Biopharma exec says Bitcoin could help industry through ‘biotech winter’

21 Marzo 2025 - 3:19AM

Cointelegraph

NASDAQ-listed biopharmaceutical firm Atai Life Sciences says

cryptocurrencies like Bitcoin could be key to survival for biotech

startups as they wade through years of regulatory

approvals.

Atai, which is developing mental health treatments using

psychedelics like DMT and MDMA, has become the latest public

company to announce plans to buy Bitcoin.

It plans to buy $5 million of Bitcoin (BTC), its founder and

chair Christian Angermayer wrote in a

March 20 Substack post.

“Drug development is a cash-hungry, long-term venture,” he said.

“The necessary steps to achieve regulatory approval can easily take

more than a decade.”

TechCrunch reported in

January that, according to multiple data sets, the number of

startups shutting down rose in 2024 compared to 2023 as firms

failed to receive more funding to keep running.

Angermayer said the approval process is essential for drug

development, but it exposes firms to financial risks while

sticky

inflation and high interest rates have caused the current

“biotech winter.”

Source: Christian

Angermayer

He added that the current industry approach is to put cash

reserves in near-zero-yield accounts, as “preserving capital was

more important than earning a return on their cash balance.”

“This context sets the stage for considering unconventional

treasury moves — like adding Bitcoin to the treasury — to address

the twin threats of inflation and low-yielding reserves, and in

general to optimize and maximize shareholder value.”

Atai will join at least five other public medical companies that

have bought

Bitcoin in recent months with the aim of boosting shareholder

returns.

Biotech firm Quantum BioPharma said on March

20 that it had now spent $3.5 million in total to buy BTC and other

cryptocurrencies after an initial $1 million investment in

December.

Medical device maker Semler Scientific said last

month that since it started in May, it had spent a total of

$280.4 million buying 3,192 BTC.

Hoth

Therapeutics, Acurx Pharmaceuticals and Enlivex Therapeutics

said in separate

statements on

Nov. 20 that each of them would buy $1 million in Bitcoin.

Related: Michael Saylor’s Strategy plans to offer 5M

shares to buy more Bitcoin

Atai’s Angermayer said his firm’s Bitcoin buy would primarily be

as a long-term inflation hedge but also a short-term

diversification play. He added that Bitcoin is likely to have

short-term price fluctuations, so the Berlin-based firm is holding

mostly US dollars, short-term securities, and stocks for its

desired run rate into 2027.

Atai’s $5 million put would mean it is able to buy just over 59

BTC at its current price of around $84,300 and make it the world’s

52nd largest holder among public firms, according to Bitbo

data.

Bitcoin has struggled to keep

afloat amid a wider market rout due to US President Donald

Trump’s tariff threats and fears of a US recession, which Trump

hasn’t ruled out.

Atai’s share price rose early in March 20 trading to a peak of

$1.47 but tapered off to close the day down 1.44% at $1.37,

according to Google

Finance. Its stock has sunk nearly 93% from its mid-2021 public

debut peak but is up 3% so far this year.

Magazine: Crypto fans are obsessed with longevity and

biohacking — Here’s why

...

Continue reading Biopharma exec says Bitcoin could

help industry through ‘biotech winter’

The post

Biopharma exec says Bitcoin could help industry

through ‘biotech winter’ appeared first on

CoinTelegraph.

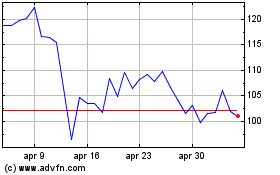

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Feb 2025 a Mar 2025

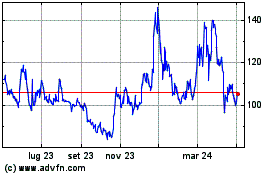

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2024 a Mar 2025