First Contract Executed to Supply

Natural Purified Graphite Anode Material to a Leading Manufacturer

of EV Batteries

Increase in Anticipated Annual Phase I CSPG

Production to 12,500 MT While Maintaining Existing Budget

Over $119 Million Invested in Kellyton

Graphite Plant Construction

Westwater Resources, Inc. (NYSE American: WWR), an energy

technology and battery-grade natural graphite development company

(“Westwater” or the “Company”), is pleased to announce its results

for the year ended December 31, 2023, and to provide business and

financial updates.

2023 a Year of Progress

During 2023, Westwater achieved critical milestones and

achievements related to its planned natural graphite business,

notably:

- In May 2023, Westwater announced the execution of a joint

development agreement (“JDA”) with SK On Co, Ltd. (“SK On”).

- On February 5, 2024, Westwater announced the execution of its

first off-take agreement with SK On for Coated Spherical Purified

Graphite (“CSPG”).

- As a result of the completion of a debottlenecking study,

Westwater has increased its anticipated Phase I production of CSPG

to 12,500 mt per year while maintaining the Phase I construction

budget of the Kellyton Graphite Plant at $271 million.

- Continued Phase I construction at the Kellyton Graphite Plant

deploying approximately $119.2 million since inception of the

project.

- In December 2023, Westwater announced the completion of its

Initial Assessment with an Economic Analysis related to its Coosa

Graphite Deposit, and publication of the S-K 1300 Technical Report

Summary (“TRS”) disclosing mineral resources, which indicates an

estimated pre-tax NPV of $229 million, estimated pre-tax internal

rate of return of 26.7%, and estimated free cash flow of $714

million over the 20+ year mine life.

“We believe 2023 was a year of significant progress across our

graphite business, which was the result of tremendous hard work by

the Westwater team,” said Terence J. Cryan, Westwater’s Executive

Chairman. “We are especially excited about our first off-take

agreement with a major Tier 1 battery manufacturer, the increase in

anticipated Phase I production while staying on budget, and the

positive anticipated economic results from our initial assessment

of the Coosa Graphite Deposit.”

“Westwater is the only U.S.-based natural graphite company under

construction on a processing facility, that has a multi-year

off-take agreement for CSPG, and that has a graphite deposit in the

same state as its future processing plant,” said Frank Bakker,

Westwater’s President and CEO. “The accomplishments of the

Westwater team were not only significant for 2023, but I believe

positions Westwater well for 2024.”

Recent Government Regulation of Graphite Products

China and the United States have imposed tariffs and export

controls on critical minerals, including graphite, indicating the

potential for further trade barriers between China and the U.S.

Effective December 1, 2023, China began requiring government

approval for exports of two types of graphite products, including

high-purity, high-hardness and high-intensity synthetic graphite

material and natural flake graphite and its products. Westwater

believes these export restrictions continue to highlight the

supply-chain risk for the U.S. and other countries related to

natural graphite products.

The U.S. Department of the Treasury (the “Treasury Department”)

has published guidance on key requirements for federal clean

vehicle tax credits established by the Inflation Reduction Act

(“IRA”); most significantly, the Treasury Department proposed new

regulations to clarify the application of Foreign Entity of Concern

(“FEOC”) credit eligibility exclusions. The U.S. Department of

Energy simultaneously released companion interpretive regulations

regarding the scope and application of FEOC-related restrictions.

Most importantly, both sets of guidance identified the People’s

Republic of China as an FEOC. These regulations are important

because, starting in 2025, any vehicle whose batteries contain

critical minerals – including graphite – that were extracted or

processed in any way, and to any degree, by an FEOC – including

China – will be ruled ineligible for the Clean Vehicle Tax credit

of $7,500 under section 30D of the Internal Revenue Code. As a

result, an FEOC must be excluded from a vehicle battery’s supply

chain in order for the vehicle to be eligible for the tax credit.

Because Westwater is not an FEOC and intends to produce

battery-grade graphite for lithium-ion batteries to be used in

electric vehicles in the United States, management believes its

future production of battery-graphite products will meet the

domestic content requirements of the IRA, which we anticipate will

provide indirect future benefit to the Company.

Continuing Customer Engagement

As previously announced, Westwater executed its first off-take

agreement for the supply of CSPG from its Kellyton Graphite Plant

to SK On battery plants located within the U.S., with forecasted

volumes ramping to 10,000 mt in the final year of the

agreement.

Additionally, Westwater continues to engage with other potential

customers by providing samples of CSPG produced by the Company for

testing and evaluation, hosting site visits at its Kellyton

Graphite Plant, and having technical product development and

commercial discussions.

“Customer interest and market demand for domestic CSPG remains

strong, and customer interest in Westwater is due to the

combination of our SK On off-take agreement, FEOC-related guidance

requiring EV tax credit eligible vehicles to use of IRA-compliant

graphite by 2025, and new Chinese export restrictions on graphite

that have reduced stability of supply,” said Jon Jacobs,

Westwater’s Chief Commercial Officer. “We believe customer interest

is accelerating in Westwater as a stable, U.S.-based supplier of

natural graphite.”

Construction Financing Update

Westwater continues its efforts to secure debt financing to fund

the balance of the estimated capital requirements for completion of

construction of Phase I of the Kellyton Graphite Plant. “We are

continuing to engage with third parties interested in funding our

project, and those parties have indicated they are pleased to see

we have our first off-take agreement in place,” said Steve Cates,

Westwater’s Chief Financial Officer and SVP – Finance. “With

positive interest from additional customers and lenders, Westwater

remains focused on executing additional off-take sales agreements

and completing the project debt financing necessary to complete

Phase I at the Kellyton Graphite Plant.”

As of December 31, 2023, Westwater had a cash balance of $10.9

million and has incurred approximately $119.2 million, inclusive of

liabilities, since beginning construction of Phase I of the

Kellyton Graphite Plant.

Financial Summary for The Year Ended December 31,

2023

($ in thousands, Except Share and Per

Share Amounts)

2023

2022

Variance

Net Cash Used in Operations

$(11,430)

$(13,176)

(13%)

Net Cash Used in Investing Activities

$(58,295)

$(52,790)

10%

Net Cash Provided by Financing

Activities

$5,381

$25,869

(79%)

Product Development Expenses

$(2,935)

$(1,145)

156%

General and Administrative Expenses

$(9,780)

$(9,902)

(1%)

Net Loss

$(7,751)

$(11,121)

(30%)

Net Loss Per Share

$(0.15)

$(0.25)

(40%)

Avg. Weighted Shares Outstanding

52,037,463

44,909,500

16%

- Net cash used in operations decreased $1.7 million in 2023

compared to 2022 primarily due to receiving $3.1 million of cash in

the fourth quarter related to the settlement of the Company’s

arbitration against the Republic of Turkey; partially offset by

$1.8 million higher product development expenses during 2023 as

discussed below.

- Net cash used in investing activities increased $5.5 million

during 2023 compared to 2022. The increase in investing cash

outflows is due to continued construction of Phase I of the

Kellyton Graphite Plant.

- Net cash provided by financing activities decreased $20.5

million during 2023, compared to 2022, due to lower sales of shares

under our equity financing facilities.

- Product development expenses for 2023 increased by $1.8 million

compared to 2022 primarily due to continued product development,

product optimization, and additional sample production for customer

evaluation.

- General and administrative expenses decreased $0.1 million

during 2023 compared to 2022, due to a reduction in personnel and

overhead costs related to stock award forfeitures and lower hiring

fees and relocations costs; offset partially by severance charges

related to executive management changes announced in the first

quarter of 2023.

- Consolidated net loss was $7.8 million, or $0.15 per share, for

2023 compared to a consolidated net loss of $11.1 million, or $0.25

per share, in 2022. The decrease in the Company’s net loss from

continuing operations was due primarily to the $3.1 million cash

settlement from the Republic of Turkey, a $1.2 million write-off of

accrued uranium royalties, a $0.3 million increase in interest

income on our investment account, and $0.5 million less exploration

expenses; offset partially by $1.8 million higher product

development expenses associated with additional sample

production.

- Cash and working capital as of December 31, 2023, were $10.9

million and $3.8 million, respectively, compared to $75.2 million

and $51.0 million as of December 31, 2022. The decrease in cash was

primarily due to capital expenditures of $58.3 million and cash

used in operations of $11.4 million; partially offset by cash

provided from financing activities. The decrease in working capital

was primarily due to the net cash spend during 2023; partially

offset by the lower current liabilities related to Phase I

construction costs as of December 31, 2023, compared to December

31, 2022.

Conference Call

Management will host a conference call to provide a business

update to investors on March 20, 2024, at 11:00 AM EDT.

Live Conference Call

- 1-800-319-4610 (USA and Canada)

- 1-604-638-5340 (International)

- Conference ID: Westwater Resources Conference Call

- Webcast:

westwaterresources.net/investors/presentations-events/

Conference Call Replay

- 1-855-669-9658 (USA and Canada)

- 1-412-317-0088 (International)

- Access Code: 0646

Going Concern Audit Opinion

Pursuant to Section 610(b) of the NYSE American Company Guide,

the Company notes that the audit opinion provided by the Company's

independent public accounting firm relating to the Company's

audited consolidated financial statements for the year ended

December 31, 2023, included a going concern qualification. The

financial statements with that opinion were included in the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, which was filed with the Securities and Exchange

Commission on March 19, 2024.

About Westwater Resources, Inc.

Westwater Resources, Inc. (NYSE American: WWR), an energy

technology company, is focused on developing battery-grade natural

graphite. The Company’s primary project is the Kellyton Graphite

Plant that is under construction in east-central Alabama. In

addition, the Company’s Coosa Graphite Deposit is the most advanced

natural flake graphite deposit in the contiguous United States and

located across 41,965 acres (~17,000 hectares) in Coosa County,

Alabama. For more information, visit

www.westwaterresources.net.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are subject to risks, uncertainties and

assumptions and are identified by words such as "expects,"

"estimates," “planned,” “intends,” "projects," "anticipates,"

"believes," "could," “scheduled,” “targets” and other similar

words. Forward-looking statements include, among other things,

statements concerning: the off-take agreement with SK On;

Westwater’s future sales of CSPG products to SK On, including the

amounts, timing, and types of products included within those sales;

possible off-take agreements with other customers; potential debt

financing arrangements; the anticipated annual production from

Phase I of Kellyton Graphite Plan; the positive anticipated

economic results from the Initial Assessment with Economic Analysis

related to its Coosa Graphite Deposit; and the construction and

operation of the Kellyton Graphite Plant, the Company’s Coosa

Graphite Deposit and its PEA, and the costs, schedules, production

and economic projections associated with them. The Company cautions

that there are factors that could cause actual results to differ

materially from the forward-looking information that has been

provided. The reader is cautioned not to put undue reliance on this

forward-looking information, which is not a guarantee of future

performance and is subject to a number of uncertainties and other

factors, many of which are outside the control of the Company;

accordingly, there can be no assurance that such suggested results

will be realized. The following factors, in addition to those

discussed in Westwater’s Annual Report on Form 10-K for the year

ended December 31, 2023, and subsequent securities filings, could

cause actual results to differ materially from management

expectations as suggested by such forward-looking information: (a)

the spot price and long‑term contract price of graphite (both flake

graphite feedstock and purified graphite products) and vanadium,

and the world-wide supply and demand of graphite and vanadium; (b)

the effects, extent and timing of the entry additional competition

in the markets in which we operate; (c) our ability to obtain

contracts or other agreements with customers; (d) available sources

and transportation of graphite feedstock; (e) the ability to

control costs and avoid cost and schedule overruns during the

development, construction and operation of the Kellyton Graphite

Plant; (f) the ability to construct and operate the Kellyton

Graphite Plant in accordance with the requirements of permits and

licenses and the requirements of tax credits and other incentives;

(g) effects of inflation, including labor shortages and supply

chain disruptions; (h) rising interest rates and the associated

impact on the availability and cost of financing sources; (i) the

availability and supply of equipment and materials needed to

construct the Kellyton Graphite Plant; (j) stock price volatility;

(k) government regulation of the mining and manufacturing

industries in the United States; (l) unanticipated geological,

processing, regulatory and legal or other problems we may

encounter; (m) the results of our exploration activities at the

Coosa Graphite Deposit, and the possibility that future exploration

results may be materially less promising than initial exploration

results; (n) any graphite or vanadium discoveries at the Coosa

Graphite Deposit not being in high enough concentration to make it

economic to extract the minerals; (o) our ability to finance growth

plans; (p) our ability to obtain and maintain rights of ownership

or access to our mining properties; (q) currently pending or new

litigation or arbitration; (r) our ability to maintain and timely

receive mining, manufacturing, and other permits from regulatory

agencies; and (s) other factors which are more fully described in

our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and

other filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240320991333/en/

Westwater Resources, Inc. Email:

Info@WestwaterResources.net

Investor Relations Email:

Investorrelations@westwaterresources.net

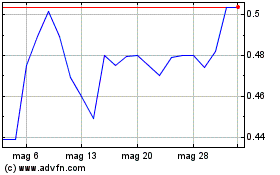

Grafico Azioni Westwater Resources (AMEX:WWR)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Westwater Resources (AMEX:WWR)

Storico

Da Feb 2024 a Feb 2025