BoD of Neurosoft S.A. approves 2011 First Half Year Results Part 1

20 Settembre 2011 - 2:50PM

Annunci Borsa (Testo)

Athens, 20 September 2011

Press release

BoD of Neurosoft S.A. approves 2011 First Half Year Results

Consolidated revenues in the first half 2011 to 1,88 million ( 1,29

million at 2010 midyear) Gross profit to 0,54 million ( gross loss

0,49 million at 2010 midyear) Net loss to 0,38 million (net loss

1,95 million at 2010 midyear) Net Financial Debt equal to 1,32

million

Athens, 20 September 2010 - The Board of Directors of Neurosoft

S.A. met today and approved the first half year results ended 30th

June 2011, including the results for its subsidiaries Rockberg

Holdings Ltd, Kestrel Information Systems S.A. and Neurosoft

Romania SRL. Neurosoft, traded on Milan's AIM Italia market

(GRS802003004, Reuters NRST.MI, Bloomberg NRST:IM), has Banca Akros

as its Nominated Adviser. Neurosoft's consolidated half year

revenues were 1,88 million, up 45,6% from the prior-year period.

The Group's loss before income taxes for the first half of 2011 was

0,33 million, compared with 1,90 million the year before.

Neurosoft's net loss decreased to 0,38 million during the first

half of 2011, from 1,95 million a year prior. "The first half year

results reflect the company's efforts to improve profitability and

adjust to the new market conditions," said Nikos Vasilonikolidakis,

Chief Executive Officer of Neurosoft. "The company has implemented

a stringent cost cutting program which along with its revised

business plan is showing its first positive results." **********

Neurosoft S.A., a Greek company listed on the AIM Italia market,

organised and managed by the Italian Stock Exchange (ISIN

GRS802003004, Reuters NRST.MI, Bloomberg NRST:IM), today is a

software provider supplying solutions that optimize business and

operational processes with a view to maximize customer

profitability. Neurosoft's innovative integrated software systems

in factoring, sports betting, business intelligence, liability

management, transactional systems, and the implementation of

mission critical applications have provided tools to financial

institutions, stock exchanges, telecom companies and sports betting

operators to increase operating efficiencies, act on well-depicted

real-time risk and liability analysis, and increase revenues and

bottom line capitalizing on sophisticated predictive analytics.

Neurosoft was founded in 1994 and became the first company to be

floated in the AIM Italia market of the Milan Stock Exchange in

2009. Based in Athens, Neurosoft has a multinational presence in

Romania, Albania, Serbia, Bulgaria and Cyprus. Banca Akros S.p.A.

is Neurosoft's Nominated Adviser for the AIM Italia market.

ndicatively in 2010 Neurosoft recorded a turnover of 2.88 million

(3.66 million in 2009), with an EBITDA equal to -3,7 million (0,1

million in 2009) and net loss equal to - 4,77 million ( -0,4

million in 2009).

On behalf of the company

Nominated Adviser

Neurosoft SA Alexandra Andriopoulou Tel.: +30 210 6855061

a.andriopoulou@neurosoft.gr Banca Akros

Carla Zanon 0243444251 carla.zanon@bancaakros.it Giovanni Reale

0243444005 giovanni.reale@bancaakros.it

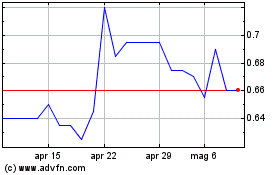

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Giu 2024 a Lug 2024

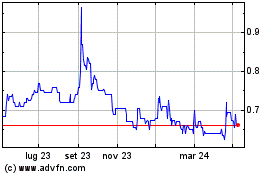

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Lug 2023 a Lug 2024