Hyperliquid opened doors to ‘democratized’ crypto whale hunting: Analyst

18 Marzo 2025 - 2:29AM

Cointelegraph

Crypto whale tracking on the Hyperliquid blockchain has enabled

traders to target whales with prominent leveraged positions in a

“democratized” attempt to liquidate them, according to the head of

10x Research.

Hyperliquid, a

blockchain network specializing in trading, allows traders to

publicly observe what type of positions a whale

is holding, and since these positions are leveraged, the market can

assess the liquidation levels unless an additional margin is added,

Markus Thielen said in a March 17 report.

Source: 10x

Research

“This transparency opens the door for coordinated efforts, where

groups of traders could intentionally target these stop levels to

trigger liquidations,” he said.

It’s a common belief in the crypto market that whales with

substantial holdings can influence the

market through their trading tactics, such as

stop-loss

hunting, to deliberately trigger other traders’

stop-loss

orders and liquidate their positions.

Thielen says the recent actions from traders show this balance

of power could be shifting.

“In effect, stop-hunting is being ‘democratized,’ with ad-hoc

groups now playing a role once reserved mainly for market-making

desks, or treasury teams, at exchanges before tighter regulatory

scrutiny,” Thielen added.

Thielen told Cointelegraph that it’s still “unclear if this type

of activity will become widespread onchain, but as always,

transparency can cut both ways.”

Why are traders trying to liquidate

whales?

This isn’t the first time smaller traders have attempted to take

down larger entities through coordinated trading tactics.

Thielen says crypto traders trying to liquidate whales have

echoes of the GameStop short

squeeze, which saw small traders flip the table on Wall Street

short-sellers by buying GameStop’s stock, sending it to all-time

highs of over $81 to liquid their positions.

“This reminds me of the dynamics we saw during the GameStop saga

in 2020/2021, where aggressive short squeezes drove rapid price

spikes,” he said.

Related: Bybit

CEO on ‘brutal’ $4M Hyperliquid loss: Lower leverage as positions

grow

“When stop levels get triggered, prices often accelerate in that

direction, providing liquidity for others to cover. We’ve seen

similar tactics from market makers and exchanges in the crypto

space over the years.”

Hunt is still on for 40x leveraged Bitcoin

short-seller

On March 16, a crypto whale known for placing large, highly

leveraged positions on Hyperliquid opened a 40x

leveraged short position at $84,043 for over 4,442 Bitcoin

(BTC), worth over $368 million on March

16, facing liquidation if Bitcoin’s price surpassed $85,592.

The move didn’t go unnoticed, and pseudonymous trader CBB

sent out the call on X

to gather a team of traders with enough funds to liquidate the

whale’s position.

Source: CBB

Thielen said in the 10x report that on March 16, Bitcoin surged

by 2.5% within minutes, partly because of a coordinated effort to

liquidate a whale’s short position on Bitcoin perpetual via

Hyperliquid.

The whale has since increased their position to $524

million, and at one point, the whale hunters nearly got their wish

when the price of Bitcoin hit $84,583.84, according to

CoinGecko.

Source: CRG

However, some speculate the exposed short position could be

intentional.

Hedge fund trader Josh Man said in a March 17 post

to X that the whale might be purposefully trying to get

liquidated.

“So this there is a fairly rare and not widely used technique of

self-liquidation and this FEELS a little like that,” he

said.

“In such events, the seller is actually creating a bomb designed

to go off and create a rally from the liquidation of his own short.

One would expect that he has a large offsetting long versus

short.”

Source: Josh Man

Magazine: Crypto fans are obsessed with longevity and

biohacking: Here’s why

...

Continue reading Hyperliquid opened doors to

‘democratized’ crypto whale hunting: Analyst

The post

Hyperliquid opened doors to ‘democratized’ crypto

whale hunting: Analyst appeared first on

CoinTelegraph.

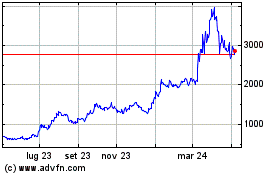

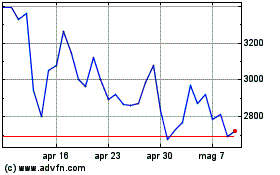

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Mar 2025