Form 8-K - Current report

29 Agosto 2024 - 10:03PM

Edgar (US Regulatory)

0001324424false00013244242024-08-292024-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): August 29, 2024

EXPEDIA GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37429 | | 20-2705720 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

1111 Expedia Group Way W.

Seattle, Washington 98119

(Address of principal executive offices) (Zip code)

(206) 481-7200

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address if changed since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

Common stock, $0.0001 par value | | EXPE | | Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 7.01. Regulation FD Disclosure.

On August 29, 2024, Expedia Group, Inc. (the “Company”) will attend Deutsche Bank’s 2024 Technology Conference where Ariane Gorin, the Company's Chief Executive Officer, will participate in a fireside chat at 5:45pm Eastern Time. A live webcast of the session along with the investor presentation to be used in conjunction with the conference (the "Investor Presentation") will be available on the Company's Investor Relations website at http://ir.expediagroup.com. The Company may also use the Investor Presentation in connection with presentations to investors, analysts, and other interested parties thereafter.

The information in this Form 8-K being furnished under Item 7.01 and 9.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The Investor Presentation speaks only as of the date of this Current Report on Form 8-K. The Company undertakes no duty or obligation to publicly update or revise the information contained in the Investor Presentation, although it may do so from time to time. The Investor Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements are based on the Company’s expectations and involve risks and uncertainties that could cause the Company’s actual results to differ materially from those set forth in the statements. These risks are discussed in the Company’s filings with the Securities and Exchange Commission, including an extensive discussion in the "Risk Factors" section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

A copy of the Investor Presentation is furnished herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EXPEDIA GROUP, INC. |

| | |

| By: | /s/ Bob Dzielak |

| | Bob Dzielak |

| | Chief Legal Officer |

Dated: August 29, 2024

B2B Overview August 2024

Safe harbor disclaimer Forward-looking statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements that describe Expedia Group management's projections, beliefs, intentions or goals. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of Expedia Group. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including those risks discussed in our Annual Report on Form 10-K for the year ended December 31, 2023, Part I, ITEM 1A, “Risk Factors.” The forward-looking statements included in this presentation are made only as of the date hereof and Expedia Group undertakes no obligation to update the forward-looking statements to reflect subsequent events or circumstances, except as required by law. Industry / market data Industry and market data used in this presentation have been obtained from industry publications and sources as well as from research reports prepared for other purposes. We have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. Trademarks & logos Trademarks and logos are the property of their respective owners. © 2024 Expedia, Inc. All rights reserved. 2

Expedia Group is a global leader in online travel and technology 3 500+ airlines 550k+ hotels 3M vacation rentals 120+ car rentals 30+ cruise lines 220k+ tours and activities Unmatched breadth & depth of travel supply AI/ML driven technology platform promotional rates (package/member) Consumer travel brands B2B business powering partners advanced planning, shopping & booking capabilities attach and cross- sell shopping multi-channel servicing powerful rewards Source: Expedia Group internal data for Q2 2024. personalizationtesting at scale fintech capabilities Media and advertising solutions We enable the complete travel journey across planning, shopping, booking and service

100 million+ Room Nights $25 billion Gross Bookings 60 thousand+ Partners We have a massive, industry-leading B2B business 4 Source: Expedia Group internal data for full year 2023

We’ve grown our B2B business rapidly over the last few years Gross Bookings 12% 24% Note: B2B gross bookings, room nights, revenue, and Adjusted EBITDA metrics above exclude Egencia, which was divested in 2021. 1 Non-GAAP measure. See slide 15 for non-GAAP to GAAP reconciliation. % of EG Total: 5 2018 2023 +16% CAGR $25B Room Nights 16% 30% 2018 2023 +14% CAGR 106M % of EG Total: Revenue 14% 26% 2018 2023 +16% CAGR $3.4B % of EG Total: Adjusted EBITDA1 12% 30% 2018 2023 +28% CAGR $798M % of EG Total:

60%+30%+ of B2B bookings come from partner loyalty programs (e.g., credit cards & airlines) ~15% B2B is incremental demand D I F F E R E N T U S E C A S E S D I F F E R E N T G E O G R A P H I E S D I F F E R E N T T R A V E L O C C A S I O N S of B2B bookings are outside of US1 of B2B bookings from corporate travel Expedia Group internal data for full year 2023. 1 Based on point of sale of partner headquarters 6

$0.4T $1.2T $1.4T Large white space exists for further growth Source: Euromonitor 2025 travel market estimates. Bloomberg EXPE/BKNG/ABNB FY25 consensus gross bookings estimates. Expedia B2B today represents only 3% of our SAM Serviceable Addressable Market (SAM) 7 Direct Suppliers EXPE/BKNG/ABNB Global Travel Industry $3 Trillion

Key differentiators and competitive moats for our B2B business 8 Strong hotel supply with competitive rates, margins, and excellent content Best in class distribution products and technology 01 02 Large, growing and diversified partner base Experienced and dedicated technology and commercial teams 03 04

Our B2C and B2B scale re-enforces our strong hotel supply 9 01 Better Supply Incremental B2B demand B2C Scale

We have three major travel distribution products API technology for partners to integrate supply and content into their own travel experiences End-to-end technology solution including supply, site experience, booking engine and servicing. May include custom loyalty integration Easy-to-use turnkey tool purpose built for travel agents 10 02 Rapid Hotel API White Label Template Travel Agent Affiliate Program

We have a large, growing and diversified 60k+ partner base Financial institutions Online travel agencies Offline travel agents Airlines Retailers Travel Management Companies Travelers … and more 03 11

We are the leader in B2B and have scaled rapidly over the last few years B2B is incremental and synergistic to our B2C business, with whitespace to grow further Our B2B business is differentiated and diversified across geographies and partner types We expect B2B growth to decelerate as global growth normalizes, but still hit double digits We’ll continue to invest in supply, technology, partnerships and our team to fuel our growth Key Messages S U M M A R Y 12

T H A N K Y O U

Non-GAAP Definitions Adjusted EBITDA is defined as net income (loss) attributable to Expedia Group adjusted for: (1) net income (loss) attributable to non-controlling interests; (2) provision for income taxes; (3) total other expenses, net; (4) stock-based compensation expense, including compensation expense related to certain subsidiary equity plans; (5) acquisition-related impacts, including (i) amortization of intangible assets and goodwill and intangible asset impairment, (ii) gains (losses) recognized on changes in the value of contingent consideration arrangements; and (iii) upfront consideration paid to settle employee compensation plans of the acquiree; (6) certain other items, including restructuring; (7) items included in legal reserves, occupancy tax and other, which includes reserves for potential settlement of issues related to transactional taxes (e.g. hotel and excise taxes), related to court decisions and final settlements, and charges incurred, if any, for monies that may be required to be paid in advance of litigation in certain transactional tax proceedings; (8) that portion of gains (losses) on revenue hedging activities that are included in other, net that relate to revenue recognized in the period; and (9) depreciation. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, not driven by core operating results and renders comparisons with prior periods and competitors less meaningful. We believe Adjusted EBITDA is a useful measure for analysts and investors to evaluate our future on-going performance as this measure allows a more meaningful comparison of our performance and projected cash earnings with our historical results from prior periods and to the results of our competitors. Moreover, our management uses this measure internally to evaluate the performance of our business as a whole and our individual business segments. In addition, we believe that by excluding certain items, such as stock-based compensation and acquisition-related impacts, Adjusted EBITDA corresponds more closely to the cash operating income generated from our business and allows investors to gain an understanding of the factors and trends affecting the ongoing cash earnings capabilities of our business, from which capital investments are made and debt is serviced. Adjusted EBITDA for our B2B segment includes allocations of certain expenses, primarily cost of revenue and facilities, the total costs of our global travel supply organizations, the majority of platform and marketplace technology costs, and the realized foreign currency gains or losses related to the forward contracts hedging a component of our net merchant lodging revenue. We base the allocations primarily on transaction volumes and other usage metrics. We do not allocate certain shared expenses such as accounting, human resources, certain information technology and legal to our reportable segments. We include these expenses in Corporate and Eliminations. Our allocation methodology is periodically evaluated and may change. 14

Non-GAAP / GAAP Reconciliation: Adjusted EBITDA Note: Expedia Group does not calculate or report net income (loss) by segment. 15 Consolidated (in millions) 2023 Net income attributable to Expedia Group Inc. 797 Net income (loss) attributable to non-controlling interests (109) Provision for income taxes 330 Total other (income) expense net 15 Operating income 1,033 Gain (loss) on revenue hedges related to revenue recognized (7) Legal reserves occupancy tax and other 8 Stock-based compensation 413 Depreciation and amortization 807 Impairment of goodwill 297 Intangible and other long-term asset impairment 129 Adjusted EBITDA 2,680 B2B Segment (in millions) 2023 Operating income (loss) 681 Realized gain (loss) on revenue hedges 4 Depreciation 113 Adjusted EBITDA 798

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

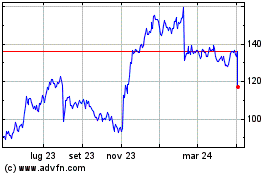

Grafico Azioni Expedia (NASDAQ:EXPE)

Storico

Da Mar 2025 a Mar 2025

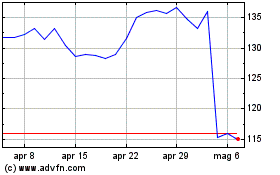

Grafico Azioni Expedia (NASDAQ:EXPE)

Storico

Da Mar 2024 a Mar 2025