dividends | | Total Shareholder Return |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total Quarterly Dividends Paid | | Capital Returned to Shareholders (cash dividends) | | One-year TSR | | Three-year TSR | | Five-year TSR |

+2.4% | | $9.5B | | (5.3%) | | (48.5%) | | (11.4%) |

Increase from 2023 | | In 2024 | | Year-End 2024 | | Year-End 2024 | | Year-End 2024 |

| | | | | | | | |

| | | | | | | | |

2025 Proxy Statement Pfizer | | 3 |

| | |

| Our Business and Strategy |

THE BOARD’S OVERSIGHT OF STRATEGY

The Board and its Committees play a crucial role in overseeing our corporate strategy, including significant business and organizational initiatives, capital allocation priorities and potential value-enhancing business development opportunities (including acquisitions, licenses, collaborations and divestitures) intended to support our strategy. In addition, Board Committees oversee the aspects of our strategy associated with their respective areas of responsibility.

The Board engages in robust discussions regarding our corporate strategy at every meeting and, at least annually, receives a formal update on the company’s short- and long-term objectives, including the company’s operating plan, long-term corporate strategic plan and competitive landscape.

To effectively oversee our corporate strategy, the Board leverages the Directors’ deep and complementary expertise across key skills and experiences that are relevant to Pfizer’s strategy — including expertise in business, finance and operations, as well as industry-specific experience in science, medicine and healthcare. In early 2024, to help enhance Board oversight over the company’s strategic priorities, the Board determined that it would seek new Directors with significant experience in financial markets, investment management, and capital allocation to supplement existing expertise on the Board. Messrs. Taraporevala and Buckley were elected, in part, given their strong backgrounds in these respective areas.

During 2024, the Board’s oversight of Pfizer’s strategy included discussions regarding Pfizer’s:

•Balanced capital allocation strategy, which focused on maintaining Pfizer’s dividend while de-leveraging and strengthening the company’s balance sheet;

•Enterprise-wide cost realignment program designed to align the company’s cost base with our go-forward strategic priorities, as well as the Manufacturing Optimization Program designed to reduce the company’s cost of goods sold;

•R&D and pipeline progress, which focused on delivering the next wave of pipeline innovation;

•Management succession planning matters, including approving the elections of Dr. Andrew Baum as Chief Strategy and Innovation Officer, Executive Vice President, and Dr. Chris Boshoff as Chief Scientific Officer and President, Research & Development; and

•Integration of Seagen, as the company created one of the most experienced and capable oncology teams in the industry.

THE BOARD’S OVERSIGHT OF RESPONSIBLE BUSINESS PRACTICES

Pfizer’s commitment to responsible business practices is rooted in our purpose, as we strive to serve patients and communities with innovation and sustainable approaches to discovering, developing and bringing medicines and vaccines to market. This commitment is overseen by our Board, primarily through the Governance Committee, which is responsible for oversight of our responsible business strategy, reporting, policies and practices. The Committee receives regular updates from management on Pfizer’s progress. Pfizer's annual Impact Report includes further information on our approach to responsible business growth.

The Board Committees oversee specific elements of our responsible business practices associated with their respective areas of responsibility:

| | | | | | | | |

4 | | Pfizer 2025 Proxy Statement |

| | |

| Our Business and Strategy |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Board Oversight of Responsible Business Practices |

| | | | | | | | | | | | | | |

| Governance Committee | | | | Compensation Committee | | | | Audit Committee | | | | Regulatory and Compliance Committee | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| •Responsible business practices strategy, reporting, policies and practices •Human capital management, including succession planning, culture and talent management •Political and lobbying activities •Climate change program •Reputational risk factors •Board composition | | | | •Executive compensation program, and approval of compensation of our executive officers •Human capital management, which may include pay practices, recruiting, retention, career development and succession planning (in collaboration with the Governance Committee) | | | | •Enterprise Risk Management (ERM) program •Information security and technology risks •Company culture (compliance related concerns, workplace behavior, harassment and retaliation) | | | | •Compliance program •Ethics and integrity, including company culture •Product quality and safety •Quality and compliance governance framework and risk management •Healthcare-related regulatory and compliance risks in connection with the development, manufacturing, supply and marketing of products and risk mitigation efforts | |

| | | | | | | | | | | | | | |

OUR CULTURE

The Board also recognizes the critical importance and value of Pfizer’s employees and the need to build and sustain a culture where employees of all abilities and experiences contribute their unique viewpoints and perspectives to all aspects of the business. Management establishes and reinforces the company’s culture, which the Board and its Committees oversee. We continue to execute a merit-based talent approach, focusing on identifying candidates with the right qualifications and ensuring they are considered for the opportunities based on their skills, abilities, and performance. We aim to provide everyone with an opportunity to demonstrate their merit. Our leaders set the tone for the company, embracing accountability and transparency, while promoting a vibrant culture in which employees are free to speak up and are encouraged to share views and raise concerns without fear of retaliation.

| | | | | | | | |

2025 Proxy Statement Pfizer | | 5 |

| | | | | | | | |

| | |

| | |

Item 1 Election of Directors | |

| | |

| | |

Thirteen members of our Board are standing for re-election. In an uncontested Director election, the number of votes cast “for” a Director nominee must exceed the number of votes cast “against” that nominee. Our Corporate Governance Principles (Principles) contain detailed procedures to be followed in the event that one or more Directors do not receive a majority of the votes cast “for” his or her election at the Annual Meeting. Each nominee elected as a Director will continue in office until our next Annual Meeting and until his or her successor has been duly elected and qualified, or until a Director’s earlier death, resignation, removal or retirement. While we expect each nominee to be able to serve if elected, if any nominee is not able to serve, the persons appointed by the Board and named as proxies in the proxy materials or, if applicable, their substitutes (the Proxy Committee), may vote their proxies for substitute nominees, unless the Board chooses to reduce the number of Directors.

In April 2025, Dr. Hobbs will retire from the Board and her committee roles.

Criteria for Board Membership

GENERAL CRITERIA

•Proven integrity and independence, with a record of substantial achievement in an area of relevance to Pfizer

•Ability and sufficient time, energy and attention to make a meaningful contribution to the Board’s advising, counseling and oversight roles

•Prior or current leadership experience with major complex organizations, including within the scientific, government service, educational, finance, marketing, technology or not-for-profit sectors, with some members of the Board being widely recognized as leaders in the fields of medicine or biological sciences

•Commitment to enhancing Pfizer’s long-term growth

•Broad experience, diverse perspectives, and the ability to exercise sound judgment, and a judicious and critical temperament that will enable objective appraisal of management’s plans and programs

•Diversity with respect to background, professional experience and perspectives.

The Board and each Committee conduct annual evaluations to help ensure that each of its members individually, and the Board as a whole, continue to meet the criteria for Board membership. Based on these activities and their review of the current composition of the Board, in December 2024, the Governance Committee and the Board determined that the criteria for Board membership have been satisfied, and the Board nominated the existing Directors, other than Dr. Hobbs who is retiring effective as of the 2025 Annual Meeting, as the slate of Director nominees for election in April 2025.

Selection of Candidates

DIRECTOR SKILLS CONSIDERATIONS AND COMMITMENT TO A RANGE OF PERSPECTIVES

In recruiting and selecting Director candidates, the Governance Committee considers the size of the Board and those skills outlined in our skills matrix. This matrix guides the Committee in determining whether a particular Board member or candidate possesses one or more of the requisite skills, as well as whether those skills and/or other attributes qualify him or her for service on a particular committee. The Committee also considers a range of additional factors, including other positions the Director or candidate holds; other boards on which he or she serves; the results of the Board and Committee evaluations; each Director’s and candidate’s projected retirement date; each Director’s and candidate's demonstrated ability and sufficient time, energy and attention to make a meaningful contribution; each Director’s independence; each Director’s attendance (if applicable); and the company’s current and future business needs, particularly in light of the company’s evolving strategic priorities.

Pursuant to its charter, the Governance Committee of the Board is responsible for considering a broad pool of candidates to fill positions on the Board; however, the company does not have a formal policy on Board diversity. Pfizer’s Principles provide that Directors should be selected so that the Board maintains its optimal composition, reflecting different backgrounds, professional experiences and perspectives.

| | | | | | | | |

6 | | Pfizer 2025 Proxy Statement |

| | |

| Item 1 – Election of Directors |

PROCESS FOR SELECTING DIRECTOR NOMINEES

During 2024, the Governance Committee conducted a needs assessment, identified and reviewed Director candidates and followed the robust process below to review potential nominees:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | | | | 2 | | | | 3 | | | | 4 | |

| Needs

Assessment | | | | Candidate

Identification | | | | Screening | | | | Nomination

and Onboarding | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Define skills and criteria based on: •Gaps to fill due to Board turnover/succession planning •Current and future business needs •Results of Board evaluation •Management team priorities | | | | Identify candidates through: •Board member recommendations •Executive Leadership Team (ELT) recommendations •Search agencies and recruiters •Shareholders | | | | Review of qualifications: •Skills matrix •Integrity and independence requirements •Past experience and perspectives •Other positions the candidate holds or has held •A range of skills, experiences and perspectives Committee members and, as appropriate, other Board members and management interview qualified candidates. | | | | Select Director nominees best suited to serve the interests of the company and its shareholders. Following election, all new independent Directors undergo a comprehensive onboarding process, which includes: •Meetings with members of the ELT and other senior leaders; and •An in-depth review of a broad set of materials that provide information on the company and Board-related matters. | |

| | | | | | | | | | | | | | |

Resulting from this process and taking into account feedback received throughout the 2024 Board evaluation process: (i) in June 2024, the Committee recommended and the Board elected Mr. Cyrus Taraporevala as a Director and a member of the Audit and Compensation Committees; and (ii) in October 2024, the Committee recommended and the Board elected Mr. Mortimer J. Buckley as a Director and a member of the Audit and Governance Committees.

Director Independence

Our Board of Directors has adopted Director Qualification Standards (Standards) to evaluate and determine Director independence. Our Standards meet, and in some respects exceed, the independence requirements of the New York Stock Exchange (NYSE). To qualify as independent under our Standards, a non-employee Director must have no material relationship with Pfizer other than as a Director. The Standards include additional strict guidelines for Directors and their immediate families and can be found on our website at https://investors.pfizer.com/Investors/Corporate-Governance/The-Pfizer-Board-Policies/default.aspx.

Under our Standards, certain relationships and transactions are not considered to be material transactions that would impair a Director’s independence, including the following:

•the Director is an employee, or an immediate family member of the Director is an executive officer, of another company that does business with Pfizer, and our annual sales to, or purchases from, the other company in each of the last three fiscal years amounted to less than 1% of the annual revenues of the other company;

•the Director, or an immediate family member of the Director, is an executive officer of another company, and our indebtedness to the other company or its indebtedness to Pfizer amounts to less than 1% of the total consolidated assets of the other company; and

•contributions to not-for-profit entities in which a Director, or a Director’s spouse, serves as an executive officer, which amount to less than 2% of that organization’s latest publicly available total revenues (or $1 million, whichever is greater).

| | | | | | | | |

2025 Proxy Statement Pfizer | | 7 |

| | |

Item 1 – Election of Directors |

Drs. Hobbs*, Hockfield and Littman, and Mr. Echevarria, are employed at medical, scientific or academic institutions with which Pfizer engages in ordinary-course business transactions. Mr. Narayen is the chief executive officer of Adobe Inc., a company with which Pfizer engages in ordinary-course business transactions. Dr. Gottlieb is a Resident Fellow of the American Enterprise Institute (AEI). In 2024, Pfizer made a payment to AEI related to a corporate sponsorship. We reviewed our transactions with and payments to each of these entities and found that these transactions/payments were made in the ordinary-course of business and were below the levels set forth in our Standards.

* In April 2025, Dr. Hobbs will retire from the Board and as a member of the Governance and Regulatory and Compliance Committees, and as the Chair and a member of the Science and Technology Committee.

Independence Assessment. Together with Pfizer’s legal counsel, the Governance Committee reviewed the applicable legal and NYSE standards for Board and Committee member independence, as well as our Standards. A summary of the answers to annual questionnaires completed by each of the Directors and a report of transactions with Director-affiliated entities were also made available to the Committee. On the basis of these reviews, the Committee delivered a report to the full Board of Directors, and the Board made its independence determinations based upon the Committee’s report and the supporting information.

The Board has determined that all of our current Directors (other than Dr. Albert Bourla) are independent of the company and its management and meet Pfizer’s criteria for independence. The independent Directors are Drs. Susan Desmond-Hellmann, Scott Gottlieb, Helen H. Hobbs, Susan Hockfield and Dan R. Littman; Ms. Suzanne Nora Johnson; and Messrs. Ronald E. Blaylock, Mortimer J. Buckley, Joseph J. Echevarria, Shantanu Narayen, James Quincey, James C. Smith and Cyrus Taraporevala.

Our 2025 Director Nominees

The Governance Committee and the Board believe that each nominee for Director brings a strong and unique set of perspectives, experiences and skills to Pfizer that creates an effective and well-functioning Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Name | Age | Independent | Director Since | Audit | Compensation | Governance | Regulatory and Compliance | Science and Technology | Other Public Boards |

| | | | | | | | | |

| Ronald E. Blaylock | 65 | ü | 2017 | l | l | | | | 2 |

Albert Bourla, DVM, Ph.D. Chairman and CEO | 63 | | 2018 | | | | | | – |

Mortimer J. Buckley | 55 | ü | 2024 | l | | l | | | 1 |

Susan Desmond-Hellmann, MD, M.P.H.(1) | 67 | ü | 2020 | | | l | | l | – |

| Joseph J. Echevarria | 67 | ü | 2015 | l | | Chair | | | 2 |

Scott Gottlieb, MD | 52 | ü | 2019 | | | | Chair | l | 2 |

Susan Hockfield, Ph.D. | 74 | ü | 2020 | | | | l | l | – |

Dan R. Littman, MD, Ph.D. | 72 | ü | 2018 | | | l | l | l | – |

Shantanu Narayen Lead Independent Director | 61 | ü | 2013 | | | | | | 1 |

Suzanne Nora Johnson | 67 | ü | 2007 | Chair | | | l | | 1 |

| James Quincey | 60 | ü | 2020 | | l | | | | 1 |

James C. Smith | 65 | ü | 2014 | l | Chair | | | | – |

Cyrus Taraporevala | 58 | ü | 2024 | l | l | | | | 1 |

(1)Effective as of the 2025 Annual Meeting, Dr. Desmond-Hellmann will become the Chair of the Science and Technology Committee.

| | | | | | | | |

8 | | Pfizer 2025 Proxy Statement |

| | |

| Item 1 – Election of Directors |

DIRECTOR NOMINEE KEY SKILLS AND EXPERIENCE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Key Skills and Experience | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Business Leadership & Operations Experience serving in a senior leadership role develops skills in core management areas and provides a valuable practical understanding of the operations of complex organizations | l | l | l | l | l | | l | | l | l | l | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

International Business Leadership experience in organizations that operate across diverse and dynamic political systems, economic conditions, and regulatory environments provides valuable perspectives for oversight of the risks and opportunities within Pfizer’s extensive global business operations | | l | l | | l | | | | l | l | l | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Medicine & Science Knowledge of relevant sciences and experience as a healthcare provider provides Directors with a deep understanding of Pfizer’s key therapeutic areas and an appreciation for our mission to deliver breakthroughs that change patients’ lives | | l | | l | | l | l | l | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Healthcare & Pharma Experience as an executive and/or in an operational role at a pharmaceutical or biotechnology focused organization or company provides Directors with a deep understanding of Pfizer’s business and key strategic and operational considerations | | l | | l | | l | | l | | l | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Finance & Accounting Expertise in finance, capital markets, mergers and acquisitions, investment management and financial reporting processes enables Directors to effectively monitor and assess Pfizer’s operating and strategic performance and capital allocation decisions, and oversee accurate financial reporting and robust controls | l | | l | | l | | | | l | l | l | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Risk Management Experience identifying, managing and mitigating key strategic and operational risks promotes effective oversight of Pfizer’s risks and opportunities and contributes to effective oversight of strategy in a variety of operating environments | l | | l | | l | | | | l | l | | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Academia Experience in a leadership or senior advisory position at a scientific, research or academic institution provides Directors with deep technical subject matter expertise related to the intricacies of Pfizer’s R&D pipeline | | | | l | | | l | l | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Human Capital Management Experience with human capital management responsibilities assists the Board in overseeing succession planning, talent development and Pfizer’s executive compensation program | | l | l | | | | | | l | | l | l | l |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Government & Public Policy Understanding of the complex regulatory and governmental environment in which Pfizer operates allows the Board to oversee the company’s long-term strategy by incorporating current and potential changes in public policy and regulation | | | | | l | l | l | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Technology & Cybersecurity Experience understanding and overseeing information technology and cybersecurity matters is critical to mitigating risks to our business, and to Board oversight of Pfizer’s actions to address innovation and competitiveness in a rapidly evolving technological age | | | l | l | | l | | | l | | l | | |

| | | | | | | | | | | | | |

| | | | | | | | |

2025 Proxy Statement Pfizer | | 9 |

| | |

Item 1 – Election of Directors |

| | | | | |

Business Leadership & Operations | |

International Business | |

Medicine & Science | |

Healthcare & Pharma | |

Finance & Accounting | |

Risk Management | |

Academia | |

Human Capital Management | |

Government & Public Policy | |

Technology & Cybersecurity | |

DIRECTOR NOMINEE ATTRIBUTES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Attributes(1) |

| | | | | | | | | | | | | | |

Gender | Female | | | | l | | | l | | | l | | | |

Male | l | l | l | | l | l | | l | l | | l | l | l |

| Race/Ethnicity | Asian | | | | | | | | | l | | | | l |

Black | l | | | | | | | | | | | | |

Latino | | | | | l | | | | | | | | |

White | | l | l | l | | l | l | l | | l | l | l | |

(1)Attributes are self-identified.

| | | | | |

| Your Board of Directors recommends a vote “FOR” the election of each of these nominees as Director. |

| | | | | | | | |

10 | | Pfizer 2025 Proxy Statement |

| | |

| Item 1 – Election of Directors |

Director Nominees

| | | | | | | | | | | |

| | | |

| | Ronald E. Blaylock KEY SKILLS & EXPERIENCE Business Leadership & Operations/Risk Management: Mr. Blaylock’s extensive experience in private equity and investment banking brings business leadership, financial expertise and risk management skills to the Board. In addition, Mr. Blaylock’s service on the compensation committees of other public companies enables him to bring valuable insights to Pfizer’s Board and Compensation Committee. Finance & Accounting: Mr. Blaylock’s significant financial background, including as the founder and managing partner of GenNx360 Capital Partners and the founder of Blaylock & Company, brings substantial financial expertise and a unique perspective to the Board on issues of importance relating to finance. BACKGROUND Founder, Managing Partner of GenNx360 Capital Partners, a private equity firm focused on investing in industrial and business services companies in the U.S. middle market since 2006. Prior to launching GenNx360 Capital Partners, Mr. Blaylock founded and managed Blaylock & Company, an investment banking firm. He also held senior management positions at UBS, PaineWebber Group and Citicorp. Director of CarMax, Inc. and W.R. Berkley Corporation, an insurance holding company. Former Director of Advantage Solutions Inc. (from 2019 to 2022) and Urban One, Inc. (from 2002 until 2019). Member of the Board of Trustees of Carnegie Hall. Member of the Board of Overseers of New York University Stern School of Business. Board Member of the Mental Health Coalition. |

| | |

Age: 65 Director Since: 2017 Board Committees: Audit and Compensation Key Skills: Business Leadership & Operations Finance & Accounting Risk Management Other Current Public Boards:

CarMax, Inc. and W.R. Berkley Corporation | | |

| | | | | | | | | | | |

| | | |

| | Albert Bourla, DVM, Ph.D. KEY SKILLS & EXPERIENCE Business Leadership & Operations/Human Capital Management/International Business/Healthcare & Pharma: Dr. Bourla has over 30 years of leadership experience and a demonstrated track record for delivering strong business results. Dr. Bourla has deep knowledge of the global healthcare industry as he has held a number of senior global positions across a range of businesses in five different countries (including eight different cities) over the course of his career, which enables him to provide important insights and perspectives to our Board on the company’s commercial, strategic, manufacturing and global product development functions. As Chairman and CEO, Dr. Bourla provides an essential link between management and the Board regarding management’s business perspectives. In addition, his experience on the Board of Pharmaceutical Research and Manufacturers of America (PhRMA) enables him to bring a broad perspective on issues facing our industry. Medicine & Science: Dr. Bourla brings expertise in medicine and science to the Board through his distinguished career at Pfizer. Since joining Pfizer in 1993, Dr. Bourla has served in various leadership positions with increasing responsibility within Pfizer’s former Animal Health and global commercial organizations. In addition, he is a Doctor of Veterinary Medicine and holds a Ph.D. in the Biotechnology of Reproduction from the Veterinary School of Aristotle University. BACKGROUND Chairman of the Board of Pfizer since January 2020; Chief Executive Officer of Pfizer since January 2019; Chief Operating Officer of Pfizer from January 2018 until December 2018; Group President, Pfizer Innovative Health from June 2016 until December 2017; Group President, Global Innovative Pharma Business of Pfizer from February 2016 until June 2016 (responsible for Vaccines, Oncology and Consumer Healthcare from 2014). President and General Manager of Established Products Business Unit of Pfizer from 2010 until 2013. Chair of the Board of PhRMA and Chair of the Board of The Pfizer Foundation, which promotes access to quality healthcare. Co-Chair of the Board of Directors of the Partnership for New York City and Member of the Board of Catalyst. |

| | |

Chairman and CEO Age: 63 Director Since: 2018 Key Skills: Business Leadership & Operations Healthcare & Pharma International Business Medicine & Science Human Capital Management Other Current Public Boards: None | | |

| | | | | | | | |

2025 Proxy Statement Pfizer | | 11 |

| | |

Item 1 – Election of Directors |

| | | | | | | | | | | |

| | | |

| | Mortimer J. Buckley KEY SKILLS & EXPERIENCE Business Leadership & Operations/Finance & Accounting/International Business/Risk Management/Human Capital Management: Mr. Buckley’s extensive experience as Chairman and Chief Executive Officer, Chief Investment Officer, and Chief Information Officer of The Vanguard Group, Inc. (Vanguard) has equipped him with invaluable expertise in financial markets, business leadership, capital allocation, regulation, talent management, technology, and operations. His background enables him to bring a unique investor and asset management perspective to the Board, which is an asset for Pfizer and our shareholders. Technology & Cybersecurity: Throughout his tenure at Vanguard, he spearheaded significant digital agendas, built out cybersecurity, and drove the innovative use of new technologies. BACKGROUND Chairman and Chief Executive Officer of Vanguard from 2018 to 2024. Previously, held a number of senior leadership positions at Vanguard, including Vanguard’s Chief Investment Officer from 2013 to 2017, overseeing the company’s managed stock, bond and money market portfolios as well as its investment research and methodology, and Chief Information Officer from 2001 to 2006. In addition, led Vanguard’s Personal Investor division from 2006 to 2012. Served as Chairman of the Board of Children’s Hospital of Philadelphia from 2011 to 2017. Director of The Boeing Company. |

| | |

Age: 55 Director Since: 2024 Board Committees: Audit and Governance Key Skills: Business Leadership & Operations Finance & Accounting International Business Risk Management Human Capital Management Technology & Cybersecurity Other Current Public Boards: The Boeing Company | | |

| | | | | | | | | | | |

| | | |

| | Susan Desmond-Hellmann, MD, M.P.H. KEY SKILLS & EXPERIENCE Business Leadership & Operations: Dr. Desmond-Hellmann brings strong leadership, expertise in business operations and global perspectives to the Board through her experiences as former Chief Executive Officer of the Bill & Melinda Gates Foundation, where she oversaw the creation of the Gates Medical Research Institute (GMRI), as former President of Product Development at Genentech and as Chancellor of the University of California, San Francisco (UCSF). Medicine & Science/Healthcare & Pharma/Academia: Dr. Desmond-Hellmann’s background reflects significant achievements in medicine, healthcare and academia. She brings expertise in medicine and science from her leadership roles in product development and clinical cancer research. Through her experiences at a biotechnology company and at a pharmaceutical institute, she brings healthcare and pharma industry expertise. In addition, she has significant achievements in academia through her service as a distinguished professor at UCSF. Pfizer and the Board benefit from her depth of experience and expertise in medicine, healthcare and academia. Technology & Cybersecurity: Dr. Desmond-Hellmann brings an expertise in technology and innovation from her previous experiences at Genentech and as a director on other public company boards, including Meta, as well as her experiences as a Director of OpenAI. BACKGROUND Board member of OpenAI, National Resilience, Inc. and Stand Up To Cancer. Senior Advisor at Lazard, Inc. in the Healthcare Group. Senior Advisor at GMRI from 2020 to 2021. CEO of the Bill & Melinda Gates Foundation, a private foundation committed to enhancing global healthcare, reducing extreme poverty and expanding educational opportunities, from 2014 to 2020. She served as the first female, and ninth overall, Chancellor of UCSF from 2009 to 2014. Dr. Desmond-Hellmann remains an Adjunct Professor at UCSF. Member of the President’s Council of Advisors on Science and Technology. From 1995 through 2009, she was employed at Genentech where she served as President of Product Development from 2005 to 2009, overseeing pre-clinical and clinical development, business development and product portfolio management. Prior to Genentech, she was Associate Director, Clinical Cancer Research at Bristol-Myers Squibb Pharmaceutical Research Institute. Director of: (i) Meta from 2013 to 2019; and (ii) Procter & Gamble from 2010 to 2017. Received the Hockfield Cancer Research Prize (2023). |

| | |

Age: 67 Director Since: 2020 Board Committees: Governance and Science and Technology Key Skills: Business Leadership & Operations Healthcare & Pharma Medicine & Science Academia Technology & Cybersecurity Other Current Public Boards: None | | |

| | | | | | | | |

12 | | Pfizer 2025 Proxy Statement |

| | |

| Item 1 – Election of Directors |

| | | | | | | | | | | |

| | | |

| | Joseph J. Echevarria KEY SKILLS & EXPERIENCE Business Leadership & Operations/International Business/Risk Management: Mr. Echevarria’s 36-year career at Deloitte and his current role as President of the University of Miami (UM) brings financial expertise and international business, leadership and operational and risk management skills to the Board. Finance & Accounting: Mr. Echevarria’s financial acumen, including his significant audit experience, expertise in accounting issues and service on the audit committees of other public companies, is an asset to Pfizer’s Board and Audit Committee. Government & Public Policy: Pfizer also benefits from Mr. Echevarria’s breadth and diversity of experience, which includes his former public service on President Obama’s Export Council. BACKGROUND President of UM since October 2024. Served as the CEO of Deloitte LLP, a global provider of professional services, from 2011 until his retirement in 2014. During his 36-year tenure with Deloitte, served in various leadership roles, including Deputy Managing Partner, Southeast Region, Audit Managing Partner and U.S. Managing Partner and Chief Operating Officer. Mr. Echevarria served as CEO of UHealth of UM from 2022 until 2024, and served as Trustee of UM since 2011. Serves as Chair Emeritus of former President Obama’s My Brother’s Keeper Alliance and as an advisor to the Obama Foundation. Chairman of the Board of The Bank of New York Mellon Corporation. Director of Unum Group, a provider of financial protection benefits. Director of Xerox Holdings Corporation from 2017 until 2023. Former member of the Presidential Commission on Election Administration. |

| | |

Age: 67 Director Since: 2015 Board Committees: Audit and Governance (Chair) Key Skills: Business Leadership & Operations Finance & Accounting International Business Risk Management Government & Public Policy Other Current Public Boards: The Bank of New York Mellon Corporation and Unum Group | | |

| | | | | | | | | | | |

| | | |

| | Scott Gottlieb, MD KEY SKILLS & EXPERIENCE Government & Public Policy/Medicine & Science/Healthcare & Pharma: Dr. Gottlieb brings significant expertise in health care, public policy and the biopharmaceutical industry to Pfizer’s Board and the Regulatory and Compliance and Science and Technology Committees. Through his work as a physician and his tenure at the U.S. Food and Drug Administration (FDA), Dr. Gottlieb has demonstrated an understanding of patient needs, the public policy environment and the rapidly changing dynamics of biopharmaceutical research and development. Technology & Cybersecurity: Dr. Gottlieb brings an expertise in technology and innovation from his experiences on the boards of directors of Tempus AI, Inc., an artificial intelligence-enabled precision medicine company, and Xaira Therapeutics, Inc., a private, AI-focused biotechnology company launched in 2024. BACKGROUND Partner, New Enterprise Associates, Inc.’s Healthcare Investment Team and Resident Fellow of the American Enterprise Institute since 2019. Served as the 23rd Commissioner of the FDA from 2017 to 2019. Prior to serving as Commissioner of the FDA, Dr. Gottlieb held several roles in the public and private sectors, including serving as a Venture Partner to New Enterprise Associates, Inc. from 2007 to 2017. Director of Illumina, Inc. and Tempus AI, Inc. Director of Aetion, Inc. a private healthcare data technology company, Comanche Biopharma, a private maternal medicine biopharmaceutical company, and Xaira Therapeutics, Inc. Board Member of National Resilience, Inc. Scientific Advisory Board Member of CellCarta. Member of the National Academy of Medicine and a contributor to the financial news network CNBC. |

| | |

Age: 52 Director Since: 2019 Board Committees: Regulatory and Compliance (Chair) and Science and Technology Key Skills: Healthcare & Pharma Medicine & Science Government & Public Policy Technology & Cybersecurity Other Current Public Boards: Illumina, Inc. and Tempus AI, Inc. | | |

| | | | | | | | |

2025 Proxy Statement Pfizer | | 13 |

| | |

Item 1 – Election of Directors |

| | | | | | | | | | | |

| | | |

| | Susan Hockfield, Ph.D. KEY SKILLS & EXPERIENCE Academia/Business Leadership & Operations/Medicine & Science: Dr. Hockfield has strong leadership skills, having served as the first woman and first life scientist President of the Massachusetts Institute of Technology (MIT) from 2004 to 2012 and as Dean of the Graduate School of Arts and Sciences from 1998 to 2002 and Provost from 2003 to 2004 at Yale University. Her background also reflects significant achievements in academia and science as she has served as a professor of Neuroscience at the Yale University School of Medicine (1985-2004) and MIT (2004-present). Pfizer benefits from her experience, expertise, achievements and recognition in both medicine and science. Government & Public Policy: Pfizer benefits from Dr. Hockfield’s breadth and depth of experience in the public policy space, including her public service as Science Envoy with the U.S. Department of State, co-chair of the Advanced Manufacturing Partnership, as a member of a Congressional Commission evaluating the Department of Energy laboratories, and as President and Chair of the American Association for the Advancement of Science. BACKGROUND Professor of Neuroscience and President Emerita at MIT. Served as MIT’s sixteenth president from 2004 to 2012. Member, Koch Institute for Integrative Cancer Research at MIT. Prior to joining MIT, she was the William Edward Gilbert Professor of Neurobiology, Dean of the Graduate School of Arts and Sciences from 1998 to 2002 and Provost from 2003 to 2004 at Yale University. Board Member of Repertoire Immune Medicines, Cajal Neuroscience (until 2024) and Break Through Cancer. Founding co-chair of the Advanced Manufacturing Partnership. Fellow of the American Association for the Advancement of Science. Member of the American Academy of Arts and Sciences and the Society for Neuroscience. Recipient of the Charles L. Branch BrainHealth Award, Charles Judson Herrick Award from the American Association of Anatomists, the Wilbur Lucius Cross Award from Yale University, the Meliora Citation from the University of Rochester, the Golden Plate Award from the Academy of Achievement, the Amelia Earhart Award from the Women’s Union, the Edison Achievement Award, the Pinnacle Award for Lifetime Achievement from the Greater Boston Chamber of Commerce and the Geoffrey Beene Builders of Science Award from Research!America. She previously served as a Director of General Electric Company from 2006 until 2018 and of Qualcomm Incorporated from 2012 until 2016. |

| | |

Age: 74 Director Since: 2020 Board Committees: Regulatory and Compliance and Science and Technology Key Skills: Business Leadership & Operations Medicine & Science Academia Government & Public Policy Other Current Public Boards: None | | |

| | | | | | | | | | | |

| | | |

| | Dan R. Littman, MD, Ph.D. KEY SKILLS & EXPERIENCE Medicine & Science/Healthcare & Pharma/Academia: Dr. Littman’s background reflects significant achievements in medicine, healthcare and academia. He has served as a faculty member at the NYU Langone Medical Center for more than 25 years and is a renowned immunologist and molecular biologist. Pfizer benefits from his experience, expertise, achievements and recognition in both medicine and science. In addition, his experiences as a member of the National Academy of the Sciences and the National Academy of Medicine enable him to bring a broad perspective of the scientific and medical community to the Board. BACKGROUND Helen L. and Martin S. Kimmel Professor of Molecular Immunology, Department of Pathology at NYU Grossman School of Medicine (NYU Grossman). Professor, Department of Microbiology at NYU Grossman since 1995 and Investigator, Howard Hughes Medical Institute, since 1987. Professor of Microbiology and Immunology at the University of California, San Francisco from 1985 to 1995. Member of the National Academy of the Sciences and the National Academy of Medicine. Fellow of the American Academy of Arts and Sciences and the American Academy of Microbiology. Founding Scientific Advisory Board Member of Vedanta Biosciences and Scientific co-founder and Advisory Board Member of Immunai, Inc. Member of Scientific Advisory Boards at the Cancer Research Institute, the Broad Institute, IMIDomics, Scleroderma Research Foundation, Sonoma Biotherapeutics, Whitehead Institute of MIT Board of Advising Scientists and the Ragon Institute of MGH, MIT and Harvard. Member of the Scientific Steering Committee of Parker Institute of Cancer Immunotherapy. Awarded the New York City Mayor’s Award for Excellence in Science and Technology (2004), the Ross Prize in Molecular Medicine (2013), the Vilcek Prize in Biomedical Science (2016), and the William B. Coley Award for Distinguished Research in Basic and Tumor Immunology (2016). |

| | |

Age: 72 Director Since: 2018 Board Committees: Governance, Regulatory and Compliance and Science and Technology Key Skills: Healthcare & Pharma Medicine & Science Academia Other Current Public Boards: None | | |

| | | | | | | | |

14 | | Pfizer 2025 Proxy Statement |

| | |

| Item 1 – Election of Directors |

| | | | | | | | | | | |

| | | |

| | Shantanu Narayen KEY SKILLS & EXPERIENCE Business Leadership & Operations/International Business/Finance & Accounting/Human Capital Management: Mr. Narayen’s experience as Chair and CEO of Adobe Inc. (Adobe) brings strong leadership and human capital management skills to the Board, and his past roles in worldwide product development provide valuable global operations experience. He also serves as a member and Vice Chairman of US-India Strategic Partnership Forum. Through his experiences as a director on another public board, he provides a broad perspective on issues facing public companies and governance matters. Technology & Cybersecurity/Risk Management: Pfizer benefits from Mr. Narayen’s extensive knowledge in technology, product innovation and leadership in the digital marketing category through his experience in the technology industry. In addition, his deep knowledge and understanding of business risks through his leadership at a global technology company provide further insight and perspective to the Board. BACKGROUND Chair since 2017 and Chief Executive Officer since 2007 of Adobe, one of the largest and most diversified software companies in the world. President of Adobe until December 2021. Prior to his appointment as CEO, he held various leadership roles at Adobe, including President and Chief Operating Officer, Executive Vice President of Worldwide Products, and Senior Vice President of Worldwide Product Development. Vice Chairman of US-India Strategic Partnership Forum. Consistently named one of the world’s best CEOs by Barron’s magazine and, in 2020, ranked as a Fortune “Businessperson of the Year.” |

| | |

Lead Independent Director Age: 61 Director Since: 2013 Key Skills: Business Leadership & Operations Finance & Accounting International Business Human Capital Management Risk Management Technology & Cybersecurity Other Current Public Boards: Adobe Inc. | | |

| | | | | | | | | | | |

| | | |