Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to report its second quarter results highlighted by

record Free Cash Flow, operational milestones and the continued

execution on return of capital commitments.

Corporate Consolidated Q2 2024

Highlights

-

Production: Average production of 37,621 boe/d

(98% Liquids). The Company is increasing its annual corporate

guidance by 1,000 boe/d to 36,000 – 37,000 boe/d, including both

Duvernay Energy and Athabasca (Thermal Oil) production.

-

Record Cash Flow: Record Adjusted Funds Flow of

$166 million and cash flow from operating activities of $135

million. In 2024, the Company forecasts Adjusted Funds Flow of

~$590 million1, supported by increased operating scale and strong

oil pricing for the balance of the year.

-

Balance Sheet: Net Cash of $125 million; Liquidity

of $429 million (including $303 million cash).

Athabasca (Thermal Oil) Quarterly

Highlights

-

Production: Second quarter production of 33,765

bbl/d (26,423 bbl/d at Leismer & 7,342 bbl/d at Hangingstone).

In June, Leismer successfully ramped up to a record ~28,000

bbl/d.

-

Cash Flow: Adjusted Funds Flow of $149 million

with an Operating Netback of $52.59/bbl. Athabasca (Thermal Oil)

expects to generate $1.4 billion of Free Cash Flow1 during the

timeframe of 2024-27.

-

Capital Program: $34 million of capital focused on

sustaining operations at Leismer and Hangingstone. Revised 2024

capital program of $193 million (previously $135 million) now

incorporates progressive growth plans at Leismer.

-

Record Free Cash Flow: $115 million of Free Cash

Flow supporting return of capital commitments.

Duvernay Energy Quarterly

Highlights

-

Production: Second quarter production of 3,856

boe/d (80% Liquids), up ~100% from the first quarter and supported

by production from new wells. Strong production results with

restricted IP90s averaging ~1,000 boe/d (86% Liquids) for each well

on the 2-well 100% working interest (“WI”) pad and approximate

IP60s averaging ~1,000 boe/d (87% Liquids) for each well on the

3-well 30% WI pad.

-

Cash Flow: Adjusted Funds Flow of $16 million with

an Operating Netback of $51.46/boe.

-

Capital Program: $14 million focused on drilling,

completions and readiness for upcoming drilling.

Sanctioning of Leismer Expansion to

40,000 bbl/d

-

Progressive Growth: The Company is sanctioning

progressive growth to 40,000 bbl/d at Leismer in stages over the

next three years. Estimated capital cost is $300 million

(~$25,000/bbl/d capital efficiency). The Company expects

incremental production in 2026 and 2027, reaching 40,000 bbl/d in

2028. Regulatory approvals are in place.

-

Maximize Long-term Free Cash Flow Generation:

Expanded scale is expected to drive additional margin growth. The

Company can maintain 40,000 bbl/d for approximately fifty years

(Proved plus Probable Reserves) at an estimated annual sustaining

capital of ~$6/bbl, maximizing long-term Free Cash Flow

generation.

-

Financial Capacity for Growth and Continued Return of

Capital: The Company expects incremental growth capital to

be funded well within cash flow while continuing to allocate 100%

of Free Cash Flow through its return of capital commitment.

Return of Capital

-

2024 Return of Capital Commitment: Athabasca

(Thermal Oil) is allocating 100% of Free Cash Flow (not including

Duvernay Energy) to share buybacks in 2024. Year to date the

Company has completed $173 million in share buybacks (34.7 million

shares at an average price of $4.99/sh) and forecasts 2024 Free

Cash Flow of ~$350 million1.

-

Focus on Per Share Metrics: A steadfast commitment

to return of capital has driven an ~88 million reduction (~14%) in

the Company’s fully diluted share count since March 31, 2023.

Corporate Consolidated – Strategic

Update

-

Value Creation: The Company’s Thermal Oil division

provides a differentiated liquids weighted growth platform

supported by financial resiliency to execute on return of capital

initiatives. Athabasca’s subsidiary company, Duvernay Energy

Corporation, is designed to enhance value for Athabasca’s

shareholders by providing a clear path for self-funded production

and cashflow growth in the Kaybob Duvernay resource play. Athabasca

(Thermal Oil) and Duvernay Energy have independent strategies and

capital allocation frameworks.

-

Consolidated Free Cash Flow Growth: Athabasca’s

capital allocation framework is designed to unlock shareholder

value by prioritizing multi‐year cash flow per share growth. In

2024, Athabasca forecasts Corporate Consolidated Adjusted Funds

Flow of ~$590 million or $1.07/sh, representing ~100% per share

growth over 2022 when the Company sanctioned growth to 28,000 bbl/d

at Leismer. The Company’s updated outlook targets a 13% net annual

production growth (23% per share) and a >20% net Adjusted Funds

Flow per share compound annual growth rate during the three-year

time to 20272.

Athabasca (Thermal Oil) – Strategic

Update

-

Large Resource Base: Athabasca’s top-tier assets

underpin a strong Free Cash Flow outlook with low sustaining

capital requirements. The long life, low decline asset base

includes ~1.2 Billion barrels of Proved plus Probable reserves and

~1 Billion barrels of Contingent Resource.

- Strong

Financial Position: Prudent long-term balance sheet

management is a core tenet of Athabasca’s strategy. The Company has

peer leading credit metrics including a Net Cash position of $125

million with Liquidity of $429 million (including $303 million

cash). The Company intends to proactively refinance its existing

term debt due in late 2026 (US$157 million outstanding) supported

by strong business fundamentals and attractive credit markets.

Maintaining a similar level of outstanding debt is expected to

provide strategic flexibility and business resiliency throughout

commodity price cycles.

-

Leismer Expansions: Athabasca recently completed

an expansion to 28,000 bbl/d at a competitive capital efficiency of

$14,000/bbl/d. Following the success of this project and with the

constructive commodity price environment, the Company has

sanctioned a further expansion to 40,000 bbl/d. This will be

completed utilizing a progressive build strategy that adds

incremental production in 2026 and 2027 with the full 40,000 bbl/d

achieved in 2028. The total capital for this project is estimated

at $300 million for a capital efficiency of ~$25,000/bbl/d. The

Company can maintain 40,000 bbl/d for approximately fifty years

(Proved plus Probable Reserves).

-

Hangingstone Activity: The Company recently spud

the first of two ~1,400 meter well pairs. Well design with extended

reach laterals is expected to drive project capital efficiencies of

~$15,000/bbl/d and will leverage off available infrastructure

capacity. These sustaining well pairs will support base production

in 2025 and beyond with the objective of ensuring Hangingstone

continues to deliver meaningful cash flow contributions to the

Company and maintaining competitive netbacks ($51.89/bbl Q2 2024

Operating Netback).

-

Corner – Future Growth: The Company’s Corner asset

is a large de-risked oil sands asset adjacent to Leismer with 351

million barrels of Proved plus Probable reserves and 520 million

barrels Contingent Resource (Best Estimate Unrisked). There are

over 300 delineation wells and ~80% seismic coverage, with

reservoir qualities similar or better than Leismer. The asset has a

40,000 bbl/d regulatory approval for development with the existing

pipeline corridor passing through the Corner lease. The Company has

updated its development plans and is finalizing facility cost

estimates. Athabasca intends to explore external funding options

and does not plan to fund an expansion utilizing existing cash flow

or balance sheet resources.

-

Significant Multi-Year Free Cash Flow: Inclusive

of the progressive growth at Leismer, Athabasca (Thermal Oil)

expects to generate $1.4 billion of Free Cash Flow1 during the

timeframe of 2024-27. Beyond 2028, the Company can maintain its

production base for approximately fifty years (Proved plus Probable

Reserves) at an estimated annual sustaining capital of ~$6/bbl,

maximizing long-term Free Cash Flow generation. Free Cash Flow will

continue to support the Company’s growth and return of capital

initiatives.

-

Thermal Oil Royalty Advantage: Athabasca has

significant unrecovered capital balances on its Thermal Oil Assets

that ensure a low Crown royalty framework (~7%1). Leismer is

forecasted to remain pre-payout until 20271 and Hangingstone is

forecasted to remain pre-payout beyond 20301.

-

Exposure to Improving Heavy Oil Pricing: With the

start-up of the Trans Mountain pipeline expansion (590,000 bbl/d)

in early May, spare pipeline capacity is expected to drive tighter

and less volatile WCS heavy differentials. Every $5/bbl WCS change

impacts Athabasca (Thermal Oil) Adjusted Funds Flow by ~$85 million

annually.

-

Tax Free Horizon: Athabasca (Thermal Oil) has $2.5

billion of valuable tax pools and does not forecast paying cash

taxes for approximately seven years.

Duvernay Energy – Strategic Update

-

Value Creation: Duvernay Energy (“DEC”) is an

operated, private subsidiary of Athabasca (owned 70% by Athabasca

and 30% by Cenovus Energy). DEC accelerates value realization for

Athabasca’s shareholders by providing a clear path for self-funded

production and cash flow growth without compromising Athabasca’s

capacity to fund its Thermal Oil assets or its return of capital

strategy.

-

Kaybob Duvernay Assets: Exposure to ~200,000 gross

acres in the liquids rich and oil windows with ~500 gross future

well locations, including ~46,000 gross acres with 100% working

interest.

-

Self-Funded Growth: Near-term activity will be

funded within Adjusted Funds Flow and initial seed capital. The

2024 program includes drilling and completions of a two-well 100%

WI pad and a three-well 30% WI pad along with spudding two

additional multi-well pads in the Fall of 2024. The Company has

self-funded growth potential to in excess of ~20,000 boe/d (75%

Liquids) by the late 2020s1.

Footnote: Refer to the “Reader Advisory” section within this news release for additional information on

Non‐GAAP Financial Measures (e.g. Adjusted Funds

Flow, Free Cash Flow, Sustaining Capital, Net

Cash, Liquidity) and production disclosure.1 Pricing

Assumptions: H1 2024 prices actualized and flat pricing of US$80

WTI, US$15 WCS heavy differential, C$67/MWh, C$1.48 AECO, and 0.73

C$/US$ FX for the balance of the year. 2025-26 US$80 WTI, US$12.50

WCS heavy differential, C$3 AECO, and 0.75 C$/US$ FX.2 The

Company’s illustrative multi-year outlook assumes a 10% annual

share buyback program at an implied share price of 4.5x EV/Debt

Adjusted Cash flow in 2025 and beyond.

Corporate Guidance

-

Athabasca (Thermal Oil) guidance: Increased

production guidance on strong performance year to date. The $193

million capital budget incorporates sustaining capital and capital

for commencing progressive growth plans to 40,000 bbl/d at

Leismer.

-

Duvernay Energy guidance is unchanged.

|

2024 Guidance |

Athabasca (Thermal Oil) May 8, 20241 |

Athabasca (Thermal Oil) July 24, 20242 |

Duvernay Energy2,3Unchanged |

Corporate Consolidated2,3 |

|

|

|

|

|

|

|

Production (boe/d) |

32,000 – 33,000 |

33,000 – 34,000 |

~3,000 |

36,000 – 37,000 |

|

Capital Expenditures ($MM) |

$135 |

$193 |

$82 |

$275 |

|

Adjusted Funds Flow ($MM) |

~$500 |

~$540 |

~$50 |

~$590 |

|

Free Cash Flow ($MM) |

~$365 |

~$350 |

- |

- |

1 May 8, 2024 commodity price forecast: US$80

WTI, US$15 WCS heavy differential, C$100/MWh, C$3 AECO, and $0.73

C$/US$ FX.2 July 24, 2024 commodity price forecast: H1 2024 prices

actualized and flat pricing of US$80 WTI, US$15 WCS heavy

differential, C$67/MWh, C$1.48 AECO, and 0.73 C$/US$ FX for the

balance of the year.3 Duvernay Energy reflects gross production and

financial metrics before taking into consideration Athabasca’s 70%

equity interest in Duvernay Energy. Duvernay Energy capital program

funded by seed capital and Adjusted Funds Flow forecast.

Financial and Operational Highlights

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

CORPORATE CONSOLIDATED(1) |

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d)(2) |

|

37,621 |

|

|

|

33,971 |

|

|

|

35,546 |

|

|

|

34,325 |

|

|

|

Petroleum, natural gas and midstream sales |

$ |

401,738 |

|

|

$ |

282,614 |

|

|

$ |

712,854 |

|

|

$ |

573,355 |

|

|

|

Operating Income(2) |

$ |

179,751 |

|

|

$ |

95,118 |

|

|

$ |

284,886 |

|

|

$ |

151,653 |

|

|

|

Operating Income Net of Realized Hedging(2)(3) |

$ |

178,176 |

|

|

$ |

90,522 |

|

|

$ |

284,756 |

|

|

$ |

125,002 |

|

|

|

Operating Netback ($/boe)(2) |

$ |

52.46 |

|

|

$ |

32.23 |

|

|

$ |

44.77 |

|

|

$ |

24.05 |

|

|

|

Operating Netback Net of Realized Hedging ($/boe)(2)(3) |

$ |

52.00 |

|

|

$ |

30.67 |

|

|

$ |

44.75 |

|

|

$ |

19.82 |

|

|

|

Capital expenditures |

$ |

48,453 |

|

|

$ |

41,432 |

|

|

$ |

124,464 |

|

|

$ |

67,794 |

|

|

|

Cash flow from operating activities |

$ |

135,083 |

|

|

$ |

46,914 |

|

|

$ |

211,721 |

|

|

$ |

67,451 |

|

|

|

per share - basic |

$ |

0.24 |

|

|

$ |

0.08 |

|

|

$ |

0.38 |

|

|

$ |

0.11 |

|

|

|

Adjusted Funds Flow(2) |

$ |

165,746 |

|

|

$ |

81,664 |

|

|

$ |

253,518 |

|

|

$ |

72,268 |

|

|

|

per share - basic |

$ |

0.30 |

|

|

$ |

0.14 |

|

|

$ |

0.45 |

|

|

$ |

0.12 |

|

|

|

ATHABASCA (THERMAL OIL) |

|

|

|

|

|

|

|

|

|

Bitumen production (bbl/d)(2) |

|

33,765 |

|

|

|

29,016 |

|

|

|

32,651 |

|

|

|

29,097 |

|

|

|

Petroleum, natural gas and midstream sales |

$ |

395,279 |

|

|

$ |

265,304 |

|

|

$ |

700,320 |

|

|

$ |

534,406 |

|

|

|

Operating Income(2) |

$ |

161,694 |

|

|

$ |

81,621 |

|

|

$ |

262,143 |

|

|

$ |

123,118 |

|

|

|

Operating Netback ($/bbl)(2) |

$ |

52.59 |

|

|

$ |

32.64 |

|

|

$ |

44.91 |

|

|

$ |

22.97 |

|

|

|

Capital expenditures |

$ |

34,084 |

|

|

$ |

30,679 |

|

|

$ |

76,203 |

|

|

$ |

55,165 |

|

|

|

Adjusted Funds Flow(2) |

$ |

149,413 |

|

|

|

|

$ |

233,126 |

|

|

|

|

|

Free Cash Flow(2) |

$ |

115,329 |

|

|

|

|

$ |

156,923 |

|

|

|

|

|

DUVERNAY ENERGY(1) |

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d)(2) |

|

3,856 |

|

|

|

4,955 |

|

|

|

2,895 |

|

|

|

5,228 |

|

|

|

Percentage Liquids (%)(2) |

80 |

% |

|

55 |

% |

|

77 |

% |

|

56 |

% |

|

|

Petroleum, natural gas and midstream sales |

$ |

26,749 |

|

|

$ |

24,006 |

|

|

$ |

38,287 |

|

|

$ |

53,895 |

|

|

|

Operating Income(2) |

$ |

18,057 |

|

|

$ |

13,497 |

|

|

$ |

22,743 |

|

|

$ |

28,535 |

|

|

|

Operating Netback ($/boe)(2) |

$ |

51.46 |

|

|

$ |

29.92 |

|

|

$ |

43.17 |

|

|

$ |

30.16 |

|

|

|

Capital expenditures |

$ |

14,369 |

|

|

$ |

10,753 |

|

|

$ |

48,261 |

|

|

$ |

12,629 |

|

|

|

Adjusted Funds Flow(2) |

$ |

16,333 |

|

|

|

|

$ |

20,392 |

|

|

|

|

|

Free Cash Flow(2) |

$ |

1,964 |

|

|

|

|

$ |

(27,869 |

|

) |

|

|

|

NET INCOME AND COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

Net income and comprehensive income(4) |

$ |

96,076 |

|

|

$ |

57,121 |

|

|

$ |

134,685 |

|

|

$ |

486 |

|

|

|

per share - basic(4) |

$ |

0.17 |

|

|

$ |

0.10 |

|

|

$ |

0.24 |

|

|

$ |

0.00 |

|

|

|

per share - diluted(4) |

$ |

0.17 |

|

|

$ |

0.07 |

|

|

$ |

0.24 |

|

|

$ |

0.00 |

|

|

|

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

557,299,962 |

|

|

|

592,223,832 |

|

|

|

562,188,451 |

|

|

|

589,442,937 |

|

|

|

Weighted average shares outstanding - diluted |

|

566,559,671 |

|

|

|

616,789,101 |

|

|

|

569,058,329 |

|

|

|

600,470,217 |

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

As at ($ Thousands) |

|

|

2024 |

|

2023 |

|

|

LIQUIDITY AND BALANCE SHEET |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

303,360 |

|

$ |

343,309 |

|

|

Available credit facilities(5) |

|

|

$ |

126,035 |

|

$ |

85,488 |

|

|

Face value of term debt(6) |

|

|

$ |

214,886 |

|

$ |

207,648 |

|

(1) Corporate Consolidated and Duvernay Energy

reflect gross production and financial metrics before taking into

consideration Athabasca's 70% equity interest in Duvernay

Energy.(2) Refer to the “Reader Advisory” section within this News

Release for additional information on Non-GAAP Financial Measures

and production disclosure.(3) Includes realized commodity risk

management loss of $1.6 million and $0.1 million for the three and

six months ended June 30, 2024 (three and six months ended June 30,

2023 – loss of $4.6 million and $26.7 million).(4) Net income and

comprehensive income per share amounts are based on net income and

comprehensive income attributable to shareholders of the Parent

Company. In the calculation of diluted net income per share for the

three months ended June 30, 2023 and 2024 net income was reduced by

$16.4 million and $0.4 million, respectively, to account for the

impact to net income had the outstanding warrants and PSUs been

converted to equity. (5) Includes available credit under

Athabasca's and Duvernay Energy's Credit Facilities and Athabasca's

Unsecured Letter of Credit Facility.(6) The face value of the term

debt at June 30, 2024 was US$157.0 million (December 31, 2023 –

US$157.0 million) translated into Canadian dollars at the June 30,

2024 exchange rate of US$1.00 = C$1.3687 (December 31, 2023 –

C$1.3226).

Operations Update

Athabasca (Thermal Oil)

Production for the second quarter of 2024

averaged 33,765 bbl/d. The Thermal Oil division generated Operating

Income of $162 million (Operating Netbacks - $52.78/bbl at Leismer

and $51.89/bbl at Hangingstone) during the period with capital

expenditures of $34 million, primarily related to drilling and

completions, and progressing the facility expansion at Leismer.

Leismer

Leismer produced a record 26,423 bbl/d during

the quarter following the completion of the facility expansion.

Current production levels are ~28,000 bbl/d with a steam oil ratio

(“SOR”) of ~3x. In Q2 the first set of redrills at Leismer were

brought on production. These wells develop bypassed pay utilizing

existing facilities, resulting in capital efficiencies

<$9,500/bbl/d. The Company plans to drill two additional

redrills in Q4 to take advantage of these short-cycle

opportunities.

The Company is continuing with progressive

growth to increase Leismer production to 40,000 bbl/d (regulatory

approved capacity) over the next three years. These capital

projects are flexible and highly economic (~$25,000/bbl/d capital

efficiency) and will maximize value creation when executed

alongside the Company’s return of capital initiatives. Activity

over the next three years will include drilling ~20 well pairs

(sustaining and growth wells), expanding steam capacity to ~130,000

bbl/d and adding oil processing capacity at the central processing

facility. The Company anticipates growth to ~32,000 bbl/d in

mid-2026, ~35,000 bbl/d in 2027 and achieving ~40,000 bbl/d

capacity in 2028. The project will benefit from installing

opportunistically pre-purchased steam generators which reduce the

timelines and costs for the project.

Leismer is forecasted to remain pre-payout under

the Crown royalty structure until late 20271.

Hangingstone

Production during the quarter averaged 7,342

bbl/d. Non-condensable gas co-injection continues to assist in

pressure support, reduced energy usage and an improved SOR

averaging ~3.4x year to date. In July, the Company spud two ~1,400

meter well pairs. Well design with extended reach laterals is

expected to drive project capital efficiencies of ~$15,000/bbl/d

and will leverage off available infrastructure capacity. These

sustaining well pairs will support base production in 2025 and

beyond with the objective of ensuring Hangingstone continues to

deliver meaningful cash flow contributions to the Company and

maintaining competitive netbacks. Hangingstone is forecasted to

remain pre-payout under the Crown royalty structure beyond

20301.

Alberta Wildfire Update

Athabasca is closely monitoring wildfires in the

greater Fort McMurray area.

The safety and well-being of our employees and

contractors is our top priority. At this time there has been no

impact to operations. Athabasca has a comprehensive emergency

response plan in place and is in close communication with relevant

government agencies. Proactive measures have been taken over the

past weeks, including building fire breaks and clearing trees

around project sites.

Athabasca will continue to monitor the situation

closely and will provide updates as material new information

becomes available.

Duvernay Energy

Production for the second quarter of 2024

averaged 3,856 boe/d (80% Liquids). Duvernay Energy generated

Operating Income of $18 million (Operating Netback - $51.46/boe)

during the period.

Duvernay Energy brought its two-well 100%

working interest pad at 03-18-64-17W5 on production in late April.

The pad generated an average restricted 90-day rate of ~1,000 boe/d

per well (86% liquids) per well. A three well pad (30% working

interest) at 02-03-65-20W5 was brought on production in late May,

with an approximate 60-day rate of ~1,000 boe/d (87% liquids) per

well. Both pads are performing in-line with management’s

expectations and exhibiting strong initial rates with high liquids

content. The Company is preparing for the upcoming drilling program

that will include spudding a three-well 100% working interest pad

in September and a four-well 30% working interest pad in

December.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s light oil assets

are held in a private subsidiary (Duvernay Energy Corporation) in

which Athabasca owns a 70% equity interest. Athabasca’s common

shares trade on the TSX under the symbol “ATH”. For more

information, visit www.atha.com.

For more information, please contact:

| Matthew

Taylor |

Robert

Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

| |

|

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “project”, “continue”, “maintain”, “may”,

“estimate”, “expect”, “will”, “target”, “forecast”, “could”,

“intend”, “potential”, “guidance”, “outlook” and similar

expressions suggesting future outcome are intended to identify

forward-looking information. The forward-looking information is not

historical fact, but rather is based on the Company’s current

plans, objectives, goals, strategies, estimates, assumptions and

projections about the Company’s industry, business and future

operating and financial results. This information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information included in this News Release should

not be unduly relied upon. This information speaks only as of the

date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans; the allocation of future

capital; timing and quantum for shareholder returns including share

buybacks; the terms of our NCIB program; our drilling plans and

capital efficiencies; production growth to expected production

rates; Leismer production rate maintenance and estimated sustaining

capital amount; timing of Leismer’s and Hangingstone’s pre-payout

royalty status; applicability of tax pools and the timing of tax

payments; expected operating results at Hangingstone; Adjusted

Funds Flow and Free Cash Flow in 2024 and 2025 to 2027; type well

economic metrics; number of drilling locations; forecasted daily

production and the composition of production; our outlook in

respect of the Company’s business environment, including in respect

of the Trans Mountain pipeline expansion and new global heavy oil

refining capacity; the refinancing of the Company’s term debt; and

other matters.

In addition, information and statements in this

News Release relating to "Reserves" and “Resources” are deemed to

be forward-looking information, as they involve the implied

assessment, based on certain estimates and assumptions, that the

reserves and resources described exist in the quantities predicted

or estimated, and that the reserves and resources described can be

profitably produced in the future. With respect to forward-looking

information contained in this News Release, assumptions have been

made regarding, among other things: commodity prices; the

regulatory framework governing royalties, taxes and environmental

matters in the jurisdictions in which the Company conducts and will

conduct business and the effects that such regulatory framework

will have on the Company, including on the Company’s financial

condition and results of operations; the Company’s financial and

operational flexibility; the Company’s financial sustainability;

Athabasca's cash flow break-even commodity price; the Company’s

ability to obtain qualified staff and equipment in a timely and

cost-efficient manner; the applicability of technologies for the

recovery and production of the Company’s reserves and resources;

future capital expenditures to be made by the Company; future

sources of funding for the Company’s capital programs; the

Company’s future debt levels; future production levels; the

Company’s ability to obtain financing and/or enter into joint

venture arrangements, on acceptable terms; operating costs;

compliance of counterparties with the terms of contractual

arrangements; impact of increasing competition globally; collection

risk of outstanding accounts receivable from third parties;

geological and engineering estimates in respect of the Company’s

reserves and resources; recoverability of reserves and resources;

the geography of the areas in which the Company is conducting

exploration and development activities and the quality of its

assets. Certain other assumptions related to the Company’s Reserves

and Resources are contained in the report of McDaniel &

Associates Consultants Ltd. (“McDaniel”) evaluating Athabasca’s

Proved Reserves, Probable Reserves and Contingent Resources as at

December 31, 2023 (which is respectively referred to herein as the

"McDaniel Report”).

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Annual Information

Form (“AIF”) dated February 29, 2024 available on SEDAR at

www.sedarplus.ca, including, but not limited to: weakness in the

oil and gas industry; exploration, development and production

risks; prices, markets and marketing; market conditions; climate

change and carbon pricing risk; statutes and regulations regarding

the environment including deceptive marketing provisions;

regulatory environment and changes in applicable law; gathering and

processing facilities, pipeline systems and rail; reputation and

public perception of the oil and gas sector; environment, social

and governance goals; political uncertainty; state of capital

markets; ability to finance capital requirements; access to capital

and insurance; abandonment and reclamation costs; changing demand

for oil and natural gas products; anticipated benefits of

acquisitions and dispositions; royalty regimes; foreign exchange

rates and interest rates; reserves; hedging; operational

dependence; operating costs; project risks; supply chain

disruption; financial assurances; diluent supply; third party

credit risk; indigenous claims; reliance on key personnel and

operators; income tax; cybersecurity; advanced technologies;

hydraulic fracturing; liability management; seasonality and weather

conditions; unexpected events; internal controls; limitations and

insurance; litigation; natural gas overlying bitumen resources;

competition; chain of title and expiration of licenses and leases;

breaches of confidentiality; new industry related activities or new

geographical areas; water use restrictions and/or limited access to

water; relationship with Duvernay Energy Corporation; management

estimates and assumptions; third-party claims; conflicts of

interest; inflation and cost management; credit ratings; growth

management; impact of pandemics; ability of investors resident in

the United States to enforce civil remedies in Canada; and risks

related to our debt and securities. All subsequent forward-looking

information, whether written or oral, attributable to the Company

or persons acting on its behalf are expressly qualified in their

entirety by these cautionary statements.

Also included in this News Release are estimates

of Athabasca's 2024 outlook which are based on the various

assumptions as to production levels, commodity prices, currency

exchange rates and other assumptions disclosed in this News

Release. To the extent any such estimate constitutes a financial

outlook, it was approved by management and the Board of Directors

of Athabasca and is included to provide readers with an

understanding of the Company’s outlook. Management does not have

firm commitments for all of the costs, expenditures, prices or

other financial assumptions used to prepare the financial outlook

or assurance that such operating results will be achieved and,

accordingly, the complete financial effects of all of those costs,

expenditures, prices and operating results are not objectively

determinable. The actual results of operations of the Company and

the resulting financial results may vary from the amounts set forth

herein, and such variations may be material. The outlook and

forward-looking information contained in this New Release was made

as of the date of this News release and the Company disclaims any

intention or obligations to update or revise such outlook and/or

forward-looking information, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

Oil and Gas Information

“BOEs" may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Initial Production Rates

Test Results and Initial Production Rates: The

well test results and initial production rates provided herein

should be considered to be preliminary, except as otherwise

indicated. Test results and initial production rates disclosed

herein may not necessarily be indicative of long-term performance

or of ultimate recovery.

Reserves Information

The McDaniel Report was prepared using the

assumptions and methodology guidelines outlined in the COGE

Handbook and in accordance with National Instrument 51-101

Standards of Disclosure for Oil and Gas Activities, effective

December 31, 2023. There are numerous uncertainties inherent in

estimating quantities of bitumen, light crude oil and medium crude

oil, tight oil, conventional natural gas, shale gas and natural gas

liquids reserves and the future cash flows attributed to such

reserves. The reserve and associated cash flow information set

forth above are estimates only. In general, estimates of

economically recoverable reserves and the future net cash flows

therefrom are based upon a number of variable factors and

assumptions, such as historical production from the properties,

production rates, ultimate reserve recovery, timing and amount of

capital expenditures, marketability of oil and natural gas, royalty

rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially. For

those reasons, estimates of the economically recoverable reserves

attributable to any particular group of properties, classification

of such reserves based on risk of recovery and estimates of future

net revenues associated with reserves prepared by different

engineers, or by the same engineers at different times, may vary.

The Company's actual production, revenues, taxes and development

and operating expenditures with respect to its reserves will vary

from estimates thereof and such variations could be material.

Reserves figures described herein have been rounded to the nearest

MMbbl or MMboe. For additional information regarding the

consolidated reserves and information concerning the resources of

the Company as evaluated by McDaniel in the McDaniel Report, please

refer to the Company’s AIF.

Reserve Values (i.e. Net Asset Value) is

calculated using the estimated net present value of all future net

revenue from our reserves, before income taxes discounted at 10%,

as estimated by McDaniel effective December 31, 2023 and based on

average pricing of McDaniel, Sproule and GLJ as of January 1,

2024.

The 500 gross Duvernay drilling locations

referenced include: 37 proved undeveloped locations and 76 probable

undeveloped locations for a total of 113 booked locations with the

balance being unbooked locations. Proved undeveloped locations and

probable undeveloped locations are booked and derived from the

Company's most recent independent reserves evaluation as prepared

by McDaniel as of December 31, 2023 and account for drilling

locations that have associated proved and/or probable reserves, as

applicable. Unbooked locations are internal management estimates.

Unbooked locations do not have attributed reserves or resources

(including contingent or prospective). Unbooked locations have been

identified by management as an estimation of Athabasca’s multi-year

drilling activities expected to occur over the next two decades

based on evaluation of applicable geologic, seismic, engineering,

production and reserves information. There is no certainty that the

Company will drill all unbooked drilling locations and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which the Company will actually drill wells, including

the number and timing thereof is ultimately dependent upon the

availability of funding, commodity prices, provincial fiscal and

royalty policies, costs, actual drilling results, additional

reservoir information that is obtained and other factors.

Non-GAAP and Other Financial Measures,

and Production Disclosure

The "Corporate Consolidated Adjusted Funds

Flow", “Corporate Consolidated Adjusted Funds Flow per Share”,

"Athabasca (Thermal Oil) Adjusted Funds Flow", "Duvernay Energy

Adjusted Funds Flow", “Corporate Consolidated Free Cash Flow”,

"Athabasca (Thermal Oil) Free Cash Flow", "Duvernay Energy Free

Cash Flow", "Duvernay Energy Operating Income", "Duvernay Energy

Operating Netback", "Athabasca (Thermal Oil) Operating Income",

"Athabasca (Thermal Oil) Operating Netback", “Corporate

Consolidated Operating Income", "Corporate Consolidated Operating

Netback", "Corporate Consolidated Operating Income Net of Realized

Hedging", "Corporate Consolidated Operating Netback Net of Realized

Hedging" and “Cash Transportation & Marketing Expense”

financial measures contained in this News Release do not have

standardized meanings which are prescribed by IFRS and they are

considered to be non-GAAP financial measures or ratios. These

measures may not be comparable to similar measures presented by

other issuers and should not be considered in isolation with

measures that are prepared in accordance with IFRS. Sustaining

Capital, Net Cash and Liquidity are

supplementary financial measures. The Leismer and

Hangingstone operating results are a supplementary financial

measure that when aggregated, combine to the Athabasca (Thermal

Oil) segment results.

Adjusted Funds Flow, Adjusted Funds Flow Per

Share and Free Cash Flow

Adjusted Funds Flow and Free Cash Flow are

non-GAAP financial measures and are not intended to represent cash

flow from operating activities, net earnings or other measures of

financial performance calculated in accordance with IFRS. The

Adjusted Funds Flow and Free Cash Flow measures allow management

and others to evaluate the Company’s ability to fund its capital

programs and meet its ongoing financial obligations using cash flow

internally generated from ongoing operating related activities.

Adjusted Funds Flow per share is a non-GAAP financial ratio

calculated as Adjusted Funds Flow divided by the applicable number

of weighted average shares outstanding. Adjusted Funds Flow and

Free Cash Flow are calculated as follows:

|

|

Three months endedJune 30,

2024 |

|

Three months endedJune 30,

2023 |

|

|

($ Thousands) |

Athabasca (Thermal Oil) |

|

Duvernay Energy(1) |

|

Corporate Consolidated(1) |

|

Corporate Consolidated |

|

|

Cash flow from operating activities |

$ |

124,027 |

|

$ |

11,056 |

|

$ |

135,083 |

|

$ |

46,914 |

|

|

Changes in non-cash working capital |

|

25,375 |

|

|

5,390 |

|

|

30,765 |

|

|

34,630 |

|

|

Settlement of provisions |

|

11 |

|

|

(113 |

) |

|

(102 |

) |

|

120 |

|

|

ADJUSTED FUNDS FLOW |

|

149,413 |

|

|

16,333 |

|

|

165,746 |

|

|

81,664 |

|

|

Capital expenditures |

|

(34,084 |

) |

|

(14,369 |

) |

|

(48,453 |

) |

|

(41,432 |

) |

|

FREE CASH FLOW |

$ |

115,329 |

|

$ |

1,964 |

|

$ |

117,293 |

|

$ |

40,232 |

|

(1) Duvernay Energy and Corporate Consolidated

reflect gross financial metrics before taking into consideration

Athabasca's 70% equity interest in Duvernay Energy.

|

|

Six months endedJune 30,

2024 |

|

Six months endedJune 30,

2023 |

|

|

($ Thousands) |

Athabasca (Thermal Oil) |

|

Duvernay Energy(1) |

|

Corporate Consolidated(1) |

|

Corporate Consolidated |

|

|

Cash flow from operating activities |

$ |

197,068 |

|

$ |

14,653 |

|

$ |

211,721 |

|

$ |

67,451 |

|

|

Changes in non-cash working capital |

|

34,761 |

|

|

5,535 |

|

|

40,296 |

|

|

16,600 |

|

|

Settlement of provisions |

|

1,297 |

|

|

204 |

|

|

1,501 |

|

|

794 |

|

|

Long-term deposit |

|

— |

|

|

— |

|

|

— |

|

|

(12,577 |

) |

|

ADJUSTED FUNDS FLOW |

|

233,126 |

|

|

20,392 |

|

|

253,518 |

|

|

72,268 |

|

|

Capital expenditures |

|

(76,203 |

) |

|

(48,261 |

) |

|

(124,464 |

) |

|

(67,794 |

) |

|

FREE CASH FLOW |

$ |

156,923 |

|

$ |

(27,869 |

) |

$ |

129,054 |

|

$ |

4,474 |

|

(1) Duvernay Energy and Corporate Consolidated

reflect gross financial metrics before taking into consideration

Athabasca's 70% equity interest in Duvernay Energy.

Duvernay Energy Operating Income and Operating

Netback

The non-GAAP measure Duvernay Energy Operating

Income in this News Release is calculated by subtracting the

Duvernay Energy royalties, operating expenses and transportation

& marketing expenses from petroleum and natural gas sales which

is the most directly comparable GAAP measure. The Duvernay Energy

Operating Netback per boe is a non-GAAP financial ratio calculated

by dividing the Duvernay Energy Operating Income by the Duvernay

Energy production. The Duvernay Energy Operating Income and the

Duvernay Energy Operating Netback measures allow management and

others to evaluate the production results from the Company’s

Duvernay Energy assets.

The Duvernay Energy Operating Income is

calculated using the Duvernay Energy Segments GAAP results, as

follows:

|

|

Three months

endedJune 30, |

|

Six months

endedJune 30, |

|

|

($ Thousands, unless otherwise noted) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Petroleum and natural gas sales |

$ |

26,749 |

|

$ |

24,006 |

|

$ |

38,287 |

|

$ |

53,895 |

|

|

Royalties |

|

(3,498 |

) |

|

(1,337 |

) |

|

(5,812 |

) |

|

(6,893 |

) |

|

Operating expenses |

|

(4,063 |

) |

|

(7,095 |

) |

|

(7,703 |

) |

|

(14,024 |

) |

|

Transportation and marketing |

|

(1,131 |

) |

|

(2,077 |

) |

|

(2,029 |

) |

|

(4,443 |

) |

| DUVERNAY ENERGY

OPERATING INCOME |

$ |

18,057 |

|

$ |

13,497 |

|

$ |

22,743 |

|

$ |

28,535 |

|

Athabasca (Thermal Oil) Operating Income and Operating

Netback

The non-GAAP measure Athabasca (Thermal Oil)

Operating Income in this News Release is calculated by subtracting

the Athabasca (Thermal Oil) segments cost of diluent blending,

royalties, operating expenses and cash transportation &

marketing expenses from heavy oil (blended bitumen) and midstream

sales which is the most directly comparable GAAP measure. The

Athabasca (Thermal Oil) Operating Netback per bbl is a non-GAAP

financial ratio calculated by dividing the respective projects

Operating Income by its respective bitumen sales volumes. The

Athabasca (Thermal Oil) Operating Income and the Athabasca (Thermal

Oil) Operating Netback measures allow management and others to

evaluate the production results from the Athabasca (Thermal Oil)

assets. The Athabasca (Thermal Oil) Operating Income is calculated

using the Athabasca (Thermal Oil) Segments GAAP results, as

follows:

|

|

Three months

endedJune 30, |

|

Six months

endedJune 30, |

|

|

($ Thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Heavy oil (blended bitumen) and midstream sales |

$ |

395,279 |

|

$ |

265,304 |

|

$ |

700,320 |

|

$ |

534,406 |

|

|

Cost of diluent |

|

(148,166 |

) |

|

(114,430 |

) |

|

(282,026 |

) |

|

(263,363 |

) |

|

Total bitumen and midstream sales |

|

247,113 |

|

|

150,874 |

|

|

418,294 |

|

|

271,043 |

|

|

Royalties |

|

(28,823 |

) |

|

(10,944 |

) |

|

(40,360 |

) |

|

(17,557 |

) |

|

Operating expenses - non-energy |

|

(24,417 |

) |

|

(20,888 |

) |

|

(47,542 |

) |

|

(43,828 |

) |

|

Operating expenses - energy |

|

(11,635 |

) |

|

(18,717 |

) |

|

(28,193 |

) |

|

(43,546 |

) |

|

Cash transportation and marketing(1) |

|

(20,544 |

) |

|

(18,704 |

) |

|

(40,056 |

) |

|

(42,994 |

) |

|

ATHABASCA (THERMAL OIL) OPERATING INCOME |

$ |

161,694 |

|

$ |

81,621 |

|

$ |

262,143 |

|

$ |

123,118 |

|

(1) Transportation and marketing excludes

non-cash costs of $0.6 million and $1.1 million for the three and

six months ended June 30, 2024 (three and six months ended June 30,

2023 - $0.6 million and $1.1 million).

Corporate Consolidated Operating Income and

Corporate Consolidated Operating Income Net of Realized Hedging and

Operating Netbacks

The non-GAAP measures of Corporate Consolidated

Operating Income including or excluding realized hedging in this

News Release are calculated by adding or subtracting realized gains

(losses) on commodity risk management contracts (as applicable),

royalties, the cost of diluent blending, operating expenses and

cash transportation & marketing expenses from petroleum,

natural gas and midstream sales which is the most directly

comparable GAAP measure. The Corporate Consolidated Operating

Netbacks including or excluding realized hedging per boe are

non-GAAP ratios calculated by dividing Corporate Consolidated

Operating Income including or excluding hedging by the total sales

volumes and are presented on a per boe basis. The Corporate

Consolidated Operating Income and Corporate Consolidated Operating

Netbacks including or excluding realized hedging measures allow

management and others to evaluate the production results from the

Company’s Duvernay Energy and Athabasca (Thermal Oil) assets

combined together including the impact of realized commodity risk

management gains or losses (as applicable).

|

|

Three months

endedJune 30, |

|

Six months

endedJune 30, |

|

($ Thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Petroleum, natural gas and midstream sales(1) |

$ |

422,028 |

|

$ |

289,310 |

|

$ |

738,607 |

|

$ |

588,301 |

|

|

Royalties |

|

(32,321 |

) |

|

(12,281 |

) |

|

(46,172 |

) |

|

(24,450 |

) |

|

Cost of diluent(1) |

|

(148,166 |

) |

|

(114,430 |

) |

|

(282,026 |

) |

|

(263,363 |

) |

|

Operating expenses |

|

(40,115 |

) |

|

(46,700 |

) |

|

(83,438 |

) |

|

(101,398 |

) |

|

Transportation and marketing(2) |

|

(21,675 |

) |

|

(20,781 |

) |

|

(42,085 |

) |

|

(47,437 |

) |

|

Operating Income |

|

179,751 |

|

|

95,118 |

|

|

284,886 |

|

|

151,653 |

|

|

Realized loss on commodity risk mgmt. contracts |

|

(1,575 |

) |

|

(4,596 |

) |

|

(130 |

) |

|

(26,651 |

) |

|

OPERATING INCOME NET OF REALIZED HEDGING |

$ |

178,176 |

|

$ |

90,522 |

|

$ |

284,756 |

|

$ |

125,002 |

|

(1) Non-GAAP measure includes intercompany NGLs

(i.e. condensate) sold by the Duvernay Energy segment to the

Athabasca (Thermal Oil) segment for use as diluent that is

eliminated on consolidation.(2) Transportation and marketing

excludes non-cash costs of $0.6 million and $1.1 million for the

three and six months ended June 30, 2024 (three and six months

ended June 30, 2023 - $0.6 million and $1.1 million).

Cash Transportation & Marketing Expense

The Cash Transportation & Marketing Expense

financial measure contained in this News Release is calculated by

subtracting the non-cash Transportation & Marketing Expense as

reported in the Consolidated Statement of Cash Flows from the

Transportation & Marketing Expense as reported in the

Consolidated Statement of Income (Loss) and is considered to be a

non-GAAP financial measure.

Sustaining Capital

The Sustaining Capital is managements' assumption of the

required capital to maintain the Company’s production base.

Net Cash

Net Cash is defined as the face value of term

debt, plus accounts payable and accrued liabilities, plus current

portion of provisions and other liabilities less current assets,

excluding risk management contracts and warrant liability.

Liquidity

Liquidity is defined as cash and cash equivalents plus available credit capacity.

Production volumes details

|

|

Three months

endedJune 30, |

|

Six months

endedJune 30, |

|

Production |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Duvernay Energy: |

|

|

|

|

|

|

|

|

|

Oil(1) |

bbl/d |

2,806 |

|

1,412 |

|

2,006 |

|

1,493 |

|

Condensate NGLs |

bbl/d |

— |

|

720 |

|

— |

|

767 |

|

Oil and condensate NGLs |

bbl/d |

2,806 |

|

2,132 |

|

2,006 |

|

2,260 |

|

Other NGLs |

bbl/d |

266 |

|

599 |

|

223 |

|

660 |

|

Natural gas(2) |

mcf/d |

4,706 |

|

13,345 |

|

3,998 |

|

13,848 |

|

Total Duvernay Energy |

boe/d |

3,856 |

|

4,955 |

|

2,895 |

|

5,228 |

|

Total Thermal Oil bitumen |

bbl/d |

33,765 |

|

29,016 |

|

32,651 |

|

29,097 |

|

Total Company production |

boe/d |

37,621 |

|

33,971 |

|

35,546 |

|

34,325 |

(1) Comprised of 99% or greater of tight oil,

with the remaining being light and medium crude oil.(2) Comprised

of 99% or greater of shale gas, with the remaining being

conventional natural gas.

This News Release also makes reference to

Athabasca's forecasted average daily Thermal Oil production of

33,000 - 34,000 bbl/d for 2024. Athabasca expects that 100% of that

production will be comprised of bitumen. Duvernay Energy’s

forecasted average daily production of ~3,000 boe/d for 2024 is

expected to be comprised of approximately 67% tight oil, 23% shale

gas and 10% NGLs.

Liquids is defined as bitumen, light crude oil,

medium crude oil and natural gas liquids.

Footnote: Refer to the “Reader Advisory” section within this news release for additional information on

Non‐GAAP Financial Measures (e.g. Adjusted Funds

Flow, Free Cash Flow, Sustaining Capital, Net

Cash, Liquidity) and production disclosure.1 Pricing

Assumptions: H1 2024 prices actualized and flat pricing of US$80

WTI, US$15 WCS heavy differential, C$67/MWh, C$1.48 AECO, and 0.73

C$/US$ FX for the balance of the year. 2025-26 US$80 WTI, US$12.50

WCS heavy differential, C$3 AECO, and 0.75 C$/US$ FX.2 The

Company’s illustrative multi-year outlook assumes a 10% annual

share buyback program at an implied share price of 4.5x EV/Debt

Adjusted Cash flow in 2025 and beyond.

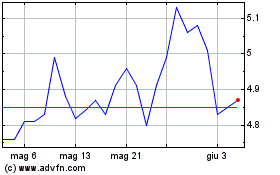

Grafico Azioni Athabasca Oil (TSX:ATH)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Athabasca Oil (TSX:ATH)

Storico

Da Mar 2024 a Mar 2025