Ethereum Capitulation Nearing Its End? Key On-Chain Metric Reveals Insights

12 Aprile 2025 - 10:00AM

NEWSBTC

According to a recent X post by seasoned crypto analyst Ali

Martinez, Ethereum (ETH) may have already gone through its

capitulation phase for this market cycle. Notably, the

second-largest cryptocurrency by market cap is down more than 55%

over the past year. Is Ethereum Capitulation Over? Unlike Bitcoin

(BTC) and altcoins such as XRP, Solana (SOL), and SUI, Ethereum has

endured a challenging two-year stretch. The cryptocurrency was

trading at $1,892 exactly two years ago, on April 11, 2023, and is

now priced around $1,560 – over 17% lower. Related Reading: Is

Ethereum Repeating Its 2020 Trend Reversal? Analyst Predicts ETH To

‘Explode’ In Q2 2025 In contrast, BTC has surged from approximately

$41,000 two years ago to $82,127 at the time of writing – an

increase of nearly 100%. While SOL currently trades below its April

2023 price, unlike ETH, it did manage to reach a new all-time high

(ATH) of $293 earlier this year in January. Understandably,

sentiment toward ETH – among both retail and institutional

investors – is hovering near all-time lows. However, Martinez

believes that “smart money” may be accumulating at current levels,

anticipating a near-term reversal. The analyst pointed out that

Ethereum’s Entity-Adjusted Dormancy Flow has recently dropped below

one million. Martinez added: This historically indicates a macro

bottom zone, meaning $ETH might be undervalued and long-term

holders are less inclined to sell. It also suggests: sentiment is

low, capitulation may have occurred, smart money might be

accumulating. For the uninitiated, Ethereum’s Entity-Adjusted

Dormancy Flow is an on-chain metric that compares the market cap to

the dormancy – the average age of ETH being moved – adjusted for

unique entities instead of raw addresses. The metric helps identify

whether the market is overheated or undervalued by tracking the

behavior of long-term holders. If ETH follows historical trends, it

may be approaching a momentum reversal. In a separate X post,

crypto trader Merlijn The Trader suggested that Bitcoin Dominance

(BTC.D) is nearing a peak, which could shift capital into altcoins

and trigger a short-term rally. At the time of writing, BTC.D

stands around 63.5%. A potential pivot by the US Federal Reserve

toward quantitative easing (QE) could inject fresh liquidity into

the market, possibly sparking a mini altcoin rally. ETH Demands

Cautious Optimism While there are multiple signs that ETH may be

close to bottoming out, some indicators suggest that there could be

continued weakness for the digital asset before any meaningful

momentum shift. Related Reading: Analyst Spots Key Ethereum

Resistance Levels While RSI Hints At Bullish Divergence In a recent

analysis, Martinez warned that ETH could fall as low as $1,200 if

the current sell-off continues. Further, ongoing capital outflows

from US-based spot Ethereum exchange-traded funds (ETF) remain a

concern for the asset’s short-term outlook. That said, crypto

analyst NotWojak recently noted that ETH may be on the verge of a

breakout, with a potential upside target of $1,835. At press time,

ETH is trading at $1,557, down 2.3% in the past 24 hours. Featured

image created with Unsplash, charts from X and TradingView.com

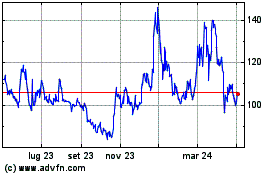

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

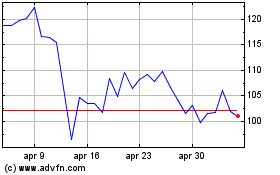

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025