- Consolidated turnover of €2,118.0 million (€1,891.1 million

in 2022);

- Group net profits of €186.7 million (€191.0 million in

2022).

The proposal to distribute a dividend of €1.00 per share has

been approved.

Board of Directors and Board of Statutory Auditors appointed

for the three-year period 2024-2026.

Resolutions in relation to the purchase and/or sale of

treasury shares.

The General Shareholders’ meeting of Reply S.p.A. [EXM, STAR:

REY] today approved the Financial Statements for the financial year

2023, confirming the distribution of a gross dividend of €1.00 per

share.

The dividend will be paid on 22 May 2024, with dividend date set

on 20 May 2024 (record date on 21 May 2024).

2023 Financial Statement

The Reply Group closed the 2023 financial year with a

consolidated turnover of €2,118.0 million, recording a 12.0%

increase compared to €1,891.1 million in 2022.

Consolidated EBITDA was €325.1 million, up 3.5% compared to

€340.3 million recorded in 2022 (growth yoy is 20% net of the

release of COVID funds accounted in 2022).

EBIT, from January to December, was €292.7 million, up 2.5%

compared to €285.5 million recorded in 2022 (growth yoy is 22.7%

net of the release of COVID funds accounted in 2022).

The Group net profit was at €186.7 million. In 2022, the

corresponding figure was €191.0 million.

The Shareholders’ Meeting also adopted the following

resolutions:

Appointment of the Board of Directors and the Board of

Statutory Auditors for the three-year period 2024-2026

The Shareholders' Meeting has appointed the new members of the

Board of Directors and the Board of Statutory Auditors for the

three-year period 2024-2026, based on the lists of candidates

submitted by the shareholders.

The following have been appointed as Directors:

- Mario Rizzante (Chairman), Tatiana Rizzante, Filippo Rizzante,

Marco Cusinato, Elena Maria Previtera, Daniele Angelucci, Domenico

Giovanni Siniscalco (who declared that he meets the independence

requirements provided for in Article 148 of the TUF and the

Corporate Governance Code) and Patrizia Polliotto (who declared

that she meets the independence requirements provided for in

Article 148 of the TUF and the Corporate Governance Code), taken

from the majority list submitted by the shareholder Alika S. r.l.

(holder of a shareholding equal to 39.754% of Reply S.p.A.'s share

capital), which obtained the highest number of votes (63.957% of

votes obtained);

- Secondina Giulia Ravera and Federico Ferro-Luzzi, both of whom

declared to possess the independence requirements foreseen by

article 148 of the TUF and by the Corporate Governance Code, taken

from the minority list presented by a group of Investors (holding a

total shareholding equal to 3.968% of Reply S.p.A.'s share

capital).

The new Board of Statutory Auditors appointed is composed of

three Standing Auditors and two Alternate Auditors:

- Ciro Di Carluccio (Chairman) and Gabriella Chersicla

(Alternate Auditor), who declared that they meet the independence

requirements provided for by article 148 of the TUF and the

Corporate Governance Code, taken from the minority list presented

by a group of Investors (holding a total of 4.978% of Reply

S.p.A.'s share capital);

- Piergiorgio Re (Standing Auditor), Donatella Busso (Standing

Auditor), Stefano Barletta (Alternate Auditor), who declared they

meet the independence requirements provided for by article 148 of

TUF and the Corporate Governance Code, drawn from the majority list

submitted by the shareholder Alika S.r.l. (owner of a 39.754%

shareholding in Reply S.p.A.), which obtained the highest number of

votes (63.821% of votes obtained).

The curricula vitae of the Directors and Statutory Auditors, as

well as the additional documentation required by current

regulations, are available in the investors section of the website

www.reply.com

Approval of the Program for the Acquisition and/or Disposal

of Treasury Shares

The Shareholders’ Meeting authorised a new share buyback

program, while withdrawing the current one approved at the

Shareholders’ Meeting of 20 April 2023: the main objective of this

program is the purchase of shares to implement the stock incentive

plans, transactions aimed at the acquisition of equity investments,

extraordinary financial transactions and/or the conclusion of

agreements with strategic partners.

The authorization has a duration of 18 months from the date of

the resolution, for a maximum of 3,607,950 ordinary shares (equal

to 9.64398% of the current share capital) with a nominal value of

€0.13 each for a maximum nominal value of €469,033.5, within the

limit of a maximum financial commitment of €450,000,000. The

purchase price may not be lower than the nominal value (currently

€0.13) and higher than the official trading price recorded on the

MTA market on the day before the purchase, increased by 20%.

Approval of the Remuneration Report

The Shareholders' Meeting also approved Sections I and II of the

Remuneration Report drafted pursuant to Article 123-ter of

Legislative Decree 58/1998.

The manager in charge of drafting the company's financial

reports, Dr Giuseppe Veneziano, declares in accordance with

Paragraph 2 of Article 154-bis of the Consolidated Finance Act,

that the accounting information contained in this press release

corresponds to the company's records, ledgers and accounting

records.

This press release is a translation, the

Italian version will prevail.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423780149/en/

Media Contacts

Reply Fabio Zappelli f.zappelli@reply.com Tel.

+390117711594

Investor Relation Contacts

Reply Riccardo Lodigiani r.lodigiani@reply.com Tel.

+390117711594

Michael Lueckenkoetter m.lueckenkoetter@reply.com Tel.

+49524150091017

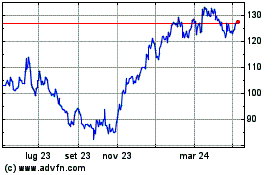

Grafico Azioni Reply (BIT:REY)

Storico

Da Gen 2025 a Feb 2025

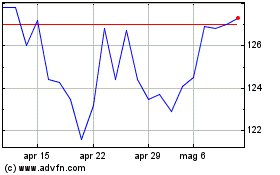

Grafico Azioni Reply (BIT:REY)

Storico

Da Feb 2024 a Feb 2025