JCDecaux : Q1 2024 – Business review

Q1 2024 – Business review

Paris, May

17th, 2024 – JCDecaux SE

(Euronext Paris: DEC), the number one outdoor advertising company

worldwide, published today this report for the three months ended

March 31st, 2024.

FIRST QUARTER 2024: BUSINESS HIGHLIGHTS

Key contracts wins

In January, JCDecaux SE announced that JCDecaux

Pearl & Dean, a 100% sister company has won the renewal of its

exclusive advertising contracts with MTR Corporation for the

operation and management of advertising across a total of eight

MTR* lines including Airport Express, as well as the non-exclusive

rights to sell and promote MTR Mobile advertising. The

renewed contracts are effective from 1st January 2024 to

31st December 2028 with the option for MTR to extend up to a

total of 10 years.

*Mass Transit Railway means the MTR Lines

including Island Line, South Island Line, Tsuen Wan Line, Kwun Tong

Line, Tung Chung Line, Tseung Kwan O Line, Disneyland Resort

Line. MTR advertising refers to advertising exclusively

operated by JCDecaux Transport, including above MTR lines and

Airport Express.

In January, JCDecaux SE announced that JCDecaux

China has won the exclusive advertising contract with Shenzhen

Bao’an International Airport, following a tender. This new

contract, effective on February 1st, 2024, extends JCDecaux’s

footprint in Chinese airports ensuring a strong presence in the

Guangdong-Hong Kong-Macao Greater Bay Area, one of the most dynamic

regions in the world, which counts more than 86 million

inhabitants. JCDecaux will invest in new iconic giant digital

screens, data and software, accompanying the digital transformation

of the airport.

Other events

In February, JCDecaux SE announced the launch of

the first global airport programmatic DOOH offer, a

first-of-its-kind solution that empowers brands and agencies to

execute targeted, dynamic and contextualised advertising campaigns

effortlessly across JCDecaux's programmatic-enabled airports

through the VIOOH SSP (Supply Side Platform) and more than 30 DSPs

(Demand Side Platform), including Displayce where it’s already

available.

In February, JCDecaux SE confirmed that it has

entered into an agreement with Pargesa Asset Management S.A., to

evaluate an intended coordinated disposal of their stakes in

APG|SGA of 30% and 25.3% respectively, following the announcement

of APG|SGA that its Board of Directors has decided to initiate a

process which aimed at finding a potential acquirer for the entire

company.

In February, JCDecaux has unveiled its latest

international airport research called “First Class Advertising –

The Enduring Magic of Airports”. This comprehensive study, carried

out by Ipsos, provides an updated perspective on air passenger

profiles, their relationship with the airport environment and their

perception of advertising within airports.

In March, JCDecaux SE announced that Software

République welcomed JCDecaux, paving the way for new

open-innovation opportunities for cities and citizens. JCDecaux

strengthens the Software République ecosystem as a new member

alongside Dassault Systèmes, Eviden, Orange, Renault Group,

STMicroelectronics and Thales. With its seven members and multiple

partners, Software République can count on new collaborations in

supporting territories and public services to meet their challenges

of tomorrow.

FIRST QUARTER 2024 AND OUTLOOK

Commenting on the 2024 first quarter revenue,

Jean-François Decaux, Chairman of the Executive Board and

Co-CEO of JCDecaux, said:

“Our Q1 2024 Group revenue grew by +11.1%,

+11.0% on an organic basis, above our expectations, to reach €801.6

million driven by continued strong digital revenue growth across

all business segments.

Digital Out Of Home (DOOH) revenue grew by

+28.0%, +27.9% on an organic basis, to reach 35.9% of Group revenue

including a continued strong programmatic revenue growth enhanced

by the increased adoption of this new way of trading our media by

advertisers including through the VIOOH SSP (Supply Side Platform)

and Displayce DSP (Demand Side Platform).

All activities recorded strong organic revenue

growth: Street Furniture grew by +9.2% with continued strong

momentum, Transport grew by +15.1% reflecting the solid recovery in

both airports and public transport systems in all geographies

except in China, and Billboard grew by +7.0% driven by its most

digitised markets.

All geographies grew positively in Q1 including

double-digit revenue growth in United Kingdom, Asia-Pacific and

Rest of the World. The gradual recovery of our activity in China,

which remained well below pre-covid levels, is continuing with a

high single-digit organic revenue growth rate this quarter.

As far as Q2 is concerned, we expect organic

revenue growth around +12.0% driven by continued strong digital

revenue growth across all business segments and including the

positive impact of the Paris Olympics and the UEFA Euro 2024 in

Germany.

We are confident that Out of Home (OOH) will

continue to grow its market share in a fragmented media landscape

with Digital Out of Home (DOOH) being the fastest growing media

segment. JCDecaux as the industry leader and the most digitised

global OOH Media company is well positioned to benefit from this

digital transformation.”

Following the adoption of IFRS 11 from January

1st, 2014, the operating data presented below is adjusted to

include our prorata share in companies under joint control. Please

refer to the paragraph “Adjusted data” of this release for the

definition of adjusted data and reconciliation with IFRS.The values

shown in the tables are generally expressed in millions of euros.

The sum of the rounded amounts or variations calculations may

differ, albeit to an insignificant extent, from the reported

values.

Adjusted revenue for the first quarter 2024

increased by +11.1% to €801.6 million compared to

€721.3 million in the first quarter of 2023.Excluding the

negative impact from foreign exchange variations and the positive

impact of changes in perimeter, adjusted revenue increased by

+11.0%.Adjusted advertising revenue, excluding revenue related to

sale, rental and maintenance of street furniture and advertising

displays, increased by +12.0% on an organic basis in the first

quarter of 2024.

By activity:

|

Q1 adjusted revenue |

2024 (€m) |

2023 (€m) |

Reported growth |

Organic growth(a) |

|

Street Furniture |

400.8 |

364.3 |

+10.0% |

+9.2% |

|

Transport |

288.2 |

254.0 |

+13.5% |

+15.1% |

|

Billboard |

112.6 |

103.0 |

+9.4% |

+7.0% |

|

Total |

801.6 |

721.3 |

+11.1% |

+11.0% |

a. Excluding acquisitions/divestitures and the impact of foreign

exchange

Please note that the geographic comments below

refer to organic revenue growth.

STREET FURNITURE

First quarter adjusted revenue increased by

+10.0% to €400.8 million (+9.2% on an organic basis). UK,

Asia-Pacific and Rest of the World all grew double-digit. France

recorded mid-single-digit growth, while the rest of Europe saw

high-single-digit growth.

First quarter adjusted advertising revenue,

excluding revenue related to sale, rental and maintenance of street

furniture was up +9.8% on an organic basis.

TRANSPORT

First quarter adjusted revenue increased by

+13.5% to €288.2 million (+15.1% on an organic basis),

reflecting the solid recovery of our activity in both airports and

public transport systems in all geographies except in China. Most

geographies grew double-digit. Transport remained meaningfully

impacted by the lower level of activity in China compared to

pre-covid.

BILLBOARD

First quarter adjusted revenue increased by

+9.4% to €112.6 million (+7.0% on an organic basis) driven by

the most digitised markets, while France decreased due to the

ongoing rationalisation of our inventory in line with regulations.

UK and Rest of the World were the drivers of growth with a

double-digit increase.

ADJUSTED DATA

Under IFRS 11, applicable from January 1st,

2014, companies under joint control are accounted for using the

equity method.However, in order to reflect the business reality of

the Group, operating data of the companies under joint control will

continue to be proportionately integrated in the operating

management reports used by directors to monitor the activity,

allocate resources and measure performance.Consequently, pursuant

to IFRS 8, Segment Reporting presented in the financial statements

complies with the Group’s internal information, and the Group’s

external financial communication therefore relies on this operating

financial information. Financial information and comments are

therefore based on “adjusted” data, consistent with historical data

prior to 2014, which is reconciled with IFRS financial

statements.In Q1 2024, the impact of IFRS 11 on adjusted

revenue was -€61.2 million (-€49.5 million in

Q1 2023), leaving IFRS revenue at €740.4 million

(€671.8 million in Q1 2023).

ORGANIC GROWTH DEFINITION

The Group’s organic growth corresponds to the

adjusted revenue growth excluding foreign exchange impact and

perimeter effect. The reference fiscal year remains unchanged

regarding the reported figures, and the organic growth is

calculated by converting the revenue of the current fiscal year at

the average exchange rates of the previous year and taking into

account the perimeter variations prorata temporis, but including

revenue variations from the gains of new contracts and the losses

of contracts previously held in our portfolio.

|

€m |

|

Q1 |

|

|

|

|

|

2023 adjusted revenue |

(a) |

721.3 |

|

|

|

|

|

2024 IFRS revenue |

(b) |

740.4 |

|

IFRS 11 impacts |

(c) |

61.2 |

|

2024 adjusted revenue |

(d) = (b) + (c) |

801.6 |

|

Currency impacts |

(e) |

7.1 |

|

2024 adjusted revenue at 2023 exchange rates |

(f) = (d) + (e) |

808.7 |

|

Change in scope |

(g) |

-8.4 |

|

2024 adjusted organic revenue |

(h) = (f) + (g) |

800.3 |

|

|

|

|

|

Organic growth |

(i) = (h) / (a) – 1 |

+11.0% |

|

€m |

Impact of currency as of March

31st, 2024 |

|

|

|

|

RMB |

3.1 |

|

AUD |

3.0 |

|

GBP |

-2.6 |

|

BRL |

-0.9 |

|

Other |

4.5 |

|

|

|

|

Total |

7.1 |

|

Average exchange rate |

Q1 2024 |

Q1 2023 |

|

|

|

|

|

RMB |

0.1281 |

0.1305 |

|

AUD |

0.6057 |

0.6140 |

|

GBP |

1.1676 |

1.1497 |

|

BRL |

0.1860 |

0.1851 |

Forward looking statements

This news release may contain some

forward-looking statements. These statements are not undertakings

as to the future performance of the Company. Although the Company

considers that such statements are based on reasonable expectations

and assumptions on the date of publication of this release, they

are by their nature subject to risks and uncertainties which could

cause actual performance to differ from those indicated or implied

in such statements.These risks and uncertainties include without

limitation the risk factors that are described in the universal

registration document registered in France with the French Autorité

des Marchés Financiers.Investors and holders of shares of the

Company may obtain copy of such universal registration document by

contacting the Autorité des Marchés Financiers on its website

www.amf-france.org or directly on the Company website

www.jcdecaux.com.The Company does not have the obligation and

undertakes no obligation to update or revise any of the

forward-looking statements.

FINANCIAL SITUATION

The evolution of revenue is the major factor

which to impact the operating margin, free cash flow or net debt

during Q1 2024.

- 17-05-24 # Q1 2024_Business Review

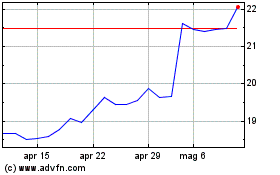

Grafico Azioni JCDecaux (EU:DEC)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni JCDecaux (EU:DEC)

Storico

Da Mar 2024 a Mar 2025