Chainlink Just Retested Key Support – Here’s Where Price Could Be Headed Next

14 Aprile 2025 - 6:00PM

NEWSBTC

Chainlink (LINK) is showing renewed promise after a fresh retest of

a crucial support level, hinting that the bulls may be gearing up

for the next phase of its upward move. The recent bounce off this

key support area, previously acting as a barrier, reinforces the

idea that the level has now become a strong foundation. This

move reinforces the strength of the support and builds the case for

a potential upside run. As LINK stabilizes above this key level,

eyes are now on the next resistance zones that could define the

near-term direction. With momentum gradually rebuilding, the stage

might be set for a breakout that could catch the broader market’s

attention. Chainlink Holds Strong: Breaking Down The Critical

Support Retest According to Jimmy X in a recent post on X,

Chainlink has broken out of a falling wedge pattern on the daily

chart, a formation often considered a bullish reversal signal. This

technical development is catching attention as it hints at a

possible shift in momentum after a period of downward

consolidation. Related Reading: Chainlink (LINK) Targets Rebound To

$19 — But Only If This Key Support Holds Jimmy noted that LINK is

currently testing the upper trendline resistance of the wedge, with

trading volume steadily increasing, a strong sign that buyers are

stepping in with conviction. Rising volume alongside a breakout

typically reinforces the validity of the move, suggesting that this

isn’t just a short-lived spike but possibly the beginning of a more

sustained upward trend. He further emphasizes that a

confirmed breakout followed by a successful retest of the previous

resistance as support could trigger a parabolic move for Chainlink.

This bullish setup, often seen as a launchpad for accelerated

rallies, places LINK on track to target multiple upside

levels. Key resistance points include $15.40 and $17.50,

which have historically served as barriers during past price

surges. Beyond these are the $20.00, $23.80, and $26.50 price

levels. With technical indicators aligning and sentiment shifting,

a sustained move above the breakout zone may set the stage for an

extended rally. Downside Potentials While Chainlink’s recent retest

of support shows bullish promise, it’s crucial to acknowledge the

downside risks in case momentum weakens. If the price fails to

maintain its current structure, the first level of support lies

around $12.50. This level has previously served as a strong demand

area, and a breakdown below it might signal the start of a deeper

correction. Related Reading: Support Or Resistance? Chainlink

(LINK) Investor Data Suggests Key Price Zones Further down, the

$11.10 level becomes the next critical point. This area marks a

prior consolidation zone and aligns with the lower trendline of the

broader ascending channel, making it a vital structure for bulls to

defend. A breach below this could open the door for a retest of the

psychological $9.28 level, where the market may once again attempt

to establish a firm base. Featured image from YouTube, chart from

Tradingview.com

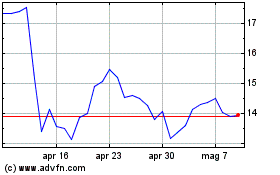

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Apr 2024 a Apr 2025