Amid Macro Uncertainty, Bitcoin Stabilizes. Incredible October Stats Inside

08 Novembre 2022 - 3:50AM

NEWSBTC

The world is upside down. Is bitcoin stable now? Or is everything

else extremely volatile all of a sudden? As the planet descends

into chaos, bitcoin remains in a weird limbo that’s

uncharacteristic of the asset and doesn’t seem to end. That’s both

what it feels like and what the stats say. In the latest ARK

Invest’s The Bitcoin Monthly report, they put it like this,

“bitcoin finds itself in a tug of war between oversold on-chain

conditions and a chaotic macro environment.” Related Reading: ARK

Invest: Despite The 9 Red Candles, “Bitcoin’s Fundamentals Remain

Strong” What about the numbers, though? The stats support the

thesis, “for the third month in a row, bitcoin continues to trade

between support at its investor cost basis ($18,814) and resistance

at its 200- week moving average ($23,460).” Three months in that

range seems like too much. Something’s got to give. However, that’s

what everyone’s been thinking for the last few months and we’re

still here. The Dollar Milkshake Theory Bitcoin has been

less-volatile than usual, sure, but the main factor here is that

the whole world is falling to pieces. Every company is in the red,

especially techy ones, and all of the world’s currencies except the

dollar fell off a cliff. Are we seeing “the dollar milkshake

theory” playing out in front of our own eyes? It sure feels that

way. Global central banks have been printing bills like there’s no

tomorrow, and that extra liquidity is there for the stronger

currency to take. According to professional investor Darren Winter,

the “dollar milkshake theory views central bank liquidity as the

milkshake and when Fed’s policy transitions from easing to

tightening they are exchanging a metaphoric syringe for a big straw

sucking liquidity from global markets.” If that’s what we’re

seeing, what happens next? Back to The Bitcoin Monthly, ARK says:

“As macro uncertainty and USD strength have increased, foreign

currency pairs have been impacted negatively while bitcoin has been

relatively stable. Bitcoin’s 30-day realized volatility is nearly

equivalent to that of the GBP and EUR for the first time since

October 2016” BTC price chart for 11/07/2022 on Bitstamp | Source:

BTC/USD on TradingView.com Bitcoin Vs. Other Assets In October The

macro-environment has been so bad lately, that there’s the

perception that bitcoin has been doing better than stocks. The

facts are that, for the first time since 2020, “bitcoin’s 30-day

volatility is on par with the Nasdaq’s and the S&P 500’s.” And,

we know past performance doesn’t guarantee future results, but “the

last time bitcoin’s volatility declined and equaled the rising

volatility of equitiy indices was in late 2018 and early 2019,

preceding bullish moves in the BTC price.” However, let’s not kid

ourselves, bitcoin has not been doing good. The thing is, not much

is prospering out there. Especially in the tech sector. “The price

drawdowns from alltime high in Meta (-75.87%) and Netflix (-76.38)

have exceeded that of bitcoin’s (-74.46%). To a lesser extent,

Amazon also suggests a correction proportional to that of BTC’s

“usual” volatility (-48.05%).” According to The Bitcoin Monthly,

the situation “suggests the severity of the macroeconomic

environment and bitcoin’s resilience against it.” Related Reading:

ARK Invest’s Cathie Wood Puts Bitcoin At $1 Million In 8 Years,

Here’s Why The only constant is change, however. Bitcoin’s

stability suggests a violent breakout, either up or down. The

entire world can’t remain the red forever, something or someone has

got to rise above the crowd and show everyone how it’s done. We’ve

been waiting for a resolution for what feels like ages, and we’ll

probably have to wait some more. There will be a movement, though.

When we least expect it, probably. Featured Image: Bitcoin 3D logo

from The Bitcoin Monthly | Charts by TradingView

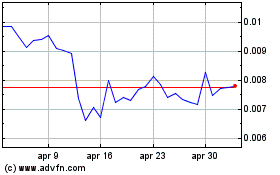

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Gen 2024 a Gen 2025