Crypto Guru Reveals His Top 10 AI Altcoins For 2025

29 Novembre 2024 - 6:00PM

NEWSBTC

Miles Deutscher, a prominent crypto analyst with over 575,000

followers on X (formerly Twitter), has unveiled his top ten

artificial intelligence (AI) altcoins poised for significant growth

by 2025. Emphasizing the burgeoning potential of the AI sector

within the cryptocurrency landscape, Deutscher suggests that this

could be “the biggest opportunity of the bull run.” Why AI Offers A

Lot Of Potential Deutscher highlights the rapid expansion of the

global AI market, noting that it grew by approximately $50 billion

between 2023 and 2024. Projections estimate a compound annual

growth rate (CAGR) of 28.46%, potentially surpassing $826 billion

by 2030. Despite AI’s significant presence in public

discourse—accounting for nearly one-third of attention in the

crypto space—it currently ranks as the 34th largest crypto sector

by market capitalization, trailing behind sectors like liquid

staking, memecoins, and decentralized finance (DeFi). “Yet, AI is

still only the 34th ranked crypto sector by market cap, behind

liquid staking, dog memes, DeFi, and more. I could easily see AI as

a top 5-10 sector in a year’s time,” Deutscher stated. He argues

that this disparity presents a massive opportunity for investors.

“Many mid-low cap AI tokens are still sitting at ridiculously low

valuations. All it takes is a strong rotation into AI for many of

these to quickly reprice 5-10x higher,” he explained. Deutscher

outlines his fundamental thesis for why AI crypto is set for

substantial growth. Firstly, he notes that everyone is becoming

aware of how impactful AI will be on society. “Either people are

scared, excited, or intrigued by the latest developments. This

already cements AI in general in the minds of the masses,” he said.

Related Reading: Crypto Expert Unveils 15 Surprising Truths About

This Bull Run You Need To Know Secondly, he points out that AI is

constantly innovating, with new products regularly entering the

market. “Every time a new AI product is released, this puts even

more focus on the sector. And crypto is an attention economy. More

eyeballs equals more speculation,” Deutscher observed. Thirdly, he

believes that crypto offers a lower barrier to gain exposure to the

growth of AI. “Crypto is easier to access, able to be

fractionalized, and generally ‘cheaper’ than investing in, let’s

say, AI equities. For retail, this is a massive benefit,” he

asserted. Finally, he highlights the recent rise of AI agents,

which has made people aware of the power of AI integrated with

crypto. “We’re moving into a future where AI agents will trade

autonomously on-chain for you, manage your portfolio and risk,

DeFi, and more. It’s going to completely change the landscape of

crypto,” Deutscher predicted. He also notes that this trend is

occurring in traditional tech sectors, with corporations like Adobe

and Expedia integrating AI agents into their operations. Focusing

on the AI and crypto landscape, Deutscher mentions that he is

investing across various verticals, with a particular emphasis on

AI agents and AI infrastructure. He is concentrating on

“pick-and-shovel infrastructure protocols” rather than individual

AI agents or broader DePIN plays. He discloses that he holds

positions in all the projects he mentions, some as a strategic

advisor and investor. Top 10 AI Altcoins Deutscher’s top ten AI

altcoins, ordered from the largest to the smallest market

capitalization, are as follows. First on the list is Bittensor

(TAO), which he describes as the AI market leader. Bittensor

focuses on decentralizing AI research and has already seen

significant adoption in scientific communities. “With the recent

rollout of EVM compatibility, the network has taken a huge step

forward, opening the door for developers to build DeFi ecosystems

and unlock new use cases,” Deutscher noted. Second is NEAR Protocol

(NEAR), which he identifies as the leading Layer 1 (L1) blockchain

intersecting with AI. “For those bullish on both verticals, NEAR

serves as a solid proxy. Fun fact: Since its mainnet launch in

October 2020, it has maintained 100% uptime,” he remarked. Third is

Grass (GRASS), a standout launch this cycle due to its data

pipeline that seamlessly connects the real world with AI and

crypto. “Recent developments in AI make data one of the most

valuable commodities in the world. Grass uses crypto incentives to

create a data pipeline that most AI companies otherwise cannot tap

into,” he explained. He added that the demand for the Grass network

is undeniable and that the protocol’s future looks incredibly

promising. Related Reading: 9 Crypto Predictions For 2025: Nansen

CEO Forecasts Biggest Bull Run Ever Fourth is Spectral (SPEC), one

of the leading AI agent infrastructure plays, allowing anyone to

deploy and engage with AI agents. “With Syntax V2, you’ll be able

to interact with sentient agents with personalities, which trade on

Hyperliquid in accordance with the community’s input. It’s an

interesting mix of fun, collaboration, and speculation,” Deutscher

commented. Fifth is Mode Network (MODE), which, although known as a

Layer 2 (L2) solution, has been building AI technology for over a

year. “They are leading the future of DeFi by facilitating the

deployment of AI-driven agents, which will autonomously farm yield

and optimize your portfolio on your behalf,” he said. Sixth on the

list is NeuralAI (NEURAL), connecting AI and gaming—two of crypto’s

biggest adoption drivers. “They just announced SentiOS, which

supplies autonomous AI to create, populate, and bring virtual

worlds and economies to life,” Deutscher mentioned. Seventh is

PinLinkAi, where Deutscher is a strategic advisor and investor.

PinLink is the first real-world asset-tokenized DePIN platform,

empowering the fractional ownership of yield-bearing assets,

physical or digital. “They have also recently partnered with Akash,

Pendle, FetchAI, OpenSea, Alephium, ParallelAI, and more. Their

business development is on another level,” he praised. Eighth is

Zero1 Labs (DEAI), another project where he serves as a strategic

advisor and investor. Zero1 Labs enables innovators to build

decentralized AI applications with fully homomorphic encryption,

ensuring secure data governance and complete privacy. “Think of it

as a pick-and-shovel AI infrastructure play. With a market cap of

around $76 million, this is one of my ‘higher upside’ AI bets,”

Deutscher revealed. He noted the debut of Seraphnet, the first of

many projects planned through their incubator. Ninth is Empyreal,

also a project where he is an advisor and investor. As a believer

in AI agents, Deutscher highlights that Empyreal provides AI

infrastructure to turn social media messages into on-chain actions

like trades and swaps through their Simulacrum platform. “It’s

super cool,” he added. Tenth is enqAI (ENQAI), another project

where Deutscher is involved as an advisor and investor. EnqAI is a

decentralized large language model network solving the bias and

censorship issues common to centralized AI. “Despite its $20

million market cap, enqAI already has 20,000 monthly active users

across 50-plus countries and has already handled over one million

API requests with minimal downtime or lags,” he highlighted. As a

bonus, Deutscher mentions Guru Network (GURU), where he is also an

advisor and investor. With its Layer 3 mainnet now live, Guru

powers AI processors and chatbots with a decentralized exchange,

stablecoin support, bridges, and base chain integration. “I’ve been

working with Guru to launch a Telegram and Discord mini-app,

delivering a full turnkey solution for DeFi on Telegram. It’s going

to be very cool!” he exclaimed. Deutscher emphasizes the importance

of risk management. He reveals that his personal portfolio balance

is approximately 70% large caps and 30% small to mid caps. “I

recommend that you do your own research, and if you do decide to

take a position in any of these protocols, make sure to manage

position sizing and risk in line with your goals and overall

strategy,” he advised. At press time, TAO traded at $630.80.

Featured image created with DALL.E, chart from TradingView.com

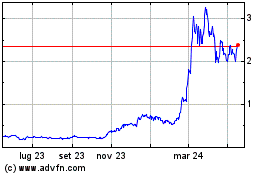

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Dic 2024 a Gen 2025

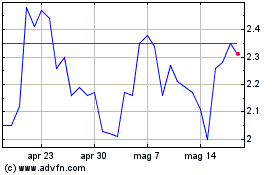

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Gen 2024 a Gen 2025