Australian Shares Midday: Flat Despite Election Uncertainty

23 Agosto 2010 - 6:03AM

Dow Jones News

Despite myriad factors working against it--an undecided

Australian election, negative leads from Wall Street and weaker

commodities prices--the Australian share market was flat midday

Monday as traders saw the potential for a proposed resources tax to

be buried under a new government.

Right now, it's unclear whether the Australian Labor Party or

main opposition Liberal-National coalition will take the helm, with

both parties lobbying independent members of parliament to form

government. But traders are bidding up mining giants BHP Billiton

and Rio Tinto, up 0.9% and 1%, respectively, given the fate of

Labor's proposed mining tax is increasingly uncertain.

At 0330 GMT, the benchmark S&P/ASX 200 index was down 2.5

points at 4428.4 points.

"The independents who are non-Greens, are largely conservative,"

Jeremy Hook, private client adviser at TMS Capital said. "The

reality is, I can't see Bob Katter or Tony Windsor or Rob Oakeshott

supporting a mining tax," he added, naming independents the Labor

and Liberal parties are lobbying in an attempt to form

government.

Hook said BHP and Rio's gains are impressive considering weaker

commodities prices.

"The weekend's (election) events probably put resources in a

favorable position regarding future negotiations" in regard to the

resources tax, said Jamie Spiteri, head of trading at Shaw

Stockbroking. "While some of those initial points are of usual

impact to our market--overseas trends, commodities prices--they are

in the mix, they're not necessarily dominating."

Spiteri says a mining tax is still likely, but that the miners

are more likely to have an easier time negotiating with the new

government.

Another sector that could benefit from the coalition forming

government is the private healthcare space, Hook said, given the

Greens wanted to scrap a private health insurance rebate. If the

rebate stays in place, that will benefit private hospitals.

Hospital operators Ramsay Health Care and Healthscope, which is

in the process of being taken private, were flat.

As for telecom companies, a coalition government could mean

changes to Labor's A$43 billion National Broadband Network plan.

Hook said the changes to that plan depend on what concessions are

reached with the independents but that "regional areas will be well

served by the outcome agreed upon".

It's unclear what that means for Telstra Corp., which had

preliminarily agreed to participate in the NBN after a protracted

back-and-forth with the government. Telstra hit a record low of

A$2.78 early. It's down 16 cents at A$2.80, having gone

ex-entitlement to a 14 cent dividend.

In other news, Westpac said third-quarter cash profit rose 27%

on the year but warned loan growth is likely to slow in the coming

year. The banks were mixed after the report with Westpac down 2.3%,

ANZ Bank up 1%, National Australia Bank down 1.5% and Commonwealth

Bank up 0.2%.

In other sectors, the world's largest drilling services provider

Boart Longyear posted a first half net profit for the period ended

June 30 of US$32.7 million, turning around a US$5.4 million loss in

the same period last year, helped by strong growth in both its

drilling services and products businesses. Its shares are down 4.4%

after Chief Executive Craig Kipp told analysts that customers are

still reluctant to commit long term.

Rubber products maker Ansell reported a 1.6% drop in full-year

net profits but beat analysts' expectations. The shares are up

2.9%.

Caltex Australia gained 2% after it reported an expected 50%

fall in first half net profit that was at the top end of the

company's guidance range. Also, Chief Executive Julian Segal said

"we're pretty much at the bottom of the supply and demand

imbalance" for fuel that has hit refining margins in the Asia

Pacific region.

-By Cynthia Koons; Dow Jones Newswires; +61-2-8272-4691;

cynthia.koons@dowjones.com

Grafico Azioni Boart Longyear (ASX:BLY)

Storico

Da Apr 2024 a Mag 2024

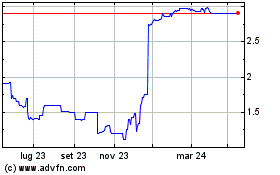

Grafico Azioni Boart Longyear (ASX:BLY)

Storico

Da Mag 2023 a Mag 2024