0001681459DEF 14Afalseiso4217:USDxbrli:pure00016814592024-01-012024-12-3100016814592023-01-012023-12-3100016814592022-01-012022-12-3100016814592021-01-012021-12-3100016814592020-01-012020-12-310001681459ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001681459ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001681459ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001681459ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001681459ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001681459ecd:PeoMember2024-01-012024-12-310001681459ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001681459ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001681459ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001681459ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001681459ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001681459ecd:NonPeoNeoMember2024-01-012024-12-31000168145912024-01-012024-12-31000168145922024-01-012024-12-31000168145932024-01-012024-12-31000168145942024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

TECHNIPFMC PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2025 Annual General Meeting of Shareholders

TechnipFMC plc, a public limited company having its registered office at Hadrian House, Wincomblee Road, Newcastle upon Tyne, NE6 3PL, United Kingdom, and incorporated in England and Wales with company number 0990970

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| April 25, 2025 at | | | | Your vote is very important. | |

| | | | | | | | |

| 4:00 p.m., London time | | | | Please ensure you: (i) promptly return the enclosed proxy card in the enclosed envelope or (ii) grant a proxy and give voting instructions by telephone or internet, so that you may be represented at the meeting. Voting instructions are provided on your proxy card or on the voting instruction form provided by your broker. | |

| | | | | | |

| Hadrian House, Wincomblee Road, Newcastle upon Tyne, NE6 3PL, United Kingdom | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Proposal | Description |

| Ordinary Resolutions |

| | | | | |

| 1 (a)-(i) | Election of Directors: To elect each of our nine director nominees for a term expiring at the Company’s 2026 Annual General Meeting of Shareholders: |

a. Douglas J. Pferdehirt b. Claire S. Farley c. Eleazar de Carvalho Filho | d. Robert G. Gwin e. John O’Leary f. Margareth Øvrum | g. Kay G. Priestly h. John Yearwood i. Sophie Zurquiyah |

| | | | | |

| | | | | |

| 2 | 2024 U.S. Say-on-Pay for Named Executive Officers: To approve, as a non-binding advisory resolution, the Company’s named executive officer compensation for the year ended December 31, 2024, as reported in the Company’s Proxy Statement |

| | | | | |

| | | | | |

| 3 | Frequency of Future Say-on-Pay Proposals for Named Executive Officers: To approve, as a non-binding advisory resolution, an annual frequency of future Say-on-Pay proposals for Named Executive Officers |

| | | | | |

| | | | | |

| 4 | 2024 U.K. Directors’ Remuneration Report: To approve, as a non-binding advisory resolution, the Company’s directors’ remuneration report for the year ended December 31, 2024, as reported in the Company’s U.K. Annual Report and Accounts |

| | | | | |

| | | | | |

| 5 | Prospective Directors’ Remuneration Policy: To approve the Company’s prospective directors’ remuneration policy (the “Directors’ Remuneration Policy”) for the three years ending December 31, 2027, in the form presented in the Company’s directors’ remuneration report for the year ended December 31, 2024 of the Company’s U.K. Annual Report and Accounts, such policy to take effect immediately after the conclusion of the 2025 Annual General Meeting of Shareholders |

| | | | | |

| | | | | |

| 6 | Receipt of U.K. Annual Report and Accounts: To receive the Company’s audited U.K. accounts for the year ended December 31, 2024, including the reports of the directors and the auditor thereon |

| | | | | |

| | | | | |

| 7 | Ratification of PwC as U.S. Auditor: To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as the Company’s U.S. independent registered public accounting firm for the year ending December 31, 2025 |

| | | | | |

| | | | | |

| 8 | Reappointment of PwC as U.K. Statutory Auditor: To reappoint PwC as the Company’s U.K. statutory auditor under the U.K. Companies Act 2006 to hold office from the conclusion of the 2025 Annual General Meeting of Shareholders until the next annual general meeting of shareholders at which accounts are laid |

| | | | | |

| | | | | |

| | | | | | | | |

ii | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | | | | | | | |

| Proposal | Description |

| | | | | |

| 9 | Approval of U.K. Statutory Auditor Fees: To authorize the Board and/or the Audit Committee to determine the remuneration of PwC, in its capacity as the Company’s U.K. statutory auditor for the year ending December 31, 2025 |

| | | | | |

| | | | | |

| 10 | Authority to Allot Equity Securities: To authorize the Board to allot equity securities in the Company under U.K. law |

| | | | | |

| Special Resolution |

| | | | | |

| 11 | Authority to Allot Equity Securities without Pre-emptive Rights: Pursuant to the authority contemplated by the resolution in Proposal 10, to authorize the Board to allot equity securities without pre-emptive rights under U.K. law |

| | | | | |

These items are more fully described in the Proxy Statement attached, which forms a part of this Notice of Annual General Meeting of Shareholders. As of the date of the Proxy Statement, TechnipFMC does not know of any other matters to be raised at the 2025 Annual General Meeting of Shareholders.

| | | | | |

| On behalf of the Board of Directors, | March 14, 2025 |

| |

Cristina Aalders Executive Vice President, Chief Legal Officer and Secretary |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | iii |

Proxy Statement for the 2025 Annual General Meeting of Shareholders

This Proxy Statement relates to the solicitation of votes or proxies by the Board of Directors (the “Board”) of TechnipFMC plc (the “Company,” “TechnipFMC,” “our,” “us,” or “we”) for use at our 2025 Annual General Meeting of Shareholders and at any adjournment or postponement of such meeting (the “Annual Meeting”).

The Notice of Internet Availability of Proxy Materials (the “Notice of Materials”) and related Proxy Materials (as defined below) were first made available to shareholders on or about March 14, 2025, at www.proxyvote.com. You may also request a printed copy of this Proxy Statement and the form of proxy by any of the following methods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Internet | | | Telephone | | | Email |

| | | | | | | | | | |

| | | | | | | | | | |

| www.proxyvote.com | | | 1-800-579-1639 | | | sendmaterial@proxyvote.com |

Our U.S. Annual Report on Form 10-K, including consolidated financial statements, for the year ended December 31, 2024 (our “Annual Report on Form 10-K”) and our U.K. Annual Report and Accounts are being made available at the same time and by the same methods.

Our registered office is located at Hadrian House, Wincomblee Road, Newcastle upon Tyne, NE6 3PL, United Kingdom. Our telephone number in our Newcastle office is +44 (0) 191 296 7000. Information regarding the Annual Meeting, including the information required by section 311A of the U.K. Companies Act 2006 (the “Companies Act”), can be found at www.technipfmc.com. Information contained on our website is not to be considered as part of the proxy solicitation material and is not incorporated into this Proxy Statement.

TechnipFMC is a public limited company incorporated under the laws of England and Wales, and our ordinary shares (the “Ordinary Shares”) trade on the New York Stock Exchange in the United States (the “NYSE”) under the symbol “FTI.” As a result, the Company is governed by the Companies Act, U.S. securities laws and regulations, and the listing standards of the NYSE.

| | | | | | | | |

| | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2025 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 25, 2025 The Notice of Annual General Meeting of Shareholders and Proxy Statement, Annual Report on Form 10-K, and U.K. Annual Report and Accounts are available at www.proxyvote.com. | |

| | |

| | | | | | | | |

iv | TechnipFMC | Proxy Statement 2025 |

Forward-Looking Statements

The Proxy Materials (as defined below) contain “forward-looking statements” as defined in Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical or current facts, including statements regarding our environmental and sustainability plans and goals, made in this document are forward-looking. We use words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “commit,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook,” and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. All of our forward-looking statements involve risks and uncertainties (some of which are significant or beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These forward-looking statements are based on our current expectations, beliefs, and assumptions concerning future developments and business conditions and their potential effect on us. While management believes these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. Known material factors that could cause actual results to differ materially from those contemplated in the forward-looking statements include unpredictable trends in the demand for and price of oil and natural gas; competition and unanticipated changes relating to competitive factors in our industry, including ongoing industry consolidation; our inability to develop, implement, and protect new technologies and services and intellectual property related thereto; the cumulative loss of major contracts, customers, or alliances and unfavorable credit and commercial terms of certain contracts; disruptions in the political, regulatory, economic, and social conditions, or public health crisis in the countries where we conduct business; unexpected geopolitical events, armed conflicts, and terrorism threats; the refusal of DTC to act as depository and clearing agency for our shares; the impact of our existing and future indebtedness; a downgrade in our debt rating; the risks caused by our acquisition and divestiture activities; additional costs or risks from increasing scrutiny and expectations regarding sustainability matters; uncertainties related to our investments, including those related to energy transition; the risks caused by fixed-price contracts; our failure to timely deliver our backlog; our reliance on subcontractors, suppliers, and our joint venture partners; a failure or breach of our IT infrastructure or that of our subcontractors, suppliers, or joint venture partners, including as a result of cyber-attacks; risks of pirates and maritime conflicts endangering our maritime employees and assets; any delays and cost overruns of capital asset construction projects for vessels and manufacturing facilities; potential liabilities inherent in the industries in which we operate or have operated; our failure to comply with existing and future laws and regulations, including those related to environmental protection, climate change, health and safety, labor and employment, import/export controls, currency exchange, bribery and corruption, taxation, privacy, data protection, and data security; uninsured claims and litigation against us; the additional restrictions on dividend payouts or share repurchases as an English public limited company; tax laws, treaties and regulations, and any unfavorable findings by relevant tax authorities; significant changes or developments in U.S. or other national trade policies, including tariffs and the reactions of other countries thereto; potential departure of our key managers and employees; adverse seasonal, weather, and other climatic conditions; unfavorable currency exchange rates; risk in connection with our defined benefit pension plan commitments; and our inability to obtain sufficient bonding capacity for certain contracts, as well as the risk factors discussed in our filings with the U.S. Securities and Exchange Commission (“SEC”), including our annual reports on Form 10-K and quarterly reports on Form 10-Q. In addition, sustainability-related statements—whether historical, current, or forward-looking are often based on evolving methodologies, data, and internal controls and processes. Like other companies, our approach to these matters continues to develop, and we cannot guarantee alignment with the expectations or preferences of any particular stakeholder. Forward-looking and other statements in the Proxy Materials may also address our corporate responsibility and sustainability progress, plans, and goals, and the inclusion of such statements is not an indication that these contents are necessarily material for the purposes of complying with or reporting pursuant to the U.S. federal securities laws and regulations, even if we use the word “material” or “materiality” in this document. Such corporate responsibility and sustainability matters are often informed by frameworks that use varying materiality standards that can differ from, and are often more expansive than, those applicable for purposes of our SEC filings. Additionally, any references to our website or other materials not included in our Proxy Materials are, absent express language to the contrary, not incorporated by reference into these documents. With respect to sustainability information that pertains to our third-party

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | v |

vendors, suppliers, and partners, we often rely on such third parties’ data and do not independently verify or audit, or commit to independently verifying or auditing, their information. These factors, as well as any inaccuracies in third-party information we use, including in estimates or assumptions, may cause results to differ materially and adversely from statements, estimates, and beliefs made by us or third parties. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a result of new information, future events, or otherwise, except to the extent required by law. Additionally, we note that standards and expectations regarding greenhouse gas (“GHG”) accounting and the processes for measuring and counting GHG emissions, GHG emission reductions, and other sustainability-related metrics are evolving, and it is possible that our approaches both to measuring our emissions and to reducing emissions and measuring those reductions may be, either currently by some stakeholders or at some point in the future, considered inconsistent with common or best practices with respect to measuring and accounting for such matters, and reducing overall emissions. Similarly, while we reference various frameworks, we cannot guarantee, and words such as “accord,” “alignment,” or similar should not be understood to mean, complete alignment with the requirements of such frameworks or any particular interpretations thereunder. Our disclosures based on any standards may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policies, or other factors, some of which may be beyond our control.

| | | | | | | | |

vi | TechnipFMC | Proxy Statement 2025 |

Contents

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | vii |

| | | | | | | | |

viii | TechnipFMC | Proxy Statement 2025 |

2025 Proxy Summary

Along with the Notice of Annual General Meeting of Shareholders, we are providing this Proxy Statement, the U.K. Annual Report and Accounts, and the Annual Report on Form 10-K in connection with the Annual Meeting (collectively, the “Proxy Materials”).

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider regarding each of the proposals to be voted on at the Annual Meeting. Please read the entire Proxy Statement carefully before voting. For further information regarding our 2024 financial performance, please review our Annual Report on Form 10-K and our U.K. Annual Report and Accounts.

Annual Meeting Information

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Time and Date April 25, 2025 at 4:00 p.m., London time | | | Place Hadrian House, Wincomblee Road, Newcastle upon Tyne, NE6 3PL, United Kingdom | | | Voting Deadline 11:59 p.m., New York time, on April 24, 2025 |

| | | | | | | |

| | | | | | | |

| Voting Each Ordinary Share is entitled to one vote for each of the proposals to be voted on. | | | Admission Admission ticket and valid photo identification required. Please see “General Information about the Annual Meeting — Who can attend the Annual Meeting?” for more information. Please follow the voting instructions on your proxy card and/or your voting instruction form as different voting deadlines may be applicable depending on how you hold your shares. Please also review “How do I vote?” in the section entitled “General Information about the Annual Meeting.” |

| | | |

| | | |

| Record Date March 3, 2025 | | |

Voting Matters and Board Recommendations

The full text of each resolution to be voted on at the Annual Meeting is set out in the Notice of Annual General Meeting of Shareholders.

| | | | | | | | | | | |

| Proposal to be Voted Upon | Board

Recommendation | Where You Can Find More Information |

| Ordinary Resolutions | | |

| 1: (a)-(i) Election of Directors | FOR Each Director Nominee | |

| 2: 2024 U.S. Say-on-Pay Proposal for Named Executive Officers | FOR | |

| 3: Frequency of Future Say-on-Pay Proposals for Named Executive Officers | FOR Each Year | |

| 4: 2024 U.K. Directors’ Remuneration Report | FOR | |

| 5: Prospective Directors’ Remuneration Policy | FOR | |

| 6: Receipt of U.K. Annual Report and Accounts | FOR | |

| 7: Ratification of PwC as U.S. Auditor | FOR | |

| 8: Reappointment of PwC as U.K. Statutory Auditor | FOR | |

| 9: Approval of U.K. Statutory Auditor Fees | FOR | |

| 10: Authority to Allot Equity Securities | FOR | |

| Special Resolution | | |

| 11: Authority to Allot Equity Securities without Pre-emptive Rights | FOR | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 1 |

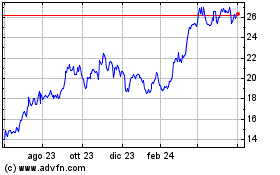

2024 Financial Performance

| | | | | | | | | | | |

| Total Company | | | $11.6 billion Inbound orders |

| }Inbound orders1 improved 5% year-over-year to $11.6 billion, driving backlog to $14.4 billion and marking a fourth consecutive year of growth in backlog |

| |

| |

| }Cash flow from operations improved 39% to $961 million, with free cash flow2 growing 45% versus the prior year to $679.4 million |

| |

| |

| }Nearly doubled shareholder distributions versus the prior year by returning $486 million through dividends and share repurchases and authorized additional share repurchases of up to $1 billion |

| |

| |

| }Achieved investment grade debt ratings from multiple credit rating agencies, reflecting the Company’s strengthened financial profile and improved market outlook |

| |

| Subsea | | | $10.4 billion Inbound orders |

| }Inbound orders increased 7% year-over-year to $10.4 billion, highlighting continued strength in offshore activity |

| |

| |

| }Third consecutive year for combination of direct awards, iEPCI™ projects, and Subsea Services to reach at least 70% of total Subsea inbound orders, reflecting our differentiated offerings, innovative technologies, and strong client relationships |

| | |

| | |

| }Record year of integrated project orders, with nearly $5 billion of inbound awarded from a diversified set of operators across six offshore basins |

| |

| |

| }Tree orders from our Subsea 2.0® product platform significantly outpaced the growth of our total tree awards versus the prior year |

| |

| |

| }Growth in Subsea Services inbound for the year was driven by increased installation activity, a growing installed base, and aging infrastructure |

| | |

| | | | | | | | |

2 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | | $1.2 billion Inbound orders |

| Surface Technologies | | }Inbound orders decreased 5% year-over-year to $1.2 billion |

| | |

| | |

| | }Successful execution on our multi-year framework agreement with Abu Dhabi National Oil Company and further activity ramp in Saudi Arabia provided increased contribution to the Company’s revenue in international markets |

| |

| |

| }Continued to benefit from proactive steps taken to refocus the business through targeted actions, including the sale of the Measurement Solutions business and further optimization of our Americas portfolio |

| | |

| | | |

| | | | | | | | | | | |

| | | |

| New Energy Initiatives | | Awarded iEPCI™ contract by Petrobras to deliver the Mero 3 HISEP® project, which will utilize subsea processing to capture carbon dioxide-rich dense gases and then inject them into the reservoir | |

| | |

| | |

| | Awarded contract for the first all-electric iEPCI™ for carbon transportation and storage by the Northern Endurance Partnership, a joint venture between bp, Equinor, and TotalEnergies |

| |

| |

| Announced collaboration agreement with Prysmian to further accelerate the development of floating offshore wind by providing an integrated solution that accelerates time to first power and reduces cost, while improving overall system reliability |

| | | |

(1)Reported financial results for the 12 months ended December 31, 2024, and inbound and backlog as of December 31, 2024, are included in our Annual Report on Form 10-K.

(2)Free cash flow is calculated as cash flow from operations less capital expenditures.

| | | | | | | | |

| | |

| For additional details regarding our 2024 financial performance, please see our Annual Report on Form 10-K, which reports our results using U.S. generally accepted accounting principles (“GAAP”), and our U.K. Annual Report and Accounts, which reports our results using international financial reporting standards (as adopted by the United Kingdom). | |

| | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 3 |

Governance Highlights

Board and Governance Best Practices

| | | | | | | | |

| Independent Board Oversight | |

| Robust Lead Independent Director role | |

| All directors are independent except the Chair and CEO | |

| Fully independent Board committees | |

| Regular executive sessions of independent directors | |

| Governance Best Practices | |

| Board oversight of sustainability matters through ESG Committee on strategic sustainability initiatives; Audit Committee on certain metrics and reporting on health, safety, and environmental matters, cybersecurity, and artificial intelligence; and Compensation and Talent (“C&T”) Committee on equal opportunity and inclusion | |

| Annual election of directors under majority vote standard | |

| Engaged Board with deep expertise, skills, and experience that are closely tied to business strategy | |

| Annual shareholder engagement program to solicit feedback on Company practices | |

| Ongoing Board refreshment efforts informed by a comprehensive annual Board and committee self-evaluation process, reflected by one new director in each of 2019, 2020, 2021, and 2023 | |

| Board oversight of risk management structures | |

| Regular review of the mix of experience, qualifications, and skills in the boardroom to meet evolving needs of the business, coupled with new director orientation and continuing education | |

| Code of Business Conduct applicable to directors | |

| Governance Guidelines with director retirement policy | |

| Director share ownership requirements | |

| | | | | | | | |

| | |

| For additional details on the Company’s corporate governance practices, please see the section entitled “Corporate Governance.” |

| | |

| | | | | | | | |

4 | TechnipFMC | Proxy Statement 2025 |

2024-2025 Shareholder Engagement Program

In 2024-2025, our annual shareholder engagement program allowed us to better understand and more closely align with our shareholders’ priorities and perspectives.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Shareholder Engagement Team SVP, Investor Relations and Corporate Development • EVP, Chief Legal Officer and Secretary • EVP, People and Culture • Other members of senior leadership, as applicable | |

| | | | | | | | |

| | | | | | | | |

| | | | |

| Who We | Key | Actions Informed by | |

| Engaged With | Topics | Shareholder Feedback | |

| | | | | | | | |

| Contacted shareholders representing 59% of our outstanding shares | | }Company Financial Performance }Actions taken to increase shareholder value }Executive Compensation }Philosophy and design, including metrics and weighting }Corporate Governance }Board refreshment, skills, and composition }Sustainability }Board oversight }Initiatives and targets | }Executive Compensation }Re-affirmed our commitment to prioritizing performance-based conditions in long-term incentive awards }Continued to have a strong link between compensation, performance, and shareholder interests }Sustainability }Reviewed the application of sustainability metrics in our short-term incentive program to ensure alignment with evolving compensation practices | |

| Met with shareholders representing 37% of our outstanding shares | | |

| | | | | | | | |

| For more information on our shareholder engagement program, please see the sections entitled “Corporate Governance — Shareholder Engagement” and “Executive Compensation Discussion and Analysis — Executive Summary — Say-on-Pay and Shareholder Engagement.” | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 5 |

Director Nominees

Key Board Statistics after Annual Meeting

| | | | | | | | | | | | | | | | | |

| | | | | |

| 8 of 9 Independent Directors | | 65 Average Age | | 6 years Average Tenure |

| | | | | |

Our director nominees and their current committee assignments:

| | | | | | | | | | | | | | |

| | | | |

Douglas J. Pferdehirt Chair and CEO Age: 61 Committees: None | | Claire S. Farley Lead Independent Director Age: 66 Committees: Compensation and Talent |

| | | | |

| | | | |

Eleazar de Carvalho Filho Independent Age: 67 Committees: ESG (Chair) | | Robert G. Gwin Independent Age: 61 Committees: Audit |

| | | | |

| | | | |

John O’Leary Independent Age: 69 Committees: Compensation and Talent (Chair) | | Margareth Øvrum Independent Age: 66 Committees: ESG |

| | | | |

| | | | |

Kay G. Priestly Independent Age: 69 Committees: Audit (Chair) | | John Yearwood Independent Age: 65 Committees: Compensation and Talent, ESG |

| | | | |

| | | Detailed biographies for each of our director nominees are disclosed in the section entitled “Proposal 1(a)-(i) — Election of Directors — Director Nominees.” |

Sophie Zurquiyah Independent Age: 58 Committees: Audit | |

| | | | |

| | | | | | | | |

6 | TechnipFMC | Proxy Statement 2025 |

Executive Compensation

Named Executive Officers

Our named executive officers (“NEOs”) for 2024 are:

| | | | | | | | | | | | | | |

| | | | |

Douglas J. Pferdehirt Age: 61 Position Held in 2024: Chair and Chief Executive Officer | | Alf Melin Age: 55 Position Held in 2024: Executive Vice President and Chief Financial Officer |

| | | | |

| | | | |

Justin Rounce Age: 58 Position Held in 2024: Executive Vice President and Chief Technology Officer | | Thierry Conti Age: 41 Position Held in 2024: President, Surface Technologies |

| | | | |

| | | | |

Jonathan Landes Age: 52 Position Held in 2024: President, Subsea | | |

| | | | |

Our Executive Compensation Philosophy

As a leading technology provider to the traditional and new energies industries, we are committed to delivering on our vision and purpose - to bring together the scope, expertise, and determination to transform our client’s project economics. The C&T Committee ensures that our executive compensation program attracts, retains, and motivates exceptionally talented individuals who drive these ambitions forward, aligning leadership incentives with Company goals and shareholder value creation.

| | | | | | | | | | | | | | |

| | | | |

| Our executive compensation philosophy is built around three core principles that emphasize pay-for-performance and delivering on our business strategies and shareholders’ interests: | |

| | | | |

| | | | |

| Align compensation to key business objectives that drive sustainable shareholder value creation. Incentivize executives to exceed our short-term and long-term goals and objectives through significant at-risk compensation. Attract, retain, and motivate highly skilled executive talent through a competitive compensation program. | |

| | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 7 |

| | | | | | | | | | | | | | |

| What We Do: | | What We Don’t Do: |

| Pay for performance by aligning performance measures with our strategy and shareholder interests | | | Single-trigger vesting upon a change-in-control |

| Ensure the majority of NEO compensation is performance-based, “at-risk” compensation | | | Guaranteed bonuses |

| Maintain a clawback policy in the event of erroneously awarded incentive-based compensation resulting from a financial restatement, malfeasance, or fraud | | | Uncapped incentives |

| Require robust share ownership by executives and directors | | | Tax gross-ups on any severance payments |

| Engage an independent, external compensation consultant | | | Excessive perquisites, benefits, or pension payments |

| Benchmark compensation against relevant industry peer groups | | | Discounting, reloading, or repricing of stock options |

| Cap PSU payout at target when relative TSR exceeds peers’ TSR, but absolute TSR is negative | | | Hedging and pledging of Company securities |

Our 2024 executive compensation framework is summarized below. For additional details regarding our executive compensation program, please see the section entitled “Executive Compensation Discussion and Analysis.”

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Component | Objective | | | | | | |

| FIXED | Base Salary | Provide market competitive compensation for the role | } | }Fixed cash compensation }Reflects major responsibilities of an NEO’s role }Set with reference to median compensation market levels of Compensation Peer Group, and positioned accordingly above or below median based on experience, performance, and expected contribution |

| VARIABLE | Annual Cash Incentive Bonus | Drive and reward the achievement of short-term Company strategic goals and individual contributions | } | | Adjusted EBITDA Margin1 | | | Sustainability Performance |

| Free Cash Flow | | | Individual Performance |

| Long-Term Equity Incentives | Drive and reward the achievement of long-term results and shareholder value creation while reinforcing retention | } | | 50%

ROIC

50%

Relative TSR | | | |

(1)“Adjusted EBITDA Margin,” for purposes of the compensation incentives, excludes foreign exchange, net, and is a non-GAAP measure. See “Appendix A — Reconciliation of Non-GAAP Measures” in this Proxy Statement.

| | | | | | | | |

8 | TechnipFMC | Proxy Statement 2025 |

Sustainability

Our sustainability decisions are guided by our Core Values and Foundational Beliefs, which underpin our commitment to responsible corporate citizenship. These principles drive our efforts to be more sustainable while delivering on strategic goals aligned with long-term value creation. Since 2017, we have implemented measures to hold ourselves accountable and to support these ambitions.

Building on the success of our 2021–2023 Sustainability Scorecard (the “Scorecard”) framework, we have adopted measurable sustainability goals for the 2024-2026 period. This approach reflects our commitment to driving meaningful change, accounting for progress achieved to date, and aligning with the interests of our stakeholders.

A snapshot of our achievements and goals for the 2024–2026 Sustainability Scorecard is set forth below.

Our Sustainability Scorecard

While the Scorecard measures specific achievements in sustainability initiatives, our activities are neither limited to those that are measured on our Scorecard nor to actions and monitoring required by law.

Year One of Our 2024-2026 Scorecard

| | | | | | | | |

| | |

| For more detail on how each metric is measured and our 2024 results, please see the section entitled “Corporate Sustainability” in our U.K. Annual Report and Accounts. For information on how ESG metrics are tied to our executive compensation program, please see the section entitled “Executive Compensation Discussion and Analysis” below. | |

| | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 9 |

Governance of Corporate Sustainability Matters

Board Oversight

All Board members participate in oversight of corporate sustainability matters. Oversight is concentrated in the Environmental, Social, and Governance Committee (“ESG Committee”), which, as set forth in its charter, has principal responsibility for overseeing our strategic sustainability initiatives. These areas of oversight include:

}Environmental stewardship, responsible investment, corporate citizenship, human rights, and sustainability risk management;

}Reviewing and monitoring the development and implementation of targets, standards, metrics, or methodologies to track the Company’s sustainability performance; and

}Reviewing the Company’s engagement with stakeholders and public disclosures with respect to sustainability matters.

In addition to oversight by the ESG Committee, the Audit Committee, and the C&T Committee also oversee certain sustainability matters that align with their areas of responsibility as detailed in each committee’s charter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Board of Directors Corporate Sustainability Oversight | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| | ESG | | Compensation and | | Audit | |

| Committee | | Talent Committee | | Committee | |

| }Policies, programs, and strategies related to environmental stewardship, responsible investment, corporate citizenship, climate change, human rights, and sustainability risk management }Development and implementation of targets, standards, metrics, and methodologies related to sustainability }Public disclosures with respect to sustainability matters }Policies that support integrity in everything we do, including respect for humanity | | }Global strategy and initiatives related to equal opportunity and inclusion efforts and to contributions to the world around us }Executive compensation structure, which includes sustainability as a performance measure in our Annual Incentive Plan (as detailed in the “Executive Compensation Discussion and Analysis” section.) | | }Certain Health, Safety, and Environmental (“HSE”) matters }Along with the ESG Committee, systems and controls for the prevention of bribery and receive reports on non-compliance }Cybersecurity and artificial intelligence risk management | |

| | | |

| | | | | | | | |

10 | TechnipFMC | Proxy Statement 2025 |

Management Oversight

TechnipFMC’s Executive Leadership Team ("ELT") sets the overall direction and approach for our environmental, social, and governance efforts. The Sustainability Steering Committee is composed of members of the ELT who are directly responsible for various aspects of the environmental, social, and governance programs. The Sustainability Steering Committee is responsible for the specific Company initiatives toward corporate responsibility, sustainability, climate-related risks and opportunities and actions aimed to further such initiatives. The Sustainability Steering Committee sets the direction and long-term strategy to achieve our sustainability-related plans, the development and implementation of targets, standards, and metrics, or methodologies to achieve our goals, and publication of our external communication on sustainability topics. The Sustainability Steering Committee regularly receives updates and provides guidance to subject-matter experts in each of the environmental, social, and governance pillars that coordinate activity across the Company that underpins our corporate sustainability strategy.

For more information on our governance of sustainability programs, please see the section entitled “Corporate Sustainability” in our U.K. Annual Report and Accounts.

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 11 |

Proposal 1 —

Election of Directors

What am I voting on?

Upon the recommendation of the ESG Committee, the Board nominated the candidates below for election at the Annual Meeting. The matrix below indicates each director nominee’s key qualifications and pertinent information. Detailed biographies for each of our director nominees are included in the section entitled “Director Nominees” below.

Board highlights

Our director nominees demonstrate a broad range of skills, experience, and perspective.

| | | | | | | | |

12 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | Proposal 1 — Election of Directors | |

| | | |

Skills, Experience, and Attributes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills, Experience, and Attributes | Pferdehirt | Farley | Carvalho Filho | Gwin | O'Leary | Øvrum | Priestly | Yearwood | Zurquiyah |

| | | | | | | | | | |

| Public Company Perspective | n | n | n | n | n | n | n | n | n |

| Executive/Board Experience | n | n | n | n | n | n | n | n | n |

| Oil & Gas Industry | n | n | n | n | n | n | n | n | n |

| International Experience/Geographic Diversity | n | n | n | n | n | n | n | n | n |

| Strategy, M&A, and Risk Management | n | n | n | n | n | n | n | n | n |

| Governance/Legal | n | n | n | n | n | n | n | n | n |

| Executive Compensation | n | n | | n | n | | n | n | n |

| Sustainability/Emerging Technologies | n | | n | n | n | n | n | n | n |

| Finance/Accounting Expertise | n | n | n | n | | | n | n | n |

| Cybersecurity | n | n | n | n | n | n | n | | n |

| Environmental Risk Management | n | n | n | n | n | n | | n | n |

| Independent Director | | n | n | n | n | n | n | n | n |

| Other Public Company Boards | 0 | 2 | 2 | 1 | 0 | 3 | 1 | 2 | 1 |

| Committee Membership | | | | | | | | | |

Audit1 | | | | n | | | Chair | | n |

C&T | | n | | | Chair | | | n | |

ESG | | | Chair | | | n | | n | |

| Demographic Background | | | | | | | | | |

| Age (Years) | 61 | 66 | 67 | 61 | 69 | 66 | 69 | 65 | 58 |

| Board Tenure (Years) | 8 | 8 | 8 | 2 | 8 | 4 | 8 | 5 | 4 |

Gender (Female or Male) | M | F | M | M | M | F | F | M | F |

(1)All members of the Audit Committee are “audit committee financial experts” as defined by the applicable rules of the SEC.

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 13 |

| | | | | | | | | | | |

| Proposal 1 — Election of Directors | | |

| | | |

Each of the director nominees has consented to serving as a nominee, being named in this Proxy Statement, and serving on the Board, if elected. Each director nominee elected at the Annual Meeting will serve for a one-year term expiring at the 2026 Annual Meeting or until the earliest to occur of (i) his or her successor is elected and qualified, or (ii) his or her earlier death, retirement, resignation, or removal in accordance with our Articles of Association (the “Articles”).

| | | | | |

| How does the Board recommend that I vote? | |

|

The Board recommends that you vote “FOR” the election of each director nominee. |

Director Nominees

Our Board is composed of a diverse group of leaders in their respective fields, each qualified to make unique and substantial contributions to our Board. The Board and its ESG Committee believe each director nominee brings valuable skills, experience, and perspectives, contributing to the collective backgrounds and enhancing its ability to effectively oversee the Company’s strategic direction and represent the best interests of the Company’s shareholders.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Mr. Pferdehirt has served as our CEO since the merger of FMC Technologies, Inc. and Technip S.A. and as our Chair since May 1, 2019. }He was previously President and Chief Executive Officer of FMC Technologies from 2016 to 2017 and Chief Operating Officer from 2012 to 2016. }Prior to joining FMC Technologies in 2012, he spent 26 years at Schlumberger Limited in a succession of executive leadership positions. Key Skills and Qualifications }Strong executive leadership skills, including experience as Chief Executive Officer of TechnipFMC and FMC Technologies }Deep knowledge of the Company’s strategy, markets, technology, and operations }Extensive energy industry experience and client relationships }Financial, risk management, strategy, and M&A expertise }Leadership in health, safety, environmental, and social responsibilities }Thorough understanding of the different cultural, political, and regulatory requirements in countries where the Company has a significant presence }Valuable link between the Company’s management and the Board that aids the Board in performing its oversight role Other Public Company Directorships }Current: None }Formerly Held in Past Five Years: None | |

| | | | |

| Douglas J. Pferdehirt Chair and CEO Age: 61 Director Since: 2017 Committees: None | | | |

| | | | | |

| | | | | | | | |

14 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | Proposal 1 — Election of Directors | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Ms. Farley was a partner at KKR & Co. L.P., a global investment firm from 2013 until her retirement in 2016, and subsequently served as Senior Advisor from 2016 to 2022 and Vice Chair of the Energy business from 2016 to 2021. }She began her affiliation with KKR in September 2010 as a co-founder of RPM Energy, LLC, a privately owned oil and gas exploration and development company, which partnered with KKR. }Prior to founding RPM Energy, Ms. Farley was an Advisory Director at Jefferies Randall & Dewey, a global oil and gas industry advisor, and was Co-President of Jefferies Randall & Dewey from February 2005 to July 2008. }Prior to that, Ms. Farley served as Chief Executive Officer of Randall & Dewey, an oil and gas asset transaction advisory firm, from September 2002 until February 2005, when Randall and Dewey became the Oil and Gas Investment Banking Group of Jefferies & Company. }Ms. Farley has extensive oil and gas exploration expertise, holding several positions within Texaco from 1981 to 1999, including President of Worldwide Exploration and New Ventures, President of North American Production, and Chief Executive Officer of Hydro-Texaco, Inc. }Ms. Farley also served as Chief Executive Officer of Intelligent Diagnostics Corporation from October 1999 to January 2001 and Trade-Ranger Inc. from January 2001 to May 2002. Key Skills and Qualifications }Executive management experience, including as chief executive officer of several major organizations }Oil and gas exploration and production experience }Extensive energy industry experience and client relationships }Financial, risk management, strategy, and M&A expertise }Experience as a board member of public and private companies with international operations Other Public Company Directorships }Current: LyondellBasell Industries B.V. and Crescent Energy Company }Formerly Held in Past Five Years: None | |

| | | | |

| Claire S. Farley Lead Independent Director Age: 66 Director Since: 2017 Committees: C&T | | | |

| | | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 15 |

| | | | | | | | | | | |

| Proposal 1 — Election of Directors | | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Mr. Carvalho Filho has been a Founding Partner of Virtus BR Partners Assessoria Corporativa Ltda. since May 2009 and is also a Founding Partner of Sinfonia Consultoria Financeira e Participações Ltda. since August 2012, both of which are financial advisory and consulting firms. }He served as Chief Executive Officer and Managing Partner of Unibanco Investment Bank, a Brazilian investment bank, from April 2008 to March 2009. }Mr. Carvalho Filho was a consultant for BHP Billiton Metais SA, a global natural resources company, from 2006 to 2011. }He was a Founding Partner of Iposeira Capital Ltda., established in 2003, as well as STK Capital Gestora de Recursos Ltda., established in 2010, which are independent advisory and asset management companies. Key Skills and Qualifications }Executive management experience, including as chief executive officer and founding/managing partner of international investment organizations }Financial, strategy, risk management, and M&A expertise }Leadership in health, safety, environmental, and social responsibilities }International investment experience }Experience as a board member of public and private companies with international operations }Contribution to the Board in a way that enhances perspective through diversity in geographic origin and experience }Experience in Brazil, one of TechnipFMC’s principal markets Other Public Company Directorships }Current: Brookfield Renewable Corporation and Companhia Brasileira de Distribuicão (Grupo Pão de Açúcar) }Formerly Held in Past Five Years: Brookfield Renewable Partners L.P.; Cnova N.V., an affiliate of Companhia Brasileira de Distribuicão; and Oi S.A. | |

| | | | |

| Eleazar de Carvalho Filho Independent Age: 67 Director Since: 2017 Committees: ESG (Chair) | | | |

| | | | | |

| | | | | | | | |

16 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | Proposal 1 — Election of Directors | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Robert G. Gwin was President of Anadarko Petroleum Corporation, one of the world’s largest independent oil and natural gas exploration and production companies, until August of 2019 when the company was purchased by Occidental Petroleum Corporation, and previously served as Executive Vice President, Finance and Chief Financial Officer of Anadarko from 2009 to 2018. }Mr. Gwin served as founding President and CEO of Western Gas Partners, LP from 2007 to 2010, as well as chairman of the boards of both Western Gas Partners, LP and its general partner Western Gas Equity Partners, LP from 2009 to 2018, and as a director of both entities from 2007 to 2019. Key Skills and Qualifications }Significant management and operational experience as an executive of a major oil and gas company with international operations }Strategy and operational expertise, including sustainability and technology experience }Financial, risk management, and M&A expertise }Experience as a board member of public and private companies with international operations Other Public Company Directorships }Current: Crescent Energy Company }Formerly Held in Past Five Years: Pembina Pipeline Corporation and Enable Midstream Partners | |

| | | | |

| Robert G. Gwin Independent Age: 61 Director Since: 2023 Committees: Audit | | | |

| | | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 17 |

| | | | | | | | | | | |

| Proposal 1 — Election of Directors | | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Mr. O’Leary has served as Chief Executive Officer of Strand Energy, a Dubai-based company specializing in business development in the oil and gas industry, since January 2007. }From 2004 to 2006, he was a partner in Pareto Offshore ASA, a Norwegian consulting firm in the exploration and production sector. }From 1997 to 2004, Mr. O’Leary served in various roles, most recently as President, for Pride International, Inc., a company specializing in onshore and offshore drilling, which acquired his former company, Forasol-Foramer N.V. }He previously served as Vice Chair for Marketing for Forasol-Foramer from 1990 to 1998, and, prior to that, served as Development and Partnerships Manager from 1985 to 1989. }He began his career as a trader in the Irish National Petroleum Corporation before joining Total S.A. as a drilling engineer in 1980. Key Skills and Qualifications }Significant industry and leadership experience gained as an executive in international oil and gas companies }Strategy, risk management, and M&A expertise }Experience as a board member of public and private companies with international operations }International experience in countries where the Company has a significant presence Other Public Company Directorships }Current: None }Formerly Held in Past Five Years: None | |

| | | | |

| John O’Leary Independent Age: 69 Director Since: 2017 Committees: C&T (Chair) | | | |

| | | | | |

| | | | | | | | |

18 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | Proposal 1 — Election of Directors | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Ms. Øvrum has more than 39 years of experience at Equinor (formerly Statoil), a Norwegian energy company, where she served as Executive Vice President of Equinor ASA, Development and Production Brazil, until her retirement in December 2020. }Ms. Øvrum held a succession of leadership positions at Equinor, including President, Equinor Brazil, from 2018 to 2020; Executive Vice President of Technology, Projects, and Drilling from 2011 to 2018; Executive Vice President of Technology and New Energy for Statoil Hydro, from 2007 to 2011; Executive Vice President of Technology and Projects, from 2004 to 2007; and Executive Vice President of Health, Safety, and the Environment, during 2004. }She has also held numerous management and operations positions, including Senior Vice President, Operations Support, Exploration and Production, Norway from 2000 to 2003; Senior Vice President, Operations, Veslefrikk, from 1996 to 1999; Offshore Installation Manager from 1993 to 1996; Production and Maintenance Superintendent from 1991 to 1993; Department Head, Operations Technology from 1989 to 1991; Section Head, Maintenance and Activity Planning from 1988 to 1989; and Strategic Analysis, Production and Maintenance, from 1982 to 1987. }Ms. Øvrum began her career at Equinor in 1982 in Strategic Analysis, and in 1993, became the first female and the youngest platform manager of the company’s Gulfaks field in the North Sea. Key Skills and Qualifications }Significant management, technology, and operational experience as an executive of a major oil and gas company with international operations }Strategy and operational expertise, including sustainability and technology experience }Experience as a board member of public and private companies with international operations }Extensive experience working in Norway and Brazil, countries in which the Company has significant operations }Contribution to the Board in a way that enhances perspective through diversity in geographic origin, and experience Other Public Company Directorships }Current: FMC Corporation, Harbour Energy plc, and Transocean Ltd. }Formerly Held in Past Five Years: None | |

| | | | |

| Margareth Øvrum Independent Age: 66 Director Since: 2020 Committees: ESG | | | |

| | | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 19 |

| | | | | | | | | | | |

| Proposal 1 — Election of Directors | | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Ms. Priestly served as Chief Executive Officer of Turquoise Hill Resources Ltd., an international mining company focused on copper, gold, and coal in the Asia Pacific region, from May 2012 until her retirement in December 2014. }She previously served as Chief Financial Officer of Rio Tinto Copper (a division of the Rio Tinto Group – Rio Tinto plc and Rio Tinto Limited), a global metal and mining corporation, from 2008 until her appointment as Chief Executive Officer of Turquoise Hill Resources in 2012. }From 2006 to 2008, she was Vice President, Finance, and Chief Financial Officer of Rio Tinto’s Kennecott Utah Copper operations. }Ms. Priestly served as Vice President, Risk Management, and General Auditor for Entergy Corporation, an integrated energy company engaged primarily in electric power production and retail distribution operations, from 2004 to 2006. }Ms. Priestly began her career with global professional services firm Arthur Andersen, where she progressed from staff accountant to partner, holding various management and leadership positions, including serving on the global executive team as Global Managing Partner – People. During her 24 years with Arthur Andersen, she provided tax, consulting, and M&A services to global companies across many industries, including energy, mining, manufacturing, and services. Key Skills and Qualifications }Executive management experience as a chief executive officer and senior officer of major organizations with international operations }Financial, strategy, risk management, and M&A expertise }Extensive consulting experience }Experience in a variety of industries that provides diversity of perspective }Thorough understanding of different cultural, political, and regulatory requirements through her extensive energy and mining experience, including in countries where the Company has a significant presence Other Public Company Directorships }Current: SSR Mining Inc. }Formerly Held in Past Five Years: Stericycle, Inc. | |

| | | | |

| Kay G. Priestly Independent Age: 69 Director Since: 2017 Committees: Audit (Chair) | | | |

| | | | | |

| | | | | | | | |

20 | TechnipFMC | Proxy Statement 2025 |

| | | | | | | | | | | |

| | Proposal 1 — Election of Directors | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Mr. Yearwood served as President, Chief Executive Officer, and Chief Operating Officer of Smith International, Inc., a Houston-based company specializing in the provision of services and the manufacturing of products used by the drilling industry from 2009 until August 2010, when the company merged with Schlumberger Limited. }Prior to joining Smith International, Inc., he spent more than 26 years at Schlumberger Limited in a succession of executive leadership positions, including President of North and South America Oilfield Services from 2004 to 2006; Vice President, Finance, WesternGeco and OFS Controller from 2000 to 2004; and Vice President, Marketing from 1999 to 2000. }He began his career serving in numerous management and technical positions for Schlumberger Limited and Dowell Schlumberger, a joint venture with Dow Chemical. Key Skills and Qualifications }Significant executive management experience as an executive of a major oil and gas company with international operations }Experience as a board member of public and private companies with international operations }Technology, strategy, governance, and M&A expertise }Oil and gas exploration and production experience }International experience in countries where the Company has a significant presence }Diversity in geographic origin that enhances the Board’s perspective Other Public Company Directorships }Current: Nabors Industries Ltd. and Vast Renewables Limited }Formerly Held in Past Five Years: Nabors Energy Transition Corp, an affiliate of Nabors Industries Ltd., which merged with Vast Renewables Limited | |

| | | | |

| John Yearwood Independent Age: 65 Director Since: 2019 Committees: C&T, ESG | | | |

| | | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 21 |

| | | | | | | | | | | |

| Proposal 1 — Election of Directors | | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Career Highlights }Ms. Zurquiyah has been Chief Executive Officer of Viridien S.A., formerly known as CGG S.A., an advanced technology, digital, and earth data leader, since April 2018. Ms. Zurquiyah has held a succession of leadership positions at Viridien, including as Senior Executive Vice President in charge of the Geology, Geophysics, and Reservoir segment. }Ms. Zurquiyah joined Schlumberger Limited in 1991 as an interpretation engineer and geophysicist and held successively senior positions before joining Viridien in 2013. She served as Schlumberger Limited’s Vice President of Technology Sustaining from August 2012 to January 2013, as well as its President, Data and Consulting Services, from May 2009 to July 2012. Prior to this, she was Schlumberger Limited’s Chief Information Officer from January 2007 to April 2009. Key Skills and Qualifications }Executive management experience, including as Chief Executive Officer of Viridien S.A. }Financial, technology, sustainability, and oil and gas drilling expertise }Experience as a board member and member of the audit committee of public companies with international operations }Contribution to the Board in a way that enhances perspective through diversity in geographic origin and experience Other Public Company Directorships }Current: Viridien S.A. }Formerly Held in Past Five Years: Safran S.A. | |

| | | | |

| Sophie Zurquiyah Independent Age: 58 Director Since: 2021 Committees: Audit | | | |

| | | |

| | | | | |

| | | | | | | | |

22 | TechnipFMC | Proxy Statement 2025 |

Corporate Governance

The Board believes that the purpose of corporate governance is to facilitate effective oversight and management of the Company to maximize shareholder value in a manner consistent with our vision statement, purpose, Core Values, Foundational Beliefs, Code of Business Conduct, and all applicable legal requirements.

The Board provides accountability, objectivity, perspective, judgment, and, in some cases, specific industry or technical knowledge or experience. In carrying out its responsibilities to our shareholders, the fundamental role of the Board is to ensure continuity of leadership; the implementation, understanding, and pursuit of a sound strategy for the success of our Company; and the availability of financial and management resources and the implementation of control systems to carry out that strategy.

Governance Guidelines and Key Board Practices

Our Corporate Governance Guidelines (“Governance Guidelines”) contain general principles and practices regarding the function of the Board and its committees. The Governance Guidelines establish a framework to guide the Board in its oversight responsibilities in a manner that is independent of management and aligned with the interests of our shareholders. The Board reviews these governance practices, the laws of England and Wales under which we are incorporated, the rules and listing standards of the NYSE, and the regulations of the SEC, as well as best practices recognized by governance authorities, to benchmark the standards under which it operates.

Key Elements and Practices

}Composition of the Board. Our Board seeks to attract professionals who are not only qualified under the governance rules pertinent to our Company but also contribute to the collective expertise and backgrounds on the Board. Our ESG Committee considers multiple factors in determining whether a candidate is qualified to serve on our Board and helps achieve a balance between fresh perspectives and the deep knowledge and experience of our more tenured directors. As such, our ESG Committee often considers a candidate’s:

(a)Experience in corporate management, as a board member of another publicly held company, and in finance and accounting and/or compensation practices;

(b)Professional and academic experience relevant to our industry and operations, including matters related to technology, cybersecurity, or sustainability;

(c)Leadership skills;

(d)Global awareness and contribution to the collective expertise and backgrounds on the Board; and

(e)Ability to commit the time required for service on our Board.

}Board and Committee Evaluations. Each year, our directors complete a self-evaluation to determine whether the Board and its committees are functioning effectively. Additionally, each of the Audit, C&T, and ESG Committees conducts a separate evaluation of its own performance and the adequacy of its charter. These evaluations include an assessment of the range of talents, expertise, and experiences of the Board members. The Board and its committees, with oversight from the ESG Committee, review the evaluation results and consider recommendations to enhance overall performance.

}New Director Orientation and Continuing Education. An orientation program has been developed for new non-executive directors, which includes written materials and meetings with our executive officers. The orientation program is designed to provide general information about our Board and its committees; a

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 23 |

review of director duties and responsibilities; and comprehensive information about our industry, operations, strategies, and challenges. The Board believes that ongoing education is important for maintaining an effective Board. Accordingly, our Board encourages directors to participate in ongoing education, and reimburses directors for expenses incurred in connection with such education programs.

}Retirement Policy. As further described in our Governance Guidelines, a non-executive director whose birth date occurs prior to July 1 must retire at the annual general meeting of shareholders of the Company during the year of such director’s 72nd birthday, and a non-executive director whose birth date occurs on or after July 1 must retire at the annual general meeting of shareholders of the Company the year following such director’s 72nd birthday. Our Board may waive this policy on a case-by-case basis on the recommendation of the ESG Committee if it deems a waiver to be in the best interests of the Company and its shareholders.

}Director Share Ownership Requirements. Within five years following initial election to the Board, directors are required to own Ordinary Shares with a value equal to or exceeding five times the Company’s annual cash retainer paid to directors.

Shareholder Engagement

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Company regularly seeks feedback through engagement with shareholders, and we continued this practice in 2024. Our relationships and ongoing dialogue with our shareholders are important to our Board’s corporate governance commitment. In addition to direct engagement with investment management teams, we continued our practice to engage with shareholders and proxy advisory firms each year as part of our regular, annual shareholder engagement sessions. During these sessions, we discussed our Board leadership structure and composition, general Board practices, and our sustainability efforts. We also welcomed our shareholders’ feedback and suggestions in maintaining the balance between strengthening the link between pay and performance, retaining and motivating our executives, and appropriately compensating our executives for performance, while increasing long-term shareholder value. | | | | |

| Contacted shareholders representing 59% of our outstanding shares |

| Met with shareholders representing 37% of our outstanding shares |

| | | | | | | | | | |

| | | | | | | | | | |

| What we discussed | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Overview of our business, strategy, and actions taken to align with shareholder interests | | Review of our compensation philosophy and framework | | Board composition and governance framework | | Environmental, Social, and Governance topics |

| | | | | | | | | | |

For our 2024-2025 engagement, we contacted proxy advisory firms and our top shareholders representing approximately 59% of our Ordinary Shares outstanding. We ultimately met with a proxy advisory firm and shareholders representing approximately 37% of our Ordinary Shares outstanding.

For more information on our actions that were informed by shareholder feedback, please see the section entitled “2025 Proxy Summary — 2024-2025 Shareholder Engagement Program” above.

| | | | | | | | |

24 | TechnipFMC | Proxy Statement 2025 |

Leadership Structure of the Board

The Board believes that our shareholders are best served by a Board that has the flexibility to adjust our leadership structure to the evolving needs of the Company. The Board believes that a strong Lead Independent Director and a combined Chair and CEO is in the best interest of shareholders.

Each of the Chair’s and Lead Independent Director’s specific responsibilities are listed below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive and Board Leadership | | Independent Leadership |

| | | | | | | | |

| | | Douglas J. Pferdehirt Chair of the Board and CEO | | | | | Claire S. Farley Lead Independent Director |

| | | | | | | | |

| | | | | | | | |

| Key Responsibilities •All strategic and operational aspects of the Company •Serving as the principal external spokesperson for the Company with analysts, investors, media, and clients •Managing all executives of the Company •Leading the Board •High-level government and client engagement | | | Key Responsibilities •Approving Board meeting schedules and agendas •Regularly meeting with the Chair and CEO to discuss Board-related matters •Presiding over all meetings of the Board at which the Chair and CEO is not present •Calling meetings of the Board, as necessary •Presiding over executive sessions of the independent directors •Acting as the liaison between the independent directors and the Chair and CEO •Monitoring and reporting to the Board any conflicts of interests of directors •Participating in the Company’s shareholder engagement program, when required |

| | | | | |

| Our Board believes that a combined Chair and CEO leads to more decisive and effective leadership, both within and outside the Company. | | |

| | | |

The CEO is the individual with primary responsibility for managing the Company’s day-to-day operations and is best positioned to chair regular Board meetings as the Board discusses key business and strategic issues for the benefit of the Company and its shareholders.

This leadership structure is balanced by the oversight of the Lead Independent Director and the remaining members of our Board, each of whom is an independent director, and ensures that the Board functions independently. Moreover, only independent directors serve on our Audit Committee, C&T Committee, and ESG Committee. In 2024, the Board again appointed Ms. Farley to continue to serve as Lead Independent Director, and she has the ability to call meetings of the Board, and presides over executive sessions of the Board.

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 25 |

Our fully independent C&T Committee approves our CEO’s compensation, after consulting all independent directors. The CEO’s annual performance objectives are reported and evaluated by both the C&T Committee and during executive sessions of the full Board to promote a comprehensive analysis and evaluation of our CEO’s annual performance.

Finally, the Board believes that the Company’s Governance Guidelines, and the quality, stature, and substantive business knowledge of the Board, as well as the Board’s culture of open communication and transparency with the CEO and senior management, are conducive to Board effectiveness with a combined Chair and CEO position.

The Board regularly evaluates its leadership structure to ensure appropriate, strong, and independent oversight for our shareholders. In doing so, the Board considers shareholder feedback, its evaluation results, peer company practices, and Company performance to confirm that its structure maintains its effectiveness.

| | | | | | | | |

26 | TechnipFMC | Proxy Statement 2025 |

Board Composition and Criteria for Board Membership

Our Board seeks directors whose complementary and diverse knowledge, experience, and skills provide a broad range of perspectives and leadership expertise in areas critical to the Company. These include expertise in the energy and engineering industry, strategic planning and business development, business operations, sustainability and emerging technologies, finance and audit, corporate governance, cybersecurity, and other areas important to the Company’s strategy and oversight. Our Board also assesses director age, tenure, and Board continuity and strives to achieve a balance between the perspectives of new directors and those of longer-serving directors with institutional insights.

Criteria for Board Membership in Governance Guidelines

Our Governance Guidelines state that candidates for our Board, in order to be nominated by our ESG Committee, must be qualified and eligible to serve under applicable law, the Articles, and the NYSE rules, and should have a high level of personal and professional integrity, strong ethics and values, and the ability to make mature business judgments.

In addition, the Governance Guidelines provide that the ESG Committee may consider additional factors when determining whether a candidate is qualified to serve on our Board, including the candidate’s:

}Experience in corporate management, as a board member of another publicly held company, and in finance and accounting and/or compensation practices;

}Professional and academic experience relevant to our industry;

}Leadership skills;

}Global awareness and contributions to the collective expertise and backgrounds on the Board; and

}Ability to commit the time required for service on our Board.

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 27 |

Board Composition, Refreshment, and Succession Planning

The ESG Committee regularly evaluates the composition of our Board and considers whether the Board has the right set of backgrounds, experience, skills, perspectives, and qualifications to effectively oversee our Company’s strategy and our executives’ execution of that strategy. One of the key goals of our Board composition is to ensure we have the right skills and experience on our Board to execute our strategic goals successfully and efficiently. As such, the Board actively considers diversity of backgrounds, experience, skills, geography, qualifications, and perspectives, in the recruitment and nomination of directors. Our current directors possess a diversity of such skills, experience, and expertise that are relevant to our business, such as the following:

}Executive leadership;

}Industry experience;

}Corporate governance and legal;

}Strategy and risk management;

}A range of backgrounds and perspectives;

}Sustainability and emerging technologies;

}External public company board service;

}Finance and audit;

}Cybersecurity;

}Environmental; and

}Acquisition, divestment, and investment portfolio management.

The ESG Committee conducts a search, which may include assistance from an independent search firm, to identify, screen, and assess the capabilities of potential new director candidates. In recent years, this process resulted in the Company identifying and appointing new Board members in 2019, 2020, 2021, and 2023: Mr. Yearwood, Mses. Øvrum and Zurquiyah, and Mr. Gwin, respectively, as part of our ongoing Board refreshment focus.

In addition to evaluating directors’ skills and experience that tie directly to our business strategy, the ESG Committee also regularly considers any changes in the professional status, independence, external commitments, and other public company directorships of our directors to assess the potential impact of these changes on the Board’s effectiveness.

| | | | | | | | |

28 | TechnipFMC | Proxy Statement 2025 |

Board and Committee Evaluations

The Board believes that a rigorous evaluation process is an essential component of strong corporate governance practices. Each year, the Board reviews its effectiveness through a comprehensive self-evaluation process at the Board and committee levels.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Process is Initiated The ESG Committee reviews and approves the process to evaluate the performance of the Board and its three committees. | | | |

| | | | | |

| 6 | |

| | | | | |

| Evaluation Distributed Questionnaires are distributed through a third-party web-based platform. The process encourages candid responses from our directors and promotes productive discussions. | | | |

| Questionnaires solicit feedback on issues, including: }Board/Committee operations }Succession planning }Committee composition, processes, and effectiveness | }Board dynamics }Director preparation, participation, and contribution }Management preparation and communications | |

| | | | | |

| 6 | |

| | | | | |

| Analysis Completed questionnaires are analyzed and summarized by Company management and reported to the ESG Committee Chair. | | | |

| | | | | |

| 6 | |

| | | | | |

| Presentation of Results The ESG Committee Chair reviews the results of the evaluations with the full Board and each committee to determine areas of opportunity. | | | |

| | | | | |

| | | | | | | | |

| Proxy Statement 2025 | TechnipFMC | 29 |

Board Commitments

In conjunction with our Board and committee evaluations, our ESG Committee is responsible for ensuring that our directors possess and demonstrate a willingness to devote the required time and attention to Board duties and to otherwise fulfill the responsibilities required of directors.

A majority of our directors serve on no more than two other public company boards of directors. In addition, unless otherwise determined by our Board, no member of the Audit Committee may serve as a member of the audit committee of more than two other public companies.

In assessing our directors’ ability to devote the required time to his or her Board duties, the ESG Committee reviews the nature of the other companies on which they serve. The ESG Committee also discusses with each director the time commitments and expectations of his or her other board duties to ensure that he or she can continue to serve the Company and its shareholders effectively. Our ESG Committee and our Board believe that each of our directors will continue to demonstrate her or his expertise and ability to dedicate sufficient time to carry out Board duties effectively and diligently.

Shareholder Recommendations for Future Candidates