Crypto Analyst Warns Of Volume Drop That Could Trigger 60% Bitcoin Price Crash To $49,000

07 Aprile 2025 - 8:30PM

NEWSBTC

Crypto analyst Melika Trader has warned of a volume drop that could

trigger a 60% Bitcoin price crash. The analyst provided an in-depth

analysis of what this price crash could mean and if it would mark

the end of the bull run. How The Bitcoin Price Could Crash By

60% And Drop To $49,000 In a TradingView post, Melika Trader

revealed how the Bitcoin price could crash by 60% and drop to

$49,000. The analyst noted that BTC is hanging just above a

critical support zone, an area he claimed many traders recognize as

the “most important support level” from a volume perspective on

Binance. Related Reading: Analyst Says Bitcoin Price Has

Entered The ‘Ideal Buy Zone’, Here’s Why His accompanying chart

showed that the Bitcoin price could suffer a 60% drop once it loses

the former trend line at $75,000. The flagship crypto is also in

danger, having lost the critical support at around $83,000. This

drop to $49,000 would bring BTC back toward the high-volume range

near $30,000. This provides an ultra-bearish outlook for the

Bitcoin price. However, Melika Trader raised a twist, stating that

only 20% of traders might actually lose. He noted that, according

to Binance’s volume profile data, the majority of buying activity

and position accumulation happened below $35,000. The analyst

further mentioned that most long-term holders and smart money

entered during the 2022/2023 accumulation range. The Volume Profile

Visible Range (VPVR) is also said to show significant support below

the current Bitcoin price, with minimal trading volume at higher

levels. Melika Trader remarked that only a minority of traders

bought BTC during its late-stage bull run above $70,000.

Meanwhile, the majority of investors are still in profit or

break-even, even if the Bitcoin price retraces back to its base. As

such, most traders are safe, as BTC risks a drop to as low as

$49,000. Why BTC’s Bull Market Is Over CryptoQuant’s CEO, Ki

Young Ju, recently asserted that BTC’s bull market is over amid the

Bitcoin price decline. He alluded to the ‘Realized Cap’ metric to

explain his confidence that the bull run is over. The CryptoQuant

CEO noted that if Realized Cap is growing but Market Cap is

stagnant or falling, it means capital is flowing in but prices

aren’t rising. Related Reading: Why Buying Bitcoin Now Is

Better Than Later As BTC Price Consolidates Within Falling Wedge Ki

Young Ju noted that this is a clear bearish signal, and this is

what is currently happening. Capital is entering the market right

now, but the Bitcoin price isn’t responding, which he claims is

typical of a bear market. The CryptoQuant CEO explained that even

large purchases like MicroStrategy’s aren’t pushing prices up

because there is too much sell pressure at the moment. Ki

Young Ju again affirmed that current data points to the Bitcoin

price being in a bear market. He noted that sell pressure could

ease anytime but warned that historically, real reversals take at

least six months. As such, the CryptoQuant CEO believes a

short-term rally seems unlikely. At the time of writing, the

Bitcoin price is trading at around $77,000, down over 7% in the

last 24 hours, according to data from CoinMarketCap. Featured image

from Unsplash, chart from Tradingview.com

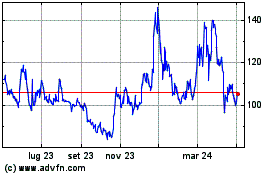

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

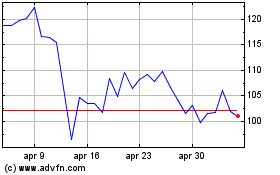

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025