VinaCapital Vietnam Opportunity Fd. Reduction in the valuations of certain investments (9435H)

29 Novembre 2022 - 12:33PM

UK Regulatory

TIDMVOF

RNS Number : 9435H

VinaCapital Vietnam Opportunity Fd.

29 November 2022

VinaCapital Vietnam Opportunity Fund Limited

(the "Company" or "VOF")

LEI Number: 2138007UD8FBBVAX9469

Reduction in the valuations of certain investments

In the light of the recent decline in the real estate market in

Vietnam, the Board of VOF announces that it has reviewed the fair

values of certain investments categorised by the Investment Manager

as Public Equity with Private Terms and has concluded that the NAV

of the Company should be reduced by $26.2 million as at 30 November

2022. This reduction will be reflected in the NAV with immediate

effect.

VOF divides its private equity investments into two categories:

traditional private equity where VOF typically holds a significant

minority stake in an unquoted business which is expected to float

on a Stock Exchange or to be sold to a trade buyer in the future;

and "public equities with private terms" where VOF has invested in

a financial instrument issued by a public company but which may or

may not be quoted on a stock exchange. These instruments typically

offer an attractive return but also incorporate protection against

losses if the expected outcomes do not materialise.

The traditional private equity investments were last valued by

KPMG, an external valuer, at 30 June 2022 and will next be valued

by the Investment Manager using the same approach as the external

valuer but with inputs updated, as at the half year end on 31

December 2022.

Each investment categorised as "public equity with private

terms" is valued by the Investment Manager on a weekly basis

according to the structure of each investment taking into account

the share price of the issuer (if that has been rising) or the

downside protection built into the investment if the share price

has not performed as expected. In most cases the downside

protection involves put options onto the sponsor at a fixed price

at a point in the future. In many cases, VOF also holds assets

which have been pledged by the sponsor and/or a guarantee from the

sponsor as security for the instrument.

In the light of the issues being faced by the real estate sector

in Vietnam, the Board asked the Investment Manager to review the

valuations of the investments categorised as "public equity with

private terms" focussing in particular on the creditworthiness of

the various sponsors as counterparties for the put options and on

the value of the assets held as security.

With some of these investments, the Investment Manager has

concluded that the put options have fallen in value as the

creditworthiness of the sponsor has reduced and in other cases, the

value of the security held has reduced as share prices have

declined. The Board has reviewed the Investment Manager's

valuations and has concluded that the fair values of these

investments should be reduced by a total of $26.2 million. This

represents approximately 18% of the original NAV of these

investments and 2.8% of the NAV of the Company prior to the

write-downs.

It should be noted that this adjustment is solely in respect of

the current Fair Value of these investments. None of these

instruments is in default and the maturity dates are some time in

the future. The Investment Manager is working on the basis that

these instruments will continue to perform and will pursue the

downside protection if that turns out not to be the case. These

investments will continue to be valued by the Investment Manager

weekly on the basis of the prevailing share prices of the

underlying investments and the Investment Manager's continuing

assessment of the values of the put options or the values of assets

held as security.

Enquiries

Joel Weiden

-----------------------------------------------------------

Investment Manager - Investor Relations and Communications

VinaCapital Investment Management Limited

T: +84 28 3821 9930

E: joel.weiden@vinacapital.com

Magdala Mullegadoo

-----------------------------------------------------------

Company Secretary / Administrator

Aztec Financial Services (Guernsey) Limited

T: +44 1481 748 814

E: vinacapital@aztecgroup.co.uk

Edward Gascoigne-Pees

-----------------------------------------------------------

Public Relations

Camarco

T: +44 20 3757 4980

E: ed.gascoigne-pees@camarco.co.uk

David Benda / Hugh Jonathan

-----------------------------------------------------------

Broker

Numis Securities Limited

T: +44 20 7260 1000

E: funds@numis.com

David Harris

-----------------------------------------------------------

Marketing and Distribution (United Kingdom)

Frostrow Capital LLP

T: +44 203 427 3835

E: david.harris@frostrow.com

Dion Di Miceli / Stuart Muress

-----------------------------------------------------------

Marketing and Investor Engagement (Global)

Barclays Bank PLC

T: +44 207 623 2323

E: BarclaysInvestmentCompanies@barclays.com

1. References to VOF or the Company in this announcement shall

mean VinaCapital Vietnam Opportunity Fund Limited, a non-cellular

company incorporated in the Bailiwick of Guernsey under The

Companies (Guernsey) Law, 2008, with registered number 61765. It is

authorised by the Guernsey Financial Services Commission (reference

number 2268242) as a registered closed-ended investment scheme

under The Protection of Investors (Bailiwick of Guernsey) Law, 1987

and in compliance with the Registered Collective Investment Scheme

Rules, as amended.

2. The registered office address of the Company is East Wing,

Trafalgar Court, Les Banques, St Peter Port, Guernsey, Channel

Islands, GY1 3PP.

3. This announcement may contain inside information as

stipulated under the Market Abuse Regulations (EU) NO. 596/2014

(MAR).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAFFNADFAFFA

(END) Dow Jones Newswires

November 29, 2022 06:33 ET (11:33 GMT)

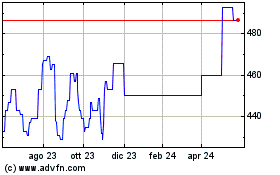

Grafico Azioni VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Storico

Da Nov 2024 a Dic 2024

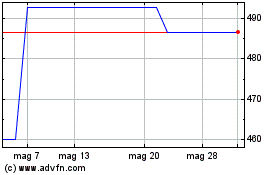

Grafico Azioni VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Storico

Da Dic 2023 a Dic 2024