Bitcoin Accumulation: USDT Issuer Tether Goes On Massive 8,888 BTC Buying Spree

20 Gennaio 2024 - 12:00AM

NEWSBTC

In an encouraging development for the crypto space, Tether, the

issuer of the world’s largest stablecoin USDT, has doubled down on

its Bitcoin investment momentum by acquiring a staggering 8,888

BTC, further diversifying its portfolio. Tether Increases Its

Bitcoin Holdings Tether has recently made its third largest Bitcoin

purchase, as the stablecoin issuer added a total of 8,888 BTC

valued at $380 million at the time of purchase. This brings its

total BTC holdings to 66,465 BTC, valued at $2.81 billion with an

average buy price of $42,353. Related Reading: Why Did The

Bitcoin Price Fall Below $41,000? This transaction was captured by

BitInfoCharts data, which also showed the previous amounts of BTC

accumulated by the blockchain-enabled platform. This recent

purchase follows Tether’s Bitcoin investment strategy, in line with

its vision to continuously strengthen its reserves by accumulating

Bitcoin. Earlier in May 2023, the stablecoin issuer announced in a

blog post that it would regularly allocate 15% of its net realized

operating profits toward increasing its BTC reserves. As of the end

of March 2023, Tether held approximately $1.5 billion worth of

cryptocurrency, a $1.3 billion difference from its total BTC

holdings presently. According to reports from Dune Analytics,

Tether has become the 11th largest Bitcoin holder, with

Microstrategy, an American business intelligence service,

surpassing Tether’s holdings with over 189,00 BTC accumulated. The

other addresses in the top 10 rankings are owned by major crypto

exchanges and governments, including Binance, Bitfinex and the US

government. Tether’s decision to double down on its Bitcoin

investments signals its confidence in the cryptocurrency’s future

trajectory. It also underscores the blockchain platform’s belief in

the long-term potential of BTC as it aims to capitalize on

Bitcoin’s potential growth by bolstering and diversifying its

digital asset reserve. BTC price sitting at $41,354 |

Source: BTCUSD on Tradingview.com BTC Accumulation Race Amidst ETF

Hype Tether’s strategic Bitcoin purchase comes at a time when the

crypto market is buzzing with excitement over Spot Bitcoin ETFs.

Before the approval of Spot Bitcoin ETFs, Tether had steadily

increased its BTC portfolio, purchasing substantial quantities of

BTC consistently. In March 2023, the stablecoin issuer bought

15,915 BTC and another 4,083 BTC between the months of May and

September. Related Reading: $245 Million Whale Wakes Up To Threaten

XRP Price Recovery The timing of Tether’s BTC purchase suggests a

proactive stance towards potentially seizing the opportunities

brought forth by the Spot Bitcoin ETF market and the upcoming

Bitcoin halving in April. In addition to Tether’s large-scale BTC

acquisition, Microstrategy is also another major player which has

been continually increasing its BTC holdings. The business

intelligence software company added a whopping 14,620 BTC to its

portfolio in December 2023. At the time, the value of the purchase

was about $615.7 million. Other companies with large BTC

holdings include Galaxy Digital and Elon Musk’s Tesla, as well as

space exploration company SpaceX. Featured image from Investopedia,

chart from Tradingview.com

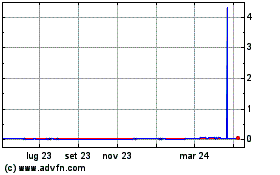

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Nov 2023 a Nov 2024