Bitcoin, Solana Suffer As Institutional Investors Pull $600 Million Out Of Crypto Funds

18 Giugno 2024 - 4:30PM

NEWSBTC

Crypto funds witnessed outflows last week after recording five

weeks of consecutive inflows. According to CoinShares data, digital

asset funds saw $600 million in net outflows for the week ending

June 14. The outflows were concentrated in Bitcoin and Solana

funds, which saw $621 million and $0.2 million exits, respectively.

These outflows come amidst a corresponding drop in the price of

Bitcoin throughout the week and a more hawkish-than-expected

Federal Open Market Committee (FOMC) meeting held during the week.

Crypto Funds Bleed Largest Since March, With Bitcoin In The Lead

Crypto funds witnessed outflows of $600 million last week after an

intense $2 billion inflow in the prior week, bringing a recent

$4.35 billion inflow run over five weeks to an end. The outflow

recorded, according to CoinShares data, was the largest since March

22, 2024, and it occurred under comparable circumstances. Notably,

the outflow ending March 22 came after a period of significant

inflows totaling $3 billion in the week prior. Investors had to

pull out their exposure to more stable assets due to the outcome of

the FOMC meeting. The FOMC held its most recent meeting on

June 11 and 12, 2024, holding interest rates at 5.25%-5.50%,

leading many crypto investors to pull out. Crypto is seen as a

risky, speculative asset, and so it is only natural for investors

to move into safer havens considering the high interest rate.

Unsurprisingly, most of the outflows came from Bitcoin, with crypto

funds of the leading crypto asset losing about $621 million.

Furthermore, the majority of this Bitcoin outflow was registered in

Spot Bitcoin ETFs trading in the US. According to data, Spot

Bitcoin ETFs witnessed outflows every day last week, save for a

$100.8 million inflow on June 12. As a result, these Bitcoin ETFs

registered a total of $580 million in outflows last week. The

negative Bitcoin investor sentiment was also reflected in short

Bitcoin products receiving $1.8 million worth of inflows. Solana,

which also had a rough week in terms of price action, recorded $0.2

million of outflows in its investment products. In addition,

multi-asset investment products experienced outflows amounting to

$1.1 million. Trading volume averaged around $11 billion for the

week, well below the $22 billion weekly average for the year. These

outflows and little trading volume saw the total assets under

management (AuM) fall from over $100 billion to $94 billion over

the week. On the other hand, Ethereum received $13.1 million in

outflows as investor interests continued to grow in anticipation of

the launch of Spot Ethereum ETFs. BNB, Litecoin, XRP, Chainlink,

and Cardano also witnessed inflows of $0.3 million, $0.8 million,

$1.1 million, $0.7 million, and $0.8 million, respectively.

Featured image created with Dall.E, chart from Tradingview.com

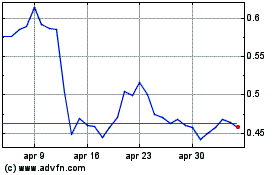

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Giu 2023 a Giu 2024