XRPL Hits 2.8 Billion Flawless Transactions—Big Players Are Paying Attention

25 Marzo 2025 - 8:00PM

NEWSBTC

Blockchain technology is receiving a boost with the XRP Ledger,

based on recent findings from industry observers. The system has

handled over 2.8 billion transactions without any security failure,

which has caught the eye of financial institutions globally.

Related Reading: XRP Breakout On Hold? Financial Expert Reveals

What’s Missing Institutions Are Taking Notice According to Jasmine

Cooper, RippleX Head of Product, the effectiveness of XRPL is one

of the major reasons institutional investors are drawn to it.

Institutional asset issuers and investors are using XRPL more

because of its speed and reliability. For example, OpenEden has

recently hit milestones in tokenizing US Treasury bills on the

platform. Institutional investors are purchasing these tokenized

assets that desire access to on-chain financial instruments.

BlackRock, the global asset management titan, is also making a push

into asset tokenization, lining up with XRPL’s platform. Regulated

exchanges like Archax are even listing tokenized assets created on

the ledger, and it’s becoming more acceptable to mainstream

financial institutions. XRP Ledger Adoption is Surging!

Institutions, DeFi, Stablecoins, Tokenization Jasmine Cooper, Head

of Product at RippleX, joined me to discuss the latest and the

greatest with the XRP Ledger. 02:34 Jasmine’s background 04:43 Real

Estate on Blockchain 06:18 RippleX overview…

pic.twitter.com/HkC2ubbflA — Tony Edward (Thinking Crypto Podcast)

(@ThinkingCrypto1) March 23, 2025 Real Estate Gears Up For

Blockchain XRPL is revolutionizing the way people buy and sell real

estate by enabling tokenization. Firms such as Propy utilize it to

facilitate automatic property sales, minimizing paperwork and

accelerating transactions. This facilitates real estate trading and

makes it more accessible. This change might have a huge effect on

an industry that is normally sluggish and convoluted. Through

blockchain, XRPL assists in making transactions easy yet secure and

reliable. DeFi Growing On XRPL DeFi on XRPL is gaining traction,

owing to fresh technology such as the Automated Market Maker (AMM).

The functionality allows traders to exchange assets and provide

liquidity directly on the blockchain, eliminating the role of

centralized exchanges. RippleX is also looking to simplify XRPL for

developers. The firm is introducing an Ethereum Virtual Machine

(EVM) sidechain that enables developers to create Ethereum-based

smart contracts with the advantage of XRPL’s low-cost, high-speed

transactions. This element is likely to have more DeFi projects

hitting the ledger and improve its connectivity with other

blockchain networks. Related Reading: Shiba Inu ETF Proposal—Could

This Be SHIB’s Breakout Moment? A New Stablecoin On The Horizon

Ripple recently rolled out RLUSD, a new US dollar-backed

stablecoin, on a small number of small crypto exchanges. The

stablecoin will be applied in cross-border payments and liquidity.

RippleX is said to be seeking regulatory approval to ensure that

RLUSD meets the regulations, which could make it more appealing to

institutional users. The stablecoin is positioned as an adjunct to

XRP, already employed as an international bridge currency. If the

RLUSD gains traction, adoption of the XRPL network is likely to

further increase. Featured image from VOI, chart from TradingView

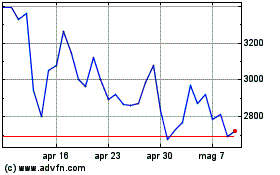

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Feb 2025 a Mar 2025

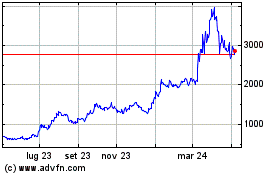

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Mar 2025