2013 REVENUES GREW TO ?1,566.1 MILLION, UP 12.8% (+14.7% ON A LIKE-FOR-LIKE EXCHANGE RATE BASIS), SHARP MARGIN GROWTH: EBITDA..

06 Marzo 2014 - 12:15PM

Annunci Borsa (Testo)

Stezzano, 6 March 2014

2013 REVENUES GREW TO 1,566.1 MILLION, UP 12.8% (+14.7% ON A

LIKE-FOR-LIKE EXCHANGE RATE BASIS), SHARP MARGIN GROWTH: EBITDA

13.5% AT 212.1 MILLION, EBIT 7.8% AT 121.4 MILLION

Compared to the 31 December 2012 results: Revenues grew by 12.8% to

1,566.1 million thanks to the positive contribution of all

applications Sharp margin growth: EBITDA +23.5% to 212.1 million;

EBIT +35.6% to 121.4 million Net profit grew by 14.4% to 89 million

Proposal to distribute a dividend of 0.50per share 130.9 million

invested in the year to improve production in the USA, Brazil and

China Net financial debt amounted to 320.5 million, improving by

51.5 million compared to 30 September 2013

Results at 31 December 2013

( million) Revenues EBITDA

% on revenues

2013 1,566.1 212.1

13.5%

2012 1,388.6 171.7

12.4%

Change % +12.8% +23.5% +35.6% +26.0% +14.4%

EBIT

% on revenues

121.4

7.8%

89.5

6.4%

Pre-tax profit

% on revenues

104.4

6.7%

82.9

6.0%

Net profit

% on revenues

89.0

5.7%

31/12/2013

77.8

5.6%

30/09/2013

Net financial debt ( million) Revenues EBITDA

% on revenues

320.5

372.0

-51.5

Fourth Quarter 2013 Results

2013 411.9 61.6

14.9%

2012 344.0 43.1

12.5%

Change % 19.7% 42.8% 76.7% 58.7% -11.2%

EBIT

% on revenues

37.0

9.0%

20.9

6.1%

Pre-tax profit

% on revenues

33.6

8.2%

21.2

6.2%

Net profit

% on revenues

25.7

6.2%

28.9

8.4%

The Chairman Alberto Bombassei stated: "We are very satisfied with

the results achieved in 2013, both in terms of revenues and

margins, as well as debt. These figures are the result of our

internationalization strategy which, thanks to the further

acceleration of the past five years, supported sales in all

sectors, despite the general shrinking of the Italian and European

car market. The investments made to support new businesses and step

up production capacity, as well as in innovation and quality are

part of the very nature of the Group and are the reason for its

growth over the past few years."

1/9

Group's Consolidated Results for 2013 Brembo's Board of Directors,

chaired by Alberto Bombassei, met today, examined and approved

Brembo Group's results as of 31 December 2013. Group's net

consolidated revenues amounted to 1,566.1 million, up by 12.8%

compared to 1,388.6 million for the previous year. On like-for-like

exchange rates, revenues increased by 14.7%. All applications

contributed to the growth of Group's revenues, especially car

applications, which increased by 16.9%; increases were also

reported in motorbike applications (+6.3%), commercial vehicles

(+4.0%) and race applications (+3.9%). At a geographical level,

European sales rose, mainly thanks to the contribution of Germany

and the United Kingdom, both of which grew 14.1% compared to the

previous year. North America continued to report an excellent

performance, closing 2013 with a 19.4% increase. By contrast,

Brazil declined slightly, merely due to the Brazilian real's

devaluation; net of this effect, sales increased by 12.2%. With

regard to the Far East, China reported an excellent performance,

increasing by 35.8%. India also grew by 3.5% (17.4% on a

like-for-like exchange rate basis) and Japan rose by +11.0%. In

2013, the cost of sales and other net operating costs amounted to

1,051.6 million, representing 67.1% of revenues, essentially in

line with 67.6% for the previous year. Personnel costs amounted to

302.4 million, with a ratio of 19.3% to revenues, decreasing from

20% for the previous year. Personnel at 31 December 2013 numbered

7,241, increasing by 304 compared 6,937 in the previous year.

EBITDA amounted to 212.1 million (13.5% of revenues), up by 23.5%

compared to the previous year. EBIT amounted to 121.4 million (7.8%

of revenues), up by 35.6% compared to year-end 2012. Net interest

expenses were 18.4 million (6.5 million in 2012) and consisted of

exchange losses of 7.3 million (compared to exchange gains of 5.1

million in 2012) and other net interest expenses of 11.2 million,

in line with 11.6 million at 31 December 2012. Exchange gains and

losses are accounting items chiefly generated by the translation

into local currency of euro-denominated loans taken out by some

foreign subsidiaries. Pre-tax profit was 104.4 million (82.9

million in 2012). Based on tax rates applicable under current tax

regulations, estimated taxes amounted to 15.3 million (5.1 million

in 2012). Tax rate for 2013 was 14.6% compared to 6.1% for the

previous year, which had been influenced by several extraordinary

items (deferred tax assets for the plants in Poland and Czech

Republic, which benefited from tax reliefs on investments made, and

a tax credit repaid to the Italian Parent Company).

2/9

Net profit for 2013 attributable to the Group was 89 million, up

14.4% compared to the previous year. Net financial debt at 31

December 2013 was 320.5 million, compared to 320.7 million for the

previous year and 372 million as of 30 September 2013. Results for

the Fourth Quarter 2013 In Q4 2013 alone, Group's net consolidated

revenues amounted to 411.9 million, up by 19.7% compared to the

same period of the previous year. Q4 margins improved sharply

compared to the same period of the previous year. EBITDA was 61.6

million (+42.8% compared to Q4 2012, with a ratio of 14.9% to

revenues), whereas EBIT stood at 37 million, up by 76.7% compared

to Q4 2012, with a ratio of 9% to revenues. Taxes for the fourth

quarter totalled 7.9 million compared to taxes positive at 7.7

million in the previous year, when they included deferred tax

assets as described above. Results of the Parent Company Brembo

S.p.A. Revenues of the Parent Company Brembo S.p.A. amounted to 638

million for 2013, slightly down compared to the previous year. Net

profit was 41.4 million, up 17.4% compared to the previous year.

Calling of Shareholders' Meeting: 29 April The General

Shareholders' Meeting has been be called on 29 April at 11a.m.

(CET) to approve, inter alia, the following proposal for dividend

distribution: a gross dividend of 0.50per ordinary share

outstanding at ex-coupon date, consequently excluding own shares;

the remaining amount carried forward. It will also be proposed that

dividends should be paid as of 15 May 2014, ex-coupon No. 22 on 12

May 2014 (record date: 14 May). The agenda will also include the

following items: - appointment of the Board of Directors and Board

of Statutory Auditors; - proposal to grant to the Board of

Directors the power to increase share capital, excluding option

rights, pursuant to Articles 2443 and 2441 of the Italian Civil

Code. In this regard, it should also be noted that the Board of

Directors has no intention to immediately exercise such power, but

rather intends to reserve the possibility to have rapid and

flexible access to the necessary financial resources to grasp

market opportunities in the context of the Group's continued growth

and international development. Plan for the Buy-back and Sale of

Own Shares Today, the Board of Directors also approved the proposal

for a new buy-back plan to be submitted to the forthcoming General

Shareholders' Meeting, aimed at: undertaking, directly or through

intermediaries, any investments, including aimed at containing

abnormal movements in stock prices, stabilizing stock trading and

supporting the liquidity of Company's stock, so as to foster the

regular conduct of trading beyond normal fluctuations related to

market performance, without prejudice in any case to compliance

with applicable statutory provisions; carrying out, in accordance

with the Company's strategic guidelines, share capital transactions

or other transactions which make it necessary or appropriate to

swap

3/9

or transfer share packages through exchange, contribution, or any

other available methods; buying back own shares as a

medium-/long-term investment. The proposal envisages the

possibility for the Board of Directors to buy and/or dispose of, in

one or more tranches, a maximum of 1,600,000 ordinary shares at a

minimum price of 0.52 and a maximum price of 30.00 each.

Authorisation will be requested for a period of 18 months from the

date of the resolution of the Shareholders' Meeting that grants

said authorisation. At present, the Company holds 1,747,000 own

shares representing 2.616% of share capital. Outlook The order book

confirms a positive performance also for the first part of the

year. Throughout 2014, Brembo will continue to strengthen its

industrial presence in all its areas of operation.

The manager in charge of the Company's financial reports, Matteo

Tiraboschi, declares, pursuant to paragraph 2 of Article 154-bis of

Italy's Consolidated Law on Finance, that the accounting

information contained in this press release corresponds to the

documented results, books and accounting records. Annexed hereto

are the Income Statement, Balance Sheet and Cash Flow Statement for

which the auditing process by the independent auditors is currently

underway.

Company contacts:

Investor Relator Matteo Tiraboschi Tel. +39 035 605 2899 Email:

ir@brembo.it www.brembo.com Communications and Institutional

Relations Director Thanai Bernardini Tel. +39 035 605 2277 +39 335

7245418 Email: press@brembo.it

4/9

CONSOLIDATED INCOME STATEMENT

(euro million) Sale s of goods and services Othe r revenues and

income Cos ts for capitalised internal works Ra w materials,

consumables and goods Othe r operating costs Pe rs onne l expenses

GROSS OPERATING INCOME % of sales of goods and services De pre ci a

ti on, amortisation and impairment losses NET OPERATING INCOME % of

sales of goods and services Ne t interest income (expense) Inte re

s t income (expense) from investments RESULT BEFORE TAXES % of

sales of goods and services Ta xe s RESULT BEFORE MINORITY

INTERESTS % of sales of goods and services Mi nori ty interests NET

RESULT FOR THE PERIOD % of sales of goods and services

BASIC/DILUTED EARNINGS PER SHARE (euro) 3 1 .1 2 .2 0 1 3 1 , 5 6 6

.1 1 4 .8 1 1 .2 (8 0 2 .8 ) (2 7 4 .8 ) (3 0 2 .4 ) 2 1 2 .1 1 3

.5 % (9 0 .7 ) 1 2 1 .4 7 .8 % (1 8 .4 ) 1 .4 1 0 4 .4 6 .7 % (1 5

.3 ) 8 9 .1 5 .7 % (0 .1 ) 8 9 .0 5 .7 % 1 .3 6 3 1 .1 2 .2 0 1 2 1

, 3 8 8 .6 1 4 .9 1 1 .5 (7 1 5 .4 ) (2 5 0 .1 ) (2 7 7 .8 ) 1 7 1

.7 1 2 .4 % (8 2 .2 ) 8 9 .5 6 .4 % (6 .5 ) (0 .2 ) 8 2 .9 6 .0 %

(5 .1 ) 7 7 .8 5 .6 % 0 .1 7 7 .8 5 .6 % 1.19 Change 1 7 7 .5 (0 .1

) (0 .3 ) (8 7 .4 ) (2 4 .7 ) (2 4 .6 ) 4 0 .4 (8 .5 ) 3 1 .9 (1 2

.0 ) 1 .6 2 1 .5 (1 0 .2 ) 1 1 .3 (0 .2 ) 1 1 .2 % 1 2 .8 % -0 .5 %

-3 .0 % 1 2 .2 % 9 .9 % 8 .9 % 2 3 .5 % 1 0 .3 % 3 5 .6 % 1 8 4 .8

% -7 5 0 .9 % 2 6 .0 % 2 0 0 .4 % 1 4 .6 % -2 0 8 .8 % 1 4 .4 %

Q4'13 4 1 1 .9 5 .1 3 .5 (2 1 0 .6 ) (6 6 .6 ) (8 1 .7 ) 6 1 .6 1 4

.9 % (2 4 .6 ) 3 7 .0 9 .0 % (4 .9 ) 1 .6 3 3 .6 8 .2 % (7 .9 ) 2 5

.7 6 .2 % 0 .0 2 5 .6 6 .2 % 0.39 Q4'12 3 4 4 .0 6 .0 2 .6 (1 7 9

.1 ) (6 0 .6 ) (6 9 .8 ) 4 3 .1 1 2 .5 % (2 2 .2 ) 2 0 .9 6 .1 % (0

.6 ) 0 .9 2 1 .2 6 .2 % 7 .7 2 8 .8 8 .4 % 0 .0 2 8 .9 8 .4 % 0.44

Change 6 7 .9 (0 .9 ) 0 .9 (3 1 .6 ) (5 .9 ) (1 1 .9 ) 1 8 .4 (2 .4

) 1 6 .0 (4 .3 ) 0 .7 1 2 .4 (1 5 .6 ) (3 .2 ) (0 .1 ) (3 .2 ) % 1

9 .7 % -1 5 .5 % 3 5 .1 % 1 7 .6 % 9 .8 % 1 7 .0 % 4 2 .8 % 1 0 .8

% 7 6 .7 % 6 9 9 .4 % 8 1 .8 % 5 8 .7 % -2 0 3 .1 % -1 1 .0 % -1 6

0 .5 % -1 1 .2 %

For comparative purposes, it should be noted that certain values of

the 2012 Consolidated Financial Statements have been revised in

accordance with the transitional provisions set forth in the IAS 19

amendments.

5/9

CONSOLIDATED BALANCE SHEET

(euro million) ASSETS NON-CURRENT ASSETS Prope rty, plant,

equipment and other equipment De ve l opme nt costs Goodwi l l and

other indefinite useful life assets Othe r intangible assets Sha re

hol di ngs valued using the equity method Othe r financial assets

(including investments in other companies and derivatives) Re c e i

va bl e s and other non-current assets De fe rre d tax assets TOTAL

NON-CURRENT ASSETS CURRENT ASSETS Inve ntori e s Tra de receivables

Othe r receivables and current assets Curre nt financial assets and

derivatives Ca s h and cash equivalents TOTAL CURRENT ASSETS TOTAL

ASSETS EQ UITY AND LIABILITIES GROUP EQUITY Sha re capital Othe r

reserves Re ta i ne d earnings/(losses) Ne t result for the period

TOTAL GROUP EQUITY TOTAL MINORITY INTERESTS TOTAL EQUITY

NON-CURRENT LIABILITIES Non-c urre nt payables to banks Othe r

non-current financial payables and derivatives Othe r non-current

liabilities Provi s i ons Provi s i ons for employee benefits De fe

rre d tax liabilities TOTAL NON -CURRENT LIABILITIES CURRENT

LIABILITIES Curre nt payables to banks Othe r current financial

payables and derivatives Tra de payables Ta x payables Othe r

current payables TOTAL CURRENT LIABILITIES TOTAL LIABILITIES TOTAL

EQUITY AND LIABILITIES 3 4 .7 9 3 .4 2 0 7 .2 8 9 .0 4 2 4 .4 4 .9

4 2 9 .2 2 5 0 .3 8 .9 5 .0 6 .2 2 7 .0 1 2 .5 3 0 9 .9 1 7 1 .5 5

.8 3 0 1 .6 4 .1 7 6 .9 5 5 9 .9 8 6 9 .8 1 , 2 9 9 .0 3 4 .7 1 0 9

.4 1 6 1 .3 7 7 .8 3 8 3 .3 1 0 .5 3 9 3 .8 2 5 5 .3 1 5 .2 0 .6 8

.1 2 6 .7 8 .3 3 1 4 .2 1 7 0 .8 4 .9 2 4 7 .3 4 .8 8 4 .1 5 1 1 .9

8 2 6 .1 1 , 2 1 9 .9 0 .0 (1 6 .0 ) 4 5 .9 1 1 .2 4 1 .0 (5 .6 ) 3

5 .4 (5 .0 ) (6 .3 ) 4 .4 (1 .9 ) 0 .3 4 .2 (4 .2 ) 0 .8 0 .9 5 4

.3 (0 .7 ) (7 .3 ) 4 8 .0 4 3 .8 7 9 .2 A 3 1 .1 2 .2 0 1 3 B 3 1

.1 2 .2 0 1 2 A-B Change

5 0 3 .1 4 5 .3 3 9 .6 1 5 .5 2 1 .9 0 .2 7 .0 4 6 .9 6 7 9 .6 2 0

9 .0 2 5 1 .5 4 2 .9 1 0 .0 1 0 6 .1 6 1 9 .4 1 , 2 9 9 .0

4 7 5 .4 4 3 .8 4 1 .8 1 7 .6 2 0 .5 0 .2 4 .0 3 7 .3 6 4 0 .6 2 0

7 .1 2 0 2 .3 4 4 .5 9 .9 1 1 5 .6 5 7 9 .3 1 , 2 1 9 .9

2 7 .8 1 .5 (2 .2 ) (2 .1 ) 1 .4 0 .0 3 .1 9 .6 3 9 .1 1 .9 4 9 .2

(1 .6 ) 0 .1 (9 .5 ) 4 0 .1 7 9 .2

For comparative purposes, it should be noted that certain values of

the 2012 Consolidated Financial Statements have been revised in

accordance with the transitional provisions set forth in the IAS 19

amendments.

6/9

CONSOLIDATED CASH-FLOW STATEMENT

(euro million) Cash and cash equivalents at beginning of period Re

sult for the period before taxes De pre c i a ti on,

amortisation/Impairment losses Ca pi ta l gains/losses Wri te -ups

/Wri te -downs of shareholdings Fi na nc i a l portion of defined

funds and payables for personnel L ong-te rm provisions for

employee benefits Othe r provisions net of utilisations Ne t cash

flow generated by operations Pa i d current taxes Us e s of

long-term provisions for employee benefits (Inc rease) reduction in

current assets: i n ve n t o r i e s fi na nc i a l assets tra de

receivables re c e i va bl e s from others and other assets Inc

rease (reduction) in current liabilities: tra de payables pa ya bl

e s to others and other liabilities Tra ns l a ti on differences on

current assets Ne t cash flows from/(for) operating activities

Investments in: i nta ngi bl e assets prope rty, plant and

equipment Ca pi ta l increase in consolidated companies by minority

shareholders Pri c e for disposal, or reimbursement value of fixed

assets Ne t cash flows from/(for) investing activities Di vi de nds

paid in the period Ac qui s i ti on of 100% ofBrembo Argentina S.A.

and BNBS Co. Ltd. from third shareholders Cha nge in fair value

valuation L oa ns and financing granted by banks and other

financial institutions in the period Re pa yme nt of long-term

loans Ne t cash flows from/(for) financing activities Total cash

flow CASH AND CASH EQUIVALENTS AT END OF THE PERIOD

3 1 .1 2 .2 0 1 3 4 1 .1 1 0 4 .4 9 0 .7 (0.4) (1.4) 0 .9 3 .6 7 .1

2 0 4 .9 (2 0 .0 ) (3 .8 ) (1 0 .6 ) 0 .0 (4 8 .3 ) (4 .4 ) 5 4 .3

(2 .8 ) (2 .4 ) 1 6 6 .8

3 1 .1 2 .2 0 1 2 2 6 .6 8 2 .9 8 2 .2 (2 .6 ) 0 .2 1 .0 1 .0 4 .0

1 6 8 .6 (2 3 .5 ) (2 .5 ) 1 6 .8 0 .0 4 .9 (0 .6 ) (1 9 .3 ) 7 .1

(6 .1 ) 1 4 5 .4

(1 7 .6 ) (1 1 5 .4 ) 0 .0 2 .2 (1 3 0 .9 ) (2 6 .0 ) (1 1 .7 ) (0

.3 ) 2 0 3 .4 (2 0 0 .0 ) (3 4 .5 ) 1 .4 4 2 .5

(1 9 .2 ) (1 2 1 .4 ) 0 .4 7 .6 (1 3 5 .1 ) (1 9 .5 ) 0 .0 0 .1 1 2

1 .3 (9 7 .7 ) 4 .2 1 4 .5 4 1 .1

For comparative purposes, it should be noted that certain values of

the 2012 Consolidated Financial Statements have been revised in

accordance with the transitional provisions set forth in the IAS 19

amendments.

7/9

NET SALES BREAKDOWN BY GEOGRAPHICAL AREA AND BY APPLICATION

(euro million) GEOGRAPHICAL AREA It a l y Ge r m a n y Fra nce Uni

te d Kingdom Othe r EU countries Indi a Ch i n a J a pa n Othe r

Asia Countries Bra zi l North America (US, Canada & Mexico)

Othe r Countries Total (euro million) APPLICATION Ca r s Motorbi ke

s Comme rci a l and Industrial Vehicles Ra ci ng Mi s ce l l a ne

ous Total 1 ,0 9 7 .8 1 5 0 .3 1 9 1 .8 1 2 0 .0 6 .2 1 , 5 6 6 .1

7 0 .1 % 9 .6 % 1 2 .2 % 7 .7 % 0 .4 % 1 0 0 .0 % 9 3 9 .5 1 4 1 .4

1 8 4 .5 1 1 5 .6 7 .7 1 , 3 8 8 .6 6 7 .7 % 1 0 .2 % 1 3 .3 % 8 .3

% 0 .5 % 1 0 0 .0 % 1 5 8 .4 8 .9 7 .3 4 .5 (1 .5 ) 1 7 7 .5 1 6 .9

% 6 .3 % 4 .0 % 3 .9 % -1 9 .6 % 1 2 .8 % 2 9 9 .8 3 3 .5 5 0 .6 2

6 .7 1 .3 4 1 1 .9 7 2 .8 % 8 .1 % 1 2 .3 % 6 .5 % 0 .3 % 1 0 0 .0

% 2 5 0 .3 3 2 .5 3 7 .4 2 2 .6 1 .2 3 4 4 .0 7 2 .8 % 9 .5 % 1 0

.9 % 6 .6 % 0 .2 % 1 0 0 .0 % 4 9 .5 0 .9 1 3 .1 4 .1 0 .2 6 7 .9 1

9 .8 % 2 .8 % 3 5 .1 % 1 8 .1 % 1 6 .3 % 1 9 .7 % 2 1 2 .1 3 7 6 .0

6 9 .7 1 1 4 .7 1 7 3 .1 3 5 .2 8 1 .3 2 1 .8 9 .4 6 6 .2 372.8 3 3

.9 1 , 5 6 6 .1 3 1 .1 2 .2 0 1 3 1 3 .5 % 2 4 .0 % 4 .5 % 7 .3 % 1

1 .0 % 2 .2 % 5 .2 % 1 .4 % 0 .6 % 4 .2 % 2 3 .8 % 2 .3 % 1 0 0 .0

% % 2 0 7 .7 3 2 9 .6 5 8 .2 1 0 0 .6 1 6 4 .0 3 4 .0 5 9 .9 1 9 .6

8 .5 6 7 .1 3 1 2 .1 2 7 .5 1 , 3 8 8 .6 3 1 .1 2 .2 0 1 2 1 5 .0 %

2 3 .7 % 4 .2 % 7 .2 % 1 1 .8 % 2 .4 % 4 .3 % 1 .4 % 0 .6 % 4 .8 %

2 2 .5 % 2 .1 % 1 0 0 .0 % % 4 .4 4 6 .4 1 1 .6 1 4 .1 9 .1 1 .2 2

1 .4 2 .2 1 .0 (0 .9 ) 6 0 .7 6 .4 1 7 7 .5 Change 2 .1 % 1 4 .1 %

1 9 .9 % 1 4 .1 % 5 .5 % 3 .5 % 3 5 .8 % 1 1 .0 % 1 1 .3 % -1 .3 %

1 9 .4 % 2 3 .2 % 1 2 .8 % % 5 3 .4 1 0 2 .3 1 6 .8 3 1 .2 3 7 .8 8

.9 2 6 .4 6 .3 2 .5 1 4 .7 1 0 4 .1 7 .5 4 1 1 .9 Q4'13 1 3 .0 % 2

4 .8 % 4 .1 % 7 .6 % 9 .2 % 2 .2 % 6 .4 % 1 .5 % 0 .6 % 3 .6 % 2 5

.3 % 1 .7 % 1 0 0 .0 % % 4 8 .6 8 1 .5 1 0 .0 2 5 .9 3 3 .5 8 .5 1

7 .4 4 .8 2 .4 1 6 .6 8 7 .0 7 .7 3 4 4 .0 Q4'12 1 4 .1 % 2 3 .7 %

2 .9 % 7 .5 % 9 .7 % 2 .5 % 5 .1 % 1 .4 % 0 .7 % 4 .8 % 2 5 .3 % 2

.3 % 1 0 0 .0 % % 4 .8 2 0 .9 6 .8 5 .2 4 .2 0 .4 9 .0 1 .6 0 .0 (2

.0 ) 1 7 .0 (0 .2 ) 6 7 .9 Change 9 .8 % 2 5 .6 % 6 7 .8 % 2 0 .2 %

1 2 .6 % 5 .1 % 5 1 .8 % 3 2 .7 % 1 .7 % -1 1 .8 % 1 9 .6 % -2 .5 %

1 9 .7 % % 3 1 .1 2 .2 0 1 3 % 3 1 .1 2 .2 0 1 2 % Change % Q4'13 %

Q4'12 % Change %

8/9

MAIN RATIOS

Ne t operating income/Sales of goods and services Re s ul t before

taxes/Sales of goods and services Ca pi ta l Expenditure/Sales of

goods and services Ne t Financial indebtedness/Shareholders' equity

Ne t financial charges(*)/Sales of goods and services Ne t

financial charges(*)/Net Operating Income ROI ROE

Q4'12 6 .1 % 6 .2 % 1 3 .0 % 8 1 .4 % 0 .8 % 1 2 .4 % 1 1 .2 % 2 9

.0 %

Q1'13 7 .0 % 5 .9 % 1 0 .2 % 8 3 .4 % 0 .8 % 1 1 .5 % 1 3 .5 % 2 0

.1 %

Q2'13 7 .5 % 6 .4 % 8 .9 % 9 3 .9 % 1 .0 % 1 3 .7 % 1 4 .9 % 2 2 .7

%

Q3'13 7 .4 % 6 .1 % 7 .7 % 9 2 .5 % 0 .9 % 1 2 .8 % 1 4 .4 % 2 0 .4

%

Q4'13 9 .0 % 8 .2 % 7 .4 % 7 4 .7 % 0 .1 % 1 .4 % 1 8 .9 % 2 3 .8

%

Note s : ROI: Net operating income/ Net invested capital multiply

by year days/period days. ROE: Result before minority interests/

Shareholders equity multiply by year days/period days. (*) Net of

exchange losses/gains For comparative purposes, it should be noted

that certain values of the 2012 Consolidated Financial Statements

have been revised in accordance with the transitional provisions

set forth in the IAS 19 amendments.

9/9

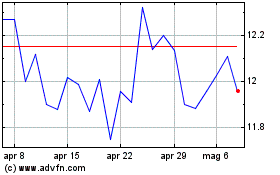

Grafico Azioni Brembo NV (BIT:BRE)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Brembo NV (BIT:BRE)

Storico

Da Lug 2023 a Lug 2024