AMP Revises Deal with Resolution, Resets Strategy After Big 1st Half Loss

08 Agosto 2019 - 12:29AM

Dow Jones News

By David Winning

SYDNEY--AMP Ltd. (AMP.AU) said it would raise more capital and

restructure a deal to sell its Australian and New Zealand

wealth-protection and mature businesses after tumbling to a deep

loss in its fiscal first half.

AMP reported a net loss of 2.3 billion Australian dollars

(US$1.55 billion) in the six months through June, reflecting

impairment charges totaling A$2.35 billion "to address legacy

issues and position AMP for the future."

AMP said it had also cut the price of a deal with Resolution

Life Group Holdings LP for its AMP life unit and was working with

New Zealand's central bank to overcome issues that had torpedoed an

earlier agreement worth A$3.3 billion, including A$1.9 billion in

cash.

AMP said the revised deal involved a A$2.5 billion cash payment,

and a A$500 million equity interest in a new company that would be

controlled by Resolution and own the AMP Life business.

That deal is forecast to complete in the first half of next

year, prompting AMP to seek to raise A$650 million in additional

capital now to fund a new strategy outlined on Thursday. The

strategy includes cutting A$300 million in costs and investing up

to A$1.3 billion over three years to drive growth.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

August 07, 2019 18:14 ET (22:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

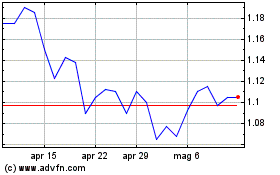

Grafico Azioni AMP (ASX:AMP)

Storico

Da Ott 2024 a Nov 2024

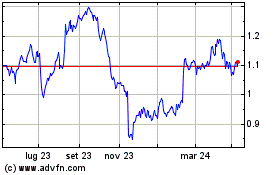

Grafico Azioni AMP (ASX:AMP)

Storico

Da Nov 2023 a Nov 2024

Notizie in Tempo Reale relative a AMP Limited (Borsa Australiana): 0 articoli recenti

Più AMP Limited Articoli Notizie