Bernstein Analysts Convinced Bitcoin Is Headed For $150,000, Here’s Why

15 Marzo 2024 - 9:30PM

NEWSBTC

Analysts from private wealth management firm, Bernstein have

reaffirmed their previous Bitcoin prediction, emphasizing that the

cryptocurrency has a greater chance to reach $150,000 by

2025. Bitcoin $150,000 Price Forecast Grows Stronger

Bernstein analysts Gautam Chhugani and Mahika Sapra said in a note

to clients on Monday that they were now more convinced of Bitcoin’s

exponential surge to new all-time highs at around $150,000 by

mid-2025. The analyst’s statements were a reiteration of their

earlier Bitcoin forecast in November 2023, when they predicted the

price of Bitcoin to surge to $150,000. Related Reading: Crypto

Expert Reveals Why XRP Is Primed For Growth In This Bull Market At

the time, Bitcoin was trading around a price of $35,000, putting

the analysts’ estimate at around five times the price of BTC. Now

with BTC recently witnessing remarkable surges to new all time

highs above $71,000, and potentially continuing its upward

momentum, Bernstein analysts’ forecast seems more probable.

Analysts from the private wealth investment firm have disclosed

several factors that could trigger BTC’s bullish momentum.

Highlighting the success and surging demand for Spot Bitcoin

Exchange Traded Funds (ETF), the company boldly affirmed that large

volume of inflows into Spot Bitcoin ETFs could significantly

contribute towards increasing the value of BTC. “We estimated

$10 billion inflows for 2024 and another $60 billion for 2025. In

the last 40 trading days since the ETF launch on Jan 10, Bitcoin

ETF inflows have crossed $9.5 billion already,” Bernstein analysts

wrote. Sharing the sentiment of most crypto analysts in the

market, Bernstein analysts believe that the price of BTC could

experience a fresh “break out” after the halving event in April

2024. At the time of writing, the cryptocurrency is trading at

$68,218, witnessing a slight price correction of about 6.96% in the

past 24 hours, according to CoinMarketCap. Miners To Become

Top Beneficiaries Of BTC Surge In their note, Bernstein analysts

highlighted that investing in Bitcoin miners could be the best

equity proxy to BTC. According to their analysis, BTC miners

typically outperform during BTC bullish cycles and conversely

underperform during bearish periods. Related Reading: Cardano Ready

For Breakout As Network Adoption Hits Major Milestone As Bitcoin

rapidly rises to all time highs above $71,000, Bernstein analysts

expect that institutional interest in Bitcoin related equities

could top over, with BTC miners becoming one of the largest

beneficiaries. Despite various analysts predicting that the next

Bitcoin halving could potentially become a death sentence to small

mining companies and solo miners, Bernstein analysts have revealed

that the rising price of BTC and elevated transaction fees could

serve as a cushioning mechanism for miners during the halving

period. BTC price at $67,700 | Source: BTCUSD on

Tradingview.com Featured image from CryptoSlate, chart from

Tradingview.com

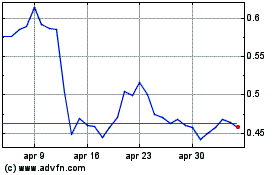

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Lug 2023 a Lug 2024