UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| SERVOTRONICS, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

STAR EQUITY FUND, LP

STAR EQUITY FUND GP, LLC

STAR VALUE, LLC

STAR EQUITY HOLDINGS, INC.

STAR INVESTMENT MANAGEMENT, LLC

JEFFREY E. EBERWEIN

RICHARD K. COLEMAN, JR.

G. MARK POMEROY

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Star Equity Fund, LP (“Star

Equity Fund”), together with the other participants named herein, has filed a definitive proxy statement and accompanying WHITE

proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director

nominees at the 2023 annual meeting of shareholders of Servotronics, Inc., a Delaware corporation.

On May 23, 2023, Star Equity

Fund issued the following press release:

Star Equity Fund

Launches Proxy Solicitation at Servotronics

Urges All Shareholders to Vote the WHITE

Proxy Card Today to Elect Mark Pomeroy and Rick Coleman to SVT’S Board at Upcoming Annual Meeting

Old Greenwich, CT – May 23, 2023 –

Star Equity Fund, LP (“Star Equity” or “we”) is an investment fund focused on unlocking shareholder value and

improving corporate governance at its portfolio companies. Star Equity owns 5.4% of the common stock of Servotronics, Inc. (NYSE American:

SVT) (“Servotronics,” “SVT,” or the “Company”) and announced today it has filed its definitive proxy

statement and begun soliciting proxies urging all stockholders to vote the WHITE proxy card to elect G. Mark Pomeroy and

Richard K. Coleman, Jr. to the Company’s board of directors (the “Board”) at the Company’s 2023 annual meeting

of shareholders (the “Annual Meeting”), which will be held in a virtual format on June 9, 2023 at 9:00 a.m., E.T.

OUR PLAN FOR CHANGE AT SVT

Please see the below hyperlink for an investor presentation

filed with the SEC on May 19, 2023, entitled “Our Plan for Change at Servotronics, Inc.”

Star Equity Fund’s Presentation on Servotronics

https://www.sec.gov/Archives/edgar/data/89140/000092189523001291/ex991dfan14a09271046_051923.pdf

We believe the incumbent Board has only been reactive

to our efforts to effect change at SVT and lacks the necessary drive to get the job done

The Board has touted “significant governance

improvements at Servotronics” over the past year. However, since we began engaging with the Company in 2021, the Board has only

been reactive to our efforts to improve corporate governance and enhance value for all shareholders and has not taken one single

action without our prodding. We firmly believe that left alone, the incumbent Board would NOT take the necessary

steps to prioritize shareholder value, improve financial and operating performance, or optimize Board composition, and the Company’s

corporate governance would be even worse.

Incumbent Board Members Edward Cosgrove and Christopher

Marks have overseen a period of poor operating and financial performance and should be held accountable

We believe the two longest tenured Board members,

Edward Cosgrove (11 years on the Board) and Christopher Marks (7 years on the Board), should be held accountable for their poor track

records at the Company.

The Company’s CPG segment has not seen

material revenue growth over the past 10 years and has consistently generated operating losses over this time. Both Cosgrove and Marks

were on the Board during this period and the Board did not communicate a plan to shareholders to improve performance at CPG or take any

meaningful action to maximize shareholder value. Although the Company announced plans for a strategic review of the CPG segment on March

30, 2023, we believe this to be in direct response to our activist campaign. And, the outcome of this review is highly uncertain given

the Board’s lack of M&A experience. The fact it took this long for the Board to announce a strategic review of this ailing segment,

and only did so after we nominated candidates for the Annual Meeting, speaks volumes about the complacency of incumbents Cosgrove and

Marks and whether shareholders can trust them to follow through on the review.

The Company’s key ATG segment achieved

gross margins between 26% and 30% from 2013 – 2019, but its financial performance during the COVID19 pandemic deteriorated and has

not shown any meaningful signs of recovery. ATG recorded operating losses for FY 2021 and FY 2022 and has recently reported another operating

loss for Q1 2023. Additionally, Q1 2023 results saw SG&A rise by 23% year over year while revenue and gross profit remained relatively

flat.

We believe the incumbent Board is ill-equipped

to execute on their stated growth strategy

Despite the recent Board turnover, we believe the

current Board lacks the necessary experience and skillsets to lead a successful turnaround at SVT, or even to execute on their articulated

growth strategy. On April 4, 2023, the Company issued a press release describing their strategic plan consisting of exploring strategic

alternatives for the CPG segment and pursuing organic growth within its ATG segment. We believe that having not even one

independent Board member with aerospace or advanced engineering expertise is unwise for a Company attempting to realign itself as an aerospace

pure play. Additionally, no incumbent Board members have any turnaround or M&A experience or a track-record of value creation for

shareholders serving on microcap Boards.

Our nominees, G. Mark Pomeroy and Richard K. Coleman,

Jr., are well positioned to address the significant skill gaps on the Board

Mr. Pomeroy currently serves as the President of Pomme

Ventures, LLC, a company that invests in, and provides leadership support for, start-ups in aerospace, energy, and medical devices since

2018. Before this, Mr. Pomeroy accumulated extensive experience in manufacturing, research and development, and aviation previously serving

as a Systems Engineer and Contract Administrator of GE Aviation for 20 years and as Vice President of R&D at LifeScan Inc., a subsidiary

of Johnson & Johnson. Mr. Pomeroy would bring crucial aerospace and engineering experience to the Board as well as a strong familiarity

with advising aerospace companies.

Mr. Coleman currently serves as Chief Executive Officer

of Star Equity Holdings, Inc. (NASDAQ: STRR), a diversified holding company and led its recent effort to sell a business division for

$40 million. Mr. Coleman is a high-performance, hands-on operations executive with a track record of increasing shareholder value for

public and private companies. While serving as the COO of MetroNet Communications, Inc., Mr. Coleman successfully led the company to IPO

and prepared it for its multi-billion-dollar sale to AT&T Canada, generating an approximate 900% return for stockholders. While serving

as CEO of Command Center, Inc., Mr. Coleman led the company through a reverse merger transaction with HireQuest generating a positive

return of 332% since that time. Additionally, while serving on the board of directors of NTS, Inc. he helped facilitate the company’s

merger with the private equity firm Tower Three Partners LLC resulting in a 122% return for stockholders. Mr. Coleman has served as CEO

of three public companies and as a board member of seven public companies, including as board chairman. Additionally, he is an Air Force

Academy graduate with significant engineering training. Mr. Coleman would bring crucial turnaround, systems engineering, and leadership

experience to the Board and is a proven money maker for stockholders.

Star Equity Fund remains resolute in its opinion that

additional Board changes are needed to meaningfully change the Company’s corporate governance practices, improve financial results,

and ultimately unlock shareholder value. We believe long-suffering SVT shareholders deserve better, and we aim to give shareholders an

opportunity to vote for much-needed change at the 2023 Annual Meeting.

Additional Information and Where to Find It

Star Equity Fund, LP (“Star Equity Fund”),

together with the other participants named herein (collectively, “Star Equity”), intends to file a definitive proxy statement

and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the

election of its slate of highly-qualified director nominees at the 2023 annual meeting of stockholders of Servotronics, Inc., a Delaware

corporation (the “Company”).

STAR EQUITY STRONGLY ADVISES ALL STOCKHOLDERS OF THE

COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS

PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

If you have any questions, require assistance

with voting your proxy card,

or need additional copies of proxy material, please contact InvestorCom LLC

InvestorCom LLC

19 Old Kings Highway S., Suite 130

Darien, CT 06820

proxy@investor-com.com

(203) 972-9300 or Toll-Free (877) 972-0090

About Star Equity Fund, LP

Star Equity Fund, LP is an investment fund affiliated with Star Equity

Holdings, Inc. Star Equity Fund seeks to unlock shareholder value and improve corporate governance at its portfolio companies.

About Star Equity Holdings, Inc.

Star Equity Holdings, Inc. is a diversified holding

company with two divisions: Construction and Investments.

| For more information contact: |

|

| Star Equity Fund, LP |

The Equity Group |

| Jeffrey E. Eberwein |

Lena Cati |

| Portfolio Manager |

Senior Vice President |

| 203-489-9501 |

212-836-9611 |

| jeff.eberwein@starequity.com |

lcati@equityny.com |

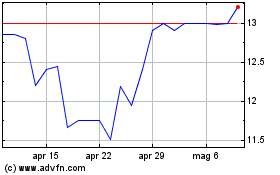

Grafico Azioni Servotronics (AMEX:SVT)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Servotronics (AMEX:SVT)

Storico

Da Dic 2023 a Dic 2024