Here Are The Major Developments That Could Drive Ethereum Price Back Above $4,000

14 Settembre 2024 - 11:00PM

NEWSBTC

Ethereum, the second largest crypto by market cap, is trading at

$2,420 after a recent price rally. Ethereum has been up by 3.4% and

6.3% in the past 24 hours and seven days, respectively, which has

raised hopes for an extended bullish run. As the price performance

continues to unfold, some major developments are taking root, which

could pave the way for Ethereum’s price to rally back above the

$4,000 mark. Stablecoin Transaction Volume Hits New High Despite

the bearish sentiment which has lingered in a 30-day timeframe,

on-chain data shows that the Ethereum blockchain continues to

witness massive activity, especially in the stablecoin niche. The

stablecoin trading volume on the blockchain soared massively in

August to break its previous all-time high. Particularly, the

stablecoin trading volume reached $1.46 trillion. This surge

in stablecoin activity further solidifies Ethereum’s position as

the go-to blockchain platform in the world of DeFi. As stablecoin

adoption continues to rise, this could drive up Ethereum revenue

due to demand for ETH tokens used to pay transaction fees. This

increased utility could, in turn, contribute to its price reaching

$4,000 or beyond. Watch Out For The 0.015 Point In Funding Rates

Another key factor to watch now for Ethereum is the funding rate.

The funding rate is a metric that tracks the cost of holding a long

or short position in the perpetual futures market. Funding rates

reflect market sentiment, as positive funding rates indicate that

longs are paying short positions, suggesting a bullish outlook,

while negative rates show a bearish trend. According to on-chain

data from CryptoQuant, the Ethereum funding rate is approaching the

0.015 point. As an analyst at CryptoQuant pointed out, the Ethereum

funding rate is currently hovering between 0.002 and 0.005. This

movement is reminiscent of a pattern in September 2023, when the

funding rate was similarly low. Although these figures might appear

modest for a typical bull market, a CryptoQuant analyst has noted

that this could be the calm before a major upward movement. This is

because the funding rates eventually crossed 0.015 in 2023,

allowing Ethereum to “surge from the $1,500s to $4,000s.” A similar

occurrence could see Ethereum surging massively to $4,000 in the

next few months. Ethereum: Network Growth According to

Santiment, the Ethereum network has witnessed massive growth in the

past week, recently reaching a four-month high. Apart from its L2

solutions like Optimism and Arbitrum, the platform remains the

foundation for decentralized finance (DeFi) and non-fungible tokens

(NFTs). This network growth was accompanied by an increase in the

creation of wallet addresses and active addresses. At the

time of writing, Ethereum is trading at $2,421. If these factors

above align in favor of Ethereum, we could see ETH continue to

approach the $4,000 mark. Featured image from StormGain, chart from

TradingView

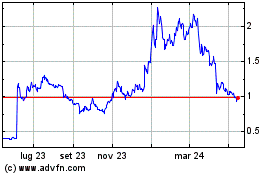

Grafico Azioni Arbitrum (COIN:ARBUSD)

Storico

Da Nov 2024 a Dic 2024

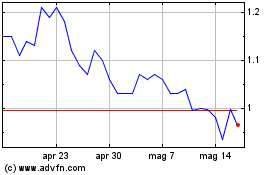

Grafico Azioni Arbitrum (COIN:ARBUSD)

Storico

Da Dic 2023 a Dic 2024