VinaCapital Vietnam Opportunity Fd. Valuation Adjustments For Some Investments (3910P)

09 Ottobre 2023 - 8:31AM

UK Regulatory

TIDMVOF

RNS Number : 3910P

VinaCapital Vietnam Opportunity Fd.

09 October 2023

VinaCapital Vietnam Opportunity Fund Limited

(the "Company" or "VOF")

LEI Number: 2138007UD8FBBVAX9469

Revaluations of Private Equity and Public Equity with Private

Terms investments as at 30 June 2023

As part of the audit of the Company's accounts as at 30 June

each year, the audit committee of the Company considers the

valuations of the unquoted investments held in the Company's

portfolio. These valuations are carried out in some cases by KPMG

Tax and Advisory Limited, the independent valuer, and in other

cases by VinaCapital Investment Management Limited (the "Investment

Manager"). This year, the valuations have received particular

scrutiny following defaults or potential for default by a number of

the investments described as Public Equities with Private Terms

("PEPT"). They have now been reviewed by PricewaterhouseCoopers CI

LLP ("PwC"), the auditor of the Company, and approved by the audit

committee of the Company.

The result of this significant work is that the valuations of

these unquoted investments have been increased by a total of

USD54.3 million as at 30 June 2023.

Public Equity with Private Terms

Part of the increase is in investments described as PEPT, where

the Company has invested in instruments issued by public companies.

When these investments were originally made, the Investment Manager

had negotiated "downside protection" in the form of put options

onto the sponsor supplemented by collateral security over shares

held by the sponsor. With the turmoil in the real estate market at

the end of 2022, however, it was not clear that these protections

would be of any effect, or if the obligations would be fulfilled

within the agreed timeframe if the counterparty defaulted.

Consequently, in November 2022, following one such default, the

Board asked the Investment Manager to review the carrying values of

these investments. At that point, the valuations were reduced by

USD26.2 million. At the time the Board prepared the 31 December

2022 interim accounts in March 2023, with the prospect of further

events of default, the valuations of these investments were

reviewed again and a further reduction of USD23.6 million was

made.

At the time of each of these revaluations there was no evidence

that the downside protections would be effective and no certainty

that the Company would recover all or part of these investments.

Over the past six months, however, the Investment Manager has made

good progress in renegotiating terms, establishing a plan for

receiving the full recovery of each investment and expected

returns, and improving the security of the investments as some

stability has returned to the real estate market. The Company has

enforced some of the security it held and sold the underlying

shares in the market as the sponsor's share price recovered. The

renegotiated terms of these transactions have been reviewed as at

30 June 2023 and the revised valuations have been subject to

scrutiny by the Company's auditors.

As a result, the aggregate fair values of PEPT investments in

Project Norfolk (Novaland), Nova Consumer Group (NCG), Dat Xanh

Services (DXS) and Hung Thinh Land (HTL) have been increased by

USD26.8million as at 30 June 2023. It should be noted that the

valuations are still lower than their original cost and expected

returns and the Investment Manager will continue to work with each

of the investments in seeking a full recovery over time.

Private Equity

At the financial year end, the valuations of the traditional

private equity investments are also reviewed. Most of the

valuations are carried out by KPMG, the independent valuer and, at

the year end, the valuations are also reviewed by the Company's

auditors. The private equity investments include Thu Cuc

International Hospital, Tam Tri Medical, In Holdings, Chicilon

Media and Hung Vuong Plaza. In total, an uplift of USD27.5million

in the value of all the private equity investments as at 30 June

2023 has been approved by the audit committee of the Company.

The total uplift of USD54.3 million will be included in the

weekly net asset value of the Company on 6 October 2023 which will

be released to the market on 9 October.

Further information is available on the Company's website at:

https://vof.vinacapital.com/

Enquiries:

Joel Weiden

-----------------------------------------------------------

Investment Manager - Investor Relations and Communications

VinaCapital Investment Management Limited

T: +84 28 3821 9930

E: joel.weiden@vinacapital.com

Magdala Mullegadoo

-----------------------------------------------------------

Company Secretary / Administrator

Aztec Financial Services (Guernsey) Limited

T: +44 1481 748 814

E: vinacapital@aztecgroup.co.uk

1. References to VOF or the Company in this announcement shall

mean VinaCapital Vietnam Opportunity Fund Limited, a non-cellular

company incorporated in the Bailiwick of Guernsey under The

Companies (Guernsey) Law, 2008, with registered number 61765. It is

authorised by the Guernsey Financial Services Commission (reference

number 2268242) as a registered closed-ended investment scheme

under The Protection of Investors (Bailiwick of Guernsey) Law, 2020

and in compliance with the Registered Collective Investment Scheme

Rules, as amended.

2. The registered office address of the Company is East Wing,

Trafalgar Court, Les Banques, St Peter Port, Guernsey, Channel

Islands, GY1 3PP.

3. This announcement contains information that is inside

information for the purposes of the UK version of the Market Abuse

Regulation (EU) No. 596/2014 which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018 (as amended and

supplemented from time to time).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUKONRORURRRA

(END) Dow Jones Newswires

October 09, 2023 02:31 ET (06:31 GMT)

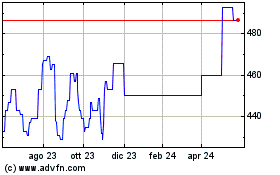

Grafico Azioni VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Storico

Da Feb 2025 a Mar 2025

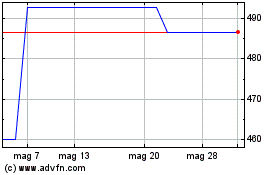

Grafico Azioni VinaCapital Vietnam Oppo... (AQSE:VOF.GB)

Storico

Da Mar 2024 a Mar 2025