BNB Under Siege: Failed Recovery Sparks Fears of Deeper Losses

11 Ottobre 2024 - 9:30PM

NEWSBTC

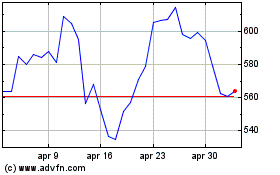

BNB finds itself under renewed selling pressure as a recent

recovery attempt falls short, leaving the cryptocurrency vulnerable

to further losses. Despite a brief upward movement, BNB’s failure

to break through key resistance levels has sparked concerns about a

deepening decline. With technical indicators signaling potential

weakness ahead, the question now is whether the token can regain

its footing or if further losses are inevitable. As bearish

sentiment intensifies, this analysis aims to evaluate the technical

indicators signaling weakness in BNB’s price action and assess

whether the asset can stage a recovery or face more declines. By

exploring key support levels, market sentiment, and price trends,

the goal is to determine BNB’s next move and the likelihood of a

bullish reversal or sustained bearish momentum. Key Technical

Indicators Flash Warning Signs BNB has recently entered pessimistic

territory on the 4-hour chart, dipping just below the 100-day

Simple Moving Average (SMA) and approaching the crucial $531

support level. This drop below the 100-day SMA indicates weakening

strength, and with sellers taking control, the cryptocurrency faces

the potential for more losses. An analysis of the 4-hour Relative

Strength Index (RSI) shows that the signal line has dropped below

the 50% threshold toward 42%, suggesting that buying pressure is

waning, as the RSI moves deeper into bearish territory. Typically,

an RSI reading below 50% implies that sellers are gaining control,

which could lead to downward pressure on the price. Related

Reading: BNB Battles Persistent Bearish Pressure, Will $500 Be The

Next Stop? After facing resistance at $587, BNB has shown

significant downbeat movement on the daily chart, marked by the

formation of a strong bearish candlestick. The price has now fallen

toward the 100-day SMA, signaling mounting selling pressure. If the

negative trend continues, BNB may experience additional declines,

leading to a reduction in buying interest. Furthermore, a closer

look at the RSI on the 1-day chart shows that the signal line has

once again dropped below the 50% threshold, now sitting at 48%,

after previously rising above it. Unless the bulls step in to shift

momentum, the market could be set for more drops, as the current

RSI level suggests weakening buying strength and heightened bearish

control. Trading Strategy: Navigating BNB Bearish Pressure BNB’s

recent price action indicates potential continued declines if

downbeat momentum intensifies. If the price hits the critical $531

mark and closes below it, this could pave the way for further

losses, possibly driving the asset down toward the $500 level.

Related Reading: BNB Price Tops $600: Can the Rally Continue?

However, should buyers step in and regain control at the $531

level, there is a chance for a bullish reversal and the price will

start moving upward toward the 605 resistance level, especially if

the RSI shows signs of recovery. Featured image from Shutterstock,

chart from Tradingview.com

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Gen 2024 a Gen 2025