UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

Seaboard Corporation

(Name of Issuer)

Common Stock, $1.00 par value per share

(Title of Class of Securities)

811543107

(CUSIP Number)

Ellen S. Bresky

c/o Seaboard Corporation

9000 West 67th Street, 3rd Floor

Merriam, Kansas 66202

(913) 676-8800

With copies to:

Bradley C. Faris, Esq.

Max Schleusener, Esq.

Latham & Watkins LLP

330 N. Wabash, Suite 2800

Chicago, Illinois 60611

(312) 876-7700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 9, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP

No. 15117V109 |

13D |

Page 1

of 15 pages |

| 1 |

Names of Reporting Persons

Seaboard Flour LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

358,068.69 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

358,068.69 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

358,068.69 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

36.9% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 2

of 15 pages |

| 1 |

Names of Reporting Persons

SFC Preferred, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

346,155.55 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

346,155.55 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

346,155.55 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

35.6% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 3

of 15 pages |

| 1 |

Names of Reporting Persons

HAB Grandchildren’s Trust A |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,775 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,775 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,775 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 4

of 15 pages |

| 1 |

Names of Reporting Persons

HAB Grandchildren’s Trust B |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,775 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,775 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,775 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 5

of 15 pages |

| 1 |

Names of Reporting Persons

SJB SEB, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,661 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

4,661 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,661 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.5% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 6

of 15 pages |

| 1 |

Names of Reporting Persons

Wally Foundation |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Kansas |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,820 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,820 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,820 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 7

of 15 pages |

| 1 |

Names of Reporting Persons

SJB Residuary HAB 2011 Trust |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Kansas |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,560 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,560 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,560 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 8

of 15 pages |

| 1 |

Names of Reporting Persons

PB 2011 Descendants Trust |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

60 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

60 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

60 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.01% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 9

of 15 pages |

| 1 |

Names of Reporting Persons

Paul M. Squires |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,661 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

4,661 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,661 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.5% |

| 14 |

Type of Reporting Person

IN |

| CUSIP

No. 15117V109 |

13D |

Page 10

of 15 pages |

| 1 |

Names of Reporting Persons

Ellen S. Bresky |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

PF |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

715,875.24 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

715,875.24 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

715,875.24 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

73.7% |

| 14 |

Type of Reporting Person

IN |

| CUSIP

No. 15117V109 |

13D |

Page 11

of 15 pages |

Explanatory Note

This Amendment No. 6 (this “Amendment

No. 6” or “Schedule 13D”) amends the Schedule 13D originally filed by certain of the Reporting Persons on November 2,

2006 (as amended to date, the “Schedule 13D”), relating to the Common Stock $1.00 Par Value (the “Common Stock”)

of Seaboard Corporation (the “Issuer”). Capitalized terms used herein and not otherwise defined shall have the same meanings

ascribed to them in the Schedule 13D.

| Item 4. | Purpose of Transaction |

Item 4 of the Schedule 13D is hereby amended and supplemented by the

following:

The information set forth in Item 6 is hereby incorporated

by reference into Item 4 of this Amendment No. 6.

General

The Reporting Persons acquired the securities described

in this Schedule 13D for investment purposes and they intend to review their investments in the Issuer on a continuing basis. Any actions

the Reporting Persons might undertake will be dependent upon the Reporting Persons’ review of numerous factors, including, but not

limited to: an ongoing evaluation of the Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s

securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities;

and other future developments.

The Reporting Persons may acquire additional securities

of the Issuer, or retain or sell all or a portion of the securities then held, in the open market or in privately negotiated transactions.

In addition, the Reporting Persons, including Ms. Bresky in her position as a director of the Issuer, may engage in discussions with

management, the Board, and other securityholders of the Issuer and other relevant parties or encourage, cause or seek to cause the Issuer

or such persons to consider or explore extraordinary corporate transactions, such as: security offerings and/or stock repurchases by the

Issuer; sales or acquisitions of assets or businesses; changes to the capitalization or dividend policy of the Issuer; or other material

changes to the Issuer’s business or corporate structure, including changes in management or the composition of the Board.

To facilitate their consideration of such matters,

the Reporting Persons may retain consultants and advisors and may enter into discussions with potential sources of capital and other third

parties. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar agreements.

The Reporting Persons will likely take some or all of the foregoing steps at preliminary stages in their consideration of various possible

courses of action before forming any intention to pursue any particular plan or direction.

The Reporting Persons are not currently pursuing

and have no intention to pursue, nor have the Reporting Persons had any discussions with the Board regarding, any sale or change of control

transaction involving the Issuer, nor any other similar transaction involving the sale of Common Stock by the Reporting Persons to an

unrelated third party.

Other than as described above, the Reporting Persons

do not currently have any plans or proposals that relate to, or would result in, any of the matters listed in Items 4(a)–(j) of

Schedule 13D, although, depending on the factors discussed herein, the Reporting Persons may change their purpose or formulate different

plans or proposals with respect thereto at any time.

| CUSIP

No. 15117V109 |

13D |

Page 12

of 15 pages |

| Item 5. | Interest in Securities of the Issuer. |

Item 5 of the Schedule 13D is hereby amended and restated as follows:

(a) – (b)

The following sets forth, as of the date of this

Schedule 13D, the aggregate number of shares of Common Stock and percentage of shares of Common Stock beneficially owned by each of the

Reporting Persons, as well as the number of shares of Common Stock as to which each Reporting Person has the sole power to vote or to

direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition of, or shared power to

dispose or to direct the disposition of, as of the date hereof, based on 1,160,779 shares of Common Stock outstanding as of July 24,

2023, as reported by the Issuer on its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 1,

2023, as adjusted for the repurchase of 189,724 shares of Common Stock by the Issuer on October 9, 2023.

| Reporting Person |

|

Amount

beneficially

owned |

|

|

Percent

of class |

|

|

Sole power

to vote or

to direct

the vote |

|

|

Shared

power to

vote or to

direct the

vote |

|

|

Sole power

to dispose

or to direct

the

disposition |

|

|

Shared

power to

dispose or to

direct the

disposition |

|

| Seaboard Flour LLC |

|

|

358,068.69 |

|

|

|

36.9 |

% |

|

|

0 |

|

|

|

358,068.69 |

|

|

|

0 |

|

|

|

358,068.69 |

|

| SFC Preferred, LLC |

|

|

346,155.55 |

|

|

|

35.6 |

% |

|

|

0 |

|

|

|

346,155.55 |

|

|

|

0 |

|

|

|

346,155.55 |

|

| HAB Grandchildren’s Trust A |

|

|

1,775 |

|

|

|

0.2 |

% |

|

|

0 |

|

|

|

1,775 |

|

|

|

0 |

|

|

|

1,775 |

|

| HAB Grandchildren’s Trust B |

|

|

1,775 |

|

|

|

0.2 |

% |

|

|

0 |

|

|

|

1,775 |

|

|

|

0 |

|

|

|

1,775 |

|

| SJB SEC, LLC |

|

|

4,661 |

|

|

|

0.5 |

% |

|

|

0 |

|

|

|

4,661 |

|

|

|

0 |

|

|

|

4,661 |

|

| Wally Foundation |

|

|

1,820 |

|

|

|

0.2 |

% |

|

|

0 |

|

|

|

1,820 |

|

|

|

0 |

|

|

|

1,820 |

|

| SJB Residuary HAB 2011 Trust |

|

|

1,560 |

|

|

|

0.2 |

% |

|

|

0 |

|

|

|

1,560 |

|

|

|

0 |

|

|

|

1,560 |

|

| PB 2011 Descendants Trust |

|

|

60 |

|

|

|

0.01 |

% |

|

|

0 |

|

|

|

60 |

|

|

|

0 |

|

|

|

60 |

|

| Paul M. Squires |

|

|

4,661 |

|

|

|

0.5 |

% |

|

|

0 |

|

|

|

4,661 |

|

|

|

0 |

|

|

|

4,661 |

|

| Ellen S. Bresky |

|

|

715,875.24 |

|

|

|

73.7 |

% |

|

|

0 |

|

|

|

715,875.24 |

|

|

|

0 |

|

|

|

715,875.24 |

|

(c) Other than as set forth in this Amendment

No. 6, during the past sixty days, no transactions in the Common Stock were effected by the Reporting Persons.

(d) None.

(e) Effective October 9, 2023, Ellen S. Bresky resigned as

business advisor of HAB Grandchildren’s Trust B and PB 2011 Descendants Trust and, as a result, will no longer share the voting

and dispositive power over the shares of Common Stock held by HAB Grandchildren’s Trust B and PB 2011 Descendants Trust as of that

date. As a result, HAB Grandchildren’s Trust B and PB 2011 Descendants Trust will no longer be included as Reporting Persons

on the Schedule 13D.

| CUSIP

No. 15117V109 |

13D |

Page 13

of 15 pages |

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Company. |

Item 6 of the Schedule 13D is hereby amended and supplemented as follows:

On October 9, 2023, to

facilitate certain internal family planning and structuring objectives among the Reporting Persons and their affiliates and

equityholders, such persons, including, Seaboard Flour LLC and SFC Preferred, LLC, entered into Stock Repurchase Agreements (the

“Repurchase Agreements”) with the Issuer. Pursuant to the Repurchase Agreements, Seaboard Flour LLC and SFC

Preferred, LLC sold, and the Issuer repurchased, 6,901 and 6,671 shares of Common Stock, respectively, at a purchase price of

$3,162.50 per share, representing a 15.7% discount to the 180-day volume weighted average trading price of the Common Stock as of

October 6, 2023, a 14.9% discount to the 30-day volume weighted average trading price of the Common Stock as of October 6,

2023 and a 13.5% discount to closing price of the Common Stock as of October 6, 2023 (collectively, the

“Repurchases”). The aggregate amount being paid by the Issuer to Seaboard Flour LLC and SFC Preferred, LLC

pursuant to the Repurchase Agreements is $42,921,450, which the Issuer funded by a combination of cash on hand, cash from the sale

of marketable securities and a draw on the Issuer’s existing credit facilities. In connection with the Reporting

Persons’ and their affiliates’ and equityholders’ internal family planning and structuring objectives, immediately

prior to the consummation of the Repurchases, Seaboard Flour LLC and SFC Preferred, LLC distributed 100,856 and 75,296 shares of

Common Stock, respectively, to one of their equityholders in exchange for equity in Seaboard Flour LLC and SFC Preferred, LLC, which

distributed shares of Common Stock were purchased by the Issuer substantially contemporaneously with the consummation of the

Repurchases. The shares described in this paragraph as being repurchased by the Issuer will be retired.

| Item 7. | Materials to be Filed as Exhibits |

Item 7 of the Schedule 13D is hereby amended and restated as follows:

| CUSIP

No. 15117V109 |

13D |

Page 14

of 15 pages |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: October 10,

2023

| |

Seaboard Flour LLC |

| |

|

| |

By: |

/s/

Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

Manager |

| |

|

|

| |

SFC Preferred, LLC |

| |

|

| |

By: |

/s/

Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

Manager |

| |

HAB Grandchildren’s Trust A |

| |

|

| |

By: |

/s/

Stephen M. Berman |

| |

|

Stephen M. Berman, not individually, but solely as Trustee |

| |

|

|

| |

HAB Grandchildren’s Trust B |

| |

|

| |

By: |

/s/

Patricia A. Bresky |

| |

|

Patricia A. Bresky, not individually, but solely as Trustee |

| |

|

|

| |

By: |

/s/

Jonathan Graber |

| |

|

Jonathan Graber, not individually, but solely as Trustee |

| |

|

|

| |

By: |

/s/

Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Business Advisor |

| |

SJB SEB LLC |

| |

|

| |

By: |

/s/

Paul M. Squires |

| |

Name: |

Paul M. Squires |

| |

Title: |

Manager |

| CUSIP

No. 15117V109 |

13D |

Page 15

of 15 pages |

| |

Wally Foundation |

| |

|

| |

By: |

/s/

Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

President |

| |

SJB Residuary HAB 2011 Trust |

| |

|

| |

By: |

/s/

Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Co-Trustee |

| |

|

| |

By: |

/s/

Stephen M. Berman |

| |

|

Stephen M. Berman, not individually, but solely as Co-Trustee |

| |

|

|

| |

PB 2011 Descendants Trust |

| |

|

| |

By: |

/s/

Patricia A. Bresky |

| |

|

Patricia A. Bresky, not individually, but solely as Trustee |

| |

|

|

| |

By: |

/s/

Jonathan Graber |

| |

|

Jonathan Graber, not individually, but solely as Trustee |

| |

|

|

| |

By: |

/s/

Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Business Advisor |

| /s/ Paul M. Squires |

| | Paul M. Squires |

| | |

| | /s/ Ellen S.

Bresky |

| | Ellen S. Bresky |

Exhibit A

Execution Version

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT

(this “Agreement”) is entered into as of October 9, 2023 by and between Seaboard Corporation, a Delaware corporation

(the “Company”), and Seaboard Flour LLC, a Delaware limited liability company (the “Seller”).

Background

A. The

Seller owns and has agreed to transfer, assign, sell, convey and deliver 6,901 shares (the “Repurchase Shares”) of

the Company’s common stock, $1.00 par value per share (“Common Stock”), to the Company on the terms and conditions

set forth in this Agreement;

B. The

Company has agreed to purchase all of the Repurchase Shares at the price and upon the terms and conditions provided in this Agreement

(the “Repurchase”);

C. The

board of directors of the Company (the “Board”) formed a special committee of the Board (the “Special Committee”)

comprised solely of disinterested, independent directors to, among other things, review, evaluate, negotiate, approve or reject the Repurchase,

and the Board further resolved it would not approve any Repurchase without the prior favorable recommendation thereof by the Special Committee;

D. The

Special Committee has received opinions (the “Opinions”) from Kroll, LLC (i) that the consideration to be paid

by the Company in exchange for the Repurchase Shares and shares of Common Stock to be acquired in simultaneous repurchases (x) pursuant

hereto and (y) from SFC Preferred, LLC and REP23 LLC, each a Delaware limited liability company, pursuant to other repurchase agreements

(together with the Repurchase, the “Aggregate Repurchases”) is fair, from a financial point of view, to the Company

and its stockholders (excluding the Bresky Group (for purposes of this Agreement, as defined in such opinion)) and (ii) regarding

certain determinations as to surplus and solvency of the Company in connection with the Aggregate Repurchases; and

E. The

Special Committee has, in reliance on the Opinions and taking into account such other factors as it deemed relevant, approved the Aggregate

Repurchases, the applicable repurchase agreements, and the transactions contemplated thereby.

THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

(a) On

the terms and subject to the conditions set forth in this Agreement, at the Closing (as defined below), the Seller agrees to transfer,

assign, sell, convey and deliver to the Company the Repurchase Shares. The per share purchase price for each Repurchase Share shall be

$3,162.50 (the “Per Share Purchase Price”). The Company hereby agrees to purchase the Repurchase Shares from the Seller

at the Per Share Purchase Price and in an aggregate amount of $21,824,412.50 (the “Purchase Price”).

(b) The

closing of the sale of the Repurchase Shares (the “Closing”) shall take place by conference call at 9:00 a.m. eastern

time on October 10, 2023, or on such other date and time as the parties agree in writing. In accordance with the wire instructions

set forth on Exhibit A hereto and completed IRS Form W-9 previously provided by the Seller to the Company, payment for

the Repurchase Shares shall be made by wire transfer of immediately available funds to the account specified by the Seller on Exhibit A

in an amount equal to the Purchase Price. Transfer taxes payable in connection with the sale of such Repurchase Shares, if any, shall

be paid by the Seller.

(c) By

executing this Agreement, the Seller hereby instructs and directs the Company, and the officers thereof, to, at the Closing, reflect the

transfer, assignment, sale, conveyance and delivery of the Repurchase Shares and the simultaneous retirement of the Repurchase Shares

by the Company in connection therewith, in all cases contemplated by, and in accordance with, this Agreement. At the Closing (i) in

accordance with the preceding sentence, Seller shall take any and all additional action necessary to cause the Repurchase Shares to be

transferred, assigned, sold, conveyed and delivered to the Company, (ii) the Company shall take any and all action necessary such

that, upon consummation of the Repurchase, the Repurchase Shares shall assume the status of authorized and unissued shares of Common Stock,

and (iii) the Company shall pay to Seller the Purchase Price.

2. Company

Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to the Seller as of

the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date

(in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Assuming the accuracy

of the representation and warranty in Section 3(f) hereof, (i) the Company has the requisite power and authority to execute

and deliver this Agreement and to perform its obligations hereunder, and (ii) all action required to be taken for the due and proper

authorization, execution and delivery by it of this Agreement and the consummation by it of the transactions contemplated hereby has been

duly and validly taken.

(b) Assuming

the accuracy of the representation and warranty in Section 3(f) hereof, this Agreement

has been duly authorized, executed and delivered by the Company and constitutes a valid and binding agreement of the Company enforceable

in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or

other laws affecting enforcement of creditors’ rights or by general equitable principles.

3. Representations

of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants to the Company as of the

date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date (in

which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware.

(b) All

consents, approvals, authorizations and orders necessary for the execution and delivery by the Seller of this Agreement, and for the sale

and delivery of the Repurchase Shares to be sold by the Seller hereunder, have been obtained; and the Seller has full right, power and

authority to enter into this Agreement, and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Seller hereunder.

(c) This

Agreement has been duly authorized, executed and delivered by the Seller and constitutes a valid and binding agreement of the Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) As

of immediately prior to the Closing, the Seller has valid title to the Repurchase Shares, free and clear of all liens, encumbrances, equities

or adverse claims, and, upon transfer of the Repurchase Shares and payment therefor pursuant hereto, good and valid title to such Repurchase

Shares, free and clear of all liens, encumbrances, equities or adverse claims, will pass to the Company.

(e) The

Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable

of evaluating the merits and risks of the Repurchase. The Seller has had the opportunity to ask questions and receive answers concerning

the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning the

Company as it has requested. The Seller has received all information that it believes is necessary or appropriate in connection with the

Repurchase. The Seller is an informed and sophisticated party and has engaged, to the extent the Seller deems appropriate, expert advisors

experienced in the evaluation of transactions of the type contemplated hereby. The Seller acknowledges that neither the Company nor any

person on behalf of the Company has made, and the Seller has not relied upon, any express or implied representations, warranties or statements

of any nature, whether or not in writing or orally, including as to the accuracy and completeness of any information provided by or on

behalf of the Company to the Seller or its representatives, except as expressly set forth for the benefit of the Seller in this Agreement.

(f) The

Seller is, and has been at all times for at least three years prior to the date of this Agreement, and shall continue to be through Closing,

an “interested stockholder” (as such term is defined in Section 203 of the Delaware General Corporation Law) of the Company.

4. Information.

The Seller acknowledges that it knows that the Company and members of the Board and of the Company’s management may have material,

non-public information regarding the Company and its condition (financial and otherwise), results of operations, businesses, properties,

plans (including, without limitation, plans regarding other potential exchanges or purchases of Common Stock, which may be for different

amounts or types of consideration) and prospects (collectively, the “Information”). The Seller acknowledges (a) that

it has been offered, and does not wish to receive, any of the Information, (b) that the Company has not disclosed, and has no obligation

to disclose, the Information to the Seller, and (c) that the Information might be material to the Seller’s decision to sell

the Repurchase Shares or otherwise materially adverse to the Seller’s interests. Accordingly, the Seller acknowledges and agrees

that neither the Company nor any member of the Board or of the Company’s management shall have any obligation to disclose to the

Seller any of the Information. The Seller hereby waives and releases, to the fullest extent permitted by law, any and all claims and causes

of action (whether known or unknown) it has or may have against the Company and its affiliates, controlling persons, officers, directors,

employees, representatives and agents, based upon, relating to or arising out of the nondisclosure of the Information in connection with

the transactions contemplated by the Agreement. The Seller is aware that the Company is relying on the foregoing acknowledgement and waiver

in this Section 4 in connection with the transactions contemplated by this Agreement.

5. Miscellaneous.

(a) Survival

of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection

herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(b) Counterparts;

Execution of Agreement. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all

of which taken together constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement

by facsimile or other electronic transmission, including by e-mail attachment or PDF document, shall be as effective as delivery of a

manually executed counterpart of this Agreement.

(c) No

Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties hereto and their successors and permitted

assigns, and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or remedies to

any person other than the parties to this Agreement and their successors and permitted assigns.

(d) Governing

Law; Arbitration; Jurisdiction. This Agreement and all disputes arising out of or related to this Agreement, whether in contract,

tort or otherwise (each, an “Agreement Dispute”), will be governed by and construed in accordance with, the laws of

the State of Delaware, without regard to any applicable principles of conflicts of law that might require the application of the laws

of any other jurisdiction. Any Agreement Dispute shall be resolved by binding arbitration in Chicago, Illinois, before one arbitrator

independent of the parties (each, an “Arbitration Proceeding”). Such arbitrator shall be selected in accordance with,

and the Arbitration Proceeding shall be administered by JAMS pursuant to, the JAMS Comprehensive Arbitration Rules and Procedures

excluding its optional Arbitration Appeal procedures. Any arbitrator designated pursuant to this Section 5(d) shall be a lawyer

experienced in commercial and business affairs. All Arbitration Proceedings will be closed to the public and kept confidential, except

to the extent necessary to (i) seek an injunction in aid of arbitration, (ii) obtain court confirmation of the judgment of the

arbitrator, or (iii) give effect to res judicata and collateral estoppel, in which case, all filings with any court shall be sealed

to the extent permissible by the court. Nothing in this Section 5(d) is intended to, or shall, preclude a party to an Arbitration

Proceeding from communicating with, or making disclosures to his, her or its lawyers, tax advisors, auditors and insurers, or from making

such other disclosures as may be required by any applicable law. To the maximum extent permitted by applicable law, the decision of the

arbitrator shall be final and binding and not be subject to appeal. If any party to an Arbitration Proceeding fails to abide by a judgment

rendered in such Arbitration Proceeding, the other party may seek to enforce such judgment in any court of competent jurisdiction. EACH

OF THE PARTIES TO THIS AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY AGREEMENT DISPUTE. Notwithstanding anything

contained in this Agreement to the contrary, no party shall have the right to institute any proceedings in any court against the other

party or any person acting by, through or under such other party to adjudicate an Agreement Dispute, except that any party shall be permitted

to seek an injunction in aid of arbitration with respect to an Agreement Proceeding, and any such injunction proceeding shall be sought

and determined exclusively in any Delaware state or federal court.

(e) Mutuality

of Drafting. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity

or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption

or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement.

(f) Amendment

and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Seller

and the Company; provided, in the case of the Company, such amendment, modification or waiver has been approved by the Special Committee

or, if the Special Committee is no longer in existence, by a majority of the members of the Board unaffiliated with the Bresky Group,

or a committee of such directors. No waiver of any of the provisions of this Agreement shall be deemed, or shall constitute, a waiver

of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to insist

upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach thereof

shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(g) Further

Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments and shall take

such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(h) Expenses.

Each of the Company and the Seller shall bear their own respective expenses in connection with the

drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(i) Entire

Agreement. This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes

all other prior or contemporaneous agreements and understandings, both written and oral, among or between any of the parties with respect

to the subject matter hereof.

[Signatures appear on following page.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| |

Company: | | |

| |

| | |

| |

| | SEABOARD CORPORATION |

| |

| | |

| |

| | By: |

/s/ Robert L. Steer |

| |

| | |

Name: Robert

L. Steer |

| |

| | |

Title: President and Chief Executive Officer |

| |

| | |

| |

Seller: | | |

| |

| | |

| |

| | SEABOARD FLOUR LLC |

| |

| | |

| |

| | By: |

/s/ Ellen S. Bresky |

| |

| | |

Name: |

Ellen S. Bresky |

| |

| | |

Title: |

Manager |

[Signature Page to Stock Repurchase Agreement]

Exhibit B

Execution Version

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT

(this “Agreement”) is entered into as of October 9, 2023 by and between Seaboard Corporation, a Delaware corporation

(the “Company”), and SFC Preferred, LLC, a Delaware limited liability company (the “Seller”).

Background

A. The

Seller owns and has agreed to transfer, assign, sell, convey and deliver 6,671 shares (the “Repurchase Shares”) of

the Company’s common stock, $1.00 par value per share (“Common Stock”), to the Company on the terms and conditions

set forth in this Agreement;

B. The

Company has agreed to purchase all of the Repurchase Shares at the price and upon the terms and conditions provided in this Agreement

(the “Repurchase”);

C. The

board of directors of the Company (the “Board”) formed a special committee of the Board (the “Special Committee”)

comprised solely of disinterested, independent directors to, among other things, review, evaluate, negotiate, approve or reject the Repurchase,

and the Board further resolved it would not approve any Repurchase without the prior favorable recommendation thereof by the Special

Committee;

D. The

Special Committee has received opinions (the “Opinions”) from Kroll, LLC (i) that the consideration to be paid

by the Company in exchange for the Repurchase Shares and shares of Common Stock to be acquired in simultaneous repurchases (x) pursuant

hereto and (y) from Seaboard Flour LLC and REP23 LLC, each a Delaware limited liability company, pursuant to other repurchase agreements

(together with the Repurchase, the “Aggregate Repurchases”) is fair, from a financial point of view, to the Company

and its stockholders (excluding the Bresky Group (for purposes of this Agreement, as defined in such opinion)) and (ii) regarding

certain determinations as to surplus and solvency of the Company in connection with the Aggregate Repurchases; and

E. The

Special Committee has, in reliance on the Opinions and taking into account such other factors as it deemed relevant, approved the Aggregate

Repurchases, the applicable repurchase agreements, and the transactions contemplated thereby.

THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

Agreement

(a) On

the terms and subject to the conditions set forth in this Agreement, at the Closing (as defined below), the Seller agrees to transfer,

assign, sell, convey and deliver to the Company the Repurchase Shares. The per share purchase price for each Repurchase Share shall be

$3,162.50 (the “Per Share Purchase Price”). The Company hereby agrees to purchase the Repurchase Shares from the Seller

at the Per Share Purchase Price and in an aggregate amount of $21,097,037.50 (the “Purchase Price”).

(b) The

closing of the sale of the Repurchase Shares (the “Closing”) shall take place by conference call at 9:00 a.m. eastern

time on October 10, 2023, or on such other date and time as the parties agree in writing. In accordance with the wire instructions

set forth on Exhibit A hereto and completed IRS Form W-9 previously provided by the Seller to the Company, payment for

the Repurchase Shares shall be made by wire transfer of immediately available funds to the account specified by the Seller on Exhibit A

in an amount equal to the Purchase Price. Transfer taxes payable in connection with the sale of such Repurchase Shares, if any, shall

be paid by the Seller.

(c) By

executing this Agreement, the Seller hereby instructs and directs the Company, and the officers thereof, to, at the Closing, reflect

the transfer, assignment, sale, conveyance and delivery of the Repurchase Shares and the simultaneous retirement of the Repurchase Shares

by the Company in connection therewith, in all cases contemplated by, and in accordance with, this Agreement. At the Closing (i) in

accordance with the preceding sentence, Seller shall take any and all additional action necessary to cause the Repurchase Shares to be

transferred, assigned, sold, conveyed and delivered to the Company, (ii) the Company shall take any and all action necessary such

that, upon consummation of the Repurchase, the Repurchase Shares shall assume the status of authorized and unissued shares of Common

Stock, and (iii) the Company shall pay to Seller the Purchase Price.

2. Company

Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to the Seller as of

the date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date

(in which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Assuming the

accuracy of the representation and warranty in Section 3(f) hereof, (i) the Company has the requisite power and authority

to execute and deliver this Agreement and to perform its obligations hereunder, and (ii) all action required to be taken for the

due and proper authorization, execution and delivery by it of this Agreement and the consummation by it of the transactions contemplated

hereby has been duly and validly taken.

(b) Assuming

the accuracy of the representation and warranty in Section 3(f) hereof, this Agreement has been duly authorized, executed and

delivered by the Company and constitutes a valid and binding agreement of the Company enforceable in accordance with its terms, except

to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement of

creditors’ rights or by general equitable principles.

3. Representations

of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants to the Company as of the

date hereof and as of the Closing (except to the extent any such representation and warranty expressly relates to an earlier date (in

which case it shall be true and correct in all material respects as of such earlier date)) that:

(a) The

Seller is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Delaware.

(b) All

consents, approvals, authorizations and orders necessary for the execution and delivery by the Seller of this Agreement, and for the

sale and delivery of the Repurchase Shares to be sold by the Seller hereunder, have been obtained; and the Seller has full right, power

and authority to enter into this Agreement, and to sell, assign, transfer and deliver the Repurchase Shares to be sold by the Seller

hereunder.

(c) This

Agreement has been duly authorized, executed and delivered by the Seller and constitutes a valid and binding agreement of the Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d) As

of immediately prior to the Closing, the Seller has valid title to the Repurchase Shares, free and clear of all liens, encumbrances,

equities or adverse claims, and, upon transfer of the Repurchase Shares and payment therefor pursuant hereto, good and valid title to

such Repurchase Shares, free and clear of all liens, encumbrances, equities or adverse claims, will pass to the Company.

(e) The

Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it is capable

of evaluating the merits and risks of the Repurchase. The Seller has had the opportunity to ask questions and receive answers concerning

the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning the

Company as it has requested. The Seller has received all information that it believes is necessary or appropriate in connection with

the Repurchase. The Seller is an informed and sophisticated party and has engaged, to the extent the Seller deems appropriate, expert

advisors experienced in the evaluation of transactions of the type contemplated hereby. The Seller acknowledges that neither the Company

nor any person on behalf of the Company has made, and the Seller has not relied upon, any express or implied representations, warranties

or statements of any nature, whether or not in writing or orally, including as to the accuracy and completeness of any information provided

by or on behalf of the Company to the Seller or its representatives, except as expressly set forth for the benefit of the Seller in this

Agreement.

(f) The

Seller is, and has been at all times for at least three years prior to the date of this Agreement, and shall continue to be through Closing,

an “interested stockholder” (as such term is defined in Section 203 of the Delaware General Corporation Law) of the

Company.

4. Information.

The Seller acknowledges that it knows that the Company and members of the Board and of the Company’s management may have material,

non-public information regarding the Company and its condition (financial and otherwise), results of operations, businesses, properties,

plans (including, without limitation, plans regarding other potential exchanges or purchases of Common Stock, which may be for different

amounts or types of consideration) and prospects (collectively, the “Information”). The Seller acknowledges (a) that

it has been offered, and does not wish to receive, any of the Information, (b) that the Company has not disclosed, and has no obligation

to disclose, the Information to the Seller, and (c) that the Information might be material to the Seller’s decision to sell

the Repurchase Shares or otherwise materially adverse to the Seller’s interests. Accordingly, the Seller acknowledges and agrees

that neither the Company nor any member of the Board or of the Company’s management shall have any obligation to disclose to the

Seller any of the Information. The Seller hereby waives and releases, to the fullest extent permitted by law, any and all claims and

causes of action (whether known or unknown) it has or may have against the Company and its affiliates, controlling persons, officers,

directors, employees, representatives and agents, based upon, relating to or arising out of the nondisclosure of the Information in connection

with the transactions contemplated by the Agreement. The Seller is aware that the Company is relying on the foregoing acknowledgement

and waiver in this Section 4 in connection with the transactions contemplated by this Agreement.

5. Miscellaneous.

(a) Survival

of Representations and Warranties. All representations and warranties contained herein or made in writing by any party in connection

herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(b) Counterparts;

Execution of Agreement. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all

of which taken together constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement

by facsimile or other electronic transmission, including by e-mail attachment or PDF document, shall be as effective as delivery of a

manually executed counterpart of this Agreement.

(c) No

Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties hereto and their successors and

permitted assigns, and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or

remedies to any person other than the parties to this Agreement and their successors and permitted assigns.

(d) Governing

Law; Arbitration; Jurisdiction. This Agreement and all disputes arising out of or related to this Agreement, whether in contract,

tort or otherwise (each, an “Agreement Dispute”), will be governed by and construed in accordance with, the laws of

the State of Delaware, without regard to any applicable principles of conflicts of law that might require the application of the laws

of any other jurisdiction. Any Agreement Dispute shall be resolved by binding arbitration in Chicago, Illinois, before one arbitrator

independent of the parties (each, an “Arbitration Proceeding”). Such arbitrator shall be selected in accordance with,

and the Arbitration Proceeding shall be administered by JAMS pursuant to, the JAMS Comprehensive Arbitration Rules and Procedures

excluding its optional Arbitration Appeal procedures. Any arbitrator designated pursuant to this Section 5(d) shall be a lawyer

experienced in commercial and business affairs. All Arbitration Proceedings will be closed to the public and kept confidential, except

to the extent necessary to (i) seek an injunction in aid of arbitration, (ii) obtain court confirmation of the judgment of

the arbitrator, or (iii) give effect to res judicata and collateral estoppel, in which case, all filings with any court shall be

sealed to the extent permissible by the court. Nothing in this Section 5(d) is intended to, or shall, preclude a party to an

Arbitration Proceeding from communicating with, or making disclosures to his, her or its lawyers, tax advisors, auditors and insurers,

or from making such other disclosures as may be required by any applicable law. To the maximum extent permitted by applicable law, the

decision of the arbitrator shall be final and binding and not be subject to appeal. If any party to an Arbitration Proceeding fails to

abide by a judgment rendered in such Arbitration Proceeding, the other party may seek to enforce such judgment in any court of competent

jurisdiction. EACH OF THE PARTIES TO THIS AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY AGREEMENT DISPUTE.

Notwithstanding anything contained in this Agreement to the contrary, no party shall have the right to institute any proceedings in any

court against the other party or any person acting by, through or under such other party to adjudicate an Agreement Dispute, except that

any party shall be permitted to seek an injunction in aid of arbitration with respect to an Agreement Proceeding, and any such injunction

proceeding shall be sought and determined exclusively in any Delaware state or federal court.

(e) Mutuality

of Drafting. The parties hereto have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity

or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and no presumption

or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement.

(f) Amendment

and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Seller

and the Company; provided, in the case of the Company, such amendment, modification or waiver has been approved by the Special Committee

or, if the Special Committee is no longer in existence, by a majority of the members of the Board unaffiliated with the Bresky Group,

or a committee of such directors. No waiver of any of the provisions of this Agreement shall be deemed, or shall constitute, a waiver

of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to

insist upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach

thereof shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(g) Further

Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments and shall take

such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(h) Expenses.

Each of the Company and the Seller shall bear their own respective expenses in connection with the drafting, negotiation, execution and

delivery of this Agreement and the consummation of the transactions contemplated hereby.

(i) Entire

Agreement. This Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes

all other prior or contemporaneous agreements and understandings, both written and oral, among or between any of the parties with respect

to the subject matter hereof.

[Signatures appear on following page.]

IN WITNESS WHEREOF, the parties

hereto have executed this Stock Repurchase Agreement as of the date first written above.

| |

Company: | | |

| |

| | |

| |

| | SEABOARD CORPORATION |

| |

| | |

| |

| | By: |

/s/ Robert L. Steer |

| |

| | |

Name: Robert

L. Steer |

| |

| | |

Title: President and Chief Executive Officer |

| |

| | |

| |

Seller: | | |

| |

| | |

| |

| | SFC PREFERRED, LLC |

| |

| | |

| |

| | By: |

/s/ Ellen S. Bresky |

| |

| | |

Name: |

Ellen S. Bresky |

| |

| | |

Title: |

Manager |

[Signature Page to Stock Repurchase Agreement]

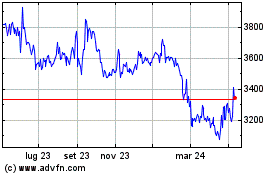

Grafico Azioni Seaboard (AMEX:SEB)

Storico

Da Dic 2024 a Gen 2025

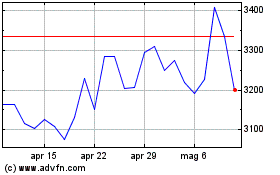

Grafico Azioni Seaboard (AMEX:SEB)

Storico

Da Gen 2024 a Gen 2025