Crypto Analyst Predicts Potential Trend For Bitcoin As Price Slips

19 Gennaio 2024 - 6:00PM

NEWSBTC

Rekt Capital, a well-known cryptocurrency analyst and enthusiast,

has revealed the potential directions that the price of Bitcoin

could take in light of the upcoming fourth BTC Halving. Potential

Retracement For Bitcoin With the halving event approaching,

analysts are debating what steps Bitcoin should take after its

recent breach from the macro downtrend. One of those is Rekt

Capital, who has weighed in on the particular issue and made a

comparison to past trends. Related Reading: Crypto Analyst Sounds

Alarm: Bitcoin Price Set To Plunge Even Lower The crypto analyst

shared his latest projections during one of his YouTube predictions

videos for Bitcoin. In the video, Rekt Capital delves in on the

“next possible steps” that BTC is anticipated to take while

highlighting “a breakout from its macro downtrend.” His analysis

focuses mainly on the reaccumulation range that formed prior to the

halving event in 2015-1016 period. He further drew a comparison

between 2023-2024 and 2015-2016, while noting similarities between

the two periods. According to him, the trend that formed within

that period has resurfaced in the current 2023-2024 period. “One of

the things that contributes to that similarity is the

reaccumulation that formed a few months before the halving,” he

stated. Rekt Capital pointed out the possibility of a retracement

around the Bitcoin halving event. This is due to a scenario

proposed by the crypto analyst in which a reaccumulation range

break triggers a retreat. An analogy to the cycle of 2015–2016

indicates a comparable rejection from a resistance level prior to

the halving, which may have contributed to a possible retreat.

Furthermore, he has highlighted that such retracements are

indicated by historical data but stresses that they are often

brief. However, he asserted that after the retrace, which is the

“last opportunity,” we would see a price increase for Bitcoin. This

surge will “turn the $46,000 price level into a new support level,

and move to touch its old all-time high.” Rekt Capital also

anticipates the price going beyond this level putting Bitcoin on a

path to a new all-time high. Factors The Buttress BTC Value, ETFs

Not Included Samson Mow, the Chief Executive Officer (CEO) of

Pixelmatic, has revealed several factors that boost Bitcoin’s

value. Mow took to X (formerly Twitter) to underscore these factors

with the crypto community. According to him, the value of Bitcoin

is amplified by “scarcity, utility, and the failure of fiat.” Mow

further insisted that BTC Spot Exchange-Traded Funds (ETFs) do not

contribute to the token’s value. His X post came in response to

CNBC’s “Mad Money” host Jim Cramer’s post over his comments on

BTC’s current action. Cramer asserted that “no one showed up” after

the approval of BTC ETFs, which led to a decline in price. Related

Reading: Jim Cramer Says Bitcoin Is Topping Off, Time To Buy

Bitcoin? Mow was displeased by Cramer’s claims, and he stated that

many people were present while noting the net inflow. “A lot of

people showed up. Just look at the net inflow and how much

BlackRock, Fidelity, and others accumulated,” he stated. Featured

image from iStock, chart from Tradingview.com

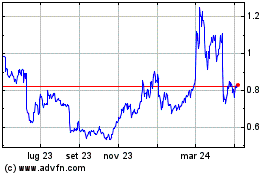

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Dic 2024 a Gen 2025

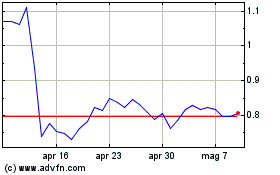

Grafico Azioni EOS (COIN:EOSUSD)

Storico

Da Gen 2024 a Gen 2025