Board of Directors of Neurosoft SA approves 2015 first semester results

23 Settembre 2015 - 3:00PM

Annunci Borsa (Testo)

Press Release

23 September 2015

BoD of Neurosoft S.A. approves 2015 First Half Year Results

Consolidated revenues in the first half of 2015 6.28 million (5.03

million in mid-year 2014) Gross profit 2.9 million ( 3.1 million in

mid-year 2014) EBITDA 2.37 million ( 2.00 million in mid-year 2014)

Profit before income taxes 2.13 million ( 1.78 million in mid-year

2014) Net Profit 1.99 million (1.67 million in mid-year 2014) Net

Financial Position is equal to 1.41 million

Iraklio Attikis, 23 September 2015 - The Board of Directors of

Neurosoft S.A. met today and approved the first th half year

results ended 30 June 2015, including the results for its

subsidiaries Neurosoft Cyprus Ltd., Neurosoft Romania Srl.

Neurosoft, traded on Milan's AIM Italia market (GRS802003004,

Reuters NRST.MI, Bloomberg NRST:IM), has Integrae SIM SpA as its

Nominated Adviser. Neurosoft's consolidated half year revenues were

6.28 million showing a significant improvement to the prioryear

period. The Group's Profit before income taxes for the first half

of 2015 was 2.13 million, compared to 1.78 of the previous year.

Commenting on the Group's half year results, Neurosoft CEO Nick

Vasilonikolidakis said: "We had a very good first half, continuing

to expand our product line, customer base and geographical

footprint. Structural Integration with K.I.S and moving to our new

headquarters as one company now, helped to streamline company

procedures and maximize efficiency. Based on our half year

performance, I believe that 2015 will be a year of continuous

growth for the company". Performance by Business Unit In

particular, in the first semester of 2015, Neurosoft accomplished

the following per Business Unit:

Neurosoft Sports Betting Unit signed an agreement with OPAP on

Software Development and Security Operations launched fully

overhauled Betscape in Android and iOS completed development of

interfacing with GVC's MM1 system on handling transactions for

Betbuzz

Factoring Unit was appointed to install Proxima+ at Stopanska FYROM

(member of NBG Group) was appointed to develop the new LOS system

at Piraeus Bank

Information and Communications Technology (ICT)

Page 1 of 6

was assigned by HOL Procurement of Juniper Networks Equipment

Expansions for the Dynamic BRAS infrastructure

was assigned by HOL Procurement for CPEs from Technicolor for DSL

residential subscribers. was assigned by Med Nautilus Procurement

of Juniper Equipment Expansions was assigned by OTE Procurement

of Juniper Networks Equipment Expansions for the Dynamic BRAS

infrastructure

was assigned by Deloitte Procurement, Commissioning and Support

for Load Balancer Equipment was assigned by OPAP S.A.

Transportation, Installation & Maintenance of 16,500 VLTs in

new Gaming Halls of OPAP nationwide

was assigned by GTECH Transportation, Installation &

Maintenance of 660 i-Link in new Gaming Halls of OPAP nationwide

i-Link Installations & Maintenance

Information and Communications Technology (ICT) & Field

Services (FS) was assigned by SNFCC Info-kiosks support Was

assigned by EDET S.A. Procurement, Installation, Commissioning

& Support of Juniper Networks Wi-Fi infrastructure for 29

Public Hospitals outside Athens was assigned by EDET S.A.

Procurement, Installation, Commissioning & Support of Juniper

Networks Switch Fabric Infrastructure in EDET Data Centers was

assigned by Infinera New installations & Support for

transport, multi-wavelength infrastructure for end-customer

OTEGLOBE. Security Operations Services (SOS) was assigned by

SARACAKIS GROUP Penetration Testing and Security Assessment

Services for SARACAKIS Corporate Network was assigned by Lafarge

Group Penetration Testing and Security Assessment Services for

Lafarge Corporate Network **********

Neurosoft S.A., a Greek company listed on the AIM Italia market,

organized and managed by the Italian Stock Exchange (ISIN

GRS802003004, Reuters NRST.MI, Bloomberg NRST:IM), today is a

software provider supplying solutions that optimize business and

operational processes with a view to maximizing customer

profitability. Neurosoft's innovative integrated software systems

in factoring, sports betting, business intelligence, liability

management, transactional systems, and the implementation of

mission critical applications have provided tools to financial

institutions, stock exchanges, telecom companies and sports betting

operators in order to increase operating efficiencies, act on

well-depicted real-time risk and liability analysis, and increase

revenues and bottom line capitalizing on sophisticated predictive

analytics. Neurosoft was founded in 1994 and became the first

company to be floated in the AIM Italia market of the Milan Stock

Exchange in 2009. Based in Athens, Neurosoft has a multinational

presence in Romania, Albania, Serbia, Cyprus and Dubai. Integrae

SIM S.p.A is Neurosoft's Nominated Adviser for the AIM Italia

market.

On behalf of Neurosoft SA, email: ir@neurosoft.gr tel.:+30 210

6855061 On behalf of Nominated Adviser, Integrae SIM SpA, email:

info@integraesim.it tel.: +39 02 78625300

INTERIM STATEMENT OF COMPREHENSIVE INCOME

Gro up

Note 0 1 .0 13 0 .0 6 .2 0 15 6.280.193 (3.339.237) 2.940.957 6 6

(291.976) (467.089) 3.289 5 5 1.260 (56.296) 0 1 .0 13 0 .0 6 .2 0

14 5.033.226 (1.943.958) 3.089.268 (808.642) (476.714) 13.065 5.442

(45.209)

R ev enues Cost of services Gross profit Selling and distribution

expenses Adminis trativ e expenses Other income Financial income

Financial costs

4 6

P rofit before income taxes Income taxes 7

2.130.145 (134.417)

1.777.210 (101.755)

Net Profit (A) Other total comprehensive income after tax (B) Total

comprehensive income after tax (A)+(B) Profit attributable t:

Equity holders of the parent Non-controlling interests

1.995.728 1.995.728 1.995.728 1.995.728 -

1.675.455 1.675.455 1.655.171 20.284 1.675.455 25.000.000

25.000.000 0,0662

Total weighted average number of ordinary shares Adjus ted weighted

average number of ordinary shares for diluted (loss)/ income per

share I nc ome per share (basic and diluted)

25.584.594 25.584.594 0,0780

The accompanying notes are an integral part of the Unaudited

Interim Condensed Consolidated Financial Statements

INTERIM STATEMENT OF FINANCIAL POSITION

Grou p Note ASS ETS Non-Cur rent Assets Property, plant and

equipment Intangible assets Invstments in subsidiaries Investments

in associates accounted under the equity method Other non-current

assets Deferred tax asset Total Non-Current Assets Current Assets

Inv entories Trade accounts receivable Prepayments and other

receivables Cash and cash equivalents Total Current Assets TOTAL

ASSETS 11 11 12 1.103.191 4.577.027 360.058 2.358.234 8.398.510

10.763.222 808.996 2.074.692 1.064.790 2.389.308 6.337.785

8.543.206 9 10 8 451.933 1.238.936 37.000 140.953 495.891 2.364.712

244.993 1.215.060 37.000 78.060 630.308 2.205.421 3 0 .0 6 .2 0 1 5

31.12.2014

EQUITY AND LIABILITIES Equ ity attributable to equity holders of

the parent company S hare capital Share premium Other reserves

Retained earnings Total equity Minority interests Total equity

Non-Current Liabilities 13 8.954.608 600.000 196.067 (2.488.043)

7.262.632 7.262.632 8.954.608 600.000 196.067 (4.483.771) 5.266.904

5.266.904

Res erv e for staff retirement indemnities Other liabilities Total

Non-Current Liabilities Current Liabilities T rade accounts payable

Short-term borrowings Income tax payable Accrued and other current

liabilities Total Current Liabilities Total Liabilities TOTAL

LIABILITIES AND EQUITY 15 14

136.109 14.281 150.390

126.764 14.281 141.045

1.729.528 951.684 69.011 599.978 3.350.201 3.500.590 10.763.222

1.646.314 916.216 69.011 503.716 3.135.257 3.276.302 8.543.206

The accompanying notes are an integral part of the Unaudited

Interim Condensed Consolidated Financial Statements

INTERIM STATEMENT OF CHANGES IN SHAREHOLDERS EQUITY

Group

Total Equity as at Jan 1, 2014 T otal operating income after tax

Balance at June 30, 2014

Sh ar e Capital

S h ar e Premium

Reser ves

Retained Earnings (7.250.728) 1.655.171 (5.595.557)

Total

Non Controlling Interests 2 6 3 .6 8 4 20.284 2 8 3 .9 6 8

Total

8 .7 5 0 .0 0 0 8 .7 5 0 .0 0 0

600.000 6 0 0 .0 0 0

196.067 1 9 6 .0 6 7

2.29 5.33 9 1.655.171 3.95 0.51 0

2 .5 5 9 .0 2 4 1.675.455 4.234.478

Total Equity as at Jan 1, 2015 T otal operating income after tax

Balance at June 30, 2015

8 .9 5 4 .6 0 8 8 .9 5 4 .6 0 8

600.000 6 0 0 .0 0 0

196.067 1 9 6 .0 6 7

(4.483.772) 1.995.728 (2.488.043)

5.26 6.90 4 7.26 2.63 2

-

5.266.904 1.995.728 7.262.632

The accompanying notes are an integral part of the Unaudited

Interim Condensed Consolidated Financial Statements

Page 5 of 6

INTERIM CASH FLOW STATEMENT

Group

01.013 0.0 6 .2 01 5 Cash flows from Operating Activities Profi t

before income taxes Adjustments for: Decreas e/(increas e) in

financial assets Depreciation and amortisation Other Provisions

Financial (income)/expenses Op er atin g profit before working

capital changes (Increase)/Decrease in: Inventories T rade accounts

receivables Prepayments and other receivables Trade accounts

payable A ccrued and other current liabilities Interes t paid T ax

paid Payement for staff indemnity Other long term liabilities Net

cash inflows/(outflows) from Operating Activities Cash flows from

Investing Activities Capital expenditure for property, plant and

equipment Interes t and related income received Increase of

participation in subsidiary / affiliated company Financial assets

at fair value through income statement Net cash used in Investing

Activities Cash flow from financing activities Net Change in

finance leases Net change in short-term borrowings Net cash

inflows/(outflows) from Financing Activities Net increase

(decrease) in cash and cash equivalents Cash and cash equivalents

at the beginning of the year Cash and cash equivalents at the end

of the year 35.468 3 5 .4 68 (3 1 .0 75 ) 2 .38 9 .3 08 2 .35 8 .2

34 (295.476) (295.476) (7 56 .8 0 1) 2.386.177 1 .6 29 .3 7 6

(420.339) 1.260 (41 9 .0 79 ) (171.119) 5.442 (1 65 .6 7 7)

(294.194) (2.502.337) 704.731 83.214 96.262 (56.296) (62.893) 35 2

.5 36 (366.531) (585.943) 254.585 (1.225.473) (212.383) (45.209)

(50.606) (295.648) 189.523 9.345 55.036 2 .38 4 .0 49 190.073

19.280 (50.651) 1.935.912 2.130.145 1.777.210 0 1 .01 30 .0 6 .20 1

4

Th e ac c o mp an y in g notes are an integral part of the

Unaudited Interim Condensed Consolidated Financ ial Statements

Page 6 of 6

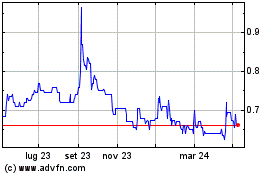

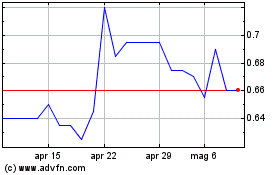

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Lug 2023 a Lug 2024