Regulatory News:

Sopra Steria (Paris:SOP), a major tech player in Europe,

announces its intention to sell most of Sopra Banking Software’s

operations to Axway Software, representing annual sales of around

€340m, for an enterprise value of €330m. As part of this project,

Sopra Steria also intends to sell 3.619 million of Axway shares to

Sopra GMT, at a price of €26.5 per share for an amount of

€95.9m.

Sopra Steria is actively pursuing an independent model that

creates sustainable value for its stakeholders. In this context,

the Group is clarifying its strategy with the announcement of its

intention to sell its banking software operations.

Sopra Banking Software was created in 2012 by capitalising on

banking software assets from Sopra’s legacy and several

acquisitions that significantly enhanced its core banking and

specialised credit offerings. The strategy developed by Sopra

Banking Software is to be a high-value business software provider.

It has more than 650 clients worldwide, including the 10 largest

European banks and half of the banks in Africa. 250 banks in Europe

use Sopra Banking Software’s payment solutions.

This project fits Sopra Steria's ambition to strengthen its

presence in Europe and to focus its investments on consulting and

digital services in its strategic market verticals: financial

services, defense & security, aerospace and public sector. The

Group aspires to become a compelling European alternative to global

players, in particular to provide solutions to its major European

clients’ digital sovereignty challenges.

In this respect, the project announced today would entail a

global operation with two indivisible components: the sale by Sopra

Steria to Axway Software of most of Sopra Banking Software’s

activities on the one hand, and the sale by Sopra Steria to Sopra

GMT of 3,619 million of Axway securities on the other.

Regarding the disposal of the majority of Sopra Banking

Software’s activities to Axway Software, the scope in question

generated around €340m of revenue during fiscal year 2023, which

represents approximately 80% of Sopra Banking Software's entire

business. Retained activities would consist of services or project

activities for large banks or financial institutions which will

continue to contribute to Sopra Steria’s ambitions in the financial

services market.

The contemplated disposal would be completed for an enterprise

value of €330m.

Axway Software has announced its intention to finance part of

the contemplated transaction through a capital increase with

preferential subscription rights attached (rights issue). Sopra

Steria would not subscribe to the rights issue but would sell all

of its rights to Sopra GMT who indicated its intention, as part of

the capital increase, to exercise its rights and those acquired

from Sopra Steria, and to commit to subscribe any shares that would

remain unsubscribed at the end of the allocation process.

As part of this project, Sopra Steria intends to sell 3.619

million of Axway shares out of the 6.914 million shares that it

currently holds to Sopra GMT. This sale would be completed at a

price of €26.5 per Axway share, for an amount of €95.9m, which

represents a 4.7% premium on Axway’s 6-month VWAP and a 2.9%

discount on Axway’s 3-month VWAP.

The valuation of Sopra Banking Software’s activities (€330m

enterprise value) and the Axway price per share (26.5€ per share)

will be reviewed by an independent expert (Crowe HAF).

After these transactions, taking into account the capital

increase of Axway and the sale by Sopra Steria to Sopra GMT of its

preferential subscription rights, Sopra Steria would remain a

shareholder of Axway with a stake of around 11% and would benefit

from Axway’s value creation through its residual shareholding. In

addition, a new strategic partnership between the two companies

would be established.

At Sopra GMT level, Sopra Steria’s reference shareholder with

19.6 % of its share capital, the financing of these operations

would be ensured by a capital increase reserved to a financial

minority partner (One Equity Partners), with whom Sopra GMT is in

advanced discussions to conclude a binding agreement1. Sopra GMT

affirms its commitment and support to the success of Sopra Steria’s

enterprise project. Sopra Steria’s capital structure remains

unchanged.

The estimated accounting impacts on Sopra Steria include (i) a

slight accretion on its operating margin rate on an annual basis

and (ii) a decrease of its net financial debt by at least €425.9m

and a stronger investment capacity to pursue its growth strategy,

including through acquisitions, with strict financial

discipline.

Sopra Steria granted exclusive rights to Axway and Sopra GMT to

negotiate these transactions. At the end of these negotiations, the

conclusion of binding agreements between Sopra Steria, Axway and

Sopra GMT will remain subject to the approval of the boards of

directors of the three companies, based on the reports of the

independent experts, that will take place after information and

consultation procedures with the employee representative bodies of

the entities in question.

The goal is to complete these operations before the end of the

second quarter of 2024 or, at the latest, during the third quarter

of 2024. They would be subject to obtaining the necessary

regulatory approvals, including a decision by the AMF on the

absence of any obligation to file a tender offer2, and to the

approval by the AMF of the prospectus to be submitted by Axway as

part of its capital increase.

Société Générale acts as Financial Advisor to Sopra Steria

Group. Crédit Agricole Corporate and Investment Bank acts as

Financial Advisor to Axway. Messier & Associés acts as

Financial Advisor to Sopra GMT.

Pierre Pasquier, Chairman of Sopra Steria Group,

stated:

“The strategic review conducted since 2022 has led us to

accelerate our transformation to adapt the company to a fast moving

environment, ensure its development throughout Europe and reach a

top level of performance within our industry. Our ambition is to

make Sopra Steria a genuine European alternative to global players

in the industry.

Developed since 2012 based on banking software assets from

Sopra’s history and acquisitions, Sopra Banking Software’s software

business is not central to the strategic priorities of a European

digital services company like Sopra Steria. It is in this context

and in line with the transformations already engaged, that today‘s

announcement clarifies our strategy with the plan to focus our

activities and investments on digital services and solutions in

Europe.

In this new model, and in order to meet the challenges of an

increasingly digital world where software plays a prominent role,

it will be strategically important to develop a stronger

partnership between Sopra Steria and Axway Software to support the

digital transformation of our major clients in the financial

services sector.

Sopra GMT is actively committed to the success of Sopra Steria’s

and Axway’s enterprise projects in the long term. The project

announced should create value for customers, employees and

shareholders in both groups”.

Fiscal year 2024 will be dedicated to building Sopra Steria’s

strategic plan for the 2025-2027 period. This plan will be

presented during a Capital Market Day scheduled for the beginning

of December 2024.

Analysts and Investors Meeting

A meeting with financial analysts and investors via a bilingual

French / English webcast will take place on Thursday, February 22,

2024 at 8:30 a.m. Paris time.

- Registration for the French webcast: here -

Registration for the English webcast: here

Or by phone:

- French access number: +33 1 70 37 71 66 -

English access number: +44 33 0551 0200

Practical information about this conference and its webcast

diffusion can be found on the Group's website under the Investors

section: https://www.soprasteria.com/investors

Upcoming financial publications

Thursday, February 22, 2024 (before market opening): 2023 annual

results publication.

Friday, April 26, 2024 (before market opening): Q1 2024 revenues

publication.

Tuesday 21 May 2024 at 2:30 p.m.: General Meeting of

Shareholders.

Wednesday, July 24, 2024 (after market close): publication of

results for the first half of 2024.

Thursday, October 31, 2024 (before market opening): Q3 2024

revenues publication.

Basis of the derogations that will be requested from the

AMF

One Equity Partners would, as a result of its acquisition of a

stake in Sopra GMT, indirectly in concert, exceed the thresholds of

30% of Sopra Steria's voting rights and 30% of Axway's share

capital and voting rights. In connection with this acquisition, the

AMF will be asked to grant waivers to the mandatory filing of a

tender offer on Sopra Steria and on Axway on the basis of Articles

234-7, 1° and 234-7, 2° of the AMF's general regulation.

Sopra GMT, individually, (i) would, as a result of the

acquisition of Axway shares from Sopra Steria, exceed the

thresholds of 30% of Axway's share capital and voting rights and

(ii) would, as a result of its participation in Axway's capital

increase, increase its stake in Axway's share capital and voting

rights by more than 1% within a period of less than twelve

consecutive months; a waiver to the mandatory filing of a tender

offer on Axway will also be requested from the AMF on the basis of

article 234-9, 6° of the AMF's general regulation.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that license

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2022 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 17 March 2023 (see

pages 40 to 45 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a major Tech player in Europe with 56,000

employees in nearly 30 countries, is recognised for its consulting,

digital services and software development. It helps its clients

drive their digital transformation and obtain tangible and

sustainable benefits. The Group provides end-to-end solutions to

make large companies and organisations more competitive by

combining in-depth knowledge of a wide range of business sectors

and innovative technologies with a fully collaborative approach.

Sopra Steria places people at the heart of everything it does and

is committed to putting digital to work for its clients in order to

build a positive future for all. In 2023, the Group generated

revenue of €5.8 billion. The world is how we shape it. Sopra

Steria (SOP) is listed on Euronext Paris (Compartment A) – ISIN:

FR0000050809 For more information, visit us at

www.soprasteria.com

____________________________ 1 One Equity Partners would own

around 20% of Sopra GMT’s share capital. 2 See below for the basis

of the derogations that will be requested from the AMF.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221074415/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

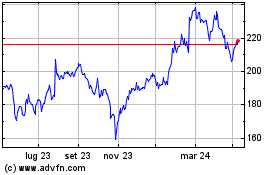

Grafico Azioni Sopra Steria (EU:SOP)

Storico

Da Feb 2025 a Mar 2025

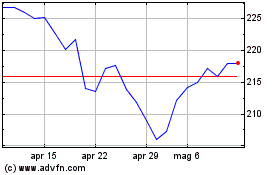

Grafico Azioni Sopra Steria (EU:SOP)

Storico

Da Mar 2024 a Mar 2025