Bitcoin’s NVT Cross Signals a Local Top – Is a Major Correction Looming?

04 Ottobre 2024 - 10:00AM

NEWSBTC

Bitcoin has been experiencing some interesting developments in its

market indicators, and a recent analysis points to the NVT (Network

Value to Transactions) Golden Cross signaling a potential

short-term local top. According to a CryptoQuant analyst known as

Darkfost, the NVT Golden Cross—a key metric used to determine

market valuation relative to transaction volume—has reached a major

level. Related Reading: Is This Bitcoin’s Last Big Drop? Expert

Points To Key Indicator Local Top Spotted, What Next? The

CryptoQuant analyst revealed that Bitcoin’s NVT Golden Cross has

recently reached the 2.9 level, suggesting that the market cap, or

price, of Bitcoin, may be outpacing its transaction volume.

Particularly, Darkfost explained that a value above 2.2 indicates

the possibility of reversing the mean, suggesting that the current

valuation could be overextended. On the other hand, a value below

-1.6 would indicate that the market is potentially undervalued. For

context, the NVT Golden Cross compares the market cap of Bitcoin to

the volume of transactions on its network, providing a measure of

whether Bitcoin is being traded at a fair value. The signals

become stronger when the metric moves deeper into its upper or

lower zones. At a current value of 2.9, the indication is that

Bitcoin may face short-term price resistance, possibly pointing to

a local top at around $65,800, Darkforst revealed. The analyst adds

that such levels can gauge potential long and short positions,

especially when viewed alongside global chart trends and broader

market behaviour. Bitcoin On The Verge Of Major Correction? While

the NVT Golden Cross presents a perspective of potential market

overvaluation, another CryptoQuant analyst, CryptoOnchain, offers

additional insights by analyzing Bitcoin’s movement between

exchanges. The recent data shows a significant outflow of Bitcoin

from centralized exchanges. This trend of Bitcoin being withdrawn

from exchanges is seen across all three key moving averages:

30-day, 50-day, and 100-day. The analyst revealed that such an

outflow hasn’t been observed at this scale since November 2022.

Notably, a decrease in Bitcoin held on exchanges can be interpreted

in multiple ways. Firstly, it often suggests that investors move

their assets to more secure storage, such as cold wallets, to hold

rather than trade. Related Reading: Is Bitcoin On The Brink Of A

Reversal? Here’s What This Key Indicator Suggests This behavior can

signal confidence in the asset, as holders may expect its value to

increase over time. With fewer BTC available on exchanges for

immediate sale, the potential for downward price pressure may

decrease, which could set the stage for a bullish momentum in the

longer term. However, it can also indicate that traders prepare to

exit their positions, anticipating a correction if they foresee

market instability or overvaluation. Featured image created with

DALL-E, Chart from TradingView

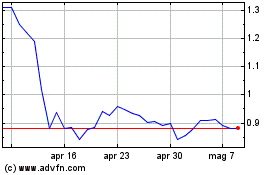

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Nov 2023 a Nov 2024